Foreign nationals looking to buy US property need to provide key documents including a valid passport, proof of visa or legal entry status, and a taxpayer identification number such as an ITIN. Buyers may also be required to submit proof of funds or bank statements to demonstrate their ability to complete the purchase. Title deeds, purchase agreements, and possibly a power of attorney if purchasing through a representative are essential documents during the transaction process.

What Documents Does a Foreign National Need to Buy US Property?

| Number | Name | Description |

|---|---|---|

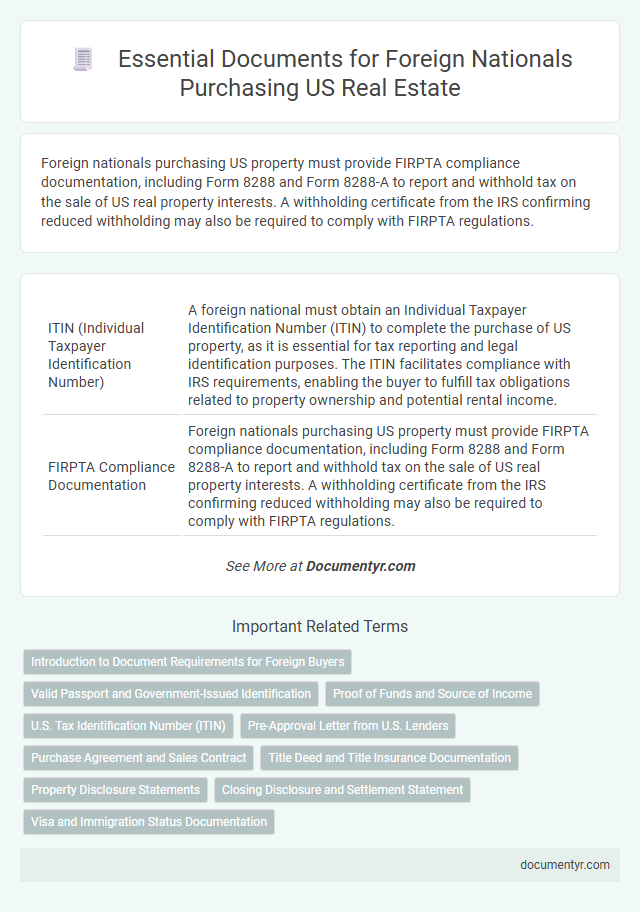

| 1 | ITIN (Individual Taxpayer Identification Number) | A foreign national must obtain an Individual Taxpayer Identification Number (ITIN) to complete the purchase of US property, as it is essential for tax reporting and legal identification purposes. The ITIN facilitates compliance with IRS requirements, enabling the buyer to fulfill tax obligations related to property ownership and potential rental income. |

| 2 | FIRPTA Compliance Documentation | Foreign nationals purchasing US property must provide FIRPTA compliance documentation, including Form 8288 and Form 8288-A to report and withhold tax on the sale of US real property interests. A withholding certificate from the IRS confirming reduced withholding may also be required to comply with FIRPTA regulations. |

| 3 | Proof of Source of Funds (Anti-Money Laundering, AML Compliance) | Foreign nationals must provide detailed Proof of Source of Funds documents to comply with Anti-Money Laundering (AML) regulations when purchasing US property, including bank statements, tax returns, employment contracts, or sale of assets records. These documents verify the legitimacy of funds, ensuring transparency and adherence to AML compliance by real estate agents and financial institutions. |

| 4 | Apostilled Identification Documents | Foreign nationals must provide apostilled identification documents such as a valid passport, birth certificate, and proof of residency to verify identity and maintain compliance with U.S. property purchase regulations. These apostilled documents authenticate their legitimacy, preventing legal issues during the property transaction process. |

| 5 | Foreign Bank Reference Letter | A foreign national buying US property typically needs a Foreign Bank Reference Letter to verify financial stability and banking history, which helps streamline mortgage approval and property transaction processes. This letter should be issued by a reputable bank abroad, detailing account duration, average balance, and overall financial conduct to satisfy US lenders and regulatory requirements. |

| 6 | OFAC (Office of Foreign Assets Control) Screening Certificate | Foreign nationals must provide an OFAC (Office of Foreign Assets Control) Screening Certificate to verify they are not on sanctions lists when purchasing US property, ensuring compliance with Treasury Department regulations. This certificate is a critical document used to prevent prohibited transactions with blocked or sanctioned individuals or entities under U.S. law. |

| 7 | Form W-8BEN (Certificate of Foreign Status) | Foreign nationals purchasing U.S. property must submit Form W-8BEN to certify their foreign status and claim treaty benefits for tax withholding purposes. This document is essential for compliance with IRS regulations and to avoid higher withholding rates on rental income or sale proceeds. |

| 8 | International Credit Report | Foreign nationals need an international credit report to demonstrate their financial reliability when purchasing US property, as this document provides detailed credit history from their home country. Lenders use the international credit report to assess risk and determine mortgage eligibility, making it a crucial element in the property acquisition process. |

| 9 | Notarized Proof of Address (with English Translation) | Foreign nationals purchasing US property must provide notarized proof of address with an official English translation to verify their residency credentials. This document, often a utility bill or bank statement, must be certified by a licensed notary to ensure authenticity and legal compliance during the transaction. |

| 10 | Title Vesting Statement for Non-Resident Buyers | Foreign nationals purchasing US property must provide a Title Vesting Statement to establish ownership and clarify how the title will be held, whether individually, jointly, or through an entity such as an LLC. This document is essential for non-resident buyers to ensure clear title transfer and compliance with US real estate regulations. |

Introduction to Document Requirements for Foreign Buyers

Foreign nationals seeking to buy property in the United States must provide specific documents to comply with legal and financial regulations. Important documents include valid passports, proof of income or financial stability, and a valid visa or residency status. Understanding these requirements helps ensure a smooth property transaction and ownership process for international buyers.

Valid Passport and Government-Issued Identification

What documents are essential for a foreign national to buy property in the US?

A valid passport is a primary requirement to establish identity and citizenship. Government-issued identification, such as a national ID card or driver's license, further verifies the buyer's identity during the property transaction process.

Proof of Funds and Source of Income

Foreign nationals must provide specific documentation to buy property in the US, emphasizing Proof of Funds and Source of Income. These documents ensure legal compliance and smooth transaction processing.

- Proof of Funds - Bank statements or financial institution letters verify available funds for the property purchase.

- Source of Income - Employment verification, tax returns, or business documents confirm the legal origin of the funds.

- Additional Identification - Valid passport and visa details support identity verification and residency status.

U.S. Tax Identification Number (ITIN)

| Document | Description | Purpose |

|---|---|---|

| U.S. Tax Identification Number (ITIN) | A unique nine-digit number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security Number (SSN). | Required for tax reporting purposes when purchasing U.S. property as a foreign national. It helps facilitate tax filings related to rental income, property sales, and withholding taxes. |

| Valid Passport | An official travel document issued by your home country. | Serves as primary identification to establish your identity and nationality during the property transaction. |

| Proof of Address | Utility bills, bank statements, or government-issued documents showing your current residence. | Confirms your residence for legal and tax documentation requirements. |

| FIRPTA Withholding Tax Forms | Documents related to the Foreign Investment in Real Property Tax Act (FIRPTA). | Ensures compliance with U.S. tax withholding on property sales by foreign owners. |

| Bank Account Information | Details of your U.S. or international bank accounts. | Necessary for transferring funds and managing financial transactions tied to the property. |

Pre-Approval Letter from U.S. Lenders

When buying property in the U.S., a foreign national must secure a Pre-Approval Letter from a U.S. lender to demonstrate financial capability. This letter strengthens your offer and expedites the purchasing process.

The Pre-Approval Letter requires proof of income, credit history, and identification documents. U.S. lenders assess your financial stability and eligibility before issuing the letter. Having this document in hand increases trust with sellers and streamlines mortgage approval.

Purchase Agreement and Sales Contract

When purchasing US property, a foreign national must secure a Purchase Agreement that outlines key terms between the buyer and seller. This document serves as a legally binding contract ensuring the buyer's commitment to the transaction.

The Sales Contract specifies detailed conditions of the sale, including price, payment schedule, and contingencies. You should review these documents carefully to ensure all terms meet your requirements for the property purchase.

Title Deed and Title Insurance Documentation

Foreign nationals purchasing property in the US must obtain a clear Title Deed to prove legal ownership of the real estate. This document is essential for verifying the property's history and confirming that it is free from liens or encumbrances.

Title Insurance Documentation protects buyers against any future disputes or claims related to the property title. It ensures financial security by covering legal costs and potential losses arising from title defects discovered after purchase.

Property Disclosure Statements

Foreign nationals buying property in the US must provide a valid passport and proof of legal status. Property disclosure statements are essential documents detailing the condition and any known issues of the property. These statements help buyers make informed decisions and comply with state regulations during the transaction.

Closing Disclosure and Settlement Statement

Foreign nationals must review specific documents when purchasing property in the US to ensure legal and financial clarity. Two essential forms in this process are the Closing Disclosure and Settlement Statement.

- Closing Disclosure - This document details all loan terms, closing costs, and fees associated with the property purchase, provided to the buyer three days before closing.

- Settlement Statement (HUD-1) - It itemizes the final credits, debits, and expenses for both buyer and seller on the closing day.

- Foreign Buyer Requirements - You need proper identification, proof of funds, and sometimes a tax identification number to process these documents effectively.

What Documents Does a Foreign National Need to Buy US Property? Infographic