To ensure a smooth life insurance beneficiary payout, essential documents typically include the original life insurance policy, a certified copy of the insured's death certificate, and a completed claim form provided by the insurance company. Beneficiaries may also need to submit identification proof, such as a government-issued ID, and sometimes additional paperwork like the beneficiary's birth certificate or proof of relationship to the deceased. Providing accurate and complete documentation helps avoid delays and facilitates prompt processing of the claim.

What Documents are Necessary for Life Insurance Beneficiary Payouts?

| Number | Name | Description |

|---|---|---|

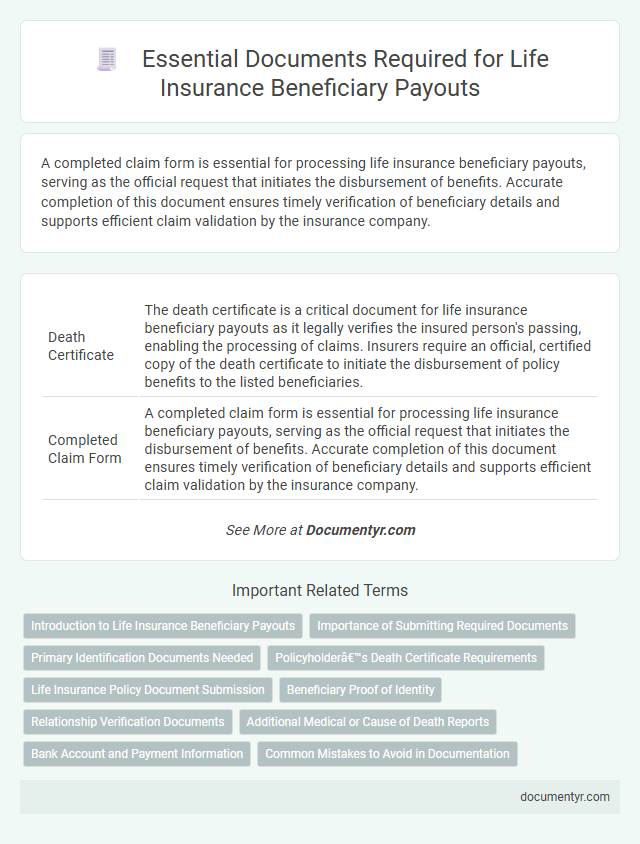

| 1 | Death Certificate | The death certificate is a critical document for life insurance beneficiary payouts as it legally verifies the insured person's passing, enabling the processing of claims. Insurers require an official, certified copy of the death certificate to initiate the disbursement of policy benefits to the listed beneficiaries. |

| 2 | Completed Claim Form | A completed claim form is essential for processing life insurance beneficiary payouts, serving as the official request that initiates the disbursement of benefits. Accurate completion of this document ensures timely verification of beneficiary details and supports efficient claim validation by the insurance company. |

| 3 | Original Life Insurance Policy Document | The original life insurance policy document is essential for beneficiary payouts as it verifies the coverage details and confirms the insurer's obligation to pay. Beneficiaries must present this document along with the death certificate to expedite the claim process and ensure accurate settlement. |

| 4 | Beneficiary’s Proof of Identity | Life insurance beneficiary payouts require valid proof of identity such as a government-issued ID (passport, driver's license), Social Security card, or birth certificate to verify the claimant's legal right. Insurers also typically request the original or certified death certificate, along with the completed claim form, to process benefits efficiently. |

| 5 | Beneficiary’s Proof of Address | Beneficiary's proof of address is essential for life insurance payouts to verify the identity and residency of the claimant, preventing fraud and ensuring compliance with policy terms. Commonly accepted documents include utility bills, bank statements, or government-issued identification showing the beneficiary's current address. |

| 6 | Medical Records (if required) | Life insurance beneficiary payouts may require medical records to verify the insured's cause of death or to confirm pre-existing conditions affecting claim approval. These records, including hospital reports and physician statements, provide critical evidence for insurance companies to process and settle claims accurately. |

| 7 | Police Report (in case of accidental death) | A police report is a critical document required for life insurance beneficiary payouts in cases of accidental death, as it provides official verification of the circumstances surrounding the incident. This report helps insurers assess the claim's validity and expedite the disbursement process by confirming details such as cause, time, and location of death. |

| 8 | Autopsy Report (if applicable) | Life insurance beneficiary payouts may require an autopsy report when the cause of death is unclear or suspicious, providing critical medical evidence to validate the claim. Alongside the autopsy report, standard documents include the original policy, death certificate, and proof of identity for a smooth and accurate settlement process. |

| 9 | Assignment Deed (if policy assigned) | For life insurance beneficiary payouts, the necessary documents typically include the original policy, a completed claim form, the insured's death certificate, and proof of identity of the beneficiary. If the policy is assigned, an Assignment Deed or Endorsement document is crucial to establish the transfer of policy benefits to the assignee. |

| 10 | Power of Attorney (if claiming on behalf of another) | To claim a life insurance beneficiary payout on behalf of another individual, a valid Power of Attorney (POA) document must be submitted, verifying the legal authority to act on the policyholder's behalf. This POA must be notarized and clearly state the scope of authority related to managing life insurance claims to ensure the insurer recognizes the claimant's entitlement. |

| 11 | Nominee’s Bank Account Details | For life insurance beneficiary payouts, precise nominee's bank account details such as account number, bank name, branch code, and IFSC are essential to ensure seamless fund transfer. Accurate documentation of these details minimizes processing delays and facilitates direct deposit of the claim amount into the beneficiary's account. |

| 12 | Court Order (if required for disputed claims) | In life insurance beneficiary payouts, a court order may be required when claims are disputed or when there is uncertainty regarding the rightful beneficiary, ensuring legal clarity before the insurer releases funds. This court order typically resolves conflicts by officially designating the beneficiary, allowing for the proper disbursement of the life insurance proceeds. |

| 13 | Relationship Proof (if requested by insurer) | Life insurance beneficiary payouts often require relationship proof documents such as birth certificates, marriage certificates, or court-issued documents to validate the beneficiary's connection to the insured. Insurers may request these documents to prevent fraud and ensure the payout aligns with the policyholder's intentions. |

| 14 | PAN Card (as per local regulations) | For life insurance beneficiary payouts, submission of the claimant's PAN card is mandatory to comply with local tax regulations and verify identity. This document ensures proper processing of claims and adherence to anti-money laundering requirements. |

| 15 | Tax Forms (if required by insurer or government) | Life insurance beneficiary payouts often require submission of specific tax forms such as IRS Form W-9 for U.S. residents to verify taxpayer identification numbers and IRS Form 1099-R for reporting distributions. Insurers may also request a completed tax declaration form to ensure compliance with government tax regulations and facilitate accurate reporting of death benefits. |

Introduction to Life Insurance Beneficiary Payouts

```html| Introduction to Life Insurance Beneficiary Payouts | |

|---|---|

| Definition | Life insurance beneficiary payouts refer to the transfer of the insured person's death benefit to the designated individuals or entities after the policyholder's passing. |

| Purpose | Ensures financial security and support for your loved ones or chosen beneficiaries by providing a lump sum payment. |

| Beneficiary Types | Primary beneficiaries receive the payout first, while contingent beneficiaries receive funds if the primary is unavailable. |

| Claim Process Overview | The beneficiary must file a claim with the insurance company, submitting required documents to initiate the payout. |

| Importance of Documentation | Proper documentation verifies identity, policy details, and cause of death, ensuring a smooth and timely payout process. |

Importance of Submitting Required Documents

Submitting the necessary documents for life insurance beneficiary payouts ensures a smooth and timely claims process. These documents verify the claimant's identity and the policyholder's death, preventing delays or disputes.

The primary documents include the original life insurance policy, a certified copy of the death certificate, and valid identification of the beneficiary. Additional paperwork may include a claim form provided by the insurance company and any legal documents such as a will or probate papers if applicable. Timely submission of these documents helps beneficiaries receive the payout without unnecessary complications.

Primary Identification Documents Needed

Life insurance beneficiary payouts require specific documentation to verify identity and claim legitimacy. Proper preparation of primary identification documents ensures a smooth claim process.

- Government-Issued Photo ID - A valid passport or driver's license confirms the beneficiary's identity and matches policy records.

- Death Certificate - An official death certificate from a medical authority or registrar proves the insured individual's passing.

- Policy Document - The original or a copy of the life insurance policy helps confirm beneficiary designation and coverage details.

Your timely submission of these key documents supports efficient beneficiary payout processing.

Policyholder’s Death Certificate Requirements

To process a life insurance beneficiary payout, the policyholder's death certificate is essential. This official document verifies the policyholder's passing and allows the insurance company to initiate the claim. Ensure you provide a certified copy of the death certificate to avoid delays in the payout process.

Life Insurance Policy Document Submission

Submitting the original life insurance policy document is crucial for beneficiary payouts. This document serves as primary proof of the contract between the insured and the insurer.

Beneficiaries must also provide a completed claim form and a certified copy of the insured's death certificate. Additional identification documents such as a government-issued ID might be required for verification purposes.

Beneficiary Proof of Identity

Providing proper beneficiary proof of identity is essential for life insurance beneficiary payouts to ensure the rightful claimant receives the benefits. Insurance companies require verified identity documents to prevent fraud and facilitate a smooth claims process.

- Government-Issued Photo ID - A valid passport, driver's license, or national ID card is required to confirm the beneficiary's identity.

- Social Security Number or Tax Identification - This helps verify the beneficiary's identity and prevent fraudulent claims.

- Beneficiary Designation Form - The original or a certified copy must be submitted, matching the beneficiary's identity to the insurer's records.

Relationship Verification Documents

Verifying the relationship between the policyholder and the beneficiary is crucial for life insurance beneficiary payouts. You must provide specific documents to confirm this connection.

- Birth Certificate - Establishes the beneficiary's familial relationship to the insured individual.

- Marriage Certificate - Proves spousal status when the beneficiary is a spouse.

- Adoption Papers - Confirms legal guardianship or parental ties in adopted beneficiaries.

Additional Medical or Cause of Death Reports

What additional medical or cause of death reports are necessary for life insurance beneficiary payouts? Life insurance claims often require detailed medical records or a cause of death certificate to process the payout efficiently. These documents verify the circumstances of the insured's death and ensure the legitimacy of the claim.

Bank Account and Payment Information

Life insurance beneficiary payouts require specific documentation to ensure a smooth and timely payment process. One of the most critical documents is the beneficiary's bank account information, which must be accurate and up to date.

Providing detailed payment information, such as the bank name, account number, and routing number, helps prevent delays or errors in fund transfer. Insurance companies rely on this data to deposit the payout directly into the beneficiary's account securely.

What Documents are Necessary for Life Insurance Beneficiary Payouts? Infographic