A seller seeking short sale approval must gather essential documents, including a hardship letter explaining the financial difficulties, recent pay stubs or proof of income, and copies of mortgage statements. They also need to provide bank statements, tax returns, and a completed short sale package requested by the lender. These documents help the lender assess the seller's financial status and authorize the short sale process.

What Documents Does a Seller Need for a Short Sale Approval?

| Number | Name | Description |

|---|---|---|

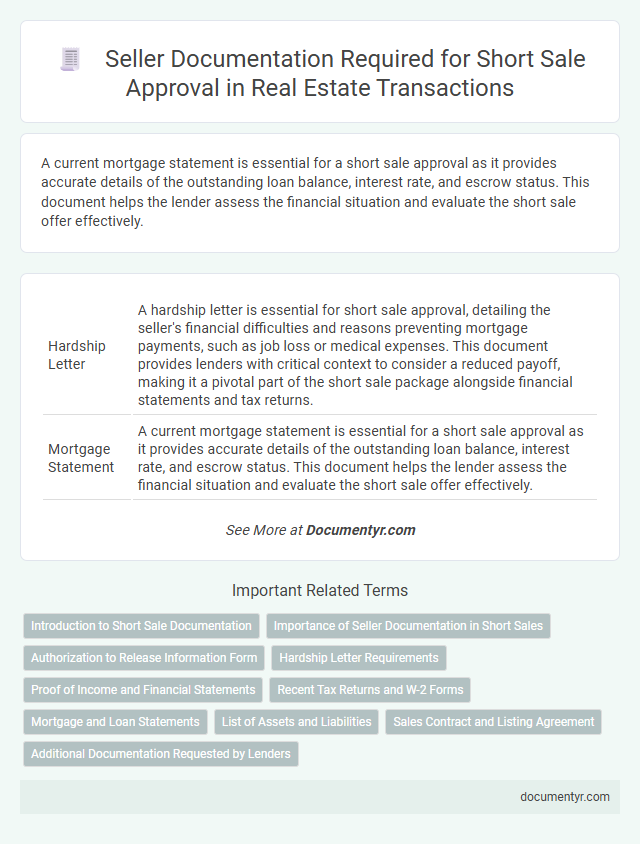

| 1 | Hardship Letter | A hardship letter is essential for short sale approval, detailing the seller's financial difficulties and reasons preventing mortgage payments, such as job loss or medical expenses. This document provides lenders with critical context to consider a reduced payoff, making it a pivotal part of the short sale package alongside financial statements and tax returns. |

| 2 | Mortgage Statement | A current mortgage statement is essential for a short sale approval as it provides accurate details of the outstanding loan balance, interest rate, and escrow status. This document helps the lender assess the financial situation and evaluate the short sale offer effectively. |

| 3 | HUD-1 Settlement Statement | A seller needs to provide the HUD-1 Settlement Statement, which details all transaction costs and the final financial terms agreed upon in the short sale, to facilitate lender approval. This document is critical for verifying the payoff amount and ensuring transparency during the short sale approval process. |

| 4 | Authorization to Release Information | Sellers must provide an Authorization to Release Information form to grant lenders permission to obtain necessary financial documents and communicate with authorized third parties during the short sale approval process. This document is crucial as it enables the lender to verify the seller's financial status and expedite the evaluation of the short sale request. |

| 5 | Preliminary Net Sheet | A Preliminary Net Sheet is a crucial document in short sale approval, outlining estimated payoff amounts, liens, and costs associated with the sale to provide the lender with a clear financial picture. Sellers must submit this alongside financial statements, hardship letters, and purchase contracts to initiate the lender's review process. |

| 6 | Short Sale Affidavit | The Short Sale Affidavit is a critical document that a seller must provide, certifying financial hardship and confirming compliance with lender requirements to initiate short sale approval. This affidavit, along with financial statements, tax returns, and hardship letters, supports the lender's decision to approve the sale below the mortgage balance. |

| 7 | Purchase Offer Agreement | A Purchase Offer Agreement is a crucial document for short sale approval as it outlines the buyer's proposed terms and purchase price, serving as proof of a legitimate offer to the lender. This agreement helps the lender evaluate the feasibility of the short sale by confirming the buyer's commitment and the financial details involved. |

| 8 | Lender-Specific Short Sale Forms | Lenders often require specific short sale forms that include a hardship letter, a completed short sale package, and the seller's financial statements to evaluate eligibility accurately. These lender-specific documents are crucial for processing approval and must be submitted along with standard property title and payoff information. |

| 9 | Proof of Income (Pay Stubs, Bank Statements) | Sellers must provide proof of income, including recent pay stubs and bank statements, to demonstrate their financial hardship for short sale approval. These documents validate the seller's inability to meet mortgage obligations and support lender evaluation of the short sale request. |

| 10 | Comparative Market Analysis (CMA) | A Comparative Market Analysis (CMA) is essential for short sale approval as it provides a detailed evaluation of recent sales and current listings in the area, demonstrating the property's fair market value. Sellers must submit this document to justify the requested price to lenders and support the short sale negotiation process. |

Introduction to Short Sale Documentation

A short sale occurs when a property is sold for less than the outstanding mortgage balance, requiring lender approval. Understanding the necessary documentation is crucial for securing short sale approval efficiently.

Your lender will require specific documents to assess your financial situation and the property's value. These documents typically include hardship letters, financial statements, and property-related documents to support your application.

Importance of Seller Documentation in Short Sales

Seller documentation is crucial for short sale approval, as it provides proof of financial hardship and property details. Lenders require accurate records to assess the eligibility for a short sale and make informed decisions.

Essential documents include a hardship letter, recent pay stubs, bank statements, tax returns, and a comparative market analysis. You must also provide the mortgage statements and any other liens on the property. Proper documentation speeds up the approval process and increases the likelihood of lender acceptance.

Authorization to Release Information Form

The Authorization to Release Information Form is a crucial document a seller must provide during a short sale approval process. This form allows the lender to access the seller's financial information and verify their eligibility for the short sale.

Without this authorization, lenders cannot review the necessary details to make an informed decision. Sellers should complete and submit this form promptly to avoid delays in approval.

Hardship Letter Requirements

| Document | Description | Hardship Letter Requirements |

|---|---|---|

| Hardship Letter | A detailed written explanation from the seller outlining the financial difficulties leading to the short sale request. |

|

| Financial Statements | Includes pay stubs, bank statements, and tax returns to verify income and expenses. | Supports the hardship letter by providing proof of the seller's financial situation. |

| Listing Agreement | Contract between the seller and real estate agent confirming the property is listed for sale. | Demonstrates seller's commitment to the short sale process. |

| Comparative Market Analysis (CMA) | Report showing property value compared to similar listings in the area. | Supports the justification for a short sale price below the mortgage balance. |

| Authorization Form | Document granting permission for the lender to communicate with the real estate agent or short sale negotiator. | Ensures proper coordination between seller, agent, and lender. |

Proof of Income and Financial Statements

Proof of income is essential for a short sale approval, demonstrating your ability to support financial obligations. Financial statements provide a clear picture of your current economic situation to the lender.

- Recent Pay Stubs - These verify your current employment income and stability.

- Bank Statements - Detailed records showcasing your cash flow and account balances.

- Tax Returns - Comprehensive evidence of your annual earnings and financial history.

Recent Tax Returns and W-2 Forms

What documents does a seller need to submit recent tax returns and W-2 forms for short sale approval?

Recent tax returns provide lenders with an accurate picture of the seller's financial health and income stability. W-2 forms verify the seller's employment and income history, essential for lenders when assessing eligibility for a short sale.

Mortgage and Loan Statements

Mortgage and loan statements are crucial documents required for short sale approval. These statements provide detailed information about the outstanding loan balance, payment history, and current status of your mortgage. Lenders use this information to assess your financial situation and determine eligibility for the short sale process.

List of Assets and Liabilities

For short sale approval, a seller must provide a comprehensive list of assets and liabilities. This list includes bank statements, investment accounts, property deeds, outstanding loans, credit card debts, and any other financial obligations. Supplying accurate documents helps streamline the approval process and ensures your financial situation is clearly understood by the lender.

Sales Contract and Listing Agreement

For a short sale approval, the seller must provide essential documents that validate the transaction and the property's market status. Two critical documents in this process are the Sales Contract and the Listing Agreement.

The Sales Contract outlines the agreed terms between the buyer and seller, ensuring the lender understands the transaction details. The Listing Agreement proves that the property was listed for sale at an appropriate market price. Providing these documents helps your lender assess the legitimacy and feasibility of approving the short sale.

- Sales Contract - This document details the purchase price, buyer information, and sale conditions, confirming the offer made on the property.

- Listing Agreement - It serves as proof that the property was actively marketed, showing the listing price and agent authorization.

- Authorization Requirement - Both documents together demonstrate to the lender that the sale was conducted fairly and transparently.

What Documents Does a Seller Need for a Short Sale Approval? Infographic