Foreigners purchasing property in the US need to provide a valid passport, a visa or proof of legal entry, and a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Lenders may also require financial statements, credit history, and proof of income to evaluate mortgage eligibility. It is essential to have a real estate attorney review contracts and ensure compliance with federal and state regulations.

What Documents Does a Foreigner Need to Purchase Property in the US?

| Number | Name | Description |

|---|---|---|

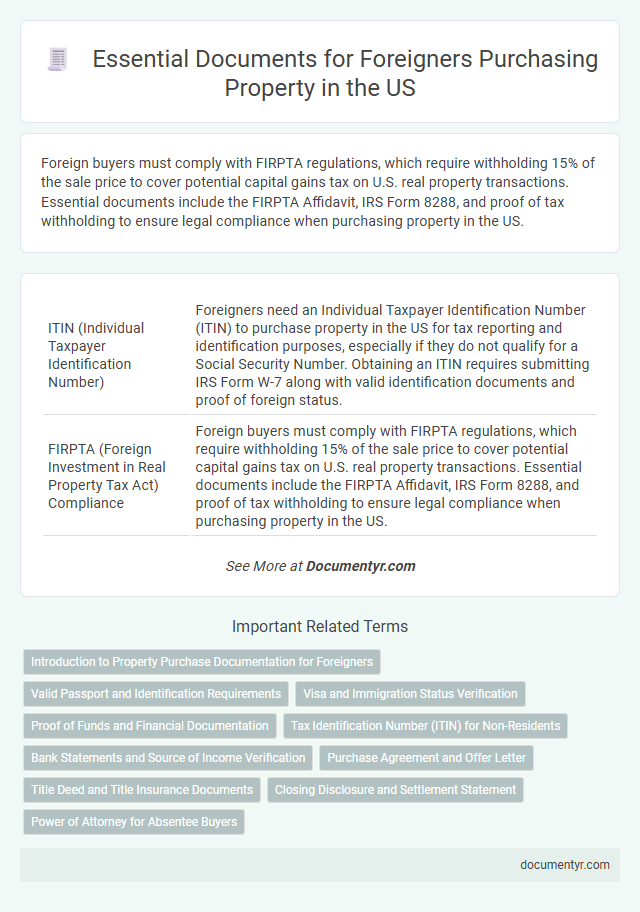

| 1 | ITIN (Individual Taxpayer Identification Number) | Foreigners need an Individual Taxpayer Identification Number (ITIN) to purchase property in the US for tax reporting and identification purposes, especially if they do not qualify for a Social Security Number. Obtaining an ITIN requires submitting IRS Form W-7 along with valid identification documents and proof of foreign status. |

| 2 | FIRPTA (Foreign Investment in Real Property Tax Act) Compliance | Foreign buyers must comply with FIRPTA regulations, which require withholding 15% of the sale price to cover potential capital gains tax on U.S. real property transactions. Essential documents include the FIRPTA Affidavit, IRS Form 8288, and proof of tax withholding to ensure legal compliance when purchasing property in the US. |

| 3 | Patriot Act Identity Verification | Foreigners purchasing property in the US must provide identification documents compliant with the Patriot Act, such as a valid passport or government-issued photo ID, to verify their identity. This verification process helps financial institutions and real estate agents prevent money laundering and terrorism financing in property transactions. |

| 4 | OFAC (Office of Foreign Assets Control) Clearance | Foreign buyers must obtain OFAC (Office of Foreign Assets Control) clearance to ensure they are not on denied parties lists, which helps prevent transactions with sanctioned individuals or countries. This process requires submitting identification and financial documents for verification before property purchase approval in the US. |

| 5 | Foreign Status Affidavit | A Foreign Status Affidavit is a critical document for non-U.S. citizens purchasing property in the United States, certifying their foreign status for tax purposes under the Foreign Investment in Real Property Tax Act (FIRPTA). This affidavit helps determine withholding requirements and ensures compliance with IRS regulations during the real estate transaction. |

| 6 | W-8 BEN Form (Certificate of Foreign Status) | Foreign buyers must submit the W-8 BEN Form (Certificate of Foreign Status) to the IRS when purchasing property in the US, establishing non-resident status for tax withholding purposes. This form ensures compliance with U.S. tax regulations, particularly under the Foreign Investment in Real Property Tax Act (FIRPTA), which mandates withholding on certain real estate transactions by foreigners. |

| 7 | Inbound Wire Verification Statements | Inbound wire verification statements are critical documents that verify the source and legitimacy of funds transferred by foreigners purchasing property in the US, ensuring compliance with anti-money laundering regulations. Lenders and title companies require these statements to validate transaction funds during the property acquisition process. |

| 8 | E-Signature Authorization for Remote Closings | Foreign buyers must provide a valid passport, proof of visa status, and an Individual Taxpayer Identification Number (ITIN) to purchase property in the US, while E-Signature Authorization enables secure and efficient remote closings without in-person presence. This digital authorization complies with the ESIGN Act and UETA, ensuring legally binding electronic signatures for all transaction documents. |

| 9 | Translated & Apostilled Government-issued ID | Foreigners must provide a translated and apostilled government-issued ID, such as a passport or national identity card, to legally purchase property in the US. This ensures the document's authenticity and compliance with US legal standards for property transactions. |

| 10 | Source-of-Funds Documentation (Anti-Money Laundering Compliance) | Foreign buyers must provide source-of-funds documentation demonstrating the legal origin of their money, including bank statements, tax returns, and employment or business earnings records, to comply with Anti-Money Laundering (AML) regulations. These documents ensure transparency and help real estate agents, escrow companies, and financial institutions verify that the funds are legitimate and not linked to illicit activities. |

Introduction to Property Purchase Documentation for Foreigners

Foreigners seeking to purchase property in the United States must navigate specific documentation requirements. Understanding these key documents is essential for a smooth transaction and legal compliance.

- Passport - Valid government-issued identification is necessary to establish identity and nationality.

- Tax Identification Number (TIN) - Required for tax reporting purposes, either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

- Property Purchase Agreement - A legally binding contract outlining the terms and conditions of the real estate transaction.

Valid Passport and Identification Requirements

Foreigners must provide valid identification to purchase property in the United States. A valid passport is the primary document required to verify identity and nationality.

- Valid Passport - Serves as the main government-issued document proving identity and citizenship for foreign buyers.

- Photo Identification - Additional government-issued ID, such as a driver's license or national ID card, may be requested to complement the passport.

- Proof of Legal Status - Documents evidencing lawful presence in the US, such as a visa or residency permit, can be necessary for specific transactions.

Providing accurate and authentic identification documents ensures compliance with US property purchase regulations for foreigners.

Visa and Immigration Status Verification

| Document Type | Description | Purpose in Property Purchase |

|---|---|---|

| Valid Passport | Government-issued identification verifying the foreign buyer's identity and nationality. | Essential for identity verification and property title registration. |

| Visa Documentation | Current U.S. visa showing legal entry status, e.g., tourist, business, student, or investor visa. | Confirms the buyer's authorized stay and intent within the United States during property transaction. |

| Immigration Status Verification | Documents such as I-94 Arrival/Departure Record or Employment Authorization Document (EAD). | Verifies lawful presence and work authorization as relevant to financial transactions and funding sources. |

| Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | SSN for eligible immigrants or ITIN for non-residents without SSN. | Required for tax reporting and mortgage application processes. |

| Proof of Funds Source | Bank statements or financial records demonstrating legitimate origin of funds used for purchase. | Ensures compliance with anti-money laundering regulations and financial transparency. |

Proof of Funds and Financial Documentation

Foreigners looking to purchase property in the US must provide proof of funds as a crucial part of the buying process. This typically includes bank statements, investment account summaries, or letters from financial institutions verifying available capital.

Financial documentation ensures the buyer has sufficient funds to cover the property price and associated costs. Your proof of funds helps establish credibility with sellers and lenders during the transaction.

Tax Identification Number (ITIN) for Non-Residents

What documents does a foreigner need to purchase property in the US? A key document for non-residents is the Tax Identification Number (ITIN). Your ITIN allows you to fulfill tax obligations related to property ownership and is essential for financial transactions in the US real estate market.

Bank Statements and Source of Income Verification

Foreigners purchasing property in the US must provide specific documents to verify their financial stability. Two crucial documents are recent bank statements and proof of source of income.

Bank statements demonstrate the buyer's ability to fund the property purchase, showing transaction history and account balances. Source of income verification confirms the legitimacy and origin of the funds, often including pay stubs, tax returns, or employment letters. These documents help lenders, sellers, and legal entities ensure compliance with US regulations and reduce the risk of money laundering.

Purchase Agreement and Offer Letter

Foreigners looking to purchase property in the US must provide specific documents to complete the transaction smoothly. Key documents include a Purchase Agreement and an Offer Letter, which outline the terms of the sale and the buyer's intent.

The Purchase Agreement is a legally binding contract that details the price, payment schedule, and contingencies. The Offer Letter serves as an initial proposal demonstrating the buyer's seriousness and sets the foundation for negotiations.

Title Deed and Title Insurance Documents

When purchasing property in the US as a foreigner, the Title Deed is a critical document that establishes legal ownership of the property. Title Insurance protects your investment by ensuring that any disputes or claims against the property's title are covered. Securing both the Title Deed and Title Insurance documents ensures a smooth and secure property transaction.

Closing Disclosure and Settlement Statement

Foreigners purchasing property in the US must carefully review key documents like the Closing Disclosure and Settlement Statement. These documents provide detailed financial information essential for completing your property transaction.

- Closing Disclosure - This document outlines the final loan terms, closing costs, and payment schedules for the buyer.

- Settlement Statement (HUD-1) - It itemizes all charges and credits related to the property purchase, ensuring transparency for both parties.

- Identification Requirements - Valid passports and proof of legal status are necessary to verify the foreign buyer's identity during closing.

What Documents Does a Foreigner Need to Purchase Property in the US? Infographic