Commercial lease agreements require essential documents such as a valid identification proof of both landlord and tenant, a copy of the property title deed or ownership proof, and a detailed lease agreement specifying terms and conditions. Financial documents like security deposit receipts, payment records, and tax identification numbers are necessary to validate the transaction and ensure legal compliance. Ensuring these documents are accurately prepared and signed protects both parties' interests throughout the lease period.

What Documents are Required for Commercial Lease Agreements?

| Number | Name | Description |

|---|---|---|

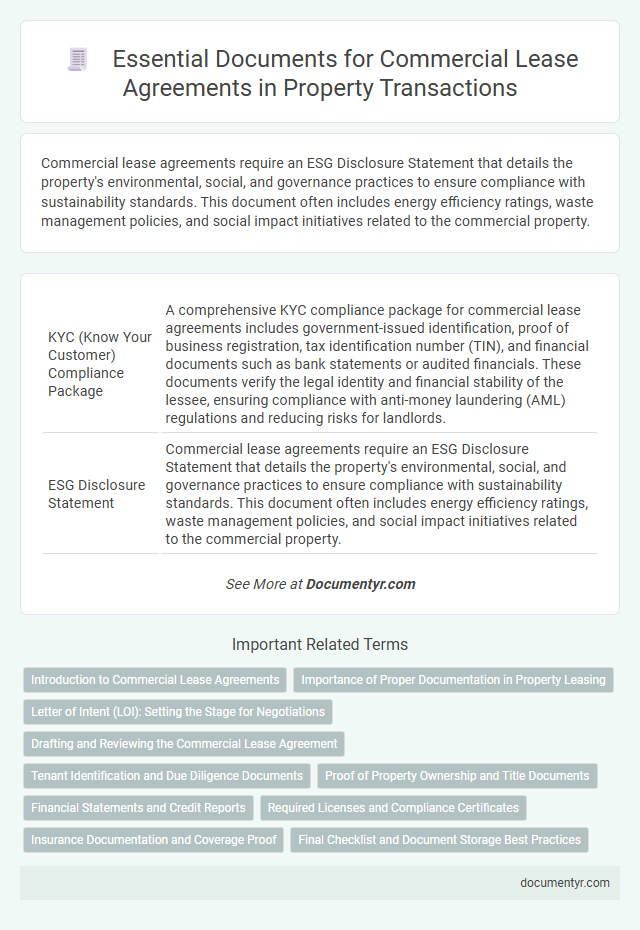

| 1 | KYC (Know Your Customer) Compliance Package | A comprehensive KYC compliance package for commercial lease agreements includes government-issued identification, proof of business registration, tax identification number (TIN), and financial documents such as bank statements or audited financials. These documents verify the legal identity and financial stability of the lessee, ensuring compliance with anti-money laundering (AML) regulations and reducing risks for landlords. |

| 2 | ESG Disclosure Statement | Commercial lease agreements require an ESG Disclosure Statement that details the property's environmental, social, and governance practices to ensure compliance with sustainability standards. This document often includes energy efficiency ratings, waste management policies, and social impact initiatives related to the commercial property. |

| 3 | Electronic Notarization Certificate | A Commercial Lease Agreement requires essential documents such as the Electronic Notarization Certificate, which verifies the authenticity of digitally signed lease contracts and ensures compliance with electronic transaction laws. This certificate enhances legal validity and security by confirming the notarization process was conducted electronically according to jurisdiction-specific regulations. |

| 4 | Beneficial Ownership Declaration | Commercial lease agreements require a Beneficial Ownership Declaration to disclose the individuals who ultimately own or control the leasing entity, ensuring transparency and compliance with anti-money laundering regulations. This document typically includes details such as names, addresses, and ownership percentages of beneficial owners holding significant interest in the tenant business. |

| 5 | Rent Escrow Verification Letter | A Rent Escrow Verification Letter is a critical document in commercial lease agreements, confirming that the tenant's rent payments are being held in escrow, which protects both parties in case of disputes. This letter typically includes details such as the escrow account holder, payment amounts, and terms under which funds can be released. |

| 6 | Smart Lease Addendum | The Smart Lease Addendum streamlines commercial lease agreements by integrating key documents such as tenant information, property details, and standard lease clauses into a cohesive digital format. Essential documents typically include identification proof, business licenses, financial statements, and the executed Smart Lease Addendum outlining specific terms and conditions. |

| 7 | Digital Identity Attestation | Commercial lease agreements require verified digital identity attestation documents to ensure the authenticity of involved parties, typically including government-issued IDs and digital certificates. These digitally attested documents streamline verification processes, reduce fraud risk, and facilitate secure, legally binding agreements in property transactions. |

| 8 | Zoning Compliance Affidavit | A Zoning Compliance Affidavit is essential for commercial lease agreements as it verifies that the leased property adheres to local zoning laws and regulations. This document ensures the intended business activities comply with designated land use, preventing legal disputes and facilitating smooth lease execution. |

| 9 | COVID-19 Health & Safety Compliance Addendum | Commercial lease agreements during the COVID-19 pandemic require a Health & Safety Compliance Addendum outlining tenant and landlord obligations for sanitation, social distancing, and PPE use to mitigate virus spread. This addendum often includes documentation of cleaning protocols, compliance with local health regulations, and emergency contact information to ensure adherence to public health guidelines. |

| 10 | Blockchain Timestamped Signature Sheet | Blockchain timestamped signature sheets provide an immutable record of all parties' consent in commercial lease agreements, enhancing document authenticity and security. This technology ensures that the lease terms are verifiably signed and tamper-proof, facilitating legal transparency and trustworthiness. |

Introduction to Commercial Lease Agreements

Commercial lease agreements are legal contracts between a landlord and a business tenant outlining the terms for renting commercial property. These agreements detail important aspects such as lease duration, rent amount, and tenant responsibilities. Understanding the required documents for commercial lease agreements is essential to ensure a smooth and legally compliant leasing process.

Importance of Proper Documentation in Property Leasing

Proper documentation is crucial in commercial lease agreements to protect both the landlord's and tenant's rights. Essential documents typically include the lease contract, proof of property ownership, and tenant identification.

Accurate paperwork helps prevent disputes and ensures legal compliance in property leasing. You must carefully review and retain all relevant documents to safeguard your interests throughout the lease term.

Letter of Intent (LOI): Setting the Stage for Negotiations

The Letter of Intent (LOI) plays a crucial role in commercial lease agreements by outlining the preliminary terms and conditions between the landlord and tenant. This document sets the stage for negotiations and helps both parties clarify their intentions before drafting the formal lease.

Your LOI should include essential details such as lease duration, rent amount, responsibilities for maintenance, and any special conditions. It serves as a non-binding agreement that guides the negotiation process and reduces misunderstandings. Having a clear LOI can expedite the preparation of the final commercial lease agreement and protect your interests.

Drafting and Reviewing the Commercial Lease Agreement

Drafting and reviewing a commercial lease agreement requires careful attention to specific documents to ensure legal compliance and clarity between parties. Proper documentation protects both landlords and tenants by clearly defining terms and obligations.

- Lease Agreement Draft - The initial draft outlines key terms such as rent, duration, and permitted use of the property.

- Title Deed or Proof of Ownership - Confirms the landlord's legal right to lease the commercial property.

- Financial Statements or Credit Reports - Assists in evaluating the tenant's financial reliability and ability to meet lease obligations.

Reviewing these documents thoroughly prevents disputes and supports a smooth leasing process.

Tenant Identification and Due Diligence Documents

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Passport, Driver's License, or National ID Card of the tenant or authorized signatory | Verifies tenant identity and legal capacity to enter into a lease agreement |

| Business Registration Documents | Certificate of Incorporation, Business License, or Trade Name Registration | Confirms the legitimacy and legal status of the tenant's business entity |

| Tax Identification Number (TIN) | Official tax registration document or certificate issued by tax authorities | Ensures tenant compliance with tax laws and facilitates rent transaction tracking |

| Financial Statements | Recent balance sheets, income statements, and cash flow reports | Assesses tenant's financial stability and ability to meet lease obligations |

| Credit Report | Credit score and history report from a recognized credit bureau | Evaluates tenant's creditworthiness and risk level for lease approval |

| References | Letters or contacts from previous landlords or business associates | Validates tenant reliability and history of lease compliance |

Proof of Property Ownership and Title Documents

Proof of property ownership is a critical document required for commercial lease agreements. It confirms the lessor's legal right to lease the property to the lessee.

Title documents, such as the property deed or title certificate, serve as official evidence of ownership. These documents must be clear of liens or disputes to ensure a valid lease agreement.

Financial Statements and Credit Reports

Commercial lease agreements require thorough documentation to assess the financial stability of potential tenants. Financial statements and credit reports play a critical role in this evaluation process.

- Financial Statements - These documents provide a detailed overview of your business's income, expenses, and overall financial health.

- Credit Reports - Landlords use credit reports to evaluate your creditworthiness and payment history.

- Compliance Verification - Providing accurate and current financial documents ensures your lease application meets the landlord's requirements.

Required Licenses and Compliance Certificates

Commercial lease agreements necessitate specific licenses and compliance certificates to ensure legal operation and regulatory adherence. These documents protect both landlords and tenants by confirming proper authorization and safety standards.

- Business License - Proof that the tenant is legally permitted to operate their business within the leased premises.

- Zoning Compliance Certificate - Verification that the property use complies with local zoning laws and regulations.

- Health and Safety Certificates - Documentation confirming that the property meets required health, fire, and safety standards for commercial use.

Insurance Documentation and Coverage Proof

What insurance documentation is required for a commercial lease agreement? Commercial lease agreements typically require tenants to provide proof of general liability insurance coverage. This documentation ensures that both parties are protected against potential property damage or liability claims during the lease term.

What type of coverage proof must tenants submit in a commercial lease? Tenants are usually asked to submit certificates of insurance that detail coverage limits, policy periods, and named insured parties. These certificates validate that the tenant maintains adequate insurance meeting the landlord's requirements before the lease starts.

What Documents are Required for Commercial Lease Agreements? Infographic