Homeowners insurance underwriting requires essential documents such as a completed application form, property deed or proof of ownership, and recent property inspection reports to assess risk accurately. Insurers also need verification of mortgage details, prior claims history, and proof of any safety features installed in the home, like smoke detectors or security systems. Accurate documentation ensures proper evaluation and helps determine the appropriate coverage and premium rates.

What Documents are Necessary for Homeowners Insurance Underwriting?

| Number | Name | Description |

|---|---|---|

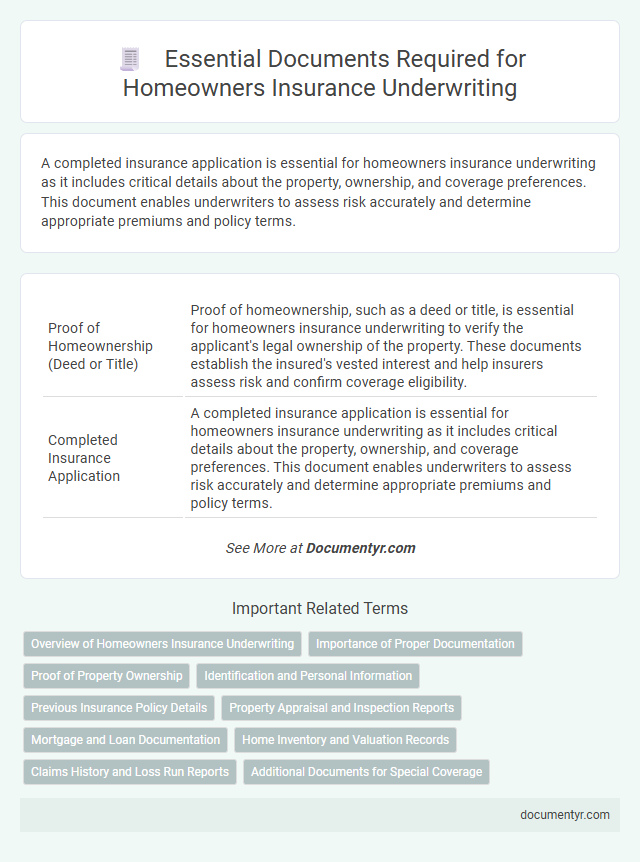

| 1 | Proof of Homeownership (Deed or Title) | Proof of homeownership, such as a deed or title, is essential for homeowners insurance underwriting to verify the applicant's legal ownership of the property. These documents establish the insured's vested interest and help insurers assess risk and confirm coverage eligibility. |

| 2 | Completed Insurance Application | A completed insurance application is essential for homeowners insurance underwriting as it includes critical details about the property, ownership, and coverage preferences. This document enables underwriters to assess risk accurately and determine appropriate premiums and policy terms. |

| 3 | Property Appraisal Report | A detailed Property Appraisal Report is essential for homeowners insurance underwriting as it provides an accurate assessment of the property's value, condition, and replacement cost, enabling insurers to determine appropriate coverage limits. This report typically includes structural details, market comparables, and any recent renovations or improvements, ensuring risk evaluation aligns with the home's true worth. |

| 4 | Home Inspection Report | A detailed Home Inspection Report is essential for homeowners insurance underwriting as it provides critical information about the property's condition, structural integrity, and potential risks. This report helps insurers assess hazards, estimate repair costs, and determine appropriate coverage and premiums. |

| 5 | Recent Mortgage Statement | A recent mortgage statement is essential for homeowners insurance underwriting as it verifies the loan balance and ownership details, helping insurers assess risk and coverage needs accurately. This document confirms financial obligations, property value, and lender information crucial for policy approval. |

| 6 | Prior Insurance Policy Declarations Page | The prior insurance policy declarations page is essential for homeowners insurance underwriting as it provides detailed information about previous coverage, policy limits, and claims history. This document helps underwriters assess risk accurately and determine appropriate premiums based on past insurance performance. |

| 7 | Photographs of Property (Interior & Exterior) | Photographs of property, including detailed images of the interior and exterior, are essential documents for homeowners insurance underwriting as they provide visual evidence of the property's condition and existing features. These photos help underwriters accurately assess risk factors such as structural integrity, maintenance status, and potential hazards, directly influencing policy terms and premium pricing. |

| 8 | Home Inventory List | A detailed home inventory list is crucial for homeowners insurance underwriting as it provides a comprehensive record of personal property, including descriptions, purchase dates, and values, helping insurers accurately assess coverage needs and potential risks. This document supports the verification of claimed assets, enabling precise premium calculations and efficient claims processing in case of loss or damage. |

| 9 | Renovation or Repair Receipts | Homeowners insurance underwriting requires detailed renovation or repair receipts to verify the scope and quality of property improvements, ensuring accurate risk assessment. These documents provide essential proof of upgrades, materials used, and compliance with building codes critical for policy evaluation and premium determination. |

| 10 | Proof of Security Systems | Proof of security systems for homeowners insurance underwriting typically includes installation certificates, monitoring service agreements, and recent inspection reports verifying operational status. These documents demonstrate risk mitigation measures, directly influencing premium rates and coverage eligibility. |

| 11 | Flood Zone Determination Certificate | A Flood Zone Determination Certificate is essential for homeowners insurance underwriting to identify the property's risk level based on FEMA flood maps, ensuring appropriate coverage and premium calculation. This document verifies whether the home lies within flood-prone areas, influencing underwriting decisions and flood insurance requirements. |

| 12 | Evidence of Upgrades (Roof, Plumbing, Electrical) | Evidence of upgrades such as recent roof replacements, plumbing renovations, and electrical system enhancements is critical for homeowners insurance underwriting as these documents verify reduced risk and improved property condition. Providing certified inspection reports, contractor invoices, and permits ensures accurate risk assessment and potential premium discounts by insurers. |

| 13 | Claims History Report (CLUE Report) | The Claims History Report (CLUE Report) is essential for homeowners insurance underwriting, providing detailed information on past claims filed within the last seven years to assess risk accurately. This report helps insurers identify patterns of loss, fraud, or frequent claims, enabling more precise premium calculations and policy eligibility decisions. |

| 14 | Occupancy Certificate | The Occupancy Certificate is a critical document in homeowners insurance underwriting, verifying that the property meets all local building codes and is legally habitable. Insurers require this certificate to assess risk accurately and ensure compliance with regulatory standards before issuing a policy. |

| 15 | Building Plans or Blueprints | Building plans or blueprints are essential for homeowners insurance underwriting as they provide detailed information on the property's structure, materials, and layout, enabling accurate risk assessment and coverage determination. These documents help insurers evaluate construction quality, potential hazards, and replacement costs to tailor appropriate insurance policies. |

Overview of Homeowners Insurance Underwriting

Homeowners insurance underwriting involves evaluating the risk associated with a property to determine coverage eligibility and pricing. Essential documents include the property deed, recent home inspection reports, and proof of prior insurance claims to assess the home's condition and history. Lenders often require mortgage statements and appraisal reports during the underwriting process to ensure accurate risk assessment.

Importance of Proper Documentation

| Document | Purpose | Importance in Underwriting |

|---|---|---|

| Proof of Ownership | Confirms that you legally own the property. | Establishes the insured asset legitimacy, reducing risk for the insurer. |

| Property Deed | Details the location, size, and boundaries of the home. | Verifies property specifications critical for risk assessment. |

| Home Inspection Report | Outlines current condition, including structure and systems. | Identifies potential hazards or needed repairs influencing premium rates. |

| Previous Insurance Policy | Shows past coverage and claim history. | Helps evaluate risk based on prior claims and policy lapses. |

| Mortgage Documents | Indicates outstanding loans secured by the property. | Confirms lender interests and financial responsibilities associated with the home. |

| Valuation Report or Appraisal | Provides current market value of the home. | Supports accurate coverage limits to ensure adequate protection. |

| Identification Documents | Verifies the identity of the homeowner. | Ensures legitimacy and prevents fraud in the underwriting process. |

| Utility Bills or Tax Statements | Confirms occupancy and property maintenance. | Establishes active use and reduces perceived risk of abandonment. |

| Importance of Proper Documentation | Proper documentation streamlines underwriting, enabling precise risk evaluation and fair premium determination. Missing or inaccurate records can delay processing or lead to coverage denials. Your attention to detail in providing these documents supports a smooth insurance approval process and reliable protection for your property. | |

Proof of Property Ownership

Proof of property ownership is a critical document required during homeowners insurance underwriting. This evidence confirms that you have the legal right to insure the property in question.

Common forms of ownership proof include a property deed, title report, or a recent property tax statement. These documents validate your ownership status and help the insurer assess risk accurately.

Identification and Personal Information

Identification documents are essential for homeowners insurance underwriting to verify your identity and assess risk. Commonly required forms include a government-issued photo ID and Social Security number.

Underwriters use personal information such as your full name, date of birth, and current address to conduct background checks and evaluate eligibility. Proof of ownership, like a property deed or mortgage statement, may also be necessary. Providing accurate and complete identification ensures a smoother underwriting process and faster policy approval.

Previous Insurance Policy Details

What previous insurance policy details are necessary for homeowners insurance underwriting? Insurers require comprehensive information about your past policies to assess risk accurately. These details typically include policy numbers, coverage limits, and claims history to ensure proper evaluation.

Property Appraisal and Inspection Reports

Property appraisal and inspection reports are essential documents for homeowners insurance underwriting. These reports provide critical insights into the home's condition and value to assess risk accurately.

- Property Appraisal - Determines the current market value of your home to establish coverage limits and premiums.

- Inspection Report - Evaluates the physical condition, identifying potential hazards or defects that could affect insurability.

- Detailed Documentation - Includes photographs, repair estimates, and structural assessments to support underwriting decisions.

Providing accurate and up-to-date appraisal and inspection reports expedites the underwriting process and ensures appropriate coverage.

Mortgage and Loan Documentation

Mortgage and loan documentation is critical for homeowners insurance underwriting as it verifies ownership and financial obligations. These documents help assess risk and determine coverage requirements.

- Mortgage agreement - This document outlines the terms of your loan and confirms the property's lienholder.

- Loan payoff statement - A statement indicating the outstanding balance on the mortgage, essential for evaluating financial liability.

- Proof of homeowner's equity - Documentation demonstrating your equity stake, which influences underwriting risk assessment.

Home Inventory and Valuation Records

Homeowners insurance underwriting requires detailed documentation to accurately assess risk and coverage needs. Essential among these are home inventory lists and property valuation records, which provide a comprehensive overview of the insured assets.

Your home inventory should include descriptions, purchase dates, and estimated values of personal belongings. Valuation records, such as professional appraisals or recent market assessments, support the accurate determination of property replacement costs.

Claims History and Loss Run Reports

Claims history is a critical document in homeowners insurance underwriting, providing insight into past incidents that may affect risk assessment. Loss run reports detail previous claims filed, including dates, amounts paid, and the nature of each loss, which helps insurers evaluate your coverage needs accurately. These documents collectively enable a thorough review of potential risks, influencing policy terms and premium calculations.

What Documents are Necessary for Homeowners Insurance Underwriting? Infographic