Transferring a home title requires several key documents, including the original deed, a completed title transfer form, and valid identification for both parties. Additional paperwork such as a sale agreement, property tax receipts, and a no-objection certificate may also be necessary depending on local regulations. Ensuring all documents are accurate and notarized helps prevent legal issues during the title transfer process.

What Documents are Needed for a Home Title Transfer?

| Number | Name | Description |

|---|---|---|

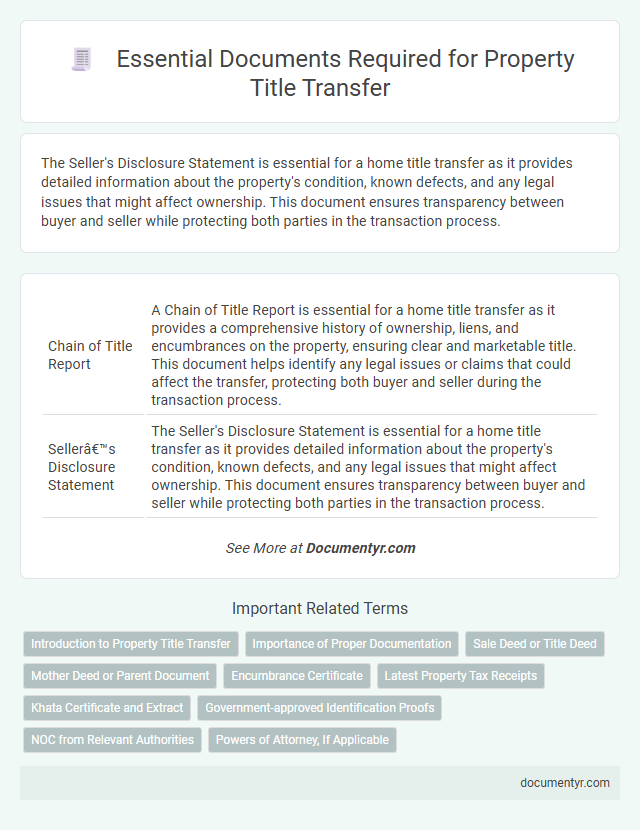

| 1 | Chain of Title Report | A Chain of Title Report is essential for a home title transfer as it provides a comprehensive history of ownership, liens, and encumbrances on the property, ensuring clear and marketable title. This document helps identify any legal issues or claims that could affect the transfer, protecting both buyer and seller during the transaction process. |

| 2 | Seller’s Disclosure Statement | The Seller's Disclosure Statement is essential for a home title transfer as it provides detailed information about the property's condition, known defects, and any legal issues that might affect ownership. This document ensures transparency between buyer and seller while protecting both parties in the transaction process. |

| 3 | Mortgage Payoff Statement | A Mortgage Payoff Statement is essential for a home title transfer as it details the exact amount required to pay off the existing mortgage, ensuring the lender's lien is released. This document prevents any encumbrances on the property's title, facilitating a clear and smooth ownership transfer. |

| 4 | Owner’s Affidavit | The Owner's Affidavit is a crucial document in a home title transfer that verifies the seller's ownership and discloses any liens, encumbrances, or legal claims on the property, ensuring a clear title for the buyer. This affidavit protects both parties by confirming the property's legal status and assisting in resolving any disputes before the transfer is finalized. |

| 5 | Preliminary Title Commitment | A Preliminary Title Commitment is essential for a home title transfer, providing a detailed report on the property's legal status and any existing liens or encumbrances. This document ensures clear ownership by outlining requirements that must be met before issuing the final title insurance policy. |

| 6 | Transfer Tax Declaration | The Transfer Tax Declaration is a critical document required for a home title transfer, detailing the agreed sale price and property information to calculate applicable local transfer taxes accurately. Submitting this declaration promptly ensures compliance with municipal regulations and facilitates the timely processing of the property title change. |

| 7 | Property Survey Certificate | A Property Survey Certificate is essential for a home title transfer as it provides a detailed and legally recognized map of the property boundaries, ensuring accurate identification of the land. This certificate helps prevent disputes by confirming the exact dimensions and location of the property being transferred. |

| 8 | FIRPTA Compliance Form | The FIRPTA Compliance Form is essential for a home title transfer when the seller is a foreign person, ensuring proper withholding of taxes under the Foreign Investment in Real Property Tax Act regulations. This document verifies the seller's foreign status and facilitates IRS compliance, preventing delays or legal issues during the property transaction. |

| 9 | Lien Release Document | A lien release document is essential for a home title transfer as it proves that any existing mortgage or lien on the property has been fully paid and cleared. This document must be submitted to the county recorder or relevant authority to ensure the title is free of encumbrances before the transfer is finalized. |

| 10 | Enhanced Title Insurance Rider | A home title transfer requires essential documents including the deed, a completed title transfer form, and a government-issued ID, while an Enhanced Title Insurance Rider provides additional protection by covering risks such as undiscovered liens or title defects that standard policies might not address. Incorporating an Enhanced Title Insurance Rider ensures comprehensive coverage, safeguarding homeowners against unexpected legal claims or financial losses related to property ownership. |

Introduction to Property Title Transfer

What documents are needed for a home title transfer? A home title transfer involves legally changing the ownership of a property from one party to another. Essential documents include the deed, a completed transfer form, and proof of identity to ensure a smooth and valid transfer process.

Importance of Proper Documentation

Proper documentation is essential for a smooth home title transfer process. It ensures legal ownership is clearly established and protects all parties involved.

The key documents required typically include the original title deed, a completed title transfer form, and proof of identity. Accurate paperwork prevents disputes and delays during property transactions.

Sale Deed or Title Deed

The Sale Deed, also known as the Title Deed, is the most crucial document required for a home title transfer. It legally establishes the transfer of ownership from the seller to the buyer.

This document must be registered with the local sub-registrar's office to validate the transaction. Along with the Sale Deed, identity proofs and previous title documents are often necessary to complete the process.

Mother Deed or Parent Document

The Mother Deed or Parent Document is a crucial property record that establishes the original title ownership and lineage of the land. It serves as foundational evidence for any home title transfer, ensuring the property's history is clear and unbroken.

- Mother Deed Definition - This document traces the property's ownership from the earliest recorded transaction to the present holder.

- Legal Importance - It helps verify the legitimacy of the current owner's claim by showing a clear chain of title.

- Required for Title Transfer - The Mother Deed is often submitted alongside other documents to validate the transfer of home ownership legally.

Obtaining the Mother Deed is essential to avoid disputes and secure a smooth home title transfer process.

Encumbrance Certificate

The Encumbrance Certificate (EC) is a crucial document required for a home title transfer. It certifies that the property is free from any legal or monetary liabilities such as mortgages or liens.

Obtaining an Encumbrance Certificate helps buyers verify the clear ownership history of the property. It includes records of all transactions registered against the property over a specified period. This certificate ensures the property is legally sound for transfer and protects both buyer and seller from future disputes.

Latest Property Tax Receipts

Latest property tax receipts are essential documents required for a home title transfer. These receipts prove that all property taxes have been paid up to date, ensuring there are no outstanding liabilities on the property. Providing the most recent tax receipts helps facilitate a smooth and legally compliant transfer process.

Khata Certificate and Extract

When transferring a home title, obtaining the Khata Certificate and Khata Extract is essential for verifying property ownership and municipal records. These documents ensure the property's legal status and tax details are accurately reflected.

- Khata Certificate - This certificate serves as proof of property registration in municipal records and is necessary for initiating a title transfer.

- Khata Extract - The Khata Extract provides a detailed summary of the property's tax payments and ownership history within the municipal limits.

- Legal Verification - Both documents aid in confirming the property's legitimate ownership and clear legal status during the title transfer process.

Government-approved Identification Proofs

Government-approved identification proofs play a crucial role in the home title transfer process. Commonly accepted documents include a valid passport, driver's license, and state-issued ID card, which verify the identity of the parties involved. These identifications ensure legal compliance and help prevent fraudulent property transactions.

NOC from Relevant Authorities

| Document | Description | Purpose | Issuing Authority |

|---|---|---|---|

| No Objection Certificate (NOC) | Official clearance document confirming no legal or financial objections exist against the property transfer | Ensures the property is free of encumbrances and approved for transfer | Municipal Corporation, Development Authority, or Local Government Body |

| Sale Deed | Legal document recording the sale and transfer of property ownership | Proof of the transaction and change of ownership | Registered Sub-Registrar's Office |

| Title Deed | Document establishing the current ownership and history of the property | Verifies legitimate ownership prior to transfer | Land Registry or Revenue Department |

| Encumbrance Certificate | Certificate showing the property is free from any monetary or legal liabilities | Ensures the property is clear of loans, mortgages, or liens | Sub-Registrar's Office or Land Records Office |

| Property Tax Receipts | Proof of payment of all applicable property taxes | Confirms no outstanding tax dues exist on the property | Local Municipal Authority |

What Documents are Needed for a Home Title Transfer? Infographic