To renew a homeowners insurance policy, essential documents include the current insurance policy, proof of home ownership, and recent property tax statements. Insurers may also require updated home inspection reports or receipts for major repairs and renovations to assess risk accurately. Providing these documents promptly ensures a smooth renewal process and continuous coverage protection.

What Documents Are Necessary for Homeowners Insurance Policy Renewal?

| Number | Name | Description |

|---|---|---|

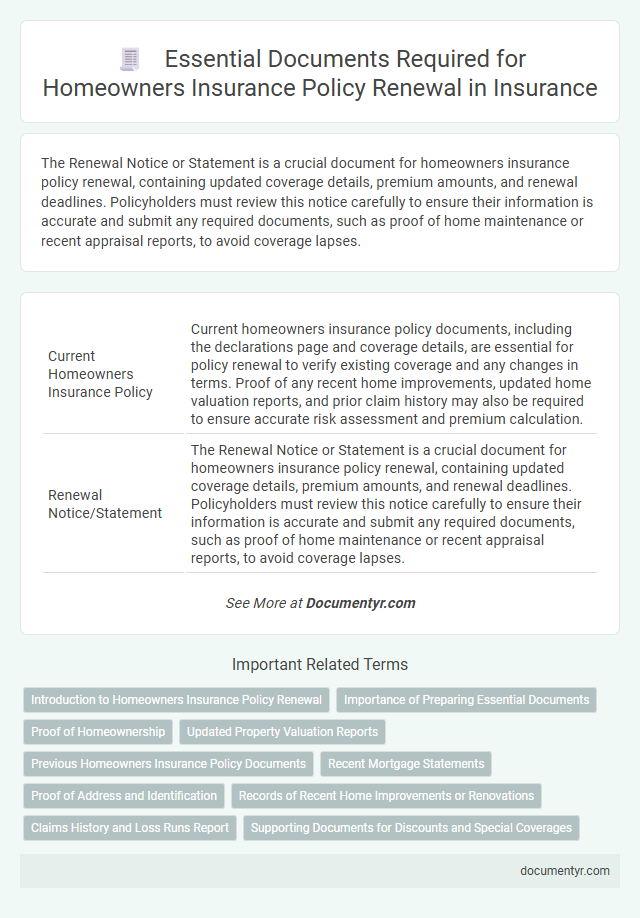

| 1 | Current Homeowners Insurance Policy | Current homeowners insurance policy documents, including the declarations page and coverage details, are essential for policy renewal to verify existing coverage and any changes in terms. Proof of any recent home improvements, updated home valuation reports, and prior claim history may also be required to ensure accurate risk assessment and premium calculation. |

| 2 | Renewal Notice/Statement | The Renewal Notice or Statement is a crucial document for homeowners insurance policy renewal, containing updated coverage details, premium amounts, and renewal deadlines. Policyholders must review this notice carefully to ensure their information is accurate and submit any required documents, such as proof of home maintenance or recent appraisal reports, to avoid coverage lapses. |

| 3 | Proof of Home Improvements or Renovations | Proof of home improvements or renovations for homeowners insurance policy renewal typically includes detailed receipts, contractor invoices, permits, and updated appraisals demonstrating the increased value or enhanced safety features of the property. Providing these documents helps insurers accurately assess the home's current condition and adjust coverage limits or premiums accordingly. |

| 4 | Claims History Report | A detailed Claims History Report is essential for homeowners insurance policy renewal, as it provides insurers with a comprehensive record of past claims, demonstrating the risk profile and precedent of coverage usage. This report typically includes dates, types, and outcomes of previous claims, aiding underwriters in accurately assessing renewal terms and premiums. |

| 5 | Updated Property Valuation/Appraisal | Updated property valuation or appraisal reports are essential for homeowners insurance policy renewal to ensure the coverage reflects current market value and replacement costs. Accurate documentation helps adjust premiums appropriately and prevents underinsurance or overinsurance risks. |

| 6 | Mortgage Statement | A current mortgage statement is essential for homeowners insurance policy renewal as it verifies the property's loan status and outstanding balance. Providing this document ensures accurate coverage calculations and compliance with lender requirements. |

| 7 | Home Inventory List | A detailed home inventory list is essential for homeowners insurance policy renewal, as it provides a comprehensive record of personal property, including descriptions, purchase dates, and values, ensuring accurate coverage and faster claim processing. Insurers rely on this document to assess risk accurately and verify claims, making it crucial to update and submit it regularly during the renewal process. |

| 8 | Updated Personal Information (ID, Address, Contact) | Providing updated personal information such as a valid government-issued ID, current residential address proof, and up-to-date contact details is essential for homeowners insurance policy renewal to ensure accurate risk assessment and communication. Insurers require these documents to verify identity, property location, and maintain effective correspondence throughout the policy term. |

| 9 | Proof of Security System Installation | Proof of security system installation, such as receipts, contracts, or certification from a licensed security company, is often required for homeowners insurance policy renewal to qualify for discounts and verify risk mitigation. Insurance providers may also request recent inspection reports or photographs confirming the active status and proper functioning of the installed security devices. |

| 10 | Receipts for High-Value Items | Receipts for high-value items such as jewelry, electronics, and artwork are essential for homeowners insurance policy renewal to verify ownership and current value. These documents help update coverage limits and ensure adequate protection against loss or damage. |

| 11 | Photographs of Property and Contents | Clear, recent photographs of the property's exterior, interior, and valuable contents are essential for homeowners insurance policy renewal to verify current condition and inventory. These images help insurers assess risk accurately and expedite the claims process in case of damage or loss. |

| 12 | Hazard or Risk Assessment Report | A Hazard or Risk Assessment Report is essential for homeowners insurance policy renewal as it provides a detailed evaluation of potential risks such as fire hazards, flood zones, and structural vulnerabilities. Insurers rely on this report to determine coverage adjustments, premiums, and necessary safety improvements to mitigate future claims. |

| 13 | Completed Renewal Application Form | A completed renewal application form is essential for homeowners insurance policy renewal as it verifies current property details and coverage needs. This document ensures accurate risk assessment and the continuation of appropriate protection based on updated information. |

| 14 | Payment Information/Proof of Payment | For homeowners insurance policy renewal, providing up-to-date payment information or proof of payment such as bank statements, canceled checks, or electronic payment confirmations ensures seamless policy continuation. Insurers require these documents to verify premium payment and maintain accurate billing records for the renewed coverage period. |

| 15 | Documentation of Changes in Occupancy | Documentation of changes in occupancy, such as new tenants or extended absences, must be submitted during homeowners insurance policy renewal to accurately update risk assessments. Providing lease agreements, occupancy affidavits, or proof of residence ensures the insurer can adjust coverage terms and premium rates accordingly. |

| 16 | Local Authority Compliance Certificates (if applicable) | Local Authority Compliance Certificates, such as building permits and safety inspection approvals, are essential documents for homeowners insurance policy renewal to verify that the property meets current regulatory standards. Insurers require these certificates to assess risk accurately and ensure the home adheres to local building codes and safety regulations. |

Introduction to Homeowners Insurance Policy Renewal

Renewing a homeowners insurance policy ensures ongoing protection for your property against unexpected damages and liabilities. It requires submitting specific documents to update your coverage details accurately.

- Current Insurance Policy - Provides a record of your existing coverage and terms for reference during renewal.

- Property Proof Documents - Includes title deeds or mortgage statements verifying ownership of the insured property.

- Updated Home Valuation - Reflects any changes in property value to adjust the insurance coverage appropriately.

Importance of Preparing Essential Documents

Preparing essential documents is crucial for a smooth homeowners insurance policy renewal process. Key documents typically include the current insurance policy, proof of property ownership, and recent home maintenance records. Having these documents ready ensures accurate policy updates and helps avoid delays or coverage lapses.

Proof of Homeownership

Proof of homeownership is a critical document required for renewing a homeowners insurance policy. This document verifies the legal ownership of the property to the insurance company.

- Deed or Title - The official deed or title proves your ownership and is essential for policy validation.

- Mortgage Statement - A current mortgage statement can serve as additional evidence if you have a mortgage on the home.

- Property Tax Records - Recent property tax receipts or records confirm ownership and support the renewal process.

Updated Property Valuation Reports

What documents are necessary for homeowners insurance policy renewal? Updated property valuation reports are essential to ensure your coverage reflects the current market value of your home. Insurers rely on these reports to adjust policy terms and premiums accurately.

Previous Homeowners Insurance Policy Documents

Renewing a homeowners insurance policy requires submitting specific documents to verify coverage history and property details. Previous homeowners insurance policy documents play a crucial role in this process.

- Proof of Prior Coverage - Previous policy documents provide evidence of continuous insurance coverage to the new insurer.

- Claims History - These documents outline any past claims made, affecting renewal terms and rates.

- Policy Details - Information on coverage limits, deductibles, and endorsements helps tailor the renewed policy accurately.

Submitting previous homeowners insurance policy documents ensures a smooth and informed policy renewal process.

Recent Mortgage Statements

Recent mortgage statements are essential documents for homeowners insurance policy renewal. These statements verify your current loan balance and payment status, ensuring accurate coverage terms. Providing up-to-date mortgage information helps streamline the renewal process and maintains policy accuracy.

Proof of Address and Identification

| Document Type | Description | Examples |

|---|---|---|

| Proof of Address | Essential for verifying the insured property location and updating records during homeowners insurance policy renewal. | Utility bills (electricity, water, gas), bank statements, lease agreements, property tax receipts, mortgage statements |

| Identification | Required to confirm the identity of the policyholder for security and compliance purposes in the renewal process. | Government-issued ID (passport, driver's license, national ID card), Social Security card, voter identification |

Records of Recent Home Improvements or Renovations

Records of recent home improvements or renovations play a crucial role in the renewal of a homeowners insurance policy. These documents provide insurers with updated information about the property's current condition and value.

Documentation such as receipts, contractor invoices, and detailed descriptions of the work completed help verify upgrades and enhancements. Accurate records assist insurance companies in assessing risk more precisely and adjusting coverage limits or premiums accordingly. Maintaining organized records ensures a smoother renewal process without delays or disputes over coverage.

Claims History and Loss Runs Report

Homeowners insurance policy renewal requires submitting an updated claims history to verify past incidents. This ensures accurate risk assessment and appropriate premium adjustments.

The loss runs report, detailing all claims within the policy period, is essential for underwriting. Your insurer uses this document to evaluate trends and determine coverage terms.

What Documents Are Necessary for Homeowners Insurance Policy Renewal? Infographic