Businesses seeking liability insurance typically need to provide key documents such as a detailed business description, proof of ownership or legal operation, and financial statements. Insurance providers may also require prior claims history, employee information, and specific contracts related to business activities. Accurate and thorough documentation ensures proper risk assessment and adequate coverage tailored to the business's unique liability exposure.

What Documents Does a Business Need for Liability Insurance?

| Number | Name | Description |

|---|---|---|

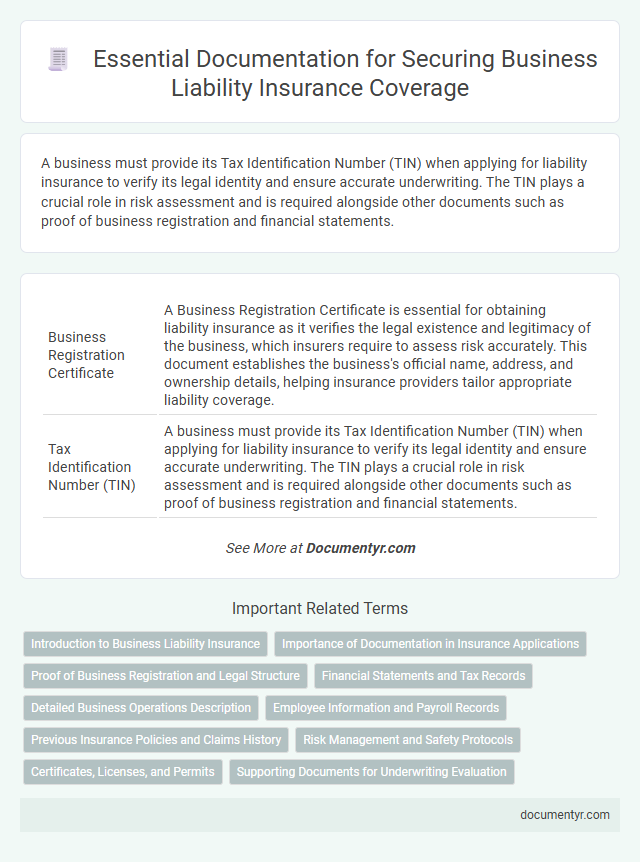

| 1 | Business Registration Certificate | A Business Registration Certificate is essential for obtaining liability insurance as it verifies the legal existence and legitimacy of the business, which insurers require to assess risk accurately. This document establishes the business's official name, address, and ownership details, helping insurance providers tailor appropriate liability coverage. |

| 2 | Tax Identification Number (TIN) | A business must provide its Tax Identification Number (TIN) when applying for liability insurance to verify its legal identity and ensure accurate underwriting. The TIN plays a crucial role in risk assessment and is required alongside other documents such as proof of business registration and financial statements. |

| 3 | Articles of Incorporation or Organization | Businesses seeking liability insurance must provide Articles of Incorporation or Organization to verify their legal formation and structure, which helps insurers assess risk accurately. These documents establish the company's legitimacy and ownership details, ensuring proper coverage terms tailored to the business type. |

| 4 | Proof of Business Address (utility bill, lease agreement) | A business must provide proof of business address when applying for liability insurance, commonly through documents such as a utility bill or lease agreement to verify its physical location. Insurance providers use these documents to assess risk factors associated with the business's operational site, directly influencing policy terms and premiums. |

| 5 | Employer Identification Number (EIN) | A Business must provide its Employer Identification Number (EIN) when applying for liability insurance to verify legal structure and tax identification; this number is essential for underwriting and policy issuance. Insurers use the EIN to assess risk and ensure compliance with state and federal regulations, making it a key document in the liability insurance application process. |

| 6 | Previous Insurance Policies | Previous insurance policies provide crucial evidence of coverage history and claims experience, which insurers use to assess risk and determine liability insurance premiums. Businesses should submit certificates of prior insurance, claims loss runs, and policy declarations to demonstrate consistent protection and minimize underwriting delays. |

| 7 | Claims History Report | A claims history report provides a detailed record of all past liability claims filed against a business, offering insurers critical data to assess risk and determine premium rates. This document, often sourced from prior insurers or specialized databases, is essential for accurately underwriting liability insurance policies. |

| 8 | Business License or Permits | A valid business license or relevant permits are essential documents required for obtaining liability insurance, as they demonstrate legal authorization to operate and compliance with industry regulations. Insurance providers rely on these documents to assess the legitimacy and risk profile of the business before issuing a liability insurance policy. |

| 9 | Financial Statements | Financial statements, including profit and loss statements, balance sheets, and cash flow statements, are essential documents for a business applying for liability insurance as they provide insurers with a clear view of the company's financial health and risk exposure. Accurate and up-to-date financial records help underwriters assess the potential liabilities and determine appropriate coverage limits and premiums. |

| 10 | Employee List and Payroll Records | A comprehensive employee list and accurate payroll records are essential documents for obtaining business liability insurance, as they help insurers assess risk by verifying the number of employees and total wages paid. These records enable precise premium calculations and ensure coverage aligns with the business's operational scope and workforce size. |

| 11 | Description of Business Operations | A detailed description of business operations is essential for liability insurance as it helps insurers assess risk exposure related to the specific activities carried out by the company. This document should include the nature of products or services provided, daily operational processes, and any interactions with clients or third parties. |

| 12 | Contract Agreements with Clients/Vendors | Contract agreements with clients and vendors serve as critical documents for obtaining business liability insurance, outlining the scope of responsibilities and risk allocation to support accurate policy assessment. These agreements help insurers evaluate potential liabilities, ensuring that coverage is tailored to the specific contractual obligations and risk exposures faced by the business. |

| 13 | Risk Management Policies | Businesses require comprehensive Risk Management Policies, including detailed safety protocols, incident reporting procedures, employee training records, and compliance certifications, to secure liability insurance effectively. These documents demonstrate proactive risk mitigation efforts essential for underwriting and claim evaluations in liability coverage. |

| 14 | Certificates of Compliance (if applicable) | Businesses seeking liability insurance must provide Certificates of Compliance to demonstrate adherence to industry regulations and safety standards, which insurers use to assess risk accurately. These certificates validate that the company meets legal and regulatory requirements, playing a crucial role in the underwriting process for liability coverage. |

| 15 | Ownership Structure Documentation | Ownership structure documentation for liability insurance typically includes articles of incorporation, partnership agreements, and operating agreements that clearly outline the entity's legal formation and ownership hierarchy. These documents help insurers assess risk by providing verified information on business control, stakeholder roles, and accountability. |

| 16 | Asset Inventory List | An asset inventory list is essential for obtaining liability insurance as it details all business-owned property, equipment, and valuable items that need coverage. This comprehensive document helps insurers assess risk accurately and determine appropriate policy limits to protect the business effectively. |

| 17 | Safety Records and Procedures | Businesses need to provide comprehensive safety records and documented procedures to secure liability insurance, demonstrating compliance with industry safety standards and risk mitigation efforts. These documents typically include accident reports, safety training logs, hazard assessments, and emergency response plans essential for underwriting liability coverage. |

| 18 | Professional Licenses (if applicable) | Professional licenses are crucial documents for businesses seeking liability insurance, as they verify the legal authority and qualifications required to perform specific services or trades. Insurers often demand proof of valid professional licenses to assess risk accurately and ensure compliance with industry regulations. |

| 19 | Organizational Chart | A detailed organizational chart is essential for liability insurance as it outlines the company's structure, key personnel, and reporting lines, providing insurers with clarity on roles and responsibilities. This transparency helps assess risk exposure accurately and supports the underwriting process in determining appropriate coverage. |

Introduction to Business Liability Insurance

| Introduction to Business Liability Insurance | |

|---|---|

| Definition | Business liability insurance protects a company from financial losses due to claims of injury, property damage, or negligence. |

| Purpose | To safeguard your business assets and provide coverage against lawsuits and legal fees. |

| Essential Documents for Liability Insurance | |

| Business License | Proof of legal operation required to validate eligibility for coverage. |

| Financial Statements | Documents like balance sheets and income statements that demonstrate business stability and risk profile. |

| Previous Insurance Records | History of prior liability coverage and claims to assess risk. |

| Business Operations Description | Detailed explanation of the services or products offered, crucial for accurate risk assessment. |

| Contracts and Agreements | Copies of client contracts and vendor agreements to confirm business relationships and responsibilities. |

| Safety Protocols and Training Records | Evidence of established safety measures and employee training programs reducing liability risks. |

Importance of Documentation in Insurance Applications

Proper documentation is critical for securing liability insurance for a business. Accurate and comprehensive records ensure a smooth application process and appropriate coverage.

- Business Registration Documents - These confirm the legal status and legitimacy of the business applying for insurance.

- Financial Statements - Essential for assessing the business's financial health and risk profile by the insurer.

- Previous Insurance Policies and Claims History - Helps insurers evaluate past risks and determine suitable coverage and premiums.

Proof of Business Registration and Legal Structure

What documents are required to obtain liability insurance for a business? Proof of business registration is essential to verify your company's legitimacy. Documentation of the legal structure, such as articles of incorporation or partnership agreements, helps insurers assess risk accurately.

Financial Statements and Tax Records

Financial statements are essential documents for obtaining liability insurance as they provide a clear overview of your business's financial health. Insurers use these records to assess risk and determine appropriate coverage levels. Tax records complement financial statements by verifying income and ensuring accuracy in reported earnings.

Detailed Business Operations Description

A detailed description of business operations is essential when applying for liability insurance. This document helps insurers assess risk accurately and determine appropriate coverage.

- Nature of Services or Products - Clearly outline the specific services offered or products manufactured by the business.

- Operational Processes - Describe daily business activities, workflows, and any on-site procedures that impact liability risk.

- Work Environment - Include information on the physical work setting, such as office, retail, or manufacturing spaces, to clarify potential hazards.

Providing a thorough business operations description ensures the insurance provider has comprehensive insight into the risks involved.

Employee Information and Payroll Records

Employee information is crucial for obtaining liability insurance as it provides insurers with details about the workforce, including roles and risk exposure. Accurate records help determine coverage needs and calculate premiums effectively.

Payroll records serve as evidence of the number of employees and total wages paid, influencing liability insurance costs. Insurers use this data to assess the potential liability and ensure the business maintains proper coverage levels.

Previous Insurance Policies and Claims History

Previous insurance policies provide crucial insight into your business's coverage history and risk profile. Claims history helps insurers assess potential liabilities and calculate appropriate premiums.

- Previous Insurance Policies - Documentation of past liability insurance shows coverage limits and exclusions, influencing current policy terms.

- Claims History - A detailed record of past claims reveals patterns of risk and potential future liabilities.

- Loss Runs - Official reports from previous insurers summarize all claims filed, offering transparency on past incidents.

Risk Management and Safety Protocols

Businesses seeking liability insurance must provide comprehensive documentation demonstrating their commitment to risk management and safety protocols. Key documents include detailed risk assessments, safety training records, and written company policies outlining procedures to mitigate potential hazards. Insurers rely on these materials to evaluate the level of risk and ensure the business has implemented effective measures to prevent accidents and liabilities.

Certificates, Licenses, and Permits

Businesses applying for liability insurance must provide proof of valid certificates, licenses, and permits relevant to their industry. These documents verify compliance with local, state, and federal regulations, ensuring the business operates legally and reduces insurance risk.

Certificates often include professional certifications or industry-specific qualifications that demonstrate expertise and commitment to standards. Licenses verify that the business is authorized to operate within a specific location or sector. Permits may cover environmental, health, or safety regulations required to conduct business activities legally and safely.

What Documents Does a Business Need for Liability Insurance? Infographic