Businesses seeking commercial property insurance must provide key documents such as a detailed property inventory, current property valuations, and proof of ownership. Insurance applications typically require financial statements, lease agreements, and building blueprints or floor plans to accurately assess risk. Having these documents ready ensures a smoother underwriting process and appropriate coverage.

What Documents Does a Business Need for Commercial Property Insurance?

| Number | Name | Description |

|---|---|---|

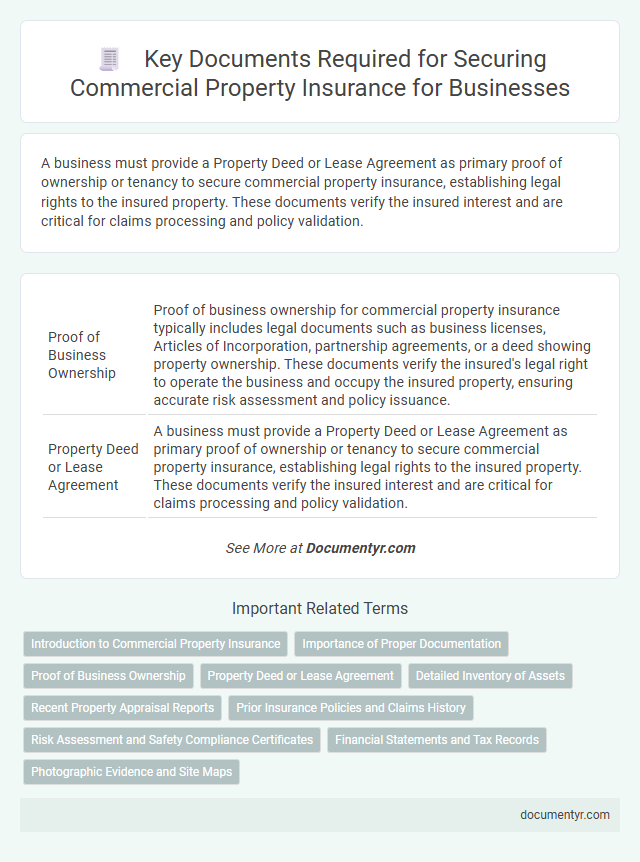

| 1 | Proof of Business Ownership | Proof of business ownership for commercial property insurance typically includes legal documents such as business licenses, Articles of Incorporation, partnership agreements, or a deed showing property ownership. These documents verify the insured's legal right to operate the business and occupy the insured property, ensuring accurate risk assessment and policy issuance. |

| 2 | Property Deed or Lease Agreement | A business must provide a Property Deed or Lease Agreement as primary proof of ownership or tenancy to secure commercial property insurance, establishing legal rights to the insured property. These documents verify the insured interest and are critical for claims processing and policy validation. |

| 3 | Business License or Registration | A valid business license or registration is essential for securing commercial property insurance, as it verifies the legal operation of the business and compliance with local regulations. Insurers require this documentation to assess risk and ensure the insured property is used for legitimate commercial activities. |

| 4 | Property Valuation Report | A Property Valuation Report is essential for commercial property insurance as it provides an accurate assessment of the building's market value, replacement cost, and depreciation status. Insurers rely on this detailed valuation to determine appropriate coverage limits and calculate premiums tailored to the property's true worth. |

| 5 | Inventory List of Physical Assets | A comprehensive inventory list of physical assets is crucial for securing commercial property insurance as it details all equipment, machinery, furniture, and stock, enabling accurate coverage and claims processing. Including descriptions, purchase dates, values, and serial numbers in the inventory helps insurers assess risk and determine appropriate policy limits. |

| 6 | Equipment and Machinery Lists | A detailed equipment and machinery list is essential for commercial property insurance as it provides accurate valuation and proof of assets covered under the policy. This list should include descriptions, serial numbers, purchase dates, and replacement costs to ensure proper coverage and expedite claims processing. |

| 7 | Financial Statements | Financial statements, including balance sheets, income statements, and cash flow statements, are essential documents for commercial property insurance as they provide insurers with a clear overview of a business's financial health and ability to cover potential losses. Accurate financial data helps determine appropriate coverage limits and premium rates, ensuring that the insurance policy adequately protects the property assets. |

| 8 | Previous Insurance Policies | Previous insurance policies serve as crucial documentation for commercial property insurance by providing a detailed history of coverage, claims, and risk management practices. Insurers use these records to assess the business's risk profile and determine accurate premium rates and policy terms. |

| 9 | Loss History Reports | Loss history reports are crucial documents for commercial property insurance, detailing a business's past claims and incidents to help insurers assess risk accurately. Providing comprehensive loss history reports can lead to more tailored coverage options and potentially lower premiums by demonstrating a history of risk management. |

| 10 | Photographic Evidence of Property and Assets | Photographic evidence of property and assets plays a crucial role in commercial property insurance by providing clear documentation of the condition and value of insured items, which supports accurate claims processing and risk assessment. High-resolution images should capture the entire property, individual assets, and any existing damages or unique features to ensure comprehensive coverage and streamlined claim validation. |

| 11 | Fire Safety Certificate | A Fire Safety Certificate is a critical document required for commercial property insurance as it verifies compliance with local fire safety regulations and demonstrates that fire prevention measures are in place. Insurers often demand this certificate to assess risk accurately and ensure that the property meets mandatory safety standards before issuing coverage. |

| 12 | Security System Documentation | Businesses require comprehensive security system documentation, including installation certificates, maintenance records, and system monitoring agreements, to satisfy commercial property insurance requirements. Detailed proof of security measures such as alarm systems, surveillance cameras, and access controls directly impacts risk assessment and premium calculations. |

| 13 | Building Plans or Blueprints | Building plans or blueprints are essential documents for commercial property insurance as they provide detailed information on the structure's layout, materials, and design specifications, helping insurers accurately assess risks and coverage needs. These documents aid in determining replacement costs and facilitate faster claims processing in the event of damage or loss. |

| 14 | Maintenance Records | Maintenance records are essential documents for commercial property insurance, demonstrating the ongoing care and upkeep of the property to reduce risk and potential claims. Insurers require detailed logs of repairs, inspections, and routine maintenance to assess property condition and validate coverage eligibility. |

| 15 | Appraisal Reports | Appraisal reports are critical documents for commercial property insurance, providing an accurate valuation of the property's current market worth and replacement cost. Insurers rely on these reports to determine appropriate coverage limits and ensure adequate protection against potential losses. |

| 16 | Loan or Mortgage Documents | Loan or mortgage documents are essential for commercial property insurance as they provide proof of ownership and financial obligations tied to the property, helping insurers assess risk accurately. These documents typically include the mortgage agreement, loan statements, and lien information, which are crucial for underwriting and claims processing. |

| 17 | Hazard Assessments | Hazard assessments for commercial property insurance require detailed documentation of potential risks such as fire hazards, structural vulnerabilities, and environmental threats specific to the business location. These assessments often include inspection reports, safety protocols, maintenance records, and any past incident reports to accurately evaluate and mitigate insurance risks. |

| 18 | Business Interruption Worksheets | Business Interruption Worksheets are essential documents for commercial property insurance claims, detailing financial losses and operational disruptions during insured events. These worksheets help quantify lost income and extra expenses, enabling accurate coverage assessment and swift claim processing. |

| 19 | Certificate of Occupancy | A Certificate of Occupancy is essential for commercial property insurance as it verifies that the building complies with local building codes and is approved for business use, reducing insurer risk assessment uncertainties. Insurers often require this document to ensure the property's legal status and safety standards are met before issuing coverage. |

| 20 | Environmental Reports | Environmental reports, including Phase I and Phase II Environmental Site Assessments, are crucial documents for commercial property insurance, as they identify potential contamination risks that could impact policy underwriting and coverage. These reports provide insurers with detailed information on environmental liabilities and ensure that businesses comply with regulatory requirements to prevent costly claims related to pollution or hazardous materials. |

Introduction to Commercial Property Insurance

What documents are essential for securing commercial property insurance? Commercial property insurance protects your business assets against risks like fire, theft, and natural disasters. Having accurate documentation streamlines the insurance application process and ensures adequate coverage.

Importance of Proper Documentation

Proper documentation is crucial for securing comprehensive commercial property insurance coverage. It ensures accurate assessment of risks and facilitates smooth claims processing.

Essential documents include property deeds, inventory lists, building plans, and previous insurance policies. Maintaining updated and detailed records safeguards your business against potential disputes and claim denials.

Proof of Business Ownership

Proof of business ownership is essential when applying for commercial property insurance. You must provide clear documentation to verify your legal control over the insured property.

- Business License - A valid business license confirms that your business is registered and legally authorized to operate.

- Deed or Lease Agreement - Ownership or lease documents prove your rights to occupy or manage the commercial property.

- Tax Identification Number (TIN) - This government-issued number links your business identity to official records, supporting ownership claims.

Property Deed or Lease Agreement

For commercial property insurance, having a valid Property Deed or Lease Agreement is crucial. These documents prove ownership or legal occupancy of the insured property, which insurance companies require to process coverage.

The Property Deed establishes clear ownership rights, ensuring the business is entitled to insure the property. A Lease Agreement confirms the business has authorized use of the property, a key factor in underwriting commercial property insurance policies.

Detailed Inventory of Assets

| Document Type | Description | Purpose in Commercial Property Insurance |

|---|---|---|

| Detailed Inventory of Assets | A comprehensive list of all physical assets owned by the business, including furniture, equipment, machinery, and inventory. | Serves as proof of ownership and value, aiding in accurate premium calculations and claim settlements. |

| Asset Descriptions | Specific details about each asset, such as make, model, serial number, purchase date, and cost. | Provides precise information to assess replacement costs and prevent underinsurance. |

| Photographic Evidence | Photographs of the assets, capturing their current condition and quantity. | Supports verification during claims and helps validate the existence of assets before a loss. |

| Proof of Purchase | Receipts, invoices, or purchase orders related to the acquisition of assets. | Documents original value and ownership, strengthening claim legitimacy and valuation accuracy. |

| Depreciation Schedules | Records reflecting the depreciation of assets over time for accounting and insurance purposes. | Assists in calculating current asset value and determining appropriate insurance coverage. |

Recent Property Appraisal Reports

Recent property appraisal reports are essential documents for obtaining commercial property insurance. They provide an accurate and up-to-date valuation of the insured property, which helps determine appropriate coverage limits.

Insurance providers rely on these reports to assess the current market value and replacement cost of the property. Detailed appraisal reports include information on structural condition, improvements, and unique features that impact risk assessment. Submitting recent appraisals ensures the business receives adequate protection without underinsuring or overpaying.

Prior Insurance Policies and Claims History

Prior insurance policies and claims history are essential documents when applying for commercial property insurance. Insurers use this information to assess risk and determine coverage terms.

- Prior Insurance Policies - These provide evidence of previous coverage and help insurers understand your business's risk management history.

- Claims History - A detailed record of past claims reveals the frequency and severity of incidents affecting your property.

- Loss Runs Report - A comprehensive document from past insurers summarizing all claims made during prior policy periods.

Providing accurate and complete prior insurance and claims documentation helps streamline your commercial property insurance application.

Risk Assessment and Safety Compliance Certificates

Businesses must provide detailed risk assessment reports to obtain commercial property insurance, highlighting potential hazards and preventive measures. Safety compliance certificates, such as fire safety and building code adherence, are essential documents that validate the property's adherence to legal safety standards. Insurers rely on these documents to evaluate risk levels and determine appropriate coverage terms and premiums.

Financial Statements and Tax Records

Businesses must provide specific financial documentation when applying for commercial property insurance to verify their financial stability and accurate asset valuation. Two critical documents in this process are financial statements and tax records, which insurers use to assess risk and determine coverage needs.

- Financial Statements - These include balance sheets, income statements, and cash flow statements that demonstrate the business's financial health and asset values.

- Tax Records - Recent tax returns provide a verified historical record of the company's income and expenses, validating financial statements.

- Audit Reports - Independent audit reports may be requested to confirm the accuracy of financial information and ensure compliance with accounting standards.

What Documents Does a Business Need for Commercial Property Insurance? Infographic