To sell property from a deceased person's estate, key documents include the original will or letters testamentary, the death certificate, and proof of ownership such as the deed. Probate court approval or a court order authorizing the sale may also be required, depending on state laws. Additionally, an affidavit of heirship or a trust document might be necessary to establish authority to sell the property.

What Documents Does a Deceased Person’s Estate Need to Sell Property?

| Number | Name | Description |

|---|---|---|

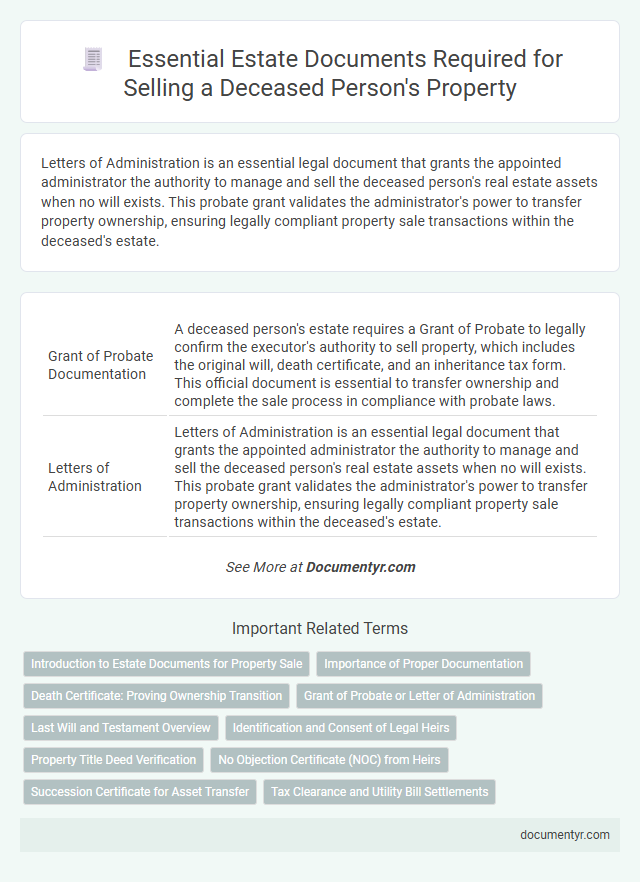

| 1 | Grant of Probate Documentation | A deceased person's estate requires a Grant of Probate to legally confirm the executor's authority to sell property, which includes the original will, death certificate, and an inheritance tax form. This official document is essential to transfer ownership and complete the sale process in compliance with probate laws. |

| 2 | Letters of Administration | Letters of Administration is an essential legal document that grants the appointed administrator the authority to manage and sell the deceased person's real estate assets when no will exists. This probate grant validates the administrator's power to transfer property ownership, ensuring legally compliant property sale transactions within the deceased's estate. |

| 3 | Testamentary Trust Deeds | Testamentary trust deeds are essential documents in a deceased person's estate to sell property, as they establish the trust and outline the distribution of assets according to the will. These deeds ensure legal authority for the trustee to manage and sell real estate, facilitating the proper transfer of ownership and compliance with probate requirements. |

| 4 | Certified Death Certificate | A certified death certificate is an essential document required to transfer ownership and sell property from a deceased person's estate, serving as legal proof of death. This document is necessary for probate proceedings and to authorize estate executors or administrators to manage and sell the property in accordance with state laws. |

| 5 | Property Title Deed (Original or Certified Copy) | To sell a deceased person's property, securing the original or a certified copy of the Property Title Deed is essential to prove legal ownership and transfer rights. This document must be submitted alongside probate or letters of administration to validate the estate's authority to sell. |

| 6 | Transmission Application (by Executor or Administrator) | A Transmission Application, filed by the Executor or Administrator, is essential to transfer legal ownership of a deceased person's property before sale, ensuring the estate's assets can be lawfully disposed of. This document confirms the authority to manage and sell the estate, facilitating clear title transfer and compliance with probate regulations. |

| 7 | Clearance Certificate (for Inheritance Tax/Debt Clearance) | The estate must obtain a Clearance Certificate from the tax authorities to confirm that all inheritance taxes and debts have been settled before selling property. This certificate legally authorizes the transfer of ownership and ensures the sale proceeds without tax liabilities or claims against the estate. |

| 8 | Estate Account Statement | An Estate Account Statement is a critical document required to sell a deceased person's property, detailing all assets, liabilities, income, and expenses related to the estate. This statement ensures accurate financial disclosure for probate courts and potential buyers, facilitating a transparent transaction and legal compliance. |

| 9 | Capital Gains Tax Clearance Letter | A deceased person's estate requires a Capital Gains Tax Clearance Letter to ensure all applicable tax liabilities on property sales are settled before transfer. This document, issued by tax authorities, verifies payment of capital gains tax, facilitating a smooth sale process and legal compliance. |

| 10 | Probate Caveat Withdrawal Form | The Probate Caveat Withdrawal Form is essential for removing objections lodged against the estate during probate, enabling the legal sale of the deceased person's property. This document must be officially filed with the probate court to proceed with the transfer of property ownership. |

Introduction to Estate Documents for Property Sale

What documents are required to sell property from a deceased person's estate? Understanding the necessary estate documents is crucial for a smooth property sale process. These documents verify ownership, establish legal authority, and ensure compliance with estate laws.

Importance of Proper Documentation

Proper documentation is crucial when selling a deceased person's estate to ensure a smooth and legal transaction. Essential documents include the death certificate, the will or probate grant, and property title deeds. Having these documents verified prevents disputes and facilitates the transfer of ownership to rightful heirs or buyers.

Death Certificate: Proving Ownership Transition

The death certificate is a crucial document when selling property from a deceased person's estate. It officially confirms the owner's death, allowing the legal transfer of ownership to heirs or executors. Without this certificate, property transactions cannot proceed, ensuring rightful ownership transition is verified.

Grant of Probate or Letter of Administration

When selling property from a deceased person's estate, obtaining the proper legal documents is essential to transfer ownership legally. You must secure either a Grant of Probate or a Letter of Administration to proceed with the sale.

- Grant of Probate - This document confirms the executor's authority to manage and distribute the deceased's assets according to the will.

- Letter of Administration - Issued when there is no will, this gives the administrator legal power to handle the estate.

- Property Title Transfer - After securing the probate or administration documents, the estate can officially transfer the property title for the sale.

Last Will and Testament Overview

The last will and testament is a crucial legal document that outlines how a deceased person's assets, including property, should be distributed. It provides clear instructions that help prevent disputes among heirs during the estate settlement process.

To sell property from a deceased person's estate, the executor must present the original will to the probate court for validation. This document establishes the authority of the executor to manage and liquidate estate assets. Without a properly executed will, the sale process becomes more complex and may require additional legal steps.

Identification and Consent of Legal Heirs

When selling a deceased person's property, proper identification and consent of legal heirs are essential. These steps ensure the transaction respects inheritance laws and legal ownership rights.

- Identification of Legal Heirs - Official documents like the death certificate and will help establish who the rightful heirs are.

- Legal Heir Consent - Written consent or a legal agreement from all heirs confirms their approval for the property sale.

- Verification through Probate - Probate court documents authenticate heirs' claims and authorize the sale of the estate's property.

Property Title Deed Verification

Verifying the property title deed is a crucial step in selling a deceased person's estate. This document proves legal ownership and must be thoroughly checked to ensure there are no encumbrances or disputes.

The title deed must be matched with probate or succession documents to confirm the executor's authority. Clear verification prevents legal complications and facilitates a smooth sale process.

No Objection Certificate (NOC) from Heirs

| Document | Description | Importance |

|---|---|---|

| No Objection Certificate (NOC) from Heirs | A legal document issued by all legal heirs of the deceased, stating they have no objection to the sale of the property from the deceased's estate. | Confirms unanimous consent among heirs, preventing future disputes and ensuring a smooth property transfer process. |

| Death Certificate | Official document stating the date and cause of death of the property owner. | Serves as proof of death, critical for initiating estate settlement procedures. |

| Probate or Succession Certificate | Legal authorization that validates the executor or administrator's right to manage and sell the estate property. | Establishes legal authority to sell the property, especially necessary when disputes or multiple heirs are involved. |

| Title Deed of Property | Official document proving ownership of the property by the deceased. | Essential for transferring property title to the buyer. |

| Mutation Certificate | Record showing the change of ownership in government land records following the property transfer. | Ensures property ownership is updated officially in municipal or revenue records. |

Succession Certificate for Asset Transfer

A Succession Certificate is a crucial document required to transfer the ownership of property from a deceased person to their legal heirs. It serves as legal proof of the rightful claimants and helps prevent disputes during the asset transfer process.

The certificate is issued by a competent court after verifying the heirs' status and validating the death of the property owner. It enables the smooth sale or transfer of immovable and movable assets, ensuring the transaction complies with legal formalities.

What Documents Does a Deceased Person’s Estate Need to Sell Property? Infographic