To secure rideshare insurance coverage, drivers must provide a valid driver's license, proof of vehicle registration, and personal auto insurance policy details. A copy of the rideshare company's insurance certificate or policy endorsement is often required to verify supplemental coverage. Maintaining up-to-date documentation ensures seamless claims processing and legal compliance during rideshare activities.

What Documents Does a Driver Need for Rideshare Insurance Coverage?

| Number | Name | Description |

|---|---|---|

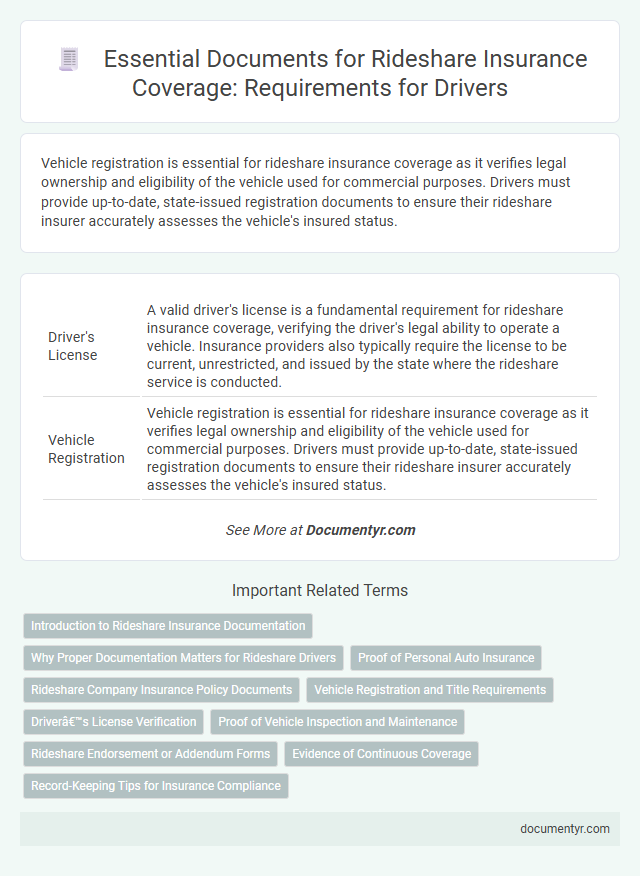

| 1 | Driver's License | A valid driver's license is a fundamental requirement for rideshare insurance coverage, verifying the driver's legal ability to operate a vehicle. Insurance providers also typically require the license to be current, unrestricted, and issued by the state where the rideshare service is conducted. |

| 2 | Vehicle Registration | Vehicle registration is essential for rideshare insurance coverage as it verifies legal ownership and eligibility of the vehicle used for commercial purposes. Drivers must provide up-to-date, state-issued registration documents to ensure their rideshare insurer accurately assesses the vehicle's insured status. |

| 3 | Proof of Personal Auto Insurance | Drivers seeking rideshare insurance coverage must provide proof of personal auto insurance, including a valid insurance card or policy declaration page that shows primary liability coverage. This documentation verifies that the driver's personal policy meets the minimum state requirements before the rideshare company's supplemental coverage activates. |

| 4 | Rideshare Company Insurance Certificate | A driver needs a Rideshare Company Insurance Certificate to verify active liability coverage that bridges gaps between personal auto insurance and rideshare activities. This document lists policy numbers, coverage limits, and effective dates critical for fulfilling legal and company requirements during rideshare trips. |

| 5 | Vehicle Inspection Report | A Vehicle Inspection Report is a crucial document for rideshare insurance coverage, providing detailed verification of a vehicle's safety and roadworthiness. This report typically includes checks on brakes, tires, lights, and other essential components to ensure compliance with insurance requirements and protect both drivers and passengers. |

| 6 | Rideshare Platform Approval (app screenshot/email) | Drivers must provide proof of rideshare platform approval, such as an app screenshot or official confirmation email, to validate their eligibility for rideshare insurance coverage. This documentation confirms active status with the rideshare company, ensuring compliance with insurer requirements and proper policy activation. |

| 7 | Background Check Clearance | Rideshare insurance coverage requires drivers to provide proof of background check clearance, which verifies their criminal record and driving history to ensure safety and compliance with company policies. This document is essential for confirming eligibility and maintaining trust between drivers, passengers, and insurance providers. |

| 8 | Proof of Driving History (Motor Vehicle Report) | A Motor Vehicle Report (MVR) serves as essential proof of driving history required for rideshare insurance coverage, detailing prior accidents, traffic violations, and license status. Insurers utilize the MVR to assess risk accurately and determine appropriate policy terms and premiums for rideshare drivers. |

| 9 | Proof of Address | Proof of address for rideshare insurance coverage typically includes utility bills, bank statements, or government-issued documents showing the driver's current residential address. Insurers require this verification to confirm the policyholder's residency and accurately assess risk factors associated with the coverage. |

| 10 | Rideshare Period Declaration (Period 1, 2, 3 coverage documentation) | Drivers must provide their rideshare insurance policy with a Rideshare Period Declaration that details coverage for Period 1 (personal use), Period 2 (app on but not en route), and Period 3 (en route to pick up passengers), ensuring each phase has appropriate documentation to validate coverage. Accurate submission of these documents, including a valid driver's license, vehicle registration, and proof of personal and commercial insurance, is essential for seamless claims processing and compliance with insurer requirements. |

Introduction to Rideshare Insurance Documentation

What documents does a driver need for rideshare insurance coverage? Understanding the necessary paperwork is essential for maintaining proper protection while driving for rideshare services. Your rideshare insurance policy requires specific documentation to validate coverage and ensure compliance with legal and company requirements.

Why Proper Documentation Matters for Rideshare Drivers

Rideshare drivers require specific documents to secure proper insurance coverage, including a valid driver's license, vehicle registration, and proof of personal auto insurance. Insurers often request a rideshare endorsement or a commercial insurance policy tailored to rideshare activities.

Proper documentation matters because it ensures drivers are financially protected in case of accidents or liability claims during rideshare operations. Missing or incorrect paperwork can lead to denied claims and leave drivers vulnerable to significant out-of-pocket expenses.

Proof of Personal Auto Insurance

Proof of personal auto insurance is essential for rideshare insurance coverage. This document verifies that your vehicle is insured under your personal policy before you begin driving for a rideshare service.

Your personal auto insurance card or policy declaration page serves as proof of coverage. It must include details such as policy number, effective dates, and coverage limits. Keeping this document accessible helps prevent coverage gaps during rideshare driving periods.

Rideshare Company Insurance Policy Documents

Rideshare insurance coverage requires specific documents from your rideshare company's insurance policy to ensure proper protection while driving. Understanding these documents helps verify coverage limits and claim processes.

- Rideshare Company Insurance Declaration Page - This document outlines the coverage types, limits, and effective dates provided by the rideshare company's insurer.

- Policy Exclusions Document - Details scenarios and situations where the rideshare insurance policy does not provide coverage.

- Proof of Insurance Card - Serves as physical evidence of active rideshare insurance coverage while driving for the company.

Vehicle Registration and Title Requirements

Vehicle registration is a critical document for rideshare insurance coverage as it proves ownership and legal authorization to operate the vehicle. The registration must be current and match the information on the insurance policy to avoid coverage issues.

The vehicle title may be required to confirm ownership status, especially if the vehicle is leased or financed. Keeping the title up-to-date ensures compliance with rideshare insurance requirements and smooth claims processing.

Driver’s License Verification

Driver's license verification is a critical requirement for rideshare insurance coverage. Insurers require a valid and current driver's license to confirm legal driving eligibility and identity. Ensuring your license information is accurate helps streamline the approval process for coverage.

Proof of Vehicle Inspection and Maintenance

Proof of vehicle inspection and maintenance is essential for rideshare insurance coverage to ensure your car meets safety standards. These documents verify that your vehicle is safe and reliable for passengers.

- Vehicle Inspection Report - A detailed report from a certified mechanic confirming your car passed all required safety checks.

- Maintenance Records - Documents showing regular upkeep such as oil changes, brake inspections, and tire rotations.

- Repair Receipts - Proof of any necessary repairs completed to keep the vehicle roadworthy and compliant with insurance requirements.

Submitting these documents promptly can help secure and maintain your rideshare insurance coverage without interruptions.

Rideshare Endorsement or Addendum Forms

Rideshare insurance coverage requires specific documentation to ensure proper protection while driving for platforms like Uber or Lyft. One crucial document is the Rideshare Endorsement or Addendum form, which modifies a personal auto policy to cover rideshare activities.

- Rideshare Endorsement Form - This form officially extends personal auto insurance to include rideshare driving periods, filling coverage gaps between personal and commercial insurance.

- Proof of Personal Auto Insurance - Drivers must submit their current personal auto insurance policy to verify baseline coverage before endorsement application.

- Rideshare Addendum Details - The addendum outlines specific terms, coverage limits, and exclusions related to rideshare driving, ensuring drivers understand their protection scope.

Evidence of Continuous Coverage

Evidence of continuous coverage is essential for securing rideshare insurance coverage. Drivers must provide proof that their personal auto insurance has remained active without lapses. Documents such as insurance declarations pages or renewal notices serve as valid evidence of continuous coverage.

What Documents Does a Driver Need for Rideshare Insurance Coverage? Infographic