A mortgage application requires key documents including proof of income such as pay stubs, tax returns, and bank statements to verify financial stability. Identification documents like a valid ID or passport are essential for identity confirmation. Lenders also request credit reports and information about existing debts or assets to assess creditworthiness and repayment ability.

What Documents are Needed for a Mortgage Application?

| Number | Name | Description |

|---|---|---|

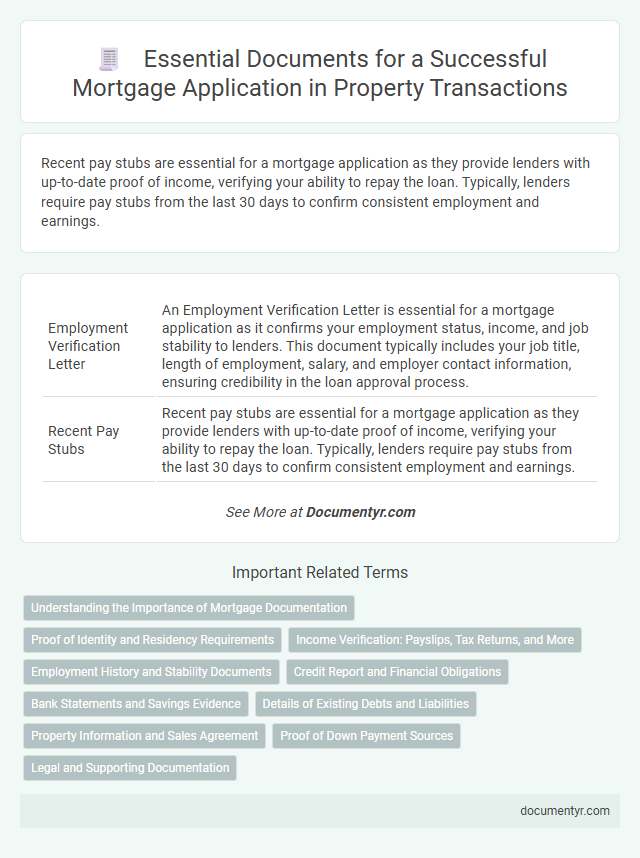

| 1 | Employment Verification Letter | An Employment Verification Letter is essential for a mortgage application as it confirms your employment status, income, and job stability to lenders. This document typically includes your job title, length of employment, salary, and employer contact information, ensuring credibility in the loan approval process. |

| 2 | Recent Pay Stubs | Recent pay stubs are essential for a mortgage application as they provide lenders with up-to-date proof of income, verifying your ability to repay the loan. Typically, lenders require pay stubs from the last 30 days to confirm consistent employment and earnings. |

| 3 | Bank Statement Seasoning Documentation | Bank statement seasoning documentation for a mortgage application typically requires providing continuous monthly bank statements from the last two to three months, demonstrating consistent deposit history and fund availability. Lenders use these seasoned statements to verify the borrower's financial stability and to ensure that funds are not recently borrowed or transferred from untraceable sources. |

| 4 | Gift Letter Compliance | Lenders require a gift letter to verify that gifted funds for a mortgage down payment are non-repayable, ensuring compliance with mortgage underwriting standards. This document must include the donor's name, relationship to the borrower, gift amount, and a clear statement that repayment is not expected. |

| 5 | Rental Payment History Report | Mortgage applications require a detailed Rental Payment History Report to verify consistent monthly payments and demonstrate financial reliability. This document typically includes landlord references, payment dates, amounts, and any missed or late payments, strengthening the applicant's creditworthiness. |

| 6 | Asset Source Verification | Mortgage applications require asset source verification documents such as recent bank statements, investment account summaries, and proof of gifts or loans used for the down payment. Lenders also request tax returns, pay stubs, and documentation of any large deposits to confirm the legitimacy and stability of the applicant's financial assets. |

| 7 | Digital Income Validation | Digital income validation streamlines the mortgage application process by securely verifying applicants' earnings through electronic pay stubs, bank statements, and tax documents. Lenders rely on automated income verification systems like The Work Number to ensure accurate and efficient assessment of financial eligibility. |

| 8 | Automated Underwriting System (AUS) Findings | Automated Underwriting System (AUS) findings streamline mortgage applications by providing preliminary eligibility assessments based on borrower data such as credit reports, income verification, and property details. Key documents required to support AUS findings include recent pay stubs, W-2 forms, tax returns, bank statements, and the property appraisal report, ensuring accurate validation of financial and property information. |

| 9 | Self-Employment Profit & Loss Statements | Lenders require self-employment profit and loss statements to verify income stability and assess the financial health of applicants running their own businesses. These documents, covering at least the past two years, must detail revenue, expenses, and net profit to support accurate mortgage qualification. |

| 10 | Down Payment Sourcing Documentation | Down payment sourcing documentation is critical in mortgage applications to verify the origin of funds, typically requiring bank statements, gift letters, or sale of assets records. Accurate documentation ensures compliance with lender requirements, reducing the risk of fraud and facilitating loan approval. |

Understanding the Importance of Mortgage Documentation

Mortgage documentation is crucial for verifying financial stability and ensuring a smooth loan approval process. Understanding the required documents helps you prepare accurately and avoid delays in your mortgage application.

- Proof of Income - Payslips, tax returns, or bank statements confirm your earnings to lenders.

- Credit History - Credit reports assess your creditworthiness and impact loan terms.

- Property Details - Documentation about the property ensures it meets lender criteria and supports the loan amount.

Proof of Identity and Residency Requirements

What documents are needed to prove identity for a mortgage application? Acceptable proof of identity includes government-issued photo IDs such as a passport or driver's license. These documents confirm the applicant's legal identity and are essential for processing the mortgage.

What proof of residency is required when applying for a mortgage? Applicants must provide recent utility bills, lease agreements, or official mail showing their current address. Residency documents help lenders verify the applicant's living situation and stability.

Income Verification: Payslips, Tax Returns, and More

Income verification is a crucial part of the mortgage application process. Lenders require documentation such as payslips and tax returns to assess your financial stability and repayment ability.

Typical documents include recent payslips, usually covering the last three months, and complete tax returns from the previous two years. Bank statements may also be requested to confirm consistent income deposits. Self-employed applicants often need additional proof like profit and loss statements or accountant-certified financials.

Employment History and Stability Documents

Employment history and stability documents are crucial for a mortgage application, providing lenders with proof of consistent income and job reliability. Commonly required documents include recent pay stubs, W-2 forms, and employer contact information.

Self-employed applicants must provide tax returns and profit-and-loss statements to demonstrate income stability. Lenders may also request verification letters from employers to confirm job status and tenure.

Credit Report and Financial Obligations

When applying for a mortgage, a thorough review of your credit report and financial obligations is essential. Lenders rely on these documents to assess your creditworthiness and repayment ability.

- Credit Report - This document provides a detailed history of your credit accounts, payment records, and outstanding debts.

- Proof of Income - Pay stubs, tax returns, and bank statements verify your income stability and support your mortgage application.

- List of Financial Obligations - Documenting monthly debts such as loans, credit cards, and other payments gives lenders a clear view of your debt-to-income ratio.

Your mortgage approval depends significantly on the accuracy and completeness of these financial documents.

Bank Statements and Savings Evidence

Bank statements are essential for a mortgage application as they provide proof of consistent income and financial stability over the past few months. Lenders review these statements to verify salary deposits, track spending habits, and identify any irregular transactions that may affect loan approval. Savings evidence, such as certificates of deposit or savings account statements, demonstrates your ability to cover down payments and closing costs, increasing lender confidence in your financial preparedness.

Details of Existing Debts and Liabilities

| Document | Details Required | Purpose |

|---|---|---|

| Credit Report | Comprehensive overview of current debts including credit cards, personal loans, and past repayments | To evaluate creditworthiness and existing liabilities |

| Loan Statements | Recent statements for all outstanding loans such as car, student, or personal loans showing balances and payment history | Prove ongoing debt obligations and repayment consistency |

| Credit Card Statements | Statements covering recent months indicating outstanding balances, limits, and minimum payments | Assess revolving credit liabilities and financial responsibility |

| Alimony or Child Support Documentation | Legal agreements or court orders specifying amounts and payment schedules | Factoring in recurring financial obligations affecting disposable income |

| Tax Liens or Judgments | Official documents listing outstanding tax debts or legal judgments | Identification of hidden liabilities impacting financial standing |

| Bankruptcy Documents (if applicable) | Discharge papers or bankruptcy filings detailing past financial distress | Understanding historical liabilities and credit rehabilitation |

| Monthly Bills and Utilities | Recent bills for regular payments that may affect debt-to-income ratio | Provide insight into consistent monthly liabilities |

Property Information and Sales Agreement

Mortgage applications require detailed property information, including the address, legal description, and valuation report. A comprehensive sales agreement must be provided, outlining the purchase price, terms, and conditions agreed upon by buyer and seller. These documents help lenders verify property details and ensure all sale terms are clear before loan approval.

Proof of Down Payment Sources

Proof of down payment sources is essential when applying for a mortgage. Lenders require clear documentation to verify the origin of the funds you plan to use.

- Bank Statements - Provide recent bank statements showing the down payment amount and its availability.

- Gift Letter - Submit a formal letter if the down payment is a gift, confirming no repayment is expected.

- Sale of Assets - Include documentation of any sold assets, such as vehicles or investments, used to fund the down payment.

What Documents are Needed for a Mortgage Application? Infographic