Land purchase closing requires key documents including the deed, which transfers property ownership, and the title report that verifies clear ownership. Buyers must also provide a purchase agreement outlining the sale terms and a property survey confirming boundaries. Additionally, essential paperwork includes proof of financing, such as loan documents, and any required disclosures related to the land condition or legal restrictions.

What Documents Are Necessary for Land Purchase Closing?

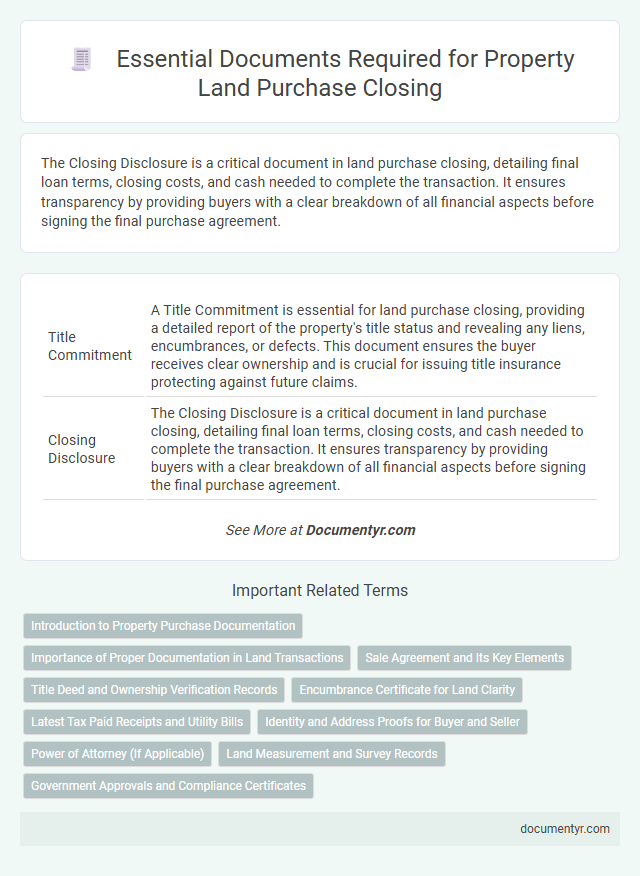

| Number | Name | Description |

|---|---|---|

| 1 | Title Commitment | A Title Commitment is essential for land purchase closing, providing a detailed report of the property's title status and revealing any liens, encumbrances, or defects. This document ensures the buyer receives clear ownership and is crucial for issuing title insurance protecting against future claims. |

| 2 | Closing Disclosure | The Closing Disclosure is a critical document in land purchase closing, detailing final loan terms, closing costs, and cash needed to complete the transaction. It ensures transparency by providing buyers with a clear breakdown of all financial aspects before signing the final purchase agreement. |

| 3 | ALTA Settlement Statement | The ALTA Settlement Statement is a critical document for land purchase closing, providing a detailed itemization of all costs, fees, and credits involved in the transaction to ensure transparency between buyers and sellers. This statement must be reviewed alongside the deed, title insurance policy, and lender documents to complete a compliant and smooth closing process. |

| 4 | Owner’s Title Insurance Policy | The Owner's Title Insurance Policy is essential for land purchase closing as it protects the buyer from potential title defects or claims against the property. This document ensures clear ownership by verifying the title's legitimacy and provides financial coverage in case undiscovered issues arise post-closing. |

| 5 | Hazard Insurance Binder | A Hazard Insurance Binder is essential for land purchase closing as it provides temporary proof of insurance coverage, protecting the property against risks like fire, wind, and other hazards until the formal policy is issued. Lenders typically require this document to ensure the land investment is safeguarded during the transaction process. |

| 6 | FIRPTA Affidavit | The FIRPTA Affidavit is a crucial document required for land purchase closings involving foreign sellers, certifying that the seller is not a foreign person under the Foreign Investment in Real Property Tax Act. This affidavit helps the buyer avoid withholding tax obligations by confirming compliance with IRS regulations during the property transaction. |

| 7 | Lien Payoff Verification | Lien payoff verification requires obtaining official statements from lenders confirming that all existing liens on the property have been fully paid and released prior to closing. This documentation ensures a clear title transfer, preventing future financial encumbrances for the buyer. |

| 8 | Preliminary Change of Ownership Report (PCOR) | The Preliminary Change of Ownership Report (PCOR) is a crucial document required during land purchase closing, used by county assessors to determine property tax reassessment and ownership transfer details. This form must be accurately completed and submitted to ensure proper recording of the transaction and compliance with local tax regulations. |

| 9 | Wet-Signed Deed | A wet-signed deed is essential for land purchase closing as it provides a legally binding proof of ownership transfer, requiring original signatures inked by all involved parties. This document, along with the title search, purchase agreement, and property survey, ensures clear and enforceable property rights. |

| 10 | Cybersecurity Notarization Record | Cybersecurity notarization records ensure the authenticity and security of digital documents during land purchase closings, preventing fraud and unauthorized alterations. Key documents include digitally notarized deeds, contracts, and title insurance policies verified through secure electronic notarization platforms. |

Introduction to Property Purchase Documentation

Purchasing land requires several essential documents to ensure a smooth closing process. These documents verify ownership, legal descriptions, and any encumbrances on the property. Proper documentation protects both the buyer and seller during the land purchase transaction.

Importance of Proper Documentation in Land Transactions

Proper documentation is essential for a successful land purchase closing, ensuring legal ownership and clear title transfer. Key documents include the deed, title report, and purchase agreement, which protect both buyer and seller rights.

Accurate records prevent future disputes and facilitate smooth registration with local authorities. Without complete documentation, buyers risk ownership challenges, liens, or unexpected encumbrances on the property.

Sale Agreement and Its Key Elements

| Document | Key Elements | Description |

|---|---|---|

| Sale Agreement |

|

The sale agreement is a legally binding contract outlining the terms of the land purchase. It specifies the agreed purchase price and detailed description of the property. Payment terms clarify how and when funds will be transferred. The closing date sets the timeline for finalizing the transaction. Contingencies protect your interests by defining conditions that must be met before the sale proceeds. Both buyer and seller signatures validate the contract. |

Title Deed and Ownership Verification Records

Closing a land purchase requires specific documents to ensure legal transfer and clear ownership. Key among these are the Title Deed and Ownership Verification Records that validate the seller's rights.

- Title Deed - This document legally proves the seller's ownership and describes the land details, boundaries, and any encumbrances.

- Ownership Verification Records - These records confirm the chain of ownership and reveal any disputes or liens on the property.

- Legal Compliance - Both documents together ensure the transaction meets local property laws and prevents future claims.

Having these documents accurately prepared is critical to a smooth and secure land purchase closing.

Encumbrance Certificate for Land Clarity

When closing a land purchase, securing the right documents ensures a smooth transaction and legal clarity. Among these, the Encumbrance Certificate plays a critical role in confirming the land's financial status and ownership history.

An Encumbrance Certificate provides evidence that the land is free from legal dues, mortgages, or liens. This document protects your investment by verifying that the property has a clear title, essential for a trustworthy closing process.

Latest Tax Paid Receipts and Utility Bills

Latest tax paid receipts and utility bills are essential documents for land purchase closing. These documents verify that the property has no outstanding dues and confirm its lawful status.

You must provide the most recent tax paid receipts issued by the local municipal authority. Utility bills such as electricity, water, and gas show consistent usage and ensure no pending payments. These documents protect both buyer and seller, facilitating a smooth closing process.

Identity and Address Proofs for Buyer and Seller

What identity documents are required for both buyer and seller during a land purchase closing?

Both parties must present government-issued identity proofs such as a passport, driver's license, or Aadhaar card to verify their identities. These documents ensure legal validation and help prevent fraud in the transaction.

Which address proofs are necessary for the buyer and seller in a land sale closing?

Utility bills, bank statements, or voter ID cards serve as acceptable address proofs for both buyer and seller. Accurate address documentation is crucial for maintaining clear records and fulfilling legal requirements in the property transfer process.

Power of Attorney (If Applicable)

Power of Attorney (POA) is a critical document in land purchase closings, allowing one party to act on behalf of another when necessary. This document must be properly executed and notarized to ensure its legal validity during the transaction.

- Authorization to Act - POA grants legal authority for an agent to sign closing documents on behalf of the principal.

- Notarization Requirement - The document must be notarized to verify the authenticity of the principal's signature.

- Scope and Limitations - The POA clearly defines the powers granted and any restrictions related to the land purchase closing.

Land Measurement and Survey Records

Land measurement and survey records are essential documents for land purchase closing, providing accurate boundary details and property dimensions. These records include survey plats, boundary surveys, and legal descriptions, ensuring clarity on the exact size and location of the land parcel. Proper verification of these documents helps prevent disputes and confirms the property's compliance with local zoning and land use regulations.

What Documents Are Necessary for Land Purchase Closing? Infographic