To complete a 1031 exchange in real estate, key documents include the original deed of the relinquished property, the purchase agreement for the replacement property, and a qualified intermediary agreement. The taxpayer must also prepare and file IRS Form 8824 to report the exchange. Maintaining detailed financial records and closing statements ensures compliance with IRS timelines and regulations.

What Documents are Needed for a 1031 Exchange in Real Estate?

| Number | Name | Description |

|---|---|---|

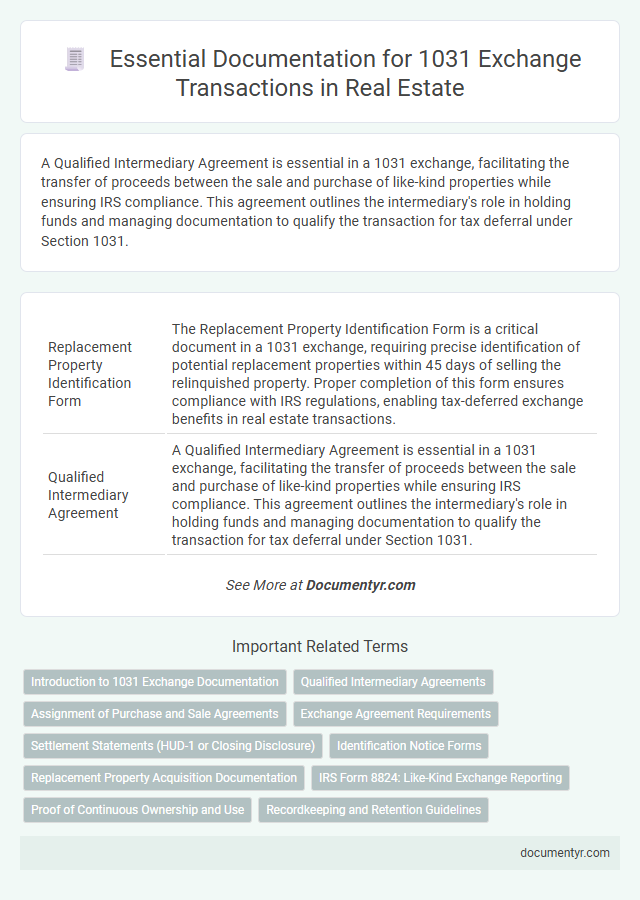

| 1 | Replacement Property Identification Form | The Replacement Property Identification Form is a critical document in a 1031 exchange, requiring precise identification of potential replacement properties within 45 days of selling the relinquished property. Proper completion of this form ensures compliance with IRS regulations, enabling tax-deferred exchange benefits in real estate transactions. |

| 2 | Qualified Intermediary Agreement | A Qualified Intermediary Agreement is essential in a 1031 exchange, facilitating the transfer of proceeds between the sale and purchase of like-kind properties while ensuring IRS compliance. This agreement outlines the intermediary's role in holding funds and managing documentation to qualify the transaction for tax deferral under Section 1031. |

| 3 | Assignment of Purchase and Sale Agreement | The Assignment of Purchase and Sale Agreement is a critical document in a 1031 Exchange, allowing the transfer of the purchase rights from the original buyer to a qualified intermediary or replacement buyer. This document ensures compliance with IRS regulations by clearly outlining the terms of the transfer, maintaining the continuity required for a like-kind exchange. |

| 4 | Relinquished Property Closing Statement | The Relinquished Property Closing Statement details the final financial transaction, including sales price, closing costs, and proration of taxes, serving as a crucial document in a 1031 Exchange to prove the relinquishing of the original property. This statement is essential for identifying the exact funds from the sale that will be reinvested into the replacement property, ensuring compliance with IRS regulations for tax deferral. |

| 5 | Replacement Property Closing Statement | The Replacement Property Closing Statement outlines crucial financial details involved in the acquisition of the new property during a 1031 exchange, including purchase price, prorations, and closing costs. Accurate documentation of this statement is essential for compliance with IRS regulations and to ensure the tax-deferred benefits of the exchange are preserved. |

| 6 | 1031 Exchange Timeline Tracker | A 1031 Exchange Timeline Tracker requires essential documents including the original property deed, the sales contract, the identification of replacement properties within 45 days, and the closing statement for the replacement property within 180 days. Maintaining accurate records of these documents ensures compliance with IRS timelines and facilitates a smooth tax-deferred exchange process in real estate transactions. |

| 7 | Exchange Proceeds Escrow Statement | The Exchange Proceeds Escrow Statement is a crucial document in a 1031 Exchange, detailing the funds held by the Qualified Intermediary to ensure compliance with IRS regulations and facilitate a tax-deferred transaction. This statement verifies the source, amount, and status of the exchange funds, providing transparency and proof of escrow throughout the exchange process. |

| 8 | IRS Form 8824 (Like-Kind Exchanges) | IRS Form 8824 is essential for reporting a 1031 Exchange in real estate, detailing the like-kind property exchange to defer capital gains taxes. Key documents include the completed Form 8824, purchase and sale agreements, closing statements, and identification of replacement properties within the 45-day period. |

| 9 | Written Acknowledgment of Property Identification | The written acknowledgment of property identification is a crucial document in a 1031 exchange, detailing the specific properties identified by the investor within the 45-day identification period as required by IRS regulations. This document must clearly describe the real estate to ensure compliance and facilitate a successful exchange without triggering capital gains taxes. |

| 10 | Reverse 1031 Exchange Structure Agreement | The Reverse 1031 Exchange Structure Agreement is a critical document that outlines the terms for acquiring replacement property before selling the relinquished property, ensuring IRS compliance. This agreement must include details of the exchange accommodation titleholder (EAT), timelines for both property transactions, and the responsibilities of each party to facilitate a smooth reverse exchange process. |

Introduction to 1031 Exchange Documentation

A 1031 Exchange allows you to defer capital gains taxes by reinvesting proceeds from the sale of a property into a like-kind property. Proper documentation is essential to comply with IRS regulations and ensure a successful transaction.

- Exchange Agreement - This contract outlines the terms between you and the qualified intermediary facilitating the exchange.

- Identification of Replacement Property - A formal document listing potential replacement properties within the IRS-mandated 45-day period.

- Closing Statements - Detailed records from both the sale of the relinquished property and the purchase of the replacement property, verifying the financial aspects of the exchange.

Qualified Intermediary Agreements

For a 1031 Exchange in real estate, having a Qualified Intermediary Agreement is essential to comply with IRS regulations. This agreement outlines the role of the intermediary in holding and transferring funds to defer capital gains taxes. Your involvement is limited to identifying replacement property while the intermediary manages the transaction paperwork and funds security.

Assignment of Purchase and Sale Agreements

For a successful 1031 exchange in real estate, the Assignment of Purchase and Sale Agreements is a crucial document. This assignment transfers the rights and obligations from the original buyer to the qualified intermediary or new buyer.

The Assignment of Purchase and Sale Agreements ensures that the sale complies with IRS regulations, maintaining the tax-deferred status of the exchange. It must clearly outline the terms and parties involved in the transaction. Proper execution of this document is essential to avoid disqualification of the 1031 exchange.

Exchange Agreement Requirements

The Exchange Agreement is a critical document in a 1031 Exchange, outlining the terms and conditions between the taxpayer and the Qualified Intermediary. It must clearly specify the relinquished property, replacement property, and the timeline for the exchange process.

This agreement ensures compliance with IRS regulations and protects Your interests throughout the transaction. Accurate execution of the Exchange Agreement is essential to successfully defer capital gains taxes in a 1031 Exchange.

Settlement Statements (HUD-1 or Closing Disclosure)

What documents are needed for a 1031 exchange in real estate, specifically regarding Settlement Statements? Settlement Statements, such as the HUD-1 or Closing Disclosure, are essential for detailing the transaction costs and final figures. These documents verify the accurate transfer of funds and ensure compliance with IRS regulations for the exchange.

Identification Notice Forms

For a 1031 Exchange in real estate, the Identification Notice Forms are essential documents that must be submitted within 45 days of selling your property. These forms clearly list the potential replacement properties you intend to acquire, complying with IRS requirements. Proper completion and timely submission of Identification Notice Forms protect your eligibility for tax-deferred exchange benefits.

Replacement Property Acquisition Documentation

Acquiring replacement property in a 1031 exchange requires thorough documentation to ensure compliance with IRS regulations. Proper paperwork confirms the validity of the exchanged real estate and facilitates a smooth transaction process.

- Purchase Agreement - This document outlines the terms and conditions agreed upon between the buyer and seller for the replacement property.

- Title Report - A title report verifies ownership and identifies any liens or encumbrances on the replacement property.

- Settlement Statement (HUD-1 or Closing Disclosure) - This statement itemizes all costs and financial transactions related to the replacement property acquisition.

IRS Form 8824: Like-Kind Exchange Reporting

IRS Form 8824 is essential for reporting a 1031 like-kind exchange in real estate transactions. This form ensures taxpayers comply with federal tax regulations when deferring capital gains taxes.

- Form 8824 Submission - Must be filed with your annual tax return to document the exchange details accurately.

- Identification of Properties - Requires listing the relinquished property and the replacement property with their values and dates of transfer.

- Gain Calculation - Provides a detailed computation of realized and recognized gain from the exchange to determine tax implications.

Proper completion of IRS Form 8824 is crucial for successfully executing a 1031 exchange and maintaining compliance with IRS rules.

Proof of Continuous Ownership and Use

| Document Type | Description | Purpose in 1031 Exchange | Key Details |

|---|---|---|---|

| Deed or Title Records | Official documents showing property ownership history. | Proves continuous ownership and establishes the start date for the exchange period. | Must show consistent ownership without interruption from the date of acquisition to the exchange. |

| Property Tax Statements | Annual tax bills provided by the local government. | Demonstrates use and ownership of the property for the required period. | Payments should be current, reflecting ongoing ownership. |

| Rental or Lease Agreements | Contracts documenting rental status if property was income-producing. | Confirms continuous use as investment property and compliance with 1031 regulations. | Should cover duration needed for exchange eligibility, with signatures from all parties. |

| Utility Bills | Monthly or quarterly statements for utilities such as water, gas, or electricity. | Supports evidence of property use and occupancy during the ownership period. | Consistent billing shows active use, reinforcing continuous possession claims. |

| Insurance Policies | Property insurance documents. | Validates ongoing ownership and protects against loss during the exchange period. | Policy dates must align with the ownership timeframe for the 1031 exchange. |

| Mortgage Statements | Documents reflecting loan payments on the property. | Supports ownership claims and financial responsibility during the exchange period. | Regular payments help prove continuous control over the property. |

| Inspection and Maintenance Records | Records of inspections, repairs, and maintenance work. | Substantiates active property management and use. | Dates should cover the entire ownership period for credibility. |

What Documents are Needed for a 1031 Exchange in Real Estate? Infographic