When financing a vacation home, essential documents typically include proof of income such as pay stubs or tax returns, bank statements to verify assets, and a credit report to assess financial reliability. Lenders also require property-related documents like a purchase agreement, appraisal report, and title insurance policy. Having these documents prepared streamlines the approval process and ensures compliance with lending requirements.

What Documents are Necessary for Financing a Vacation Home?

| Number | Name | Description |

|---|---|---|

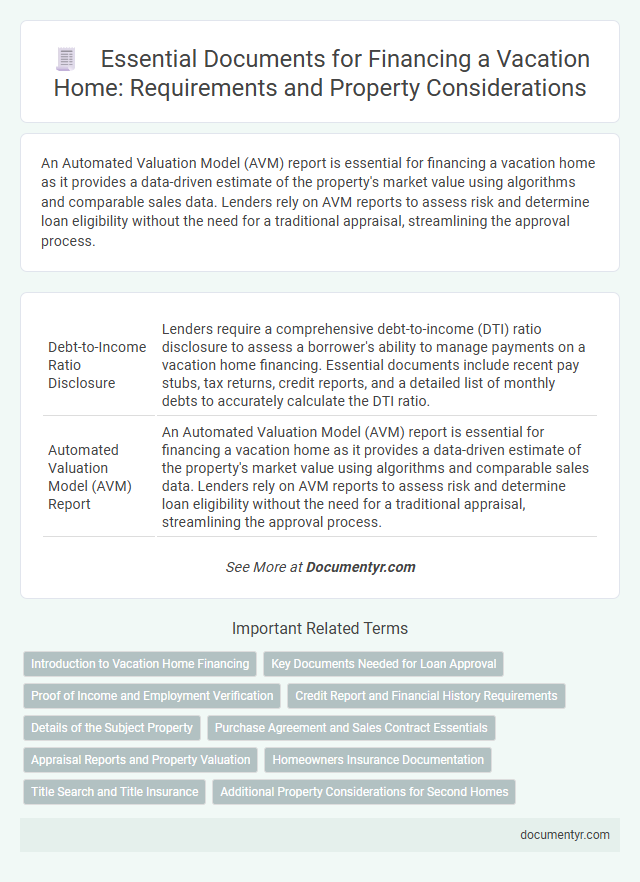

| 1 | Debt-to-Income Ratio Disclosure | Lenders require a comprehensive debt-to-income (DTI) ratio disclosure to assess a borrower's ability to manage payments on a vacation home financing. Essential documents include recent pay stubs, tax returns, credit reports, and a detailed list of monthly debts to accurately calculate the DTI ratio. |

| 2 | Automated Valuation Model (AVM) Report | An Automated Valuation Model (AVM) report is essential for financing a vacation home as it provides a data-driven estimate of the property's market value using algorithms and comparable sales data. Lenders rely on AVM reports to assess risk and determine loan eligibility without the need for a traditional appraisal, streamlining the approval process. |

| 3 | Electronic Verification of Assets (EVOA) | Electronic Verification of Assets (EVOA) streamlines the financing process for vacation homes by digitally confirming bank statements, investment accounts, and other financial records in real-time. Lenders require EVOA to ensure accurate assessment of a borrower's liquidity and financial stability without manual document submission. |

| 4 | Title Commitment with Encumbrance Addendum | A Title Commitment with Encumbrance Addendum is essential for vacation home financing as it provides a detailed report of the property's legal ownership and any existing liens or encumbrances that may affect the loan approval. Lenders require this document to ensure clear title transfer and identify potential legal or financial obstacles before finalizing the mortgage. |

| 5 | FinCEN Geographic Targeting Order Compliance | Lenders require comprehensive documentation for vacation home financing, including proof of income, credit history, and compliance with FinCEN Geographic Targeting Order to identify and mitigate risks of money laundering. This includes submitting detailed ownership records and transaction information for properties located in designated high-risk geographic areas as mandated by FinCEN regulations. |

| 6 | Short-Term Rental Income Verification Statement | A Short-Term Rental Income Verification Statement is essential for financing a vacation home, as lenders require proof of consistent rental income to assess loan eligibility and repayment capability. This document must include detailed records of bookings, rental rates, and income generated over a specified period, typically supported by tax returns and bank statements. |

| 7 | Remote Online Notarization Certificate | A Remote Online Notarization (RON) certificate is essential for financing a vacation home as it verifies the authenticity of electronically signed documents through a secure, virtual notary process. Lenders require the RON certificate to ensure compliance with state laws and to facilitate faster, more convenient loan approval without in-person notarization. |

| 8 | Alternative Credit Data Report | Lenders require an Alternative Credit Data Report to assess the creditworthiness of borrowers without traditional credit history when financing a vacation home, including documentation of rent payments, utility bills, and other recurring expenses. This report provides a comprehensive view of financial responsibility, enhancing approval chances for buyers lacking conventional credit records. |

| 9 | Second-Home Occupancy Affidavit | A Second-Home Occupancy Affidavit is a crucial document in financing a vacation home, confirming the property will not be the borrower's primary residence but used for personal vacation purposes. Lenders require this affidavit to assess risk and verify eligibility for second-home loan programs, impacting loan terms and approval. |

| 10 | Homeowner Association (HOA) Estoppel Letter | An HOA Estoppel Letter is a critical document required for financing a vacation home, as it verifies the current status of fees, assessments, and any pending violations within the homeowner association. Lenders rely on this letter to assess financial obligations linked to the property, ensuring clear understanding of potential liabilities before approving the loan. |

Introduction to Vacation Home Financing

Financing a vacation home requires careful preparation and specific documentation. Understanding the necessary paperwork helps streamline the approval process and ensures a smooth transaction.

Your lender will typically request proof of income, credit history, and property details. These documents confirm your financial stability and the value of the vacation property.

Key Documents Needed for Loan Approval

Key documents necessary for financing a vacation home include proof of income, recent tax returns, and credit history. Lenders require these documents to assess your financial stability and repayment ability. Other important papers are asset statements, identification, and details of the property being purchased.

Proof of Income and Employment Verification

Securing financing for a vacation home requires specific documentation to verify your financial stability and employment status. Proof of income and employment verification are critical components lenders assess to approve your loan application.

- Proof of Income - Lenders require recent pay stubs, tax returns, or bank statements that demonstrate consistent income to evaluate your ability to repay the loan.

- Employment Verification - A letter from your employer or direct confirmation of employment ensures your job stability and ongoing income.

- Additional Documentation - Self-employed individuals need to provide profit and loss statements or 1099 forms as supplementary proof of income.

Credit Report and Financial History Requirements

What documents are necessary to finance a vacation home focusing on credit report and financial history requirements? Lenders require a comprehensive credit report to assess your creditworthiness and debt management. Detailed financial history documents, including income statements and tax returns, validate your ability to repay the loan.

Details of the Subject Property

| Document | Description | Purpose |

|---|---|---|

| Property Deed | Official legal document proving ownership of the vacation home. | Confirms the seller's legal right to sell the property and verifies the exact boundaries and location. |

| Property Appraisal Report | Professional assessment report estimating the current market value of the vacation home. | Ensures the property value supports the requested loan amount and reflects market conditions. |

| Title Report | Comprehensive report reviewing the property's title history and any existing liens or encumbrances. | Protects the lender and borrower by confirming clear ownership without legal obstacles. |

| Property Survey | Detailed map outlining property boundaries, dimensions, and any easements or encroachments. | Verifies property lines and identifies any physical constraints impacting financing or insurance. |

| Inspection Report | Evaluation conducted by a licensed inspector detailing the physical condition of the vacation home. | Highlights structural integrity, safety issues, or repairs needed that may affect loan approval. |

| Insurance Documents | Proof of property insurance coverage, often including hazard and liability insurance. | Ensures the vacation home is protected against risks during the loan term, a lender requirement. |

Purchase Agreement and Sales Contract Essentials

Securing financing for a vacation home requires specific documentation to ensure the lender has clear information about the property transaction. The purchase agreement and sales contract play critical roles in this process.

- Purchase Agreement Overview - This document outlines the terms and conditions agreed upon between the buyer and seller, establishing the fundamental details of the vacation home sale.

- Sales Contract Essentials - Includes binding commitments, purchase price, contingencies, and closing date, forming a legally enforceable agreement for both parties.

- Your Role in Documentation - You must provide a fully executed purchase agreement or sales contract to your lender to verify the transaction details and facilitate loan approval.

Appraisal Reports and Property Valuation

Appraisal reports and accurate property valuation are crucial documents for financing a vacation home. These documents provide lenders with an independent assessment of the property's market value, ensuring loan amounts align with the home's worth.

An appraisal report is prepared by a licensed appraiser who evaluates the vacation home based on location, condition, and comparable sales in the area. Property valuation helps determine the loan-to-value ratio, influencing financing terms and interest rates. Lenders rely on these reports to mitigate risks and approve mortgage applications confidently.

Homeowners Insurance Documentation

Homeowners insurance documentation is a critical component when financing a vacation home. Lenders require proof of active coverage to protect their investment against potential risks such as natural disasters or theft.

Your insurance policy must detail the coverage limits, deductibles, and the insured property's address. Providing this documentation ensures the financing process proceeds smoothly and meets lender requirements.

Title Search and Title Insurance

Securing a vacation home loan requires specific documents to ensure the property's legal status and ownership are clear. Title Search and Title Insurance are crucial components in the financing process.

- Title Search - A thorough examination of public records confirms the property's legal ownership and reveals any liens or claims.

- Title Insurance - Protects the buyer and lender against potential future disputes or defects in the property's title.

- Property Deed - Provides legal proof of ownership and is essential for both title search and insurance verification.

Submitting these documents helps lenders verify the property's legitimacy and secure your investment in a vacation home.

What Documents are Necessary for Financing a Vacation Home? Infographic