Non-residents looking to buy property in the US typically need a valid passport, proof of visa status if applicable, and a US taxpayer identification number (ITIN). Additional documents may include proof of funds or financing, a purchase agreement, and identification for any authorized agents or representatives. It's essential to consult local regulations as requirements can vary by state and transaction type.

What Documents Does a Non-Resident Need to Buy Property in the US?

| Number | Name | Description |

|---|---|---|

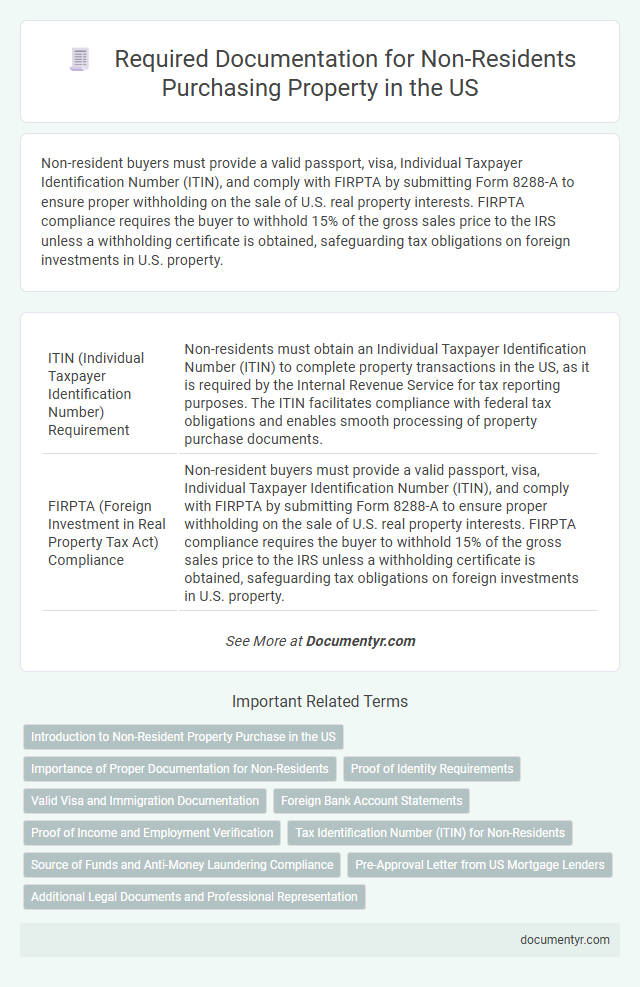

| 1 | ITIN (Individual Taxpayer Identification Number) Requirement | Non-residents must obtain an Individual Taxpayer Identification Number (ITIN) to complete property transactions in the US, as it is required by the Internal Revenue Service for tax reporting purposes. The ITIN facilitates compliance with federal tax obligations and enables smooth processing of property purchase documents. |

| 2 | FIRPTA (Foreign Investment in Real Property Tax Act) Compliance | Non-resident buyers must provide a valid passport, visa, Individual Taxpayer Identification Number (ITIN), and comply with FIRPTA by submitting Form 8288-A to ensure proper withholding on the sale of U.S. real property interests. FIRPTA compliance requires the buyer to withhold 15% of the gross sales price to the IRS unless a withholding certificate is obtained, safeguarding tax obligations on foreign investments in U.S. property. |

| 3 | OFAC (Office of Foreign Assets Control) Screening | Non-residents purchasing property in the US must undergo OFAC (Office of Foreign Assets Control) screening to ensure they are not listed on the Specially Designated Nationals (SDN) list or involved in prohibited transactions. Required documents typically include a valid passport, proof of income or financial statements, and completion of OFAC compliance checks conducted by financial institutions or real estate agents. |

| 4 | Qualified Intermediary Usage | Non-resident buyers in the US typically require a valid passport, a taxpayer identification number (such as an ITIN), and proof of funds for property purchase, while using a Qualified Intermediary (QI) is essential for facilitating a 1031 exchange to defer capital gains tax. The QI ensures compliance with IRS regulations by holding the proceeds from the sale and reinvesting them into a replacement property, streamlining the transaction process for international investors. |

| 5 | Foreign Source Fund Documentation | Non-residents must provide foreign source fund documentation, including bank statements, tax returns, and proof of income from overseas accounts, to verify the legality and origin of funds used for purchasing property in the US. These documents ensure compliance with anti-money laundering regulations and facilitate smooth property transactions within US legal frameworks. |

| 6 | Patriot Act Disclosure Forms | Non-resident buyers must complete Patriot Act Disclosure Forms as part of the U.S. property purchase process to verify their identity and comply with anti-money laundering laws. These forms typically require valid identification, proof of address, and may include declarations related to the source of funds and beneficial ownership. |

| 7 | Beneficial Ownership Transparency | Non-resident buyers must provide a valid passport, proof of income, and tax identification number (TIN) or ITIN, along with documents confirming beneficial ownership in compliance with the Corporate Transparency Act to ensure transparency and prevent illicit activities. Financial institutions and government agencies require these disclosures to verify the true owners behind legal entities involved in property transactions. |

| 8 | Enhanced KYC (Know Your Customer) Protocol | Non-resident buyers must provide enhanced KYC documents including a valid passport, visa, proof of address in their home country, and a completed IRS Form W-8BEN for tax identification purposes. Lenders and real estate agents often require these rigorous identity and financial verification documents to comply with US anti-money laundering laws and ensure secure property transactions. |

| 9 | Sworn Translation of Supporting Documents | Non-residents buying property in the US must provide a sworn translation of all supporting documents not originally in English to ensure legal compliance and accurate verification. This certified translation, often notarized, plays a crucial role in mortgage approvals, title transfers, and meeting regulatory requirements. |

| 10 | Non-Resident Alien Affidavit | Non-resident buyers must provide a Non-Resident Alien Affidavit to confirm their foreign status and comply with the Foreign Investment in Real Property Tax Act (FIRPTA) regulations. This affidavit helps clarify tax withholding responsibilities and ensures smooth property transactions for non-resident aliens in the US real estate market. |

Introduction to Non-Resident Property Purchase in the US

Non-residents looking to purchase property in the US must navigate specific documentation requirements. Understanding these requirements helps streamline the buying process and ensures legal compliance.

Essential documents typically include valid identification, proof of income, and tax identification numbers such as the Individual Taxpayer Identification Number (ITIN). Lenders and sellers may request additional paperwork to verify financial standing and residency status.

Importance of Proper Documentation for Non-Residents

Proper documentation is essential for non-residents looking to buy property in the US to ensure a smooth transaction and legal compliance. Key documents include a valid passport, proof of funds, and a taxpayer identification number (TIN) such as an Individual Taxpayer Identification Number (ITIN). Ensuring Your paperwork is complete helps avoid delays, legal issues, and financial complications during the property purchase process.

Proof of Identity Requirements

Non-resident buyers must provide valid proof of identity to purchase property in the US. Accepted documents typically include a valid passport or government-issued photo ID from your home country.

Some states may also require additional documentation such as a visa or proof of legal entry status. Ensuring all identity documents are current and verifiable helps streamline the property purchase process.

Valid Visa and Immigration Documentation

Non-residents must provide valid visa and immigration documentation to purchase property in the United States. These documents verify legal entry and residency status necessary for property acquisition.

- Valid Visa - A current and appropriate visa, such as B-1/B-2 for visitors or F-1 for students, confirms lawful presence during the property purchase process.

- Passport - A valid passport from the buyer's country of origin serves as primary identification and proof of nationality.

- Immigration Status Documentation - Documents including Form I-94 or Employment Authorization Card validate the non-resident's authorized duration of stay and working rights in the U.S.

Foreign Bank Account Statements

What foreign bank account statements are required to buy property in the US as a non-resident? Lenders typically require recent statements from your foreign bank accounts to verify funds and financial stability. These documents help confirm the source of your down payment and demonstrate your ability to cover ongoing mortgage payments.

Proof of Income and Employment Verification

| Document Type | Description | Purpose | Specific Requirements |

|---|---|---|---|

| Proof of Income | Documents that demonstrate the buyer's financial earnings | Verify ability to afford property purchase and mortgage payments |

|

| Employment Verification | Formal confirmation of buyer's current employment status | Confirm steady income source and job stability |

|

Tax Identification Number (ITIN) for Non-Residents

Foreign nationals looking to purchase property in the US must obtain specific documents to comply with legal and tax requirements. A critical document for non-residents is the Individual Taxpayer Identification Number (ITIN), essential for tax reporting and property transactions.

- ITIN Issuance - The IRS issues the ITIN to non-resident aliens who do not qualify for a Social Security Number but need to fulfill US tax obligations.

- Property Purchase Requirement - An ITIN enables non-residents to open bank accounts, file tax returns, and complete real estate transactions in the US.

- Application Process - Non-residents must submit Form W-7 along with valid identification documents to apply for an ITIN through the IRS or authorized acceptance agents.

Securing an ITIN is a vital step for non-residents to legally buy property and manage tax responsibilities in the United States.

Source of Funds and Anti-Money Laundering Compliance

Non-residents must provide clear documentation verifying the source of funds when purchasing property in the US. Strict anti-money laundering (AML) compliance measures are enforced to ensure the legitimacy of all transactions.

- Proof of Fund Source - Bank statements, employment income records, or sale of assets documents confirm the origin of funds used for the purchase.

- AML Compliance Checks - Financial institutions verify identities and monitor transactions to prevent money laundering and terrorist financing.

- Additional Identification - Valid passport and taxpayer identification number (such as an ITIN) support buyer verification and regulatory adherence.

Pre-Approval Letter from US Mortgage Lenders

Non-residents looking to buy property in the US must obtain a pre-approval letter from US mortgage lenders to streamline the purchasing process. This letter verifies your financial ability to secure a loan and strengthens your property offer.

A pre-approval letter requires submitting documents such as proof of income, credit history, and identification. US mortgage lenders assess these details to determine your loan eligibility and maximum borrowing limit. Having this letter demonstrates seriousness to sellers and helps in negotiating better terms.

What Documents Does a Non-Resident Need to Buy Property in the US? Infographic