Essential documents for property tax filing include the property deed, which proves ownership, and the latest property tax assessment or valuation report to determine the taxable value. Additionally, identification proof such as a government-issued ID is required, along with previous property tax receipts to verify payment history and any applicable exemption certificates. Accurate submission of these documents ensures compliance and prevents penalties during the property tax filing process.

What Documents are Necessary for Property Tax Filing?

| Number | Name | Description |

|---|---|---|

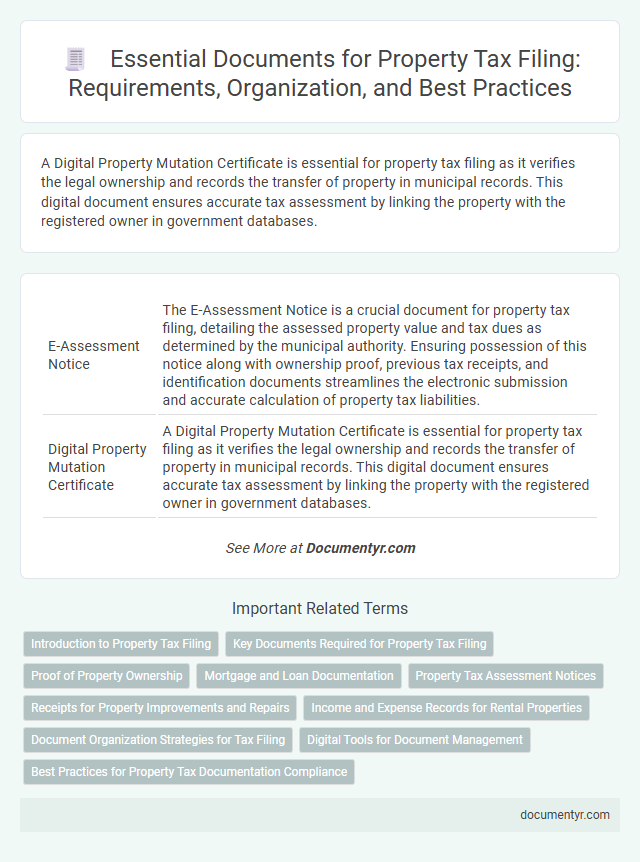

| 1 | E-Assessment Notice | The E-Assessment Notice is a crucial document for property tax filing, detailing the assessed property value and tax dues as determined by the municipal authority. Ensuring possession of this notice along with ownership proof, previous tax receipts, and identification documents streamlines the electronic submission and accurate calculation of property tax liabilities. |

| 2 | Digital Property Mutation Certificate | A Digital Property Mutation Certificate is essential for property tax filing as it verifies the legal ownership and records the transfer of property in municipal records. This digital document ensures accurate tax assessment by linking the property with the registered owner in government databases. |

| 3 | GIS-based Property ID Document | GIS-based Property ID documents provide precise geospatial identification of properties, essential for accurate property tax assessment and filing. These documents link property boundaries to Geographic Information Systems (GIS) databases, ensuring legally recognized ownership verification and enabling jurisdiction-specific tax calculations. |

| 4 | Smart Ledger Extract | Smart Ledger Extract provides a detailed and tamper-proof record of property transactions, essential for accurate property tax filing by verifying ownership and transaction history. Essential documents alongside the Smart Ledger Extract include property tax assessment records, previous tax receipts, and identification proofs to ensure compliance and accuracy in filing. |

| 5 | Online Self-Declaration Form (Property Tax) | The Online Self-Declaration Form for property tax filing requires essential documents such as the latest property tax receipt, proof of ownership (sale deed or title deed), property identification number, and valid identity proof like Aadhaar card or PAN card. These documents ensure accurate assessment and smooth processing of property tax payments through the municipal or local government portal. |

| 6 | QR Code-Based Payment Receipt | The essential documents for property tax filing include the QR code-based payment receipt, which serves as a verified proof of payment ensuring seamless tracking and validation by municipal authorities. This digital receipt contains encrypted transaction details critical for accurate tax record keeping and prevents fraudulent claims during the filing process. |

| 7 | Encumbrance e-Statement | The Encumbrance e-Statement is a critical document for property tax filing, providing a verified record of all financial liabilities, such as mortgages or loans, registered against the property. This digital statement ensures transparency and accuracy in ownership verification, helping to avoid disputes and streamline the tax assessment process. |

| 8 | Blockchain Property Ownership Record | Blockchain property ownership records provide a secure and transparent way to verify ownership history and transaction details, streamlining the property tax filing process. Essential documents include the blockchain-based title deed, previous tax receipts, and proof of payment linked to the digital ledger for accurate assessment and record-keeping. |

| 9 | Virtual Property Tax Challan | The essential documents for property tax filing include the Virtual Property Tax Challan, property deed, previous tax receipts, and identification proof of the owner. The Virtual Property Tax Challan serves as a digital receipt confirming the payment of property tax, streamlining the filing process and ensuring accurate record-keeping. |

| 10 | Dynamic Property Valuation Report | The Dynamic Property Valuation Report is essential for accurate property tax filing, providing up-to-date market value assessments that reflect current economic conditions. This report ensures transparency and precise calculation, minimizing discrepancies and potential audits during the tax submission process. |

Introduction to Property Tax Filing

Property tax filing requires various essential documents to ensure accurate assessment and timely payment. These documents include proof of ownership, property tax receipts from previous years, and the latest property valuation certificate. Gathering these records helps streamline the filing process and avoid potential legal issues.

Key Documents Required for Property Tax Filing

Property tax filing requires several essential documents to ensure accurate assessment and timely submission. Key documents include the property deed, tax assessment notice, and proof of ownership.

You must also provide a recent property tax receipt and any exemption certificates if applicable. Accurate documentation helps avoid penalties and streamlines the tax filing process.

Proof of Property Ownership

Proof of property ownership is a crucial document for property tax filing to verify your legal claim to the property. Submitting accurate ownership documents ensures proper assessment and prevents disputes during the tax evaluation process.

- Title Deed - The official document that establishes legal ownership of the property.

- Sale Deed - A contract proving the transfer of property ownership from the seller to you.

- Property Tax Receipt - Previous payment receipts that confirm your responsibility as the property owner.

Mortgage and Loan Documentation

Mortgage statements and loan agreements are essential documents required for accurate property tax filing. These documents provide proof of outstanding balances and interest paid, which can affect your tax deductions. Ensuring you have up-to-date mortgage and loan documentation helps in verifying the correct tax amount owed.

Property Tax Assessment Notices

Property tax assessment notices are essential documents required for accurate property tax filing. These notices provide detailed information on the assessed value of the property, which determines the tax amount due.

Taxpayers must keep the latest property tax assessment notice as it reflects the official valuation used by local tax authorities. This document includes critical data such as property location, assessed value, and tax rate. Ensuring the accuracy of the assessment notice helps avoid discrepancies and potential disputes during the filing process.

Receipts for Property Improvements and Repairs

| Document Type | Description | Importance for Property Tax Filing |

|---|---|---|

| Receipts for Property Improvements | Invoices and payment confirmations for enhancements such as room additions, kitchen remodels, or new roofing installed. | These receipts help prove increases in property value, which may affect assessed property tax amounts. |

| Receipts for Property Repairs | Records of expenditures for maintaining the property, including plumbing fixes, electrical repairs, and painting. | Repair receipts demonstrate upkeep, potentially preventing unjustified tax increases based on deteriorated condition assessments. |

| Contractor Agreements | Written contracts between property owners and contractors outlining scope of improvement or repair work. | Contracts validate the nature and cost of work claimed for tax filing purposes. |

| Payment Proof | Bank statements, canceled checks, or electronic payment confirmations for services rendered. | Supports authenticity and completion of improvements or repairs, ensuring compliance with property tax authorities. |

| Before and After Photos | Visual documentation showing property condition prior to and following improvements or repairs. | Helps property assessors evaluate the impact of work on property valuation for tax determination. |

Income and Expense Records for Rental Properties

Income and expense records play a crucial role in accurately filing property taxes for rental properties. Maintaining organized documentation ensures compliance and maximizes potential deductions.

- Rental Income Records - Detailed records of all rental payments received, including dates and amounts, are essential for reporting accurate income.

- Expense Receipts - Keep receipts and invoices for property-related expenses such as repairs, maintenance, and utilities to claim valid deductions.

- Bank Statements - Bank statements provide proof of income and expenses, supporting accuracy in reported figures during tax filing.

Document Organization Strategies for Tax Filing

What documents are necessary for efficient property tax filing? Organizing key documents such as the property deed, previous tax returns, and assessment notices ensures a smooth filing process. Keeping these records systematically reduces errors and accelerates tax submission.

How can document organization improve property tax filing accuracy? Categorizing documents by type and date, and using labeled folders or digital scanning, enhances accessibility during tax preparation. Proper organization minimizes missed deductions and compliance issues.

Which documents should be prioritized for property tax filing? Prioritize the property tax bill, payment receipts, mortgage statements, and proof of exemptions or credits. These documents provide critical information for accurate tax calculations and eligibility verification.

What strategies help maintain organized property tax documents year-round? Establish a consistent filing system that includes both physical and digital copies of tax-related documents. Regular updates and reviews prevent the loss of important paperwork when tax season arrives.

Digital Tools for Document Management

Efficient property tax filing requires organizing key documents such as the property deed, previous tax returns, and payment receipts. Digital tools streamline this process by securely storing these documents, enabling quick access and reducing the risk of loss.

Many property owners use cloud-based platforms to upload and categorize tax-related files, ensuring compliance with local regulations. These tools also offer features like automatic reminders and integrated calculators to optimize tax filing accuracy and timeliness.

What Documents are Necessary for Property Tax Filing? Infographic