Students need to provide a valid government-issued ID, proof of full-time enrollment, and a completed insurance application form to qualify for school insurance coverage. Some schools may also require proof of previous health insurance or a waiver form if the student plans to opt out. Having these documents ready ensures a smooth enrollment process in the school's health insurance plan.

What Documents Does a Student Need for School Insurance Coverage?

| Number | Name | Description |

|---|---|---|

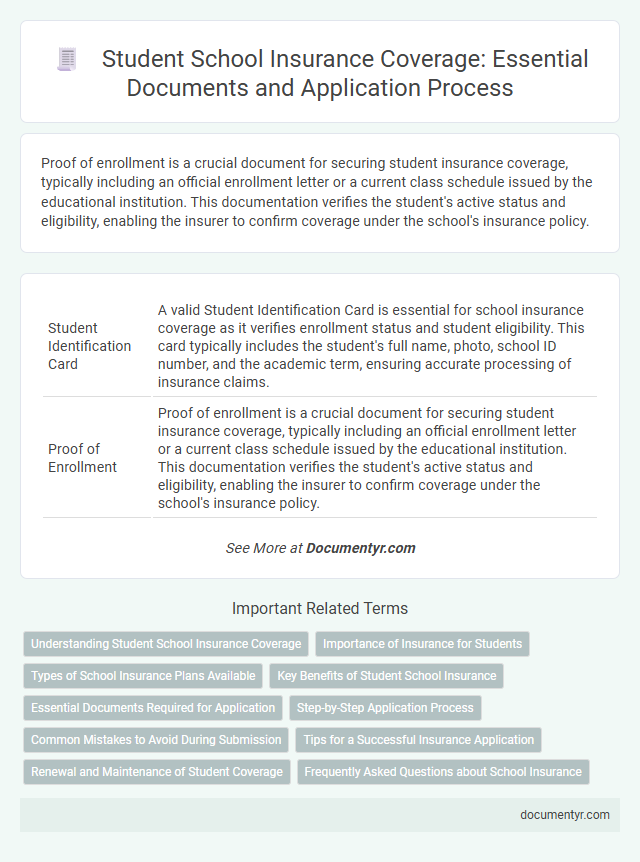

| 1 | Student Identification Card | A valid Student Identification Card is essential for school insurance coverage as it verifies enrollment status and student eligibility. This card typically includes the student's full name, photo, school ID number, and the academic term, ensuring accurate processing of insurance claims. |

| 2 | Proof of Enrollment | Proof of enrollment is a crucial document for securing student insurance coverage, typically including an official enrollment letter or a current class schedule issued by the educational institution. This documentation verifies the student's active status and eligibility, enabling the insurer to confirm coverage under the school's insurance policy. |

| 3 | Birth Certificate | A birth certificate is a primary document required for school insurance coverage, as it verifies the student's identity and age. Schools and insurance providers use this official record to confirm eligibility and accurately process enrollment in the insurance plan. |

| 4 | Parent/Guardian Identification | A student needs a valid parent or guardian identification document, such as a government-issued ID or passport, to establish eligibility for school insurance coverage. This identification verifies the responsible party for policy enrollment and claims processing under the student's insurance plan. |

| 5 | Completed Insurance Application Form | A completed insurance application form serves as the primary document verifying a student's eligibility for school insurance coverage, including essential personal information and selected insurance options. Schools often require this form to process enrollment and ensure that students are officially registered for health and accident insurance benefits under the institution's plan. |

| 6 | Previous Medical Records | Previous medical records are essential for student school insurance coverage as they provide a detailed history of pre-existing conditions and past treatments, enabling accurate risk assessment and personalized coverage plans. Schools and insurance providers often require vaccination records, allergy information, and any chronic illness documentation to ensure comprehensive protection and timely medical support. |

| 7 | Immunization Records | Immunization records are essential for school insurance coverage as they verify that the student has received required vaccinations, ensuring compliance with health regulations and minimizing risks. Schools typically require up-to-date immunization documentation to process insurance claims and provide comprehensive health benefits. |

| 8 | Proof of Residency | A student needs to provide proof of residency, such as a utility bill, lease agreement, or a government-issued document, to verify their address for school insurance coverage eligibility. This documentation ensures accurate policy application and confirms that the student resides within the required geographic area for coverage. |

| 9 | Emergency Contact Information | Students must provide accurate emergency contact information including full names, phone numbers, and relationship to the student for school insurance coverage. This data ensures prompt communication and swift medical intervention during emergencies under the insurance policy. |

| 10 | Consent or Authorization Form | A student needs to submit a signed Consent or Authorization Form to enable school insurance coverage, granting permission for medical treatment and the release of health information when necessary. This form is essential for processing claims and ensuring compliance with privacy regulations under student health insurance policies. |

| 11 | Policyholder Information | Students applying for school insurance coverage must provide comprehensive policyholder information, including a valid government-issued ID, proof of enrollment, and the policyholder's identification details such as name, address, and contact information. Accurate submission of these documents ensures verification of eligibility and smooth processing of the insurance claim. |

| 12 | Previous Insurance Documents (if applicable) | Students applying for school insurance coverage must provide previous insurance documents, such as prior health or student insurance policies, to verify existing coverage and ensure proper coordination of benefits. These documents may include policy numbers, coverage periods, and claims history to facilitate accurate eligibility assessment and prevent duplicate coverage. |

| 13 | Tuition Payment Receipt | A tuition payment receipt serves as essential documentation verifying a student's enrollment status, which insurance providers require to activate school insurance coverage. This receipt confirms the payment of tuition fees, ensuring eligibility for policy benefits tied to academic enrollment periods. |

| 14 | Passport (for international students) | International students must provide a valid passport as proof of identity and residency status when applying for school insurance coverage, ensuring compliance with enrollment requirements. This essential document verifies eligibility and facilitates the issuance of appropriate insurance plans tailored to their international status. |

| 15 | Visa (for international students) | International students must provide a valid student visa along with their enrollment confirmation and passport to qualify for school insurance coverage. The visa serves as proof of legal status and eligibility, ensuring compliance with both school and insurance provider requirements. |

| 16 | Transcript or Academic Record (if requested) | A transcript or academic record may be required by insurance providers to verify a student's enrollment status and eligibility for school insurance coverage. This document typically includes details such as course load, enrollment dates, and institution information to support the insurance application process. |

Understanding Student School Insurance Coverage

Understanding what documents are required for student school insurance coverage is essential for a smooth application process. Proper documentation ensures students receive the necessary benefits and protection while enrolled.

- Proof of Enrollment - Verification of student status from the educational institution is required to activate coverage.

- Identification Documents - A government-issued ID or student ID card is necessary to confirm the individual's identity.

- Insurance Application Form - A completed and signed form submitted to the school's insurance provider initiates the coverage process.

Importance of Insurance for Students

School insurance coverage is essential for protecting students from unexpected medical expenses during their academic journey. Proper documentation ensures smooth enrollment and claim processing.

To obtain school insurance, students typically need proof of enrollment, a completed application form, and valid identification such as a student ID or government-issued ID. Medical history or immunization records may also be required to confirm eligibility for specific coverage. Having these documents ready helps secure immediate access to vital health benefits and peace of mind.

Types of School Insurance Plans Available

School insurance coverage typically requires students to submit specific documents to ensure eligibility and proper enrollment. Common documents include proof of enrollment, identification, and sometimes medical history or previous insurance details.

Types of school insurance plans available include general health insurance, accident insurance, and dental insurance tailored for students. Each plan offers different levels of coverage, catering to various health needs and financial situations.

Key Benefits of Student School Insurance

To obtain school insurance coverage, a student typically needs to provide proof of enrollment, a completed insurance application form, and a valid identification document such as a student ID or passport. Key benefits of student school insurance include coverage for medical emergencies, accident protection, and access to preventive health services. Your school insurance plan ensures financial support for healthcare expenses, promoting a safe and healthy learning environment.

Essential Documents Required for Application

Applying for school insurance coverage requires submitting specific documents to verify eligibility and personal information. Gathering these essential documents ensures a smooth application process and timely coverage activation.

- Proof of Enrollment - A current official enrollment letter or student ID card from the educational institution confirms your status as an active student.

- Identification Document - A government-issued ID such as a passport or driver's license verifies your identity and date of birth.

- Completed Application Form - The insurance provider's standardized form with accurate personal and contact details is mandatory for processing coverage.

Step-by-Step Application Process

To apply for school insurance coverage, start by gathering essential documents such as your student ID, proof of enrollment, and a valid form of identification like a passport or driver's license. Next, obtain any required medical forms or immunization records specified by the insurance provider or school. Submit these documents through the school's insurance office or online portal to complete the application process efficiently.

Common Mistakes to Avoid During Submission

| Required Documents for School Insurance Coverage | Details |

|---|---|

| Proof of Enrollment | Official enrollment verification letter or student ID confirming active registration |

| Completed Insurance Application Form | Accurately filled and signed application specific to the insurance provider |

| Identification Documents | Valid government-issued ID such as passport, driver's license, or national ID card |

| Parental Consent (If Applicable) | Consent form signed by parent or guardian for students under legal adult age |

| Proof of Previous Insurance (If Required) | Documentation showing existing insurance coverage or prior claims history |

| Common Mistakes to Avoid During Document Submission | How to Prevent |

|---|---|

| Submitting Incomplete or Incorrect Forms | Double-check all fields, signatures, and dates are accurate before submission |

| Missing or Expired Identification | Ensure all ID documents are current and clearly legible |

| Failure to Provide Proof of Enrollment | Obtain official and recent school enrollment verification from the registrar's office |

| Ignoring Additional Document Requirements | Review insurance provider instructions carefully to include all necessary paperwork |

| Submitting Blurry or Poor-Quality Copies | Scan or photocopy documents using high resolution to avoid rejection |

| Delaying Submission Past Deadlines | Submit all documents promptly to avoid coverage delays or denial |

Tips for a Successful Insurance Application

What essential documents are required for student school insurance coverage? A valid student ID and proof of enrollment form the core requirements. These items verify student status and facilitate your insurance application process.

How can students ensure their insurance application is successful? Submit all documents accurately and double-check for any missing information. Timely submission increases the likelihood of prompt insurance activation.

Why is proof of residency necessary for school insurance coverage? Insurance providers use residency details to confirm eligibility and appropriate plan options. Providing a recent utility bill or lease agreement satisfies this requirement effectively.

What role does a completed insurance application form play in securing coverage? This form collects essential personal and contact information. Accurate completion prevents processing delays and supports smooth policy issuance.

How important is a parental consent form for students under 18? Many schools and insurers require this document to authorize coverage and claims processing. Ensuring this form is signed and included avoids application rejection.

Renewal and Maintenance of Student Coverage

Maintaining student insurance coverage requires timely submission of updated documents each academic year. Renewal depends on verifying current enrollment and personal information.

- Proof of Enrollment - A recent official enrollment letter or student ID verifies your active student status for the renewal period.

- Previous Insurance Card - The current insurance card is often needed to update your coverage details for continuous protection.

- Identification Document - A valid government-issued ID ensures accurate identification during the insurance renewal process.

Keeping these documents current guarantees uninterrupted student insurance coverage throughout your academic journey.

What Documents Does a Student Need for School Insurance Coverage? Infographic