Property title insurance requires key documents including the original deed, which proves ownership, and a title search report that verifies the property's legal status and any existing liens or encumbrances. A survey or plat map may be necessary to confirm property boundaries, while past mortgage records and tax statements help ensure there are no outstanding financial claims. These documents collectively protect buyers and lenders from potential disputes or defects in the property's title.

What Documents are Necessary for Property Title Insurance?

| Number | Name | Description |

|---|---|---|

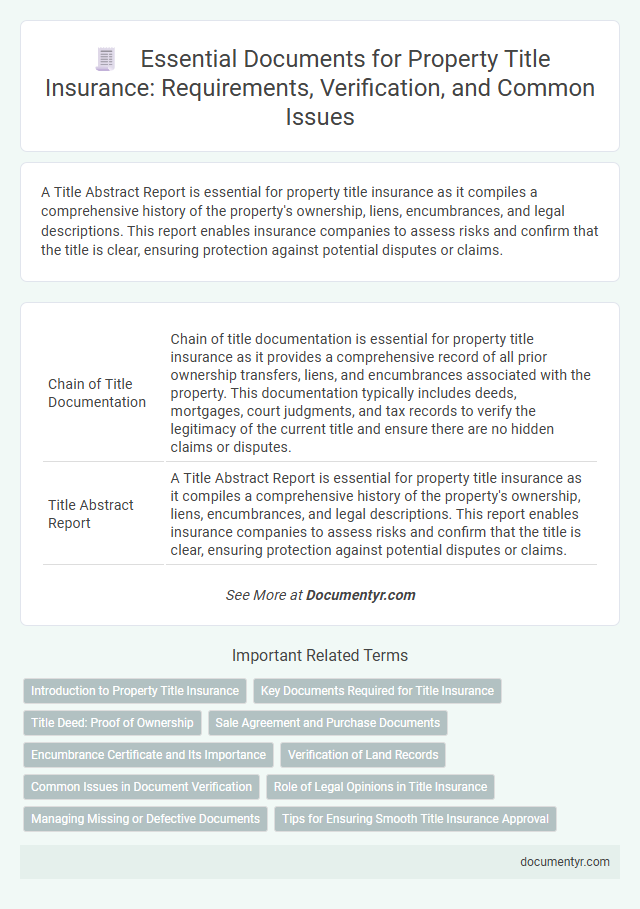

| 1 | Chain of Title Documentation | Chain of title documentation is essential for property title insurance as it provides a comprehensive record of all prior ownership transfers, liens, and encumbrances associated with the property. This documentation typically includes deeds, mortgages, court judgments, and tax records to verify the legitimacy of the current title and ensure there are no hidden claims or disputes. |

| 2 | Title Abstract Report | A Title Abstract Report is essential for property title insurance as it compiles a comprehensive history of the property's ownership, liens, encumbrances, and legal descriptions. This report enables insurance companies to assess risks and confirm that the title is clear, ensuring protection against potential disputes or claims. |

| 3 | Owners Policy Disclosure | Owners Policy Disclosure requires providing the homeowner with a detailed summary of the title insurance coverage, exclusions, and the legal rights protected by the policy. This document ensures transparency by outlining any known title defects, liens, or encumbrances that may affect the property's ownership. |

| 4 | Encumbrance Certificate | An Encumbrance Certificate (EC) is a critical document required for property title insurance, as it certifies that the property is free from any monetary or legal liabilities such as mortgages, liens, or unpaid loans. Obtaining a recent EC ensures clear ownership and helps insurers verify the absence of encumbrances that could affect the property's title. |

| 5 | Lien Payoff Statement | A Lien Payoff Statement is crucial for property title insurance as it details the exact amount needed to clear existing liens, ensuring the title is free of financial encumbrances. This document verifies that all prior debts tied to the property are settled, protecting the buyer and insurer from future claims. |

| 6 | Title Vesting Instrument | The title vesting instrument is essential for property title insurance as it legally establishes ownership by detailing how the title is held, such as joint tenancy or tenancy in common. This document ensures clear identification of owners and their rights, reducing the risk of future title disputes. |

| 7 | Preliminary Title Commitment | A Preliminary Title Commitment outlines the essential documents required for property title insurance, including the legal description of the property, current deed, encumbrances, liens, easements, and any pending legal actions affecting the title. This document serves as a conditional agreement before issuing a final title insurance policy, ensuring clear ownership and identifying potential title defects. |

| 8 | Legal Property Description Addendum | The Legal Property Description Addendum is a crucial document for property title insurance as it provides an exact, legally recognized description of the property's boundaries and location, ensuring clarity in ownership. This detailed addendum helps prevent disputes by accurately defining the property's dimensions and legal identifiers in the title insurance policy. |

| 9 | Seller Affidavit of Title | The Seller Affidavit of Title is a crucial document for property title insurance, as it provides a sworn statement from the seller confirming ownership and disclosing any liens, encumbrances, or legal issues affecting the title. This affidavit helps insurers verify the property's clear title and reduces the risk of future claims or disputes. |

| 10 | Unrecorded Interest Disclosure | Unrecorded interest disclosure is essential for property title insurance as it reveals any claims or rights not officially recorded in public records, protecting against hidden liens or ownership disputes. Title insurance requires documents such as the title report, deed, mortgage records, and affidavits disclosing any unrecorded interests to ensure clear ownership and minimize risk. |

Introduction to Property Title Insurance

| Introduction to Property Title Insurance | |

|---|---|

| Definition | Property title insurance protects property owners and lenders against losses arising from defects in the title to real estate. |

| Purpose | Ensures clear ownership by covering legal fees and financial losses caused by title disputes, liens, or undisclosed encumbrances. |

| Essential Documents for Property Title Insurance | |

| Deed | Legal document that transfers ownership of the property from the seller to you. |

| Title Search Report | Comprehensive examination of public records to verify the property's ownership history and discover any existing claims. |

| Mortgage Documents | Details of any existing loans or liens on the property that could affect title insurance coverage. |

| Survey Report | Shows property boundaries and any encroachments or easements that may impact ownership rights. |

| Previous Title Insurance Policies | Provides history of past coverage, if applicable, to ensure continuity and thorough protection. |

| Property Tax Receipts | Proof of payment of property taxes, confirming no tax liens exist. |

Key Documents Required for Title Insurance

Key documents required for property title insurance include the property's deed, which proves ownership, and the previous title insurance policy, if available. A title search report is essential to identify any liens, encumbrances, or disputes associated with the property's title. Your lender may also require an affidavit of title to confirm that there are no undisclosed claims against the property.

Title Deed: Proof of Ownership

Title deed serves as the primary proof of ownership in property title insurance. It establishes the legal right to the property by documenting the transfer of ownership.

- Legal Documentation - The title deed is an official document that records the owner's name and details of the property.

- Ownership Verification - It confirms your legal right to possess and use the property as stated in the deed.

- Risk Protection - Title insurance uses the deed to protect against disputes or claims on the property's ownership.

Your title deed must be accurate and free of errors to ensure valid title insurance coverage.

Sale Agreement and Purchase Documents

Securing property title insurance requires specific documents to verify ownership and protect against title defects. The Sale Agreement and Purchase Documents play a crucial role in this process.

- Sale Agreement - This contract outlines the terms and conditions agreed upon by the buyer and seller, serving as proof of the transaction.

- Purchase Deed - The deed transfers property ownership and must be clear and legally executed to ensure proper title insurance coverage.

- Supporting Purchase Documents - These include receipts, payment proofs, and any amendments to the sale agreement that validate the transaction details.

Encumbrance Certificate and Its Importance

Property title insurance safeguards buyers against potential legal issues related to property ownership. One of the essential documents required for obtaining title insurance is the Encumbrance Certificate (EC).

The Encumbrance Certificate provides a detailed record of all transactions related to the property, confirming it is free from any monetary or legal liabilities such as mortgages, liens, or claims. It helps verify the clear ownership status before the title insurance is issued. Lenders and insurers rely heavily on this document to ensure the property's title is marketable and undisputed.

Verification of Land Records

Verification of land records is a critical step in obtaining property title insurance. These records confirm rightful ownership and reveal any liens or encumbrances related to the property.

Essential documents include the deed, property tax receipts, and previous title reports. Your title insurance relies on these verified documents to ensure a clear title and protect against future disputes.

Common Issues in Document Verification

Property title insurance requires several key documents, including the deed, title search report, and mortgage details. Common issues in document verification often involve discrepancies in ownership records, unpaid liens, and unresolved easements that can affect the property's legal status. You must ensure these documents are thoroughly reviewed to prevent future claims and secure your investment.

Role of Legal Opinions in Title Insurance

What documents are necessary for property title insurance? Title insurance requires several key documents including the property deed, the title search report, and the title commitment. These documents establish ownership and identify any liens or encumbrances on the property.

How do legal opinions play a role in title insurance? Legal opinions provide expert evaluations of the property's title status and potential legal issues. These opinions help insurers assess risks and ensure that the title is clear before issuing insurance.

Why is your legal opinion important in obtaining title insurance? Your legal opinion can clarify complex title matters and verify the legitimacy of ownership claims. This added assurance supports the issuance of a more comprehensive title insurance policy.

Managing Missing or Defective Documents

Property title insurance requires specific documents to verify ownership and protect against defects. Essential documents include the deed, title search report, and any lien or encumbrance records.

Managing missing or defective documents involves thorough due diligence and may require obtaining affidavits or corrective deeds. Title insurers often work with attorneys to resolve discrepancies and ensure clear title issuance.

What Documents are Necessary for Property Title Insurance? Infographic