When selling a rental property, gather essential documents such as the deed, mortgage statements, and property tax records to ensure a smooth transaction. Include detailed rental agreements, tenant payment histories, and maintenance records to provide transparency and build buyer confidence. Having these documents organized helps streamline the selling process and supports accurate property valuation.

What Documents Should You Collect When Selling a Rental Property?

| Number | Name | Description |

|---|---|---|

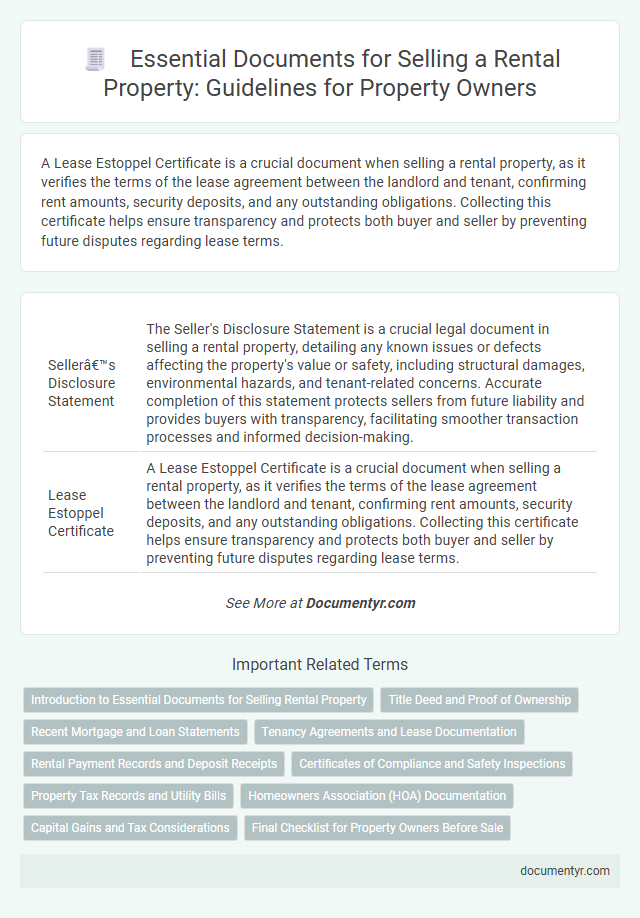

| 1 | Seller’s Disclosure Statement | The Seller's Disclosure Statement is a crucial legal document in selling a rental property, detailing any known issues or defects affecting the property's value or safety, including structural damages, environmental hazards, and tenant-related concerns. Accurate completion of this statement protects sellers from future liability and provides buyers with transparency, facilitating smoother transaction processes and informed decision-making. |

| 2 | Lease Estoppel Certificate | A Lease Estoppel Certificate is a crucial document when selling a rental property, as it verifies the terms of the lease agreement between the landlord and tenant, confirming rent amounts, security deposits, and any outstanding obligations. Collecting this certificate helps ensure transparency and protects both buyer and seller by preventing future disputes regarding lease terms. |

| 3 | Rent Roll Report | A Rent Roll Report is essential when selling a rental property as it provides a detailed summary of rental income, tenant information, lease terms, and payment history, helping buyers assess the property's financial performance. Collecting this document ensures transparency and supports accurate valuation during the sales process. |

| 4 | Tenant Move-in/Move-out Inspection Checklists | Tenant move-in and move-out inspection checklists are essential for documenting the property's condition and protecting both landlord and tenant interests during a rental property sale. These detailed checklists, including photos and repair records, provide critical evidence for security deposit disputes and help establish property value at the time of sale. |

| 5 | Short-Term Rental Permits | Collect valid short-term rental permits and licenses issued by local authorities to ensure legal compliance when selling a rental property. These documents include registration certificates, proof of tax payments, and any renewal confirmations required for short-term rental operations. |

| 6 | Utility Transfer Agreements | Collecting utility transfer agreements is essential when selling a rental property to ensure a smooth transition of services such as electricity, water, and gas to the new owner. These documents verify the transfer of account responsibilities and help prevent billing disputes or service interruptions after the sale. |

| 7 | 1031 Exchange Documentation | When selling a rental property and utilizing a 1031 Exchange, you must collect critical documentation including the original purchase deed, IRS Form 8824 for reporting the exchange, qualified intermediary agreements, and evidence of like-kind replacement property identification within 45 days. Proper organization of closing statements, property tax records, and proof of reinvestment ensures compliance with IRS regulations to defer capital gains taxes effectively. |

| 8 | Lead-Based Paint Disclosure (if applicable) | When selling a rental property built before 1978, collecting a Lead-Based Paint Disclosure form is crucial to comply with federal regulations and inform buyers about potential lead hazards. This document must be provided alongside any available lead inspection reports or records to ensure transparency and protect both parties from liability. |

| 9 | Digital Access Log (for smart home features) | Collecting a Digital Access Log is essential when selling a rental property with smart home features, as it provides a detailed record of entry times and user access permissions, ensuring transparency for potential buyers. This document supports the security history of the property and verifies the functionality of connected devices, enhancing buyer confidence in the property's technological assets. |

| 10 | Environmental Site Assessment (Phase I ESA) | When selling a rental property, obtaining a Phase I Environmental Site Assessment (ESA) is crucial to identify any potential environmental contamination or liabilities that could affect the transaction. This report, conducted by qualified environmental professionals, provides buyers and sellers with essential information about the property's historical use and environmental risks, ensuring compliance with legal standards and protecting financial interests. |

Introduction to Essential Documents for Selling Rental Property

Selling a rental property requires thorough preparation and organization of key documents. Essential paperwork includes the property deed, rental agreements, and records of maintenance or repairs. These documents ensure a smooth transaction and protect both buyers and sellers during the sale process.

Title Deed and Proof of Ownership

When selling a rental property, gathering the correct legal documents is crucial for a smooth transaction. Two of the most important documents to have are the Title Deed and Proof of Ownership.

- Title Deed - This document verifies the legal ownership of the property and is essential for proving your right to sell the rental.

- Proof of Ownership - Records such as previous sale agreements or tax receipts confirm your possession and authority over the rental property.

- Importance of Documents - Presenting these documents ensures transparency, prevents legal disputes, and speeds up the selling process.

Recent Mortgage and Loan Statements

When selling a rental property, recent mortgage and loan statements are essential documents to gather. These statements provide an accurate record of the outstanding loan balance and payment history.

Buyers and lenders often require these documents to verify financial obligations associated with the property. Keeping these statements up-to-date ensures a smoother transaction process and prevents delays in closing.

Tenancy Agreements and Lease Documentation

When selling a rental property, collecting comprehensive tenancy agreements is essential for a smooth transaction. These documents detail the rights and obligations of both landlords and tenants, ensuring transparency for potential buyers.

Lease documentation outlines the duration, rent terms, and conditions of tenancy, providing critical information on ongoing rental income. Properly organized lease agreements help buyers assess the investment potential and legal responsibilities tied to the property.

Rental Payment Records and Deposit Receipts

| Document Type | Description | Importance in Selling Rental Property |

|---|---|---|

| Rental Payment Records | Comprehensive documentation of all rental payments made by tenants, including dates, amounts, and payment methods. | Proves consistent cash flow history, highlights tenant reliability, and supports accurate property valuation for potential buyers. |

| Deposit Receipts | Receipts provided to tenants confirming security deposits or other refundable payments collected at lease signing. | Verifies deposit amounts held, aids in the transparent transfer of funds to the new owner, and ensures compliance with local regulations. |

Certificates of Compliance and Safety Inspections

Collecting Certificates of Compliance and Safety Inspections is essential when selling a rental property. These documents verify that the property meets all legal and safety standards required by local authorities.

Certificates of Compliance include electrical, gas, and plumbing approvals, ensuring all systems function correctly and safely. Safety inspections cover fire alarms, smoke detectors, and carbon monoxide detectors, confirming they are installed and operational. Providing these documents boosts buyer confidence and streamlines the sale process.

Property Tax Records and Utility Bills

Collecting essential documents is crucial when selling a rental property. Property tax records and utility bills provide transparency and support the sales process.

- Property Tax Records - These documents verify your payment history and outstanding taxes on the property.

- Utility Bills - Utility statements demonstrate the average monthly costs and show that all accounts are current.

- Document Accuracy - Accurate records help avoid disputes and expedite closing by confirming financial details.

Organizing these documents ensures a smoother transaction and builds buyer confidence.

Homeowners Association (HOA) Documentation

Collecting the right Homeowners Association (HOA) documentation is essential when selling a rental property to ensure a smooth transaction. These documents provide potential buyers with critical information about the community rules, fees, and regulations.

- HOA Financial Statements - These statements reveal the association's financial health, including budgets, reserves, and any outstanding debts.

- HOA Bylaws and Covenants - This documentation outlines the rules, restrictions, and responsibilities residents must follow within the community.

- HOA Meeting Minutes - Meeting minutes give insight into past decisions, upcoming projects, and any ongoing issues within the HOA.

Capital Gains and Tax Considerations

When selling a rental property, gathering all relevant financial documents is essential for accurate capital gains and tax calculation. Important records include purchase agreements, improvement receipts, rental income statements, and expense documentation such as property management fees and maintenance costs. Keeping these documents organized helps ensure proper reporting and maximizes potential tax benefits during the sale process.

What Documents Should You Collect When Selling a Rental Property? Infographic