To apply for a property tax exemption, essential documents typically include proof of ownership, such as the property deed, along with personal identification like a government-issued ID. Additional requirements may involve income statements, residency verification, or documentation supporting eligibility criteria such as disability status or veteran benefits. Ensuring all relevant paperwork is accurately prepared and submitted helps facilitate a smooth exemption process.

What Documents are Necessary for Property Tax Exemption Application?

| Number | Name | Description |

|---|---|---|

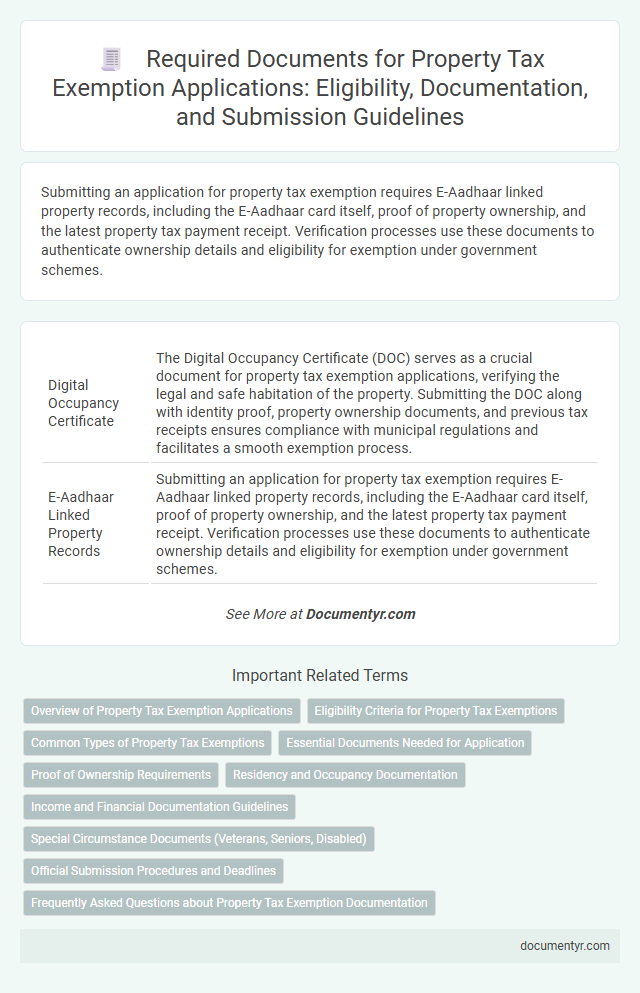

| 1 | Digital Occupancy Certificate | The Digital Occupancy Certificate (DOC) serves as a crucial document for property tax exemption applications, verifying the legal and safe habitation of the property. Submitting the DOC along with identity proof, property ownership documents, and previous tax receipts ensures compliance with municipal regulations and facilitates a smooth exemption process. |

| 2 | E-Aadhaar Linked Property Records | Submitting an application for property tax exemption requires E-Aadhaar linked property records, including the E-Aadhaar card itself, proof of property ownership, and the latest property tax payment receipt. Verification processes use these documents to authenticate ownership details and eligibility for exemption under government schemes. |

| 3 | Income Tax Return (ITR) for Means Verification | Income Tax Return (ITR) documents are essential for property tax exemption applications as they verify the applicant's income and financial eligibility. Submission of the latest ITR ensures accurate assessment of means, facilitating rightful exemption approval by municipal authorities. |

| 4 | GIS-Verified Boundary Map | A GIS-Verified Boundary Map is essential for a property tax exemption application as it accurately delineates property lines, ensuring compliance with local tax authorities. This detailed geographic data supports the verification process by confirming the exact location and dimensions necessary to qualify for exemptions. |

| 5 | Smart Card Property Ownership Proof | The Smart Card Property Ownership Proof serves as a crucial document verifying legal ownership and property details necessary for a property tax exemption application. This digitally encoded card streamlines the verification process by providing authenticated ownership records, ensuring eligibility for tax benefits. |

| 6 | Green Building Certification (for Eco-Tax Exemption) | Green Building Certification is a crucial document required for property tax exemption applications focused on eco-tax benefits, as it validates a property's compliance with sustainability and energy efficiency standards. Applicants must submit official certification reports from recognized green building rating systems such as LEED, BREEAM, or local eco-certification authorities to qualify for the tax exemption. |

| 7 | Annual Self-Declaration Form (Online Submission) | The Annual Self-Declaration Form (Online Submission) is a crucial document for property tax exemption applications, enabling property owners to declare eligibility and provide accurate valuation details digitally. Submission of this form ensures timely processing and helps local authorities verify exemption claims efficiently through a secure online portal. |

| 8 | Blockchain-Authenticated Sale Deed | A Blockchain-Authenticated Sale Deed provides a secure and tamper-proof proof of ownership required for property tax exemption applications, ensuring the authenticity and traceability of the transaction. This digital document, verified on a decentralized ledger, eliminates the risk of forgery while streamlining the verification process for local tax authorities. |

| 9 | RTI-Based Municipal Dues Clearance Certificate | The RTI-Based Municipal Dues Clearance Certificate is a crucial document required for property tax exemption applications, verifying that all municipal dues on the property have been cleared. This certificate, obtained through a Right to Information (RTI) request, ensures transparency and confirms the absence of outstanding property tax payments or municipal charges. |

| 10 | Utility Bill Geo-Tagging Verification | Utility bill geo-tagging verification is essential for property tax exemption applications as it confirms the property's location authenticity by embedding GPS coordinates within the utility bill. This digital verification method ensures accurate address validation, reducing fraud and expediting the exemption approval process. |

Overview of Property Tax Exemption Applications

Property tax exemption applications require specific documentation to verify eligibility and ensure accurate processing. Common documents include proof of ownership, income statements, and identification. Understanding the necessary paperwork streamlines your application and increases the chances of approval.

Eligibility Criteria for Property Tax Exemptions

What documents are necessary for a property tax exemption application? Proof of ownership such as a deed or title is essential. Applicants must also provide identification and evidence demonstrating eligibility based on specific exemption criteria.

What are the eligibility criteria for property tax exemptions? Qualifications often include age, income level, disability status, or veteran status. Verification documents may include birth certificates, income statements, medical records, or military service proofs.

Common Types of Property Tax Exemptions

Applying for property tax exemption requires submitting specific documents that verify eligibility. Different types of exemptions demand varied documentation based on the property owner's status and property use.

- Proof of Ownership - A deed or title document confirming legal ownership of the property.

- Occupancy or Residency Certificate - Evidence showing the property is the applicant's primary residence, often required for homestead exemptions.

- Income Verification - Tax returns or pay stubs used to qualify for low-income or senior citizen property tax exemptions.

- Disability Documentation - Medical certifications or government disability awards needed for disability-related exemptions.

- Veteran Status Proof - Military service records or discharge papers for veteran property tax exemptions.

Essential Documents Needed for Application

Applying for a property tax exemption requires submitting specific documents that verify eligibility. These essential documents ensure the application process is smooth and successful.

Proof of property ownership is mandatory, typically a deed or title document. Income verification documents, such as tax returns or pay stubs, help determine qualification based on financial status. Identification proof, like a government-issued ID, confirms the applicant's identity and supports the exemption claim.

Proof of Ownership Requirements

Proof of ownership is a critical document when applying for a property tax exemption, verifying the applicant's legal rights over the property. Accurate and accepted ownership documents ensure the legitimacy of the exemption claim.

- Title Deed - Official document that establishes the legal owner of the property.

- Property Tax Receipt - Recent paid receipt showing the property is registered under the applicant's name.

- Purchase Agreement - Contract evidencing the transfer of ownership from seller to buyer.

Submitting valid proof of ownership documents is essential to avoid delays or rejection in the property tax exemption application process.

Residency and Occupancy Documentation

Proof of residency is essential when applying for property tax exemption. Common documents include a valid driver's license, state ID, or utility bills showing the applicant's name and address.

Occupancy documentation verifies the property is the applicant's primary residence. Examples include a signed lease agreement, a signed affidavit of occupancy, or a voter registration card linked to the property address.

Income and Financial Documentation Guidelines

Income and financial documentation are crucial for property tax exemption applications to verify eligibility accurately. Required documents typically include recent pay stubs, tax returns from the last fiscal year, and bank statements demonstrating financial status. Providing comprehensive financial records ensures compliance with local tax authority guidelines and supports a successful exemption review process.

Special Circumstance Documents (Veterans, Seniors, Disabled)

Applying for a property tax exemption requires specific documentation to verify eligibility under special circumstances. Certain categories such as veterans, seniors, and disabled individuals must provide additional proof to qualify for exemptions.

- Veteran Identification - Documents like a DD214 form or VA disability letter confirm military service and eligibility for veteran exemptions.

- Senior Citizen Proof - A government-issued ID or birth certificate is necessary to verify age and qualify for senior exemptions.

- Disability Certification - Medical records or Social Security Disability award letters demonstrate disability status required for exemption considerations.

Official Submission Procedures and Deadlines

To apply for a property tax exemption, you must gather essential documents such as proof of ownership, identification, and exemption qualification certificates. Official submission procedures require these documents to be submitted to the local tax assessor's office or through the authorized online portal.

Deadlines for property tax exemption applications vary by jurisdiction but are typically set annually, often before the tax billing cycle begins. Missing the deadline may result in denial of exemption for the current tax year, so timely submission is crucial for your application to be processed successfully.

What Documents are Necessary for Property Tax Exemption Application? Infographic