For a real estate probate sale, it is essential to gather the deceased's original will, the death certificate, and court-issued letters testamentary or letters of administration. Collecting the property deed, tax statements, and any existing mortgage documents ensures a smooth transaction. These documents verify legal authority and provide clear ownership details necessary for the probate process.

What Documents Should Be Collected for a Real Estate Probate Sale?

| Number | Name | Description |

|---|---|---|

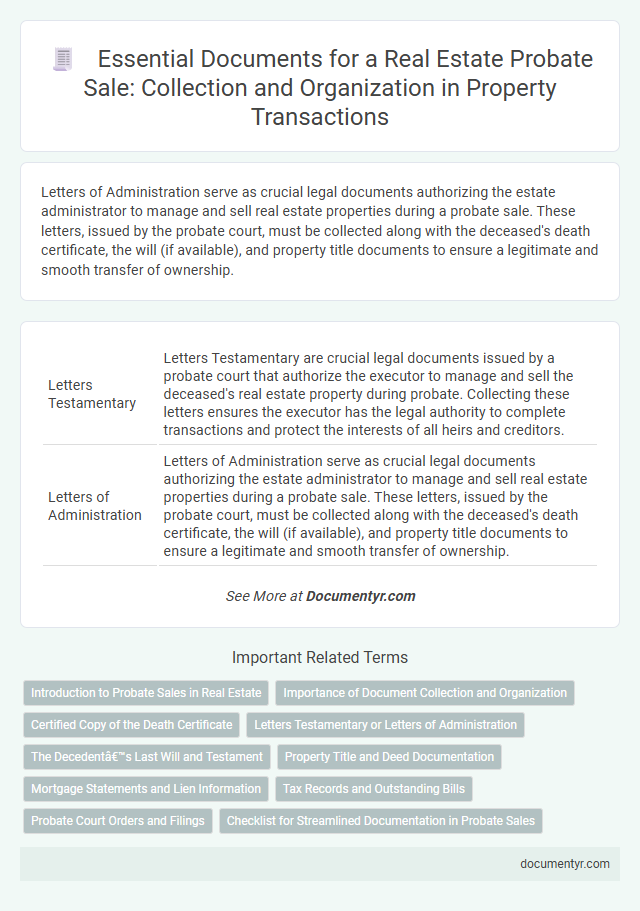

| 1 | Letters Testamentary | Letters Testamentary are crucial legal documents issued by a probate court that authorize the executor to manage and sell the deceased's real estate property during probate. Collecting these letters ensures the executor has the legal authority to complete transactions and protect the interests of all heirs and creditors. |

| 2 | Letters of Administration | Letters of Administration serve as crucial legal documents authorizing the estate administrator to manage and sell real estate properties during a probate sale. These letters, issued by the probate court, must be collected along with the deceased's death certificate, the will (if available), and property title documents to ensure a legitimate and smooth transfer of ownership. |

| 3 | Preliminary Change of Ownership Report (PCOR) | The Preliminary Change of Ownership Report (PCOR) is a critical document in a real estate probate sale, required by county assessors to record the transfer of property ownership and assist in property tax assessment. This report must be accurately completed and submitted to avoid delays in the probate process and ensure the proper valuation of the estate's real property. |

| 4 | Affidavit of Heirship | An Affidavit of Heirship is a critical document in a real estate probate sale, used to establish the ownership of property when the deceased owner did not leave a will. This affidavit helps verify the rightful heirs and facilitates the transfer of title by providing a sworn statement from individuals familiar with the family history and property ownership. |

| 5 | Certified Death Certificate | A certified death certificate is a crucial document in a real estate probate sale, serving as official proof of the deceased owner's passing and enabling the probate process to proceed legally. This document must be collected alongside the property deed, will, and court-issued letters testamentary to ensure clear title transfer and compliance with probate regulations. |

| 6 | Order Confirming Sale | The Order Confirming Sale is a critical document that validates the court's approval of the real estate probate sale, ensuring legal authority to transfer ownership. Collecting this order helps guarantee that the transaction complies with probate laws and protects buyers and sellers from potential legal disputes. |

| 7 | Final Inventory and Appraisal | The Final Inventory and Appraisal is a critical document in a real estate probate sale, detailing all property assets and their appraised values to establish an accurate estate worth. This comprehensive report ensures transparency for heirs and buyers by providing an official assessment used for settling debts and distributing property. |

| 8 | Petition for Probate | The Petition for Probate is a critical legal document filed to initiate the probate process, proving the validity of the deceased's will and requesting court supervision over the estate. Collecting a complete, properly executed Petition for Probate ensures legal authority to manage and sell the real estate during the probate sale. |

| 9 | Notice of Proposed Action | The Notice of Proposed Action is a critical document in a real estate probate sale, providing formal notification to heirs and interested parties about the intended sale of the property. This notice ensures legal compliance by outlining the sale terms, deadlines for objections, and details necessary for court approval, thereby safeguarding the probate process. |

| 10 | Executor’s Deed | The Executor's Deed is a critical document in a real estate probate sale, transferring property ownership from the deceased to the buyer under the executor's authority. Essential supporting documents include the original will, court-issued letters testamentary, the death certificate, and the court order approving the sale to validate the Executor's Deed and ensure a clear title transfer. |

Introduction to Probate Sales in Real Estate

Probate sales in real estate occur when a property owned by a deceased person is sold under court supervision. These sales often require specific documentation to ensure a smooth transaction and legal compliance.

Collecting the correct documents is crucial for verifying ownership, appraising the property, and satisfying probate court requirements. This introduction outlines the essential paperwork needed for probate sales in real estate.

Importance of Document Collection and Organization

Collecting the correct documents is crucial for a successful real estate probate sale, ensuring all legal requirements are met and the transaction proceeds smoothly. Proper organization of these documents, including the will, death certificate, probate court orders, and property deed, helps prevent delays and disputes. You benefit from a well-prepared file that facilitates clear communication between heirs, buyers, and legal professionals.

Certified Copy of the Death Certificate

A Certified Copy of the Death Certificate is essential for a real estate probate sale. It serves as official proof of the property owner's passing.

This document is required to initiate the probate process and transfer property ownership legally. Lenders, title companies, and courts often request the certified death certificate to verify the decedent's identity. Obtaining this document early helps prevent delays in the sale and ensures compliance with probate regulations.

Letters Testamentary or Letters of Administration

Letters Testamentary or Letters of Administration are essential documents for a real estate probate sale. These legal papers authorize the executor or administrator to manage and sell the deceased's property. Collecting these letters ensures the probate sale proceeds legally and protects all parties involved.

The Decedent’s Last Will and Testament

The Decedent's Last Will and Testament is a crucial document in a real estate probate sale. It validates the transfer of property ownership according to the deceased's wishes.

- Proof of Ownership - The will identifies the rightful heirs entitled to inherit the real estate.

- Instructions for Property Distribution - It outlines specific directions for selling or distributing the property among beneficiaries.

- Legal Authorization - The probate court uses the will to authorize the sale and transfer of the property title.

Collecting the decedent's last will ensures a smooth and legally compliant probate sale process.

Property Title and Deed Documentation

What documents are essential for verifying property title and deed in a real estate probate sale? Clear title and deed documentation are crucial to ensure the legal transfer of ownership during probate. You must collect the original deed, title report, and any related liens or encumbrances to confirm the property's status.

Mortgage Statements and Lien Information

Mortgage statements are essential documents for a real estate probate sale, providing current details on outstanding loan balances and payment history. These statements help verify the financial obligations attached to the property.

Accurate lien information must also be gathered to ensure all claims against the estate are disclosed and resolved. You need this data to clear the title, facilitating a smooth probate sale process.

Tax Records and Outstanding Bills

Tax records and outstanding bills are critical documents in a real estate probate sale, ensuring legal compliance and accurate financial assessment. Collecting these records helps prevent liens and clarifies the property's financial status for all parties involved.

- Property Tax Records - These documents confirm the current tax obligations and any arrears associated with the estate.

- Outstanding Utility Bills - Utility bills must be reviewed to identify unpaid amounts that could affect the sale or transfer of the property.

- Other Outstanding Debts - Review any additional liens or bills, such as homeowner association fees, that may impact the probate process.

Probate Court Orders and Filings

Collecting essential documents is crucial for a real estate probate sale to ensure legal compliance and smooth property transfer. Probate court orders and filings serve as primary evidence of the estate's authority to sell the property.

- Probate Court Order of Appointment - This document verifies the appointment of the executor or administrator managing the estate.

- Letters Testamentary or Letters of Administration - These filings grant legal authority to act on behalf of the deceased's estate in property transactions.

- Probate Petition and Case Number - The petition initiates the probate process, and the case number tracks the court proceedings related to the estate.

What Documents Should Be Collected for a Real Estate Probate Sale? Infographic