A first-time home buyer needs several essential documents to complete the purchase process, including proof of identity, income verification such as pay stubs or tax returns, and bank statements to demonstrate financial stability. Lenders typically require a credit report, employment history, and a pre-approval letter to assess loan eligibility. Additionally, buyers should prepare documents related to the property, like purchase agreements and disclosures, to ensure a smooth transaction.

What Documents Does a Buyer Need for a First-Time Home Purchase?

| Number | Name | Description |

|---|---|---|

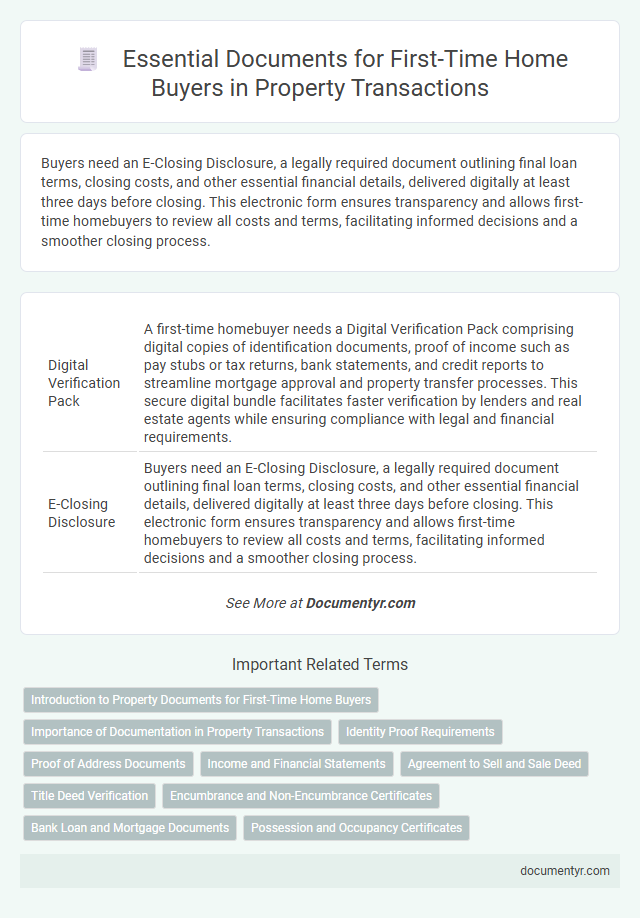

| 1 | Digital Verification Pack | A first-time homebuyer needs a Digital Verification Pack comprising digital copies of identification documents, proof of income such as pay stubs or tax returns, bank statements, and credit reports to streamline mortgage approval and property transfer processes. This secure digital bundle facilitates faster verification by lenders and real estate agents while ensuring compliance with legal and financial requirements. |

| 2 | E-Closing Disclosure | Buyers need an E-Closing Disclosure, a legally required document outlining final loan terms, closing costs, and other essential financial details, delivered digitally at least three days before closing. This electronic form ensures transparency and allows first-time homebuyers to review all costs and terms, facilitating informed decisions and a smoother closing process. |

| 3 | Automated Income Verifier (AIV) Report | Buyers need an Automated Income Verifier (AIV) Report to streamline income verification during a first-time home purchase, ensuring accurate and efficient documentation. This report pulls data from various financial sources, reducing manual errors and expediting loan approval processes. |

| 4 | Blockchain Property Ledger | Buyers need identification documents, proof of income, and a validated title recorded on a Blockchain Property Ledger to ensure transparency and immutability of ownership records. The blockchain ledger eliminates traditional paperwork by securely verifying property history, liens, and transaction authenticity. |

| 5 | Remote Notarization Certificate | Remote notarization certificates provide first-time homebuyers with a secure, legally recognized method to authenticate documents without in-person visits, streamlining the property purchase process. This digital validation is increasingly accepted by lenders and title companies, ensuring compliance with state regulations and enhancing transaction efficiency. |

| 6 | Pre-Approval Soft Pull Statement | Buyers need a Pre-Approval Letter based on a soft pull credit inquiry, which verifies their financial ability without impacting their credit score, and a recent bank statement to demonstrate sufficient funds for down payment and closing costs. These documents streamline the mortgage approval process and strengthen the buyer's offer in competitive real estate markets. |

| 7 | Fraud Detection Consent Form | Buyers must provide a Fraud Detection Consent Form to authorize the lender or agent to verify the authenticity of personal and financial information, reducing the risk of identity theft and fraudulent activity during the home purchase. This document is essential for safeguarding both parties and ensuring compliance with legal and regulatory standards in real estate transactions. |

| 8 | Smart Contract Home Agreement | Buyers need essential documents such as proof of identity, income verification, credit reports, and pre-approval letters for first-time home purchases, with smart contract home agreements streamlining the process by securely automating contract execution on blockchain. These digital agreements reduce fraud risks and increase transparency, ensuring all parties fulfill obligations before finalizing property transfers. |

| 9 | Down Payment Gift Compliance Letter | A Down Payment Gift Compliance Letter verifies that the funds given as a gift for a home purchase meet lender requirements and are not a loan, ensuring the buyer's eligibility for mortgage approval. This document must detail the donor's information, the amount gifted, and a statement confirming no repayment is expected, providing crucial compliance evidence for first-time homebuyers. |

| 10 | AI-Powered Document Checklist | An AI-powered document checklist streamlines the first-time home buying process by automatically identifying essential documents such as proof of income, credit reports, tax returns, and bank statements. This technology ensures buyers submit accurate, complete paperwork, reducing delays and improving mortgage approval efficiency. |

Introduction to Property Documents for First-Time Home Buyers

Purchasing a property for the first time involves understanding a variety of essential documents. These documents verify ownership, outline financial commitments, and ensure legal compliance throughout the buying process. Familiarizing yourself with key property documents helps streamline your first-time home purchase experience.

Importance of Documentation in Property Transactions

Proper documentation is crucial in property transactions to ensure a smooth and legally secure home purchase. Accurate paperwork protects all parties involved by clearly outlining the terms and conditions of the sale.

For a first-time home purchase, essential documents include proof of identity, financial statements, and loan approval letters. You must gather these documents early to expedite the buying process and avoid delays.

Identity Proof Requirements

What identity proof documents are required for a first-time home purchase? Buyers must provide government-issued identification such as a passport or driver's license to verify their identity. These documents help ensure the authenticity of the buyer and prevent fraud during the transaction.

Proof of Address Documents

Proof of address documents are essential for first-time home buyers to verify their current residence. Commonly accepted documents include utility bills, bank statements, and government-issued IDs with the buyer's address.

Mortgage lenders require these documents to confirm stability and residency status before approving a home loan. Providing accurate proof of address helps streamline the buying process and avoid delays.

Income and Financial Statements

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Income | Recent pay stubs, typically covering the last 30 days | Verifies stable and sufficient income to qualify for mortgage approval |

| W-2 Forms | Copies of W-2 forms from the past two years | Demonstrates consistent employment and income history |

| Tax Returns | Complete federal tax returns for the past two years | Confirms overall financial health and income stability |

| Bank Statements | Statements from checking and savings accounts for the last 2-3 months | Shows available funds for down payment and reserves |

| Asset Documentation | Records of investments, retirement accounts, and other assets | Supports financial strength and ability to cover closing costs |

| Employment Verification Letter | Letter from employer confirming current employment status and salary | Provides lender with validation of job stability |

Agreement to Sell and Sale Deed

When buying your first home, having the correct legal documents is crucial for a smooth transaction. Two of the most important documents are the Agreement to Sell and the Sale Deed.

- Agreement to Sell - This document outlines the terms and conditions agreed upon by the buyer and seller before the property transfer.

- Sale Deed - The final legal document that officially transfers ownership of the property to the buyer.

- Importance of Verification - Both documents must be thoroughly verified to ensure the property's title is clear and free of disputes.

Keeping these documents organized protects your rights and ensures a lawful property purchase process.

Title Deed Verification

Title deed verification is a crucial step in the first-time home purchase process to ensure the property's legal ownership is clear. This document confirms that the seller has the legal right to sell the property and that there are no outstanding liens or disputes. You must obtain a certified copy of the title deed from the local land registry office to verify its authenticity and accuracy.

Encumbrance and Non-Encumbrance Certificates

When purchasing your first home, ensuring the property is free of legal claims is crucial. Obtaining the right documents safeguards your investment and confirms clear ownership.

- Encumbrance Certificate (EC) - This document proves that the property is free from any monetary or legal liabilities such as loans or mortgages.

- Non-Encumbrance Certificate - It certifies that the property has no outstanding dues, liens, or third-party claims that could affect ownership transfer.

- Importance for Buyers - These certificates provide legal assurance that the property title is clear and can be safely transferred without disputes or legal obstacles.

Bank Loan and Mortgage Documents

When purchasing your first home, securing a bank loan requires specific documents to verify your financial status and eligibility. Mortgage documents are essential to outline the terms and conditions of your loan agreement.

Bank loan documents typically include proof of income, credit reports, and bank statements to demonstrate your repayment ability. Mortgage documents consist of the loan application, promissory note, and the deed of trust or mortgage agreement. These papers protect both you and the lender throughout the home buying process.

What Documents Does a Buyer Need for a First-Time Home Purchase? Infographic