An estate executor needs several key documents to sell inherited property, including the original will, letters testamentary or letters of administration proving their authority, and the death certificate of the deceased. A clear title or deed to the property must also be obtained or verified to ensure transferability. Tax clearance certificates and any necessary court orders may be required depending on the jurisdiction to finalize the sale legally.

What Documents Does an Estate Executor Need to Sell Inherited Property?

| Number | Name | Description |

|---|---|---|

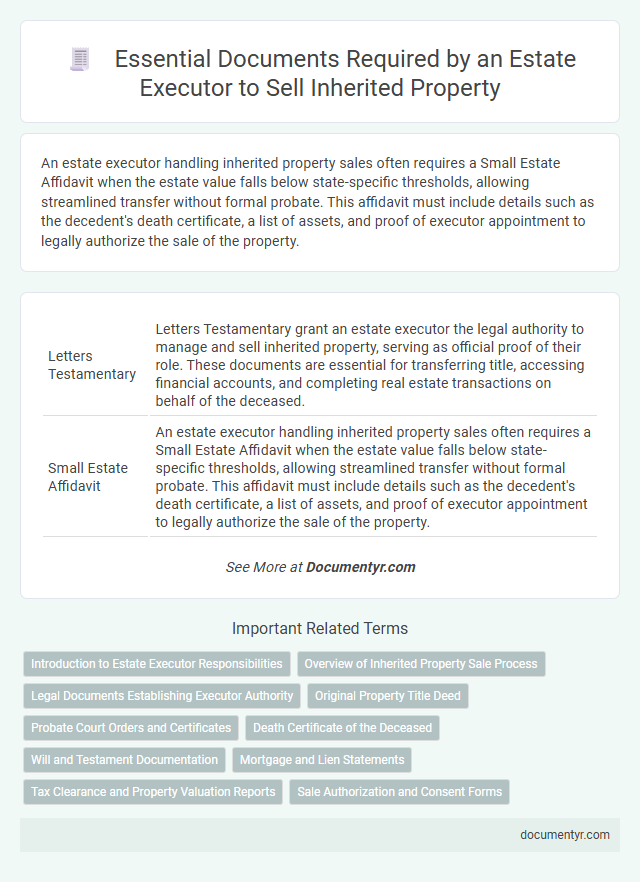

| 1 | Letters Testamentary | Letters Testamentary grant an estate executor the legal authority to manage and sell inherited property, serving as official proof of their role. These documents are essential for transferring title, accessing financial accounts, and completing real estate transactions on behalf of the deceased. |

| 2 | Small Estate Affidavit | An estate executor handling inherited property sales often requires a Small Estate Affidavit when the estate value falls below state-specific thresholds, allowing streamlined transfer without formal probate. This affidavit must include details such as the decedent's death certificate, a list of assets, and proof of executor appointment to legally authorize the sale of the property. |

| 3 | Death Certificate Authentication | An estate executor must obtain multiple certified copies of the death certificate to authenticate the deceased's passing and facilitate the transfer of property ownership. This document is essential for probate court proceedings, title transfers, and validating the executor's authority to sell inherited real estate. |

| 4 | Executor’s Deed | An Executor's Deed is a legal document granting the estate executor authority to transfer ownership of inherited property to a buyer, ensuring clear title conveyance from the deceased to the new owner. Essential supporting documents include the will, death certificate, probate court order appointing the executor, and any tax clearance certificates required for the sale. |

| 5 | Estate EIN (Estate Tax Identification Number) | An Estate Executor needs the Estate Tax Identification Number (EIN) to manage and sell inherited property, as it acts like a Social Security Number for the estate and is required for tax filings and financial transactions. Obtaining the EIN from the IRS enables the executor to open estate bank accounts, pay debts, and legally transfer ownership of the property to beneficiaries or buyers. |

| 6 | Probate Court Order for Sale | A Probate Court Order for Sale is a critical legal document required by an estate executor to transfer ownership of inherited property, ensuring the sale complies with court authorization. This order verifies the executor's authority to sell the property and protects against potential disputes from heirs or creditors during the probate process. |

| 7 | Inheritance Tax Waiver | An estate executor needs the original grant of probate, the deceased's will, title deeds, and a valid inheritance tax waiver to legally sell inherited property. The inheritance tax waiver confirms that any due taxes have been settled or waived, ensuring a clear transfer of ownership. |

| 8 | Real Estate Disclosure Compliance | An estate executor must obtain the original will, death certificate, letters testamentary or administration, and the property deed to legally transfer ownership of inherited real estate. Compliance with state-specific real estate disclosure laws requires providing detailed disclosures about the property's condition, including known defects, liens, and any environmental hazards to protect buyers and ensure a transparent transaction. |

| 9 | Title Vesting Documentation | Estate executors must obtain title vesting documentation, including the original deed and any court-issued letters testamentary or letters of administration, to establish legal authority to transfer inherited property. These documents verify the executor's right to sell the estate asset and are required by title companies and buyers to clear ownership title. |

| 10 | Release of Estate Lien | An estate executor must obtain the Release of Estate Lien, a legal document confirming that any outstanding liens or debts on the inherited property have been cleared, ensuring a smooth transfer of ownership. This release is essential to sell the property without encumbrances and provides clear title to the buyer. |

Introduction to Estate Executor Responsibilities

Handling the sale of inherited property is a crucial duty for an estate executor. Proper documentation is essential to ensure a legal and smooth transaction.

- Death Certificate - A certified copy of the deceased's death certificate is required to prove the property owner's passing.

- Will or Probate Documents - The will or court-issued probate documents authorize the executor to manage and sell estate assets.

- Property Title or Deed - Legal ownership documents must be reviewed and transferred to validate the sale of the inherited property.

Overview of Inherited Property Sale Process

What documents does an estate executor need to sell inherited property? An estate executor must gather several key documents to ensure a smooth sale process, including the death certificate, the will, and the grant of probate or letters of administration. These documents establish the executor's authority and clarify ownership, allowing the property to be legally transferred to the buyer.

Legal Documents Establishing Executor Authority

To sell inherited property, an estate executor must have key legal documents that establish their authority. These documents prove to third parties that the executor has the legal right to manage and sell the property.

The most critical document is the Letters Testamentary or Letters of Administration, issued by the probate court. This official paperwork confirms the executor's appointment and grants the authority to act on behalf of the estate. You will also need the original will, if available, to demonstrate the testator's wishes and support your role as executor.

Original Property Title Deed

The original property title deed is essential for an estate executor to sell inherited property. This document proves ownership and is required to transfer the title legally.

You must present the original title deed along with the death certificate and probate documents to complete the sale process. Without the original deed, the transaction cannot proceed smoothly with the land registry.

Probate Court Orders and Certificates

To sell inherited property, an estate executor must obtain specific legal documents to validate their authority. Probate court orders and certificates are essential to establish your right to manage and sell the estate assets.

Probate court orders officially appoint the executor and authorize the sale of the property, ensuring the transaction complies with legal requirements. Certificates such as the "Letters Testamentary" or "Letters of Administration" serve as proof of your legal authority granted by the probate court.

Death Certificate of the Deceased

When selling inherited property, the death certificate of the deceased is a crucial document that verifies the passing of the original owner. You must provide this official record to proceed with legal and financial transactions related to the estate.

- Proof of Death - The death certificate serves as the primary legal proof that the original property owner has died.

- Title Transfer Requirement - This document is necessary to transfer the property title from the deceased to the estate executor or beneficiaries.

- Recording with Authorities - Courts and financial institutions require the death certificate to authorize the sale or distribution of the inherited property.

Will and Testament Documentation

When selling inherited property, the estate executor must have specific documentation to prove authority and ownership. The Will and Testament play a critical role in validating the executor's right to manage and sell the property.

- Original Will - The executor needs the original signed Will to demonstrate legal authority over the estate.

- Probate Court Approval - Official probate documents confirm the executor's appointment and permission to sell inherited assets.

- Death Certificate - The certified death certificate of the deceased is required to initiate the estate settlement process.

Possessing the correct Will and testamentary documents ensures a smooth legal transfer during the sale of the inherited property.

Mortgage and Lien Statements

When selling inherited property, the estate executor must obtain all relevant mortgage statements to verify outstanding loan balances. Lien statements are crucial to identify any claims or encumbrances that must be resolved before the sale. You should gather these documents early to ensure a smooth transaction and clear title transfer.

Tax Clearance and Property Valuation Reports

An estate executor needs the Tax Clearance Certificate to prove all estate taxes have been paid before selling inherited property. The Property Valuation Report is essential to determine the accurate market value of the estate asset for sale. These documents ensure legal compliance and fair transaction pricing during the property sale process.

What Documents Does an Estate Executor Need to Sell Inherited Property? Infographic