Homebuyers need several key documents for mortgage approval, including proof of income such as pay stubs, tax returns, and W-2 forms to verify financial stability. Lenders also require credit reports, bank statements, and identification to assess creditworthiness and confirm identity. Property-related documents like the purchase agreement and home appraisal are essential to validate the loan amount and property value.

What Documents Does a Homebuyer Need for Mortgage Approval?

| Number | Name | Description |

|---|---|---|

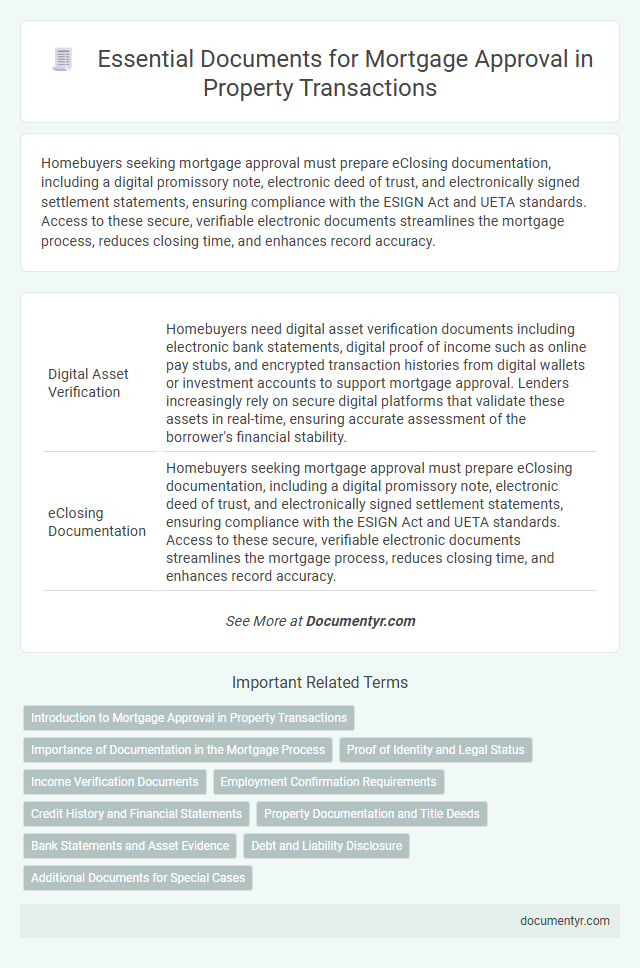

| 1 | Digital Asset Verification | Homebuyers need digital asset verification documents including electronic bank statements, digital proof of income such as online pay stubs, and encrypted transaction histories from digital wallets or investment accounts to support mortgage approval. Lenders increasingly rely on secure digital platforms that validate these assets in real-time, ensuring accurate assessment of the borrower's financial stability. |

| 2 | eClosing Documentation | Homebuyers seeking mortgage approval must prepare eClosing documentation, including a digital promissory note, electronic deed of trust, and electronically signed settlement statements, ensuring compliance with the ESIGN Act and UETA standards. Access to these secure, verifiable electronic documents streamlines the mortgage process, reduces closing time, and enhances record accuracy. |

| 3 | Automated Income Validation | Automated Income Validation streamlines mortgage approval by using third-party data sources to verify a homebuyer's earnings quickly and accurately, reducing the need for extensive paper documentation such as pay stubs or tax returns. This technology integrates with employer payroll systems and financial institutions to provide lenders with real-time income verification, enhancing approval efficiency and reducing processing times. |

| 4 | Remote Online Notarization Files | Homebuyers seeking mortgage approval must submit Remote Online Notarization (RON) files, including digitally notarized property disclosures, identity verification documents, and electronic signatures, to comply with lender requirements. These secure RON documents streamline the approval process by enabling remote validation of legal paperwork and borrower authenticity. |

| 5 | Smart Contract Deeds | Homebuyers seeking mortgage approval must provide key documents including income verification, credit reports, and Smart Contract Deeds, which digitally record property ownership and streamline transaction security. Smart Contract Deeds enhance transparency and reduce fraud risk by automatically executing contract terms on a blockchain, making them essential for modern mortgage workflows. |

| 6 | Blockchain Title Records | Blockchain title records provide secure, tamper-proof property ownership documents that expedite mortgage approval by offering verifiable title history and reducing the risk of fraud. Homebuyers need to present these blockchain-verified title records alongside identification, income proof, and credit information for a streamlined mortgage approval process. |

| 7 | Cybersecurity Consent Forms | Homebuyers must provide cybersecurity consent forms to authorize lenders to securely access and verify sensitive personal and financial information during the mortgage approval process. These forms ensure compliance with data protection regulations and safeguard against identity theft while facilitating efficient verification of income, employment, and credit history. |

| 8 | Alternative Credit Data Reports | Alternative credit data reports provide mortgage lenders with non-traditional financial information, such as utility payments, rental history, and phone bills, enabling approval for buyers lacking conventional credit histories. These reports enhance the evaluation of a homebuyer's creditworthiness, increasing access to mortgage approval for individuals with limited or no credit scores. |

| 9 | Fintech Aggregator Statements | Homebuyers need to provide fintech aggregator statements, which consolidate financial data from multiple accounts, to give lenders a comprehensive view of their financial health and spending patterns. These statements are crucial for verifying income consistency, identifying debt obligations, and assessing creditworthiness during the mortgage approval process. |

| 10 | Environmental Risk Disclosure Docs | Homebuyers must provide Environmental Risk Disclosure documents, including reports on flood zones, radon levels, and soil contamination, to ensure compliance with lender requirements and federal regulations. These disclosures help assess potential environmental hazards that could affect property value and mortgage eligibility. |

Introduction to Mortgage Approval in Property Transactions

Mortgage approval is a crucial step in property transactions, ensuring that homebuyers qualify for the necessary financing. Lenders require specific documents to assess the applicant's financial stability and eligibility.

- Proof of Income - Documents such as pay stubs, tax returns, and employment verification demonstrate the borrower's ability to repay the loan.

- Credit History - A credit report helps lenders evaluate the homebuyer's creditworthiness and past financial behavior.

- Identification and Property Details - Valid ID and property information confirm the applicant's identity and the specifics of the home being financed.

Importance of Documentation in the Mortgage Process

Proper documentation is crucial for mortgage approval to verify financial stability and creditworthiness. Lenders require detailed proof of income, employment, and assets to assess risk accurately.

Providing complete and accurate documents accelerates the approval process and helps secure favorable loan terms. You must prepare tax returns, pay stubs, bank statements, and identification to meet lender requirements efficiently.

Proof of Identity and Legal Status

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Valid driver's license, passport, or state ID card | Verifies Your identity and confirms photo identification |

| Social Security Number (SSN) Proof | Social Security card or official tax documents showing SSN | Confirms legal status to work and qualifies credit check |

| Residency Documentation | Permanent resident card (Green Card), visa, or naturalization certificate | Proves legal residency or immigration status |

| Birth Certificate | Certified copy of birth certificate | Used to verify citizenship or identity when no photo ID is available |

Income Verification Documents

What income verification documents does a homebuyer need for mortgage approval? Lenders require specific documents to confirm your financial stability and ability to repay the loan. These typically include recent pay stubs, W-2 forms from the past two years, and tax returns.

Employment Confirmation Requirements

Employment confirmation is a critical part of the mortgage approval process for homebuyers. Lenders require specific documents to verify a borrower's income stability and job status.

- Recent Pay Stubs - Lenders typically ask for the last two to three months of pay stubs to confirm current income and employment status.

- Employer Contact Information - A lender may contact the employer directly to verify job title, length of employment, and salary details.

- Employment Verification Letter - This letter, usually provided by the employer, officially confirms the borrower's job position, salary, and employment duration.

Credit History and Financial Statements

Mortgage approval requires a detailed review of your credit history. Lenders analyze credit scores and payment patterns to assess risk and repayment capability.

Financial statements play a crucial role in verifying income and assets. Recent pay stubs, tax returns, and bank statements provide evidence of financial stability for homebuyers.

Property Documentation and Title Deeds

Homebuyers must provide essential property documentation to secure mortgage approval, including recent property tax receipts, a detailed property survey, and the original title deeds. Title deeds verify ownership and confirm that the property is free from legal disputes or encumbrances, which is critical for lenders to assess the property's legitimacy. You should ensure these documents are accurate and up-to-date to streamline the mortgage approval process and avoid delays.

Bank Statements and Asset Evidence

Homebuyers must provide bank statements to verify their financial stability when applying for a mortgage. These documents demonstrate consistent income deposits and available funds for down payments.

Asset evidence supplements bank statements by confirming ownership of valuable properties or investments. Lenders require proof of assets to assess the borrower's ability to cover closing costs and repay the loan. Typical documents include retirement account statements, stock certificates, and property deeds.

Debt and Liability Disclosure

Debt and liability disclosure is a critical part of the mortgage approval process, requiring detailed documentation of all outstanding debts, including credit cards, personal loans, and other liabilities. Mortgage lenders evaluate your debt-to-income ratio using these documents to assess your financial stability and ability to repay the loan. Properly disclosing your liabilities ensures accurate underwriting and increases the likelihood of mortgage approval.

What Documents Does a Homebuyer Need for Mortgage Approval? Infographic