To apply for short-term disability insurance, essential documents include medical records, proof of income, and a completed claim form detailing the nature of the disability. A physician's statement confirming the diagnosis and expected recovery timeline is often required to validate the claim. Employer verification of disability status and salary information may also be necessary to determine benefit eligibility and amount.

What Documents are Needed for Short-Term Disability Insurance?

| Number | Name | Description |

|---|---|---|

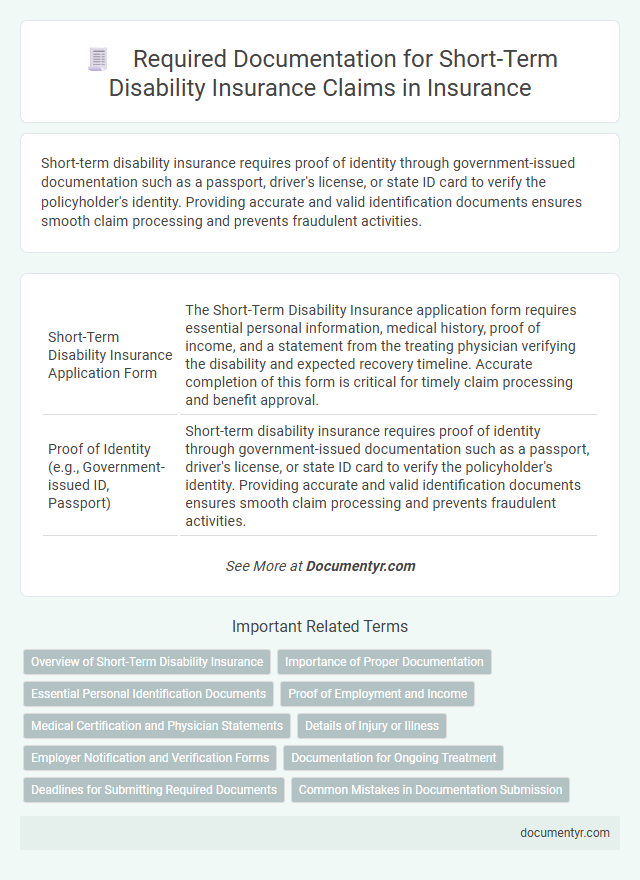

| 1 | Short-Term Disability Insurance Application Form | The Short-Term Disability Insurance application form requires essential personal information, medical history, proof of income, and a statement from the treating physician verifying the disability and expected recovery timeline. Accurate completion of this form is critical for timely claim processing and benefit approval. |

| 2 | Proof of Identity (e.g., Government-issued ID, Passport) | Short-term disability insurance requires proof of identity through government-issued documentation such as a passport, driver's license, or state ID card to verify the policyholder's identity. Providing accurate and valid identification documents ensures smooth claim processing and prevents fraudulent activities. |

| 3 | Social Security Number | A Social Security Number is a crucial document required for short-term disability insurance, as it verifies identity and facilitates benefit processing. Insurers use the Social Security Number to cross-check employment history and eligibility, ensuring accurate and timely claim approval. |

| 4 | Employer Verification Letter | An Employer Verification Letter is essential for short-term disability insurance claims, confirming the employee's job status, salary, and employment dates to validate eligibility. This document helps insurers verify claim details quickly and ensures accurate benefit processing. |

| 5 | Recent Pay Stubs | Recent pay stubs are essential documents for short-term disability insurance claims, providing proof of income and employment status. Insurers use these pay stubs to verify the claimant's earnings and calculate benefit amounts accurately. |

| 6 | Employment Contract | The employment contract is a crucial document for short-term disability insurance claims, detailing job responsibilities, salary, and employment status necessary for benefit verification. Insurers often require the contract to confirm eligibility and calculate appropriate disability payments based on the employee's agreed terms. |

| 7 | Job Description | A detailed job description is crucial for short-term disability insurance claims as it outlines specific duties and physical requirements, enabling accurate assessment of disability eligibility. Insurers rely on this document to verify the claimant's inability to perform essential job functions due to injury or illness. |

| 8 | Physician's Statement or Attending Physician’s Statement (APS) | The Attending Physician's Statement (APS) is a critical document for short-term disability insurance, providing detailed medical information from the claimant's healthcare provider to verify the disability claim. Insurers require the APS to include diagnosis, treatment history, prognosis, and the physician's assessment of the claimant's ability to work, ensuring accurate claim evaluation. |

| 9 | Medical Records and Reports | Medical records and reports are essential documents for short-term disability insurance, providing detailed evidence of the disabling condition from healthcare professionals. These records typically include physician statements, treatment notes, diagnostic test results, and hospital admission summaries, which help insurers evaluate the validity and duration of the disability claim efficiently. |

| 10 | Hospital Admission and Discharge Papers | Hospital admission and discharge papers are essential documents for short-term disability insurance claims, providing verified proof of hospitalization and treatment duration. These papers detail the medical condition, dates of stay, and treatments received, enabling accurate assessment and prompt processing of disability benefits. |

| 11 | Diagnosis Report | A detailed diagnosis report from a certified healthcare provider is essential for short-term disability insurance claims, as it verifies the medical condition and outlines the severity and expected duration of disability. This document must include the diagnosis code, treatment plan, and the healthcare provider's signature to ensure claim approval and timely benefits. |

| 12 | Prescription Records | Prescription records are essential for short-term disability insurance claims as they provide documented evidence of ongoing medical treatment and medication prescribed by healthcare professionals. These records help validate the severity and duration of the disabling condition, ensuring accurate assessment and timely approval of benefits. |

| 13 | Statement of Disability | The Statement of Disability is a critical document required for short-term disability insurance claims, providing detailed information from a healthcare professional confirming the nature and duration of the disability. This statement helps insurers assess the eligibility and extent of benefits by verifying that the claimant meets the policy's medical criteria for temporary disability coverage. |

| 14 | Workers' Compensation Documentation (if applicable) | Workers' compensation documentation, including injury reports and claim forms, is essential for short-term disability insurance claims when the injury is work-related. Providing detailed medical records and employer statements related to the workers' compensation claim ensures faster processing and verification of benefits. |

| 15 | Prior Insurance Policies (if applicable) | Short-term disability insurance applications often require prior insurance policies to verify previous coverage and claim history, ensuring accurate assessment of eligibility and benefit coordination. Essential documents include previous disability insurance contracts, claim statements, and any related medical reports to facilitate seamless policy integration. |

| 16 | Completed Authorization to Release Medical Information | A completed Authorization to Release Medical Information form is essential for processing short-term disability insurance claims, allowing insurers to verify medical records directly from healthcare providers. This document ensures timely evaluation and approval of benefits by granting permission to access detailed health information relevant to the claimant's disability. |

| 17 | FMLA Documentation (if applicable) | Short-term disability insurance claims often require comprehensive FMLA documentation, including a completed medical certification form from a healthcare provider verifying the employee's serious health condition and expected duration of leave. This documentation ensures compliance with both FMLA regulations and insurer requirements for accurate benefit determination. |

| 18 | Tax Forms (e.g., W-2 Form, 1099 Form) | Short-term disability insurance requires submitting tax forms such as the W-2 Form or 1099 Form to verify income and employment status. These documents help insurers accurately calculate benefit amounts based on reported earnings. |

| 19 | Proof of Income (e.g., Bank Statements) | Proof of income for short-term disability insurance commonly requires recent bank statements to verify regular earnings and financial stability. These documents help insurers assess eligibility and calculate benefit amounts accurately. |

| 20 | Direct Deposit Authorization Form | Short-term disability insurance requires a Direct Deposit Authorization Form to ensure timely and secure payment of benefits directly into the insured's bank account. This form typically includes bank account details, routing number, and the policyholder's signature to authorize electronic fund transfers. |

Overview of Short-Term Disability Insurance

Short-term disability insurance provides financial support by replacing a portion of Your income during temporary illnesses or injuries. To apply, essential documents include medical records, a completed claim form, and proof of income. Gathering these papers promptly ensures a smooth and quicker claims process.

Importance of Proper Documentation

Proper documentation is crucial for successfully obtaining short-term disability insurance benefits. It ensures that your claim is processed quickly and accurately.

- Medical Records - Detailed medical records from your healthcare provider verify your condition and support your claim.

- Physician's Statement - A formal statement from your doctor confirms your inability to work due to illness or injury.

- Claim Form - A completed and signed claim form provides essential personal and employment information for processing.

Essential Personal Identification Documents

For short-term disability insurance, essential personal identification documents verify your identity and eligibility. Commonly required forms include a government-issued photo ID, such as a driver's license or passport.

Proof of Social Security number, like a Social Security card or tax document, is also necessary to confirm your identity. These documents ensure accurate processing of your claim and maintain security throughout the application process.

Proof of Employment and Income

Proof of employment is a critical document required for short-term disability insurance claims. Employers often provide official letters or pay stubs that verify current employment status.

Income verification typically involves submitting recent pay stubs, tax returns, or W-2 forms. These documents help insurers determine the benefit amount based on the claimant's earnings.

Medical Certification and Physician Statements

What documents are needed for short-term disability insurance claims? Medical certification is essential to verify the condition causing the disability. Physician statements provide detailed information on the diagnosis, treatment plan, and expected recovery timeline.

Details of Injury or Illness

Providing detailed information about your injury or illness is essential when applying for short-term disability insurance. This ensures accurate assessment of your claim and timely benefit approval.

- Medical Records - Comprehensive medical documents detailing diagnosis, treatments, and prognosis from your healthcare provider.

- Doctor's Statement - An official note from your physician describing the nature and severity of your condition and its impact on your ability to work.

- Incident Report - If applicable, formal documentation explaining how and when the injury or illness occurred, supporting the claim's validity.

Submitting precise injury or illness details helps streamline the short-term disability insurance approval process.

Employer Notification and Verification Forms

Short-term disability insurance requires specific documentation for claim processing. Employer notification and verification forms are critical components of this paperwork.

Employer notification forms officially inform the employer of the disability claim and start the verification process. Verification forms confirm employment status, salary details, and job responsibilities to the insurer. You must ensure these documents are accurately completed and submitted promptly to avoid delays in claim approval.

Documentation for Ongoing Treatment

| Document Type | Description | Purpose |

|---|---|---|

| Medical Progress Reports | Regularly updated reports from healthcare providers detailing the patient's condition and response to treatment. | Verify ongoing medical necessity and track recovery progress. |

| Physician's Treatment Plan | Detailed plan outlining prescribed therapies, medications, and scheduled follow-ups. | Confirm active treatment requirements for disability claims. |

| Therapist or Specialist Notes | Documentation from therapists or specialists involved in patient care including therapy sessions or specialist evaluations. | Provide evidence of continuous rehabilitation or specialty care. |

| Prescription Records | Copies of prescriptions related to the treatment of the disabling condition. | Demonstrate consistent medication management as part of treatment. |

| Appointment Schedules | Confirmations or reminders for upcoming medical appointments and treatment sessions. | Show ongoing engagement with healthcare providers. |

Deadlines for Submitting Required Documents

Submitting the correct documents on time is crucial for approval of short-term disability insurance claims. Meeting deadlines ensures your benefits start without unnecessary delays.

- Claim Form Submission Deadline - Most insurers require the initial claim form within 30 days of your disability onset to process benefits promptly.

- Medical Documentation Deadline - Detailed medical records from your healthcare provider are typically due within 15 to 45 days, depending on the insurer's policy.

- Additional Information Request Deadline - Any follow-up documents requested by the insurance company must be submitted within the specified timeframe, often 10 to 20 days, to avoid claim denial.

What Documents are Needed for Short-Term Disability Insurance? Infographic