A landlord typically requires a copy of the renter's insurance policy declaration page to verify coverage, which outlines the coverage limits and effective dates. Proof of payment or a binder letter from the insurance company may also be requested as confirmation. These documents ensure that the tenant has adequate liability and property damage protection before moving in.

What Documents Does a Landlord Need for Renters Insurance Verification?

| Number | Name | Description |

|---|---|---|

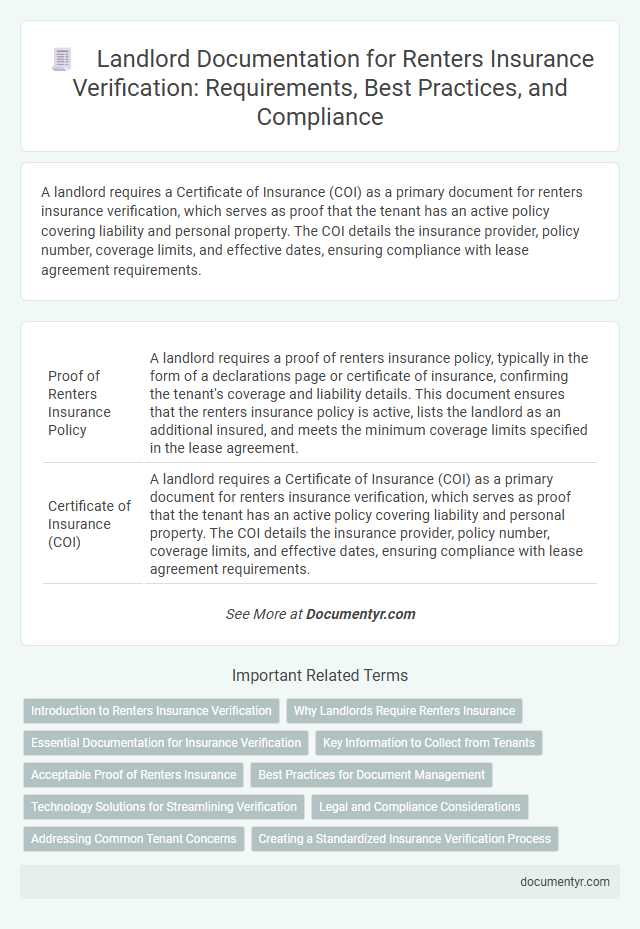

| 1 | Proof of Renters Insurance Policy | A landlord requires a proof of renters insurance policy, typically in the form of a declarations page or certificate of insurance, confirming the tenant's coverage and liability details. This document ensures that the renters insurance policy is active, lists the landlord as an additional insured, and meets the minimum coverage limits specified in the lease agreement. |

| 2 | Certificate of Insurance (COI) | A landlord requires a Certificate of Insurance (COI) as a primary document for renters insurance verification, which serves as proof that the tenant has an active policy covering liability and personal property. The COI details the insurance provider, policy number, coverage limits, and effective dates, ensuring compliance with lease agreement requirements. |

| 3 | Insurance Declarations Page | The insurance declarations page is essential for renters insurance verification as it provides detailed information about the policyholder, coverage limits, policy period, and insured property. Landlords use this document to confirm that tenants have active renters insurance that meets the required liability and personal property protection standards. |

| 4 | Insurance Binder | A landlord requires an insurance binder as proof of renters insurance coverage, detailing the policy's effective dates, coverage limits, and insured parties. This document serves as temporary verification until the full renters insurance policy is issued, ensuring tenants meet the landlord's insurance requirements. |

| 5 | Copy of Insurance Policy | A landlord requires a copy of the renter's insurance policy to verify coverage details, ensuring it meets the property's liability and personal property protection requirements. This document must clearly show the policyholder's name, coverage limits, effective dates, and the landlord listed as an interested party for notification of policy changes or cancellations. |

| 6 | Policy Number Documentation | Landlords require renters insurance verification primarily through the policy number documentation provided by the tenant's insurance provider. This policy number, along with the insurer's contact details and effective coverage dates, ensures the tenant has active liability and personal property protection essential for rental agreements. |

| 7 | Policy Start and End Dates Document | Landlords require renters insurance verification that clearly displays the policy start and end dates to ensure continuous coverage throughout the lease term. This document helps confirm that tenants maintain active insurance, protecting both parties from potential liabilities during occupancy. |

| 8 | Insurer’s Contact Information Page | The insurer's contact information page is crucial for renters insurance verification, as it provides the landlord with direct access to the insurance company for claims and policy confirmation. This page typically includes the insurer's name, phone number, mailing address, and policy number, enabling efficient communication and validation of coverage details. |

| 9 | Named Insured (Tenant) Documentation | Landlords require renters insurance verification that includes the Named Insured's policy declarations page, which clearly lists the tenant as the insured party. Proof of coverage should also contain the policy number, effective dates, liability limits, and the landlord's name as the additional insured or certificate holder. |

| 10 | Landlord or Property Management Listed as Interested Party (Additional Interest) | Landlords or property management companies must be listed as an Interested Party or Additional Interest on the renter's insurance policy to receive verification and timely updates about coverage status or cancellations. This ensures landlords have direct access to critical policy details, protecting their property interests without requiring tenants to manually provide documents. |

| 11 | Proof of Policy Payment/Receipt | Proof of policy payment or receipt is essential for renters insurance verification, demonstrating that the tenant's coverage is active and financial obligations have been met. Landlords typically require a paid receipt or confirmation of the first premium payment to ensure the renter's policy is valid and current. |

| 12 | Coverage Summary Document | A Coverage Summary Document is essential for renters insurance verification as it provides a detailed overview of the tenant's policy limits, covered perils, and liability protections. Landlords rely on this document to confirm adequate insurance coverage and ensure the tenant meets the lease requirements for property and liability protection. |

| 13 | Liability Coverage Confirmation | Landlords require renters insurance verification documents that clearly demonstrate liability coverage, typically including the insurance declaration page or a certificate of insurance specifying the policyholder's name, coverage limits, and effective dates. These documents ensure tenants have adequate protection against potential property damage or injury claims, safeguarding the landlord's legal and financial interests. |

| 14 | Personal Property Coverage Confirmation | Landlords require renters insurance verification documents that specifically include confirmation of personal property coverage to ensure tenants are protected against loss or damage to belongings. A renters insurance declaration page or a certificate of insurance clearly outlining personal property coverage limits and policy details serves as essential proof for landlords during the verification process. |

| 15 | Renters Insurance Renewal Notice | A Renters Insurance Renewal Notice is a crucial document landlords require to verify continuous coverage from tenants, confirming that the policy remains active and compliant with lease terms. This notice typically includes the policy number, renewal date, coverage limits, and the insurance provider's contact information, ensuring ongoing protection against potential liabilities. |

| 16 | Lapse or Cancellation Notice | A landlord requires a lapse or cancellation notice from the renter's insurance provider to verify continuous coverage and identify any gaps that could expose the property to liability risks. This document ensures tenants maintain active renters insurance, protecting both the landlord's investment and compliance with lease agreements. |

| 17 | Email Confirmation from Insurance Provider | Email confirmation from the insurance provider serves as primary documentation for renters insurance verification, containing essential policy details such as coverage limits, effective dates, and insured property information. Landlords rely on this digital confirmation to ensure tenants maintain the required insurance coverage throughout their lease term. |

Introduction to Renters Insurance Verification

Renters insurance verification ensures tenants have adequate coverage for personal belongings and liability protection. Landlords use this process to minimize financial risks associated with tenant-related damages or losses.

Key documents required include the renter's insurance policy declarations page and a certificate of insurance. These documents confirm the renter's active coverage and provide details about policy limits, coverage dates, and insured parties.

Why Landlords Require Renters Insurance

Landlords require renters insurance verification to protect their property from potential damage caused by tenants. This insurance helps cover liability and property loss, reducing financial risks for both parties. Essential documents include a valid renters insurance policy declaration page and proof of premium payment.

Essential Documentation for Insurance Verification

Landlords require specific documents to verify renters insurance effectively. Essential documentation ensures both parties are protected and obligations are clearly outlined.

The primary document needed is the renters insurance declaration page, which details coverage limits and policy dates. Proof of payment or premium receipt confirms the policy is active. Sometimes, landlords may request the insurance binder as temporary verification until the formal policy is issued.

Key Information to Collect from Tenants

Landlords must collect specific documents to verify renters insurance effectively. Key documents include the renters insurance policy declaration page and proof of payment.

These documents confirm that the tenant has active coverage and outline the policy limits and liabilities. Requesting a certificate of insurance from Your tenant provides additional verification and protects your property.

Acceptable Proof of Renters Insurance

Acceptable proof of renters insurance typically includes a certificate of insurance issued by the insurer, detailing the policyholder's name, coverage limits, and effective dates. A declaration page from the insurance policy may also serve as valid verification, showing the required coverage for the rental property. Your landlord may request these documents to ensure your insurance meets their requirements for liability and property protection.

Best Practices for Document Management

Verifying renters insurance is crucial for landlords to ensure tenant compliance and property protection. Proper document management streamlines the verification process and reduces risks associated with uninsured tenants.

- Insurance Policy Declaration Page - Confirms coverage details, including policyholder name, coverage limits, and effective dates.

- Proof of Payment - Validates that the insurance premium is current and the policy is active.

- Certificate of Insurance (COI) - Provides official confirmation from the insurer listing the landlord as an additional interested party.

Organizing and securely storing these documents in digital formats enhances accessibility and compliance monitoring for landlords.

Technology Solutions for Streamlining Verification

Landlords require specific documents to verify renters insurance efficiently. Technology solutions enhance the accuracy and speed of this verification process.

- Certificate of Insurance (COI) - This document confirms that renters insurance is active and outlines coverage details.

- Digital Verification Platforms - Automated systems validate insurance policies in real-time, reducing manual errors and delays.

- Insurance Provider Portals - These portals allow landlords to access insured renters' information securely and instantly.

Legal and Compliance Considerations

What documents does a landlord need for renters insurance verification? A landlord typically requires a certificate of insurance (COI) to confirm that the tenant has active renters insurance coverage. This document serves as proof of policy details, including liability limits and coverage dates, ensuring compliance with lease agreements and legal standards.

How do legal and compliance considerations impact renters insurance verification? Landlords must verify renters insurance to protect their property and limit liability risks in accordance with state laws and local regulations. Ensuring that tenants maintain proper coverage helps landlords meet legal obligations and avoid potential disputes related to property damage or personal injury claims.

What specific information should be included in the renters insurance certificate for verification? The certificate must detail the insurer's name, policy number, effective dates, coverage limits, and types of protection provided. This transparency guarantees that both the landlord and tenant understand the scope of coverage required by the lease contract.

Why is maintaining accurate renters insurance documentation important for landlords? Proper record-keeping supports landlords in demonstrating compliance during audits, legal proceedings, or insurance claims. Having up-to-date documentation reduces financial and legal exposure by confirming the tenant's adherence to insurance requirements.

How often should landlords verify renters insurance documentation to ensure compliance? Landlords should request updated certificates of insurance annually or whenever a tenant renews their policy. Regular verification aligns with risk management best practices and helps landlords maintain continuous protection throughout the lease term.

Addressing Common Tenant Concerns

| Document | Description | Purpose for Verification | Common Tenant Concerns Addressed |

|---|---|---|---|

| Certificate of Insurance (COI) | Official document from the tenant's insurance company confirming the existence of renters insurance coverage. | Confirms active policies with required coverage limits and landlord's interest endorsement if applicable. | Ensures tenants that their personal property is protected; clarifies which damages are covered to avoid misunderstandings. |

| Insurance Policy Declaration Page | Summary page containing policy number, coverage limits, effective dates, and insured address. | Verifies that the insured address matches the rental property and confirms coverage details. | Reassures tenants that the policy specifically covers their rented unit; alleviates concern about incorrect policy details. |

| Proof of Payment or Premium Receipt | Document showing recent payment to maintain renters insurance policy active. | Provides evidence the policy is current and premiums are paid. | Reduces tenant anxiety about policy lapses or cancellations during tenancy. |

| Landlord's Additional Insured Endorsement (if required) | Endorsement adding the landlord as an additional insured party on the tenant's policy. | Protects landlord from liability claims related to tenant's occupancy. | Clarifies landlord and tenant responsibilities; reassures tenants this does not increase their personal premiums. |

| Tenant Identification Information | Copies of tenant's government-issued ID such as driver's license or passport. | Confirms identity for accurate insurance verification and record-keeping. | Ensures tenant confidentiality and prevents insurance fraud concerns. |

What Documents Does a Landlord Need for Renters Insurance Verification? Infographic