To file a property tax appeal, you need several key documents including the original property tax assessment notice, recent property tax bills, and evidence of the property's market value such as recent sales comparisons or professional appraisals. Supporting documentation like photographs showing property condition or records of improvements or damages can strengthen your case. Organizing these documents clearly helps ensure a smooth review process during the appeal.

What Documents Are Needed for Property Tax Appeal?

| Number | Name | Description |

|---|---|---|

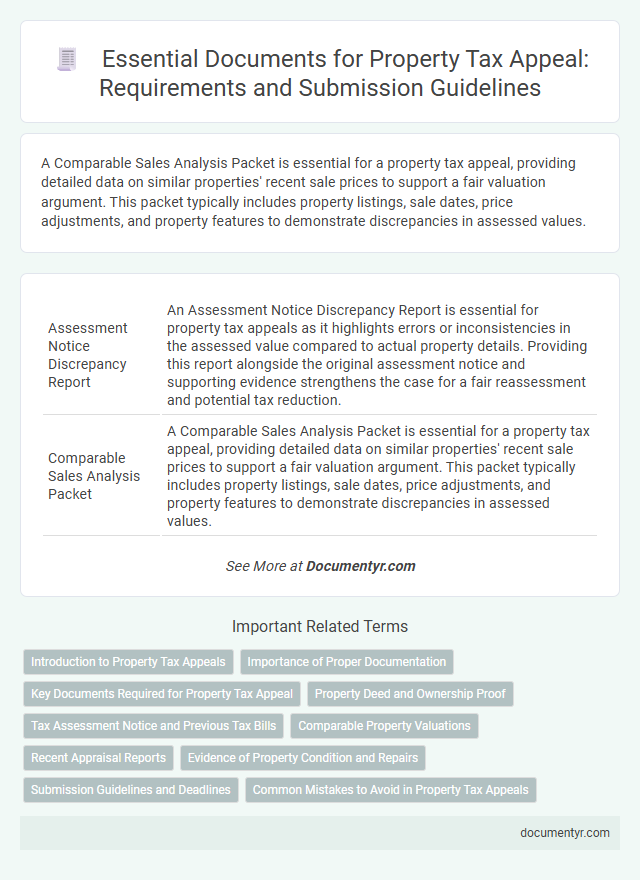

| 1 | Assessment Notice Discrepancy Report | An Assessment Notice Discrepancy Report is essential for property tax appeals as it highlights errors or inconsistencies in the assessed value compared to actual property details. Providing this report alongside the original assessment notice and supporting evidence strengthens the case for a fair reassessment and potential tax reduction. |

| 2 | Comparable Sales Analysis Packet | A Comparable Sales Analysis Packet is essential for a property tax appeal, providing detailed data on similar properties' recent sale prices to support a fair valuation argument. This packet typically includes property listings, sale dates, price adjustments, and property features to demonstrate discrepancies in assessed values. |

| 3 | Tax Assessor’s Valuation Worksheet | The Tax Assessor's Valuation Worksheet is essential for a property tax appeal, providing a detailed breakdown of the assessed value, including land and improvement costs, which supports arguments for a reduced valuation. Submitting this worksheet alongside recent property appraisals, sales comparisons, and relevant permits strengthens the appeal by demonstrating discrepancies in the assessor's valuation. |

| 4 | Digital Property Sketch Submission | For a property tax appeal, submitting a digital property sketch is essential to accurately represent the home's dimensions and layout, ensuring a clear assessment of its value. Required documents typically include the digital property sketch file, recent appraisal reports, property tax statements, and any photographic evidence supporting discrepancies in the current tax assessment. |

| 5 | Automated Valuation Model (AVM) Output | To support a property tax appeal, obtaining the Automated Valuation Model (AVM) output is crucial as it provides an objective, data-driven estimate of property value based on recent sales, property characteristics, and market trends. This AVM report, often generated by real estate analytics platforms or government databases, serves as key evidence to challenge or validate the assessed property value. |

| 6 | Energy Efficiency Certification Documents | Energy Efficiency Certification Documents, such as Energy Star ratings or LEED certifications, are essential for property tax appeals to demonstrate reduced energy costs and increased value. Including these documents helps support claims for property value adjustments by verifying improvements in energy performance and sustainability. |

| 7 | Pre-Appeal Data Reconciliation Statement | The Pre-Appeal Data Reconciliation Statement is essential for property tax appeals as it details the assessor's recorded property information, serving as a basis for disputing inaccuracies. This document verifies data such as ownership, property characteristics, and assessed value, allowing taxpayers to prepare targeted evidence and negotiate adjustments before formal appeal submission. |

| 8 | Geographic Information System (GIS) Parcel Map | A Geographic Information System (GIS) parcel map is essential for a property tax appeal as it provides detailed spatial data and boundaries that support accurate property identification and valuation. Including this map alongside tax bills, property deeds, and recent appraisals strengthens the appeal by clarifying discrepancies in property description or assessment. |

| 9 | Cost Segregation Study Summary | A Cost Segregation Study Summary provides a detailed breakdown of property components, accelerating depreciation schedules to reduce taxable value in a property tax appeal. Including this study supports the argument for reassessment by demonstrating accurate asset classification and valuation to local tax authorities. |

| 10 | Remote Appraisal Video Evidence | Remote appraisal video evidence is essential for property tax appeals, providing visual documentation that accurately captures property conditions and discrepancies. This evidence complements traditional appraisal documents such as property tax assessments, recent appraisals, and photographs, enhancing the appeal's credibility and supporting a fair reassessment. |

Introduction to Property Tax Appeals

Property tax appeals allow you to challenge the assessed value of your property if you believe it is inaccurate. Understanding the required documentation is essential to successfully navigate the appeal process.

Key documents include the property tax assessment notice, recent property tax bills, and evidence supporting your claim such as recent appraisals or comparable property sales. Photographs of the property and repair estimates also strengthen your case. Gathering these materials thoroughly enhances your chances of a favorable review.

Importance of Proper Documentation

Proper documentation is crucial for a successful property tax appeal. Essential documents include the original property tax assessment, recent property appraisal reports, and evidence of comparable property values. These documents provide concrete evidence to support your case and ensure the appeal is evaluated accurately.

Key Documents Required for Property Tax Appeal

Key documents are essential for a successful property tax appeal. These documents provide evidence to support your claim that the property's assessed value is incorrect.

Commonly required documents include the property tax assessment notice, recent property appraisal reports, and comparable property sales data. Additionally, photographs of the property and repair invoices can strengthen your appeal case.

Property Deed and Ownership Proof

| Document | Description | Importance for Property Tax Appeal |

|---|---|---|

| Property Deed | The official legal document that establishes ownership and details the property's boundaries and description. | Serves as primary evidence of ownership and legal rights, essential to validating any appeal regarding property valuation or taxation. |

| Proof of Ownership | Additional documents such as mortgage statements, property tax bills, or title insurance policies that confirm the owner's legal stake in the property. | Supports the claim of ownership, strengthening the appeal by demonstrating clear and undisputed property control. |

Tax Assessment Notice and Previous Tax Bills

When preparing for a property tax appeal, the Tax Assessment Notice is a crucial document as it provides the official assessed value of your property. This notice often serves as the basis for your property's tax calculation and is essential to understanding the grounds for your appeal.

Previous Tax Bills also play an important role by showing how much property tax you have been charged over time. These bills help identify any discrepancies or inconsistencies in tax amounts that could strengthen your case.

Comparable Property Valuations

When preparing for a property tax appeal, comparable property valuations are essential documents that support your case. These valuations help demonstrate that your property's assessed value should be adjusted based on similar properties in the area.

- Recent Sales Data - Provides evidence of current market values for properties similar to yours.

- Assessment Records - Shows the assessed values of comparable properties to highlight discrepancies.

- Property Details - Includes size, features, and condition comparisons to justify valuation differences.

Recent Appraisal Reports

Recent appraisal reports are crucial when filing a property tax appeal. These documents provide updated valuations that can support your case for a lower tax assessment.

- Recent Appraisal Report - An official, professional property valuation conducted within the last year to reflect current market conditions.

- Comparative Market Analysis - A report showing recent sales of similar properties in your area to establish fair market value.

- Tax Assessment Notice - The current property tax statement detailing the assessed value that you are appealing.

Evidence of Property Condition and Repairs

Evidence of property condition and repairs plays a crucial role in a property tax appeal. Documentation such as repair invoices, contractor estimates, and before-and-after photos help demonstrate the current state and improvements made to the property. These documents support your claim for adjusting the assessed value by proving any damage, deterioration, or changes affecting the property's worth.

Submission Guidelines and Deadlines

Submitting the correct documents is crucial when filing a property tax appeal. Meeting submission guidelines and deadlines ensures your appeal is considered without delay.

- Proof of Ownership - Submit a copy of the deed or title as evidence you own the property.

- Assessment Notice - Include the most recent property tax assessment notice to highlight the disputed valuation.

- Supporting Evidence - Provide appraisal reports, recent sales data, or repair estimates to justify your appeal.

Review local tax authority instructions carefully to ensure your property tax appeal is properly filed on time.

What Documents Are Needed for Property Tax Appeal? Infographic