College students applying for renter's insurance typically need to provide proof of identity, such as a driver's license or passport, and proof of residency, like a college ID or lease agreement. Insurance companies may also require an inventory of personal belongings to determine coverage amounts. Proof of prior insurance or payment information may be necessary for policy setup and verification.

What Documents Does a College Student Need for Renter’s Insurance?

| Number | Name | Description |

|---|---|---|

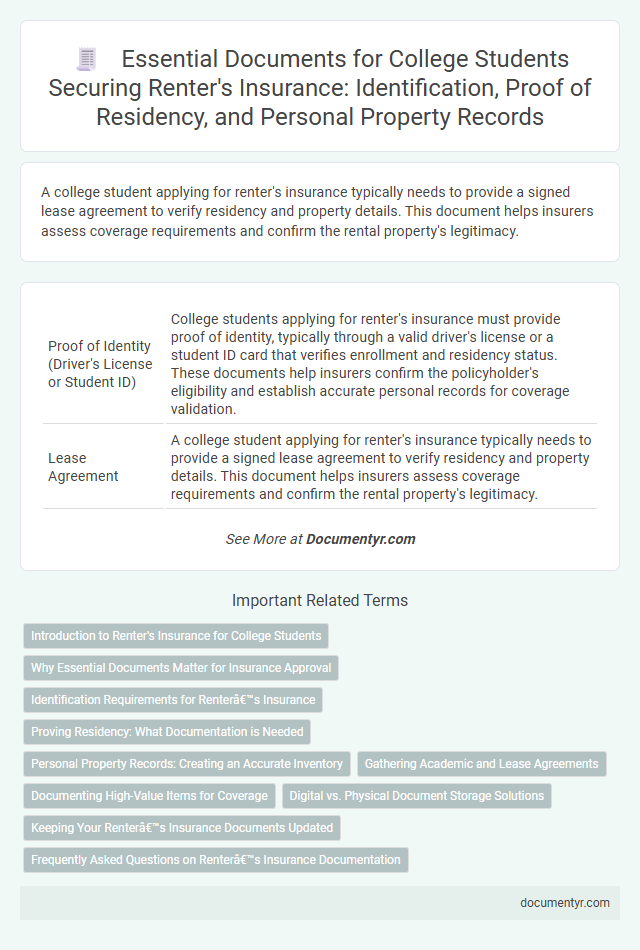

| 1 | Proof of Identity (Driver's License or Student ID) | College students applying for renter's insurance must provide proof of identity, typically through a valid driver's license or a student ID card that verifies enrollment and residency status. These documents help insurers confirm the policyholder's eligibility and establish accurate personal records for coverage validation. |

| 2 | Lease Agreement | A college student applying for renter's insurance typically needs to provide a signed lease agreement to verify residency and property details. This document helps insurers assess coverage requirements and confirm the rental property's legitimacy. |

| 3 | Roommate Agreement (if applicable) | A college student applying for renter's insurance should provide a copy of the roommate agreement if applicable, as it outlines the responsibilities and shared liabilities between tenants. This document helps insurers understand the division of coverage and liability, ensuring appropriate policy terms and protection for each occupant. |

| 4 | Personal Property Inventory List | A personal property inventory list is essential for college students applying for renter's insurance, detailing all valuable items such as electronics, clothing, and furniture along with their purchase dates and estimated values. This comprehensive list helps streamline claim processing and ensures accurate coverage for personal belongings in case of loss or damage. |

| 5 | Receipts or Proof of Ownership for Valuable Items | College students applying for renter's insurance should provide receipts or proof of ownership for valuable items such as electronics, jewelry, and bicycles to verify their worth. These documents help insurers accurately assess coverage limits and expedite claims in case of loss or damage. |

| 6 | Renter’s Insurance Policy Document | A college student needs a renter's insurance policy document that outlines coverage details, limits, and personal property protection essential for dorm or off-campus housing. This document serves as proof of insurance, required when signing leases or filing claims for theft, damage, or liability incidents. |

| 7 | Parental Consent or Guarantor Form (if under 18 or required) | College students under 18 or those required by their insurer must provide a Parental Consent or Guarantor Form to secure renter's insurance, ensuring a responsible adult assumes financial responsibility. This document typically includes the guarantor's contact information, relationship to the student, and authorization to approve claims, streamlining the insurance process and meeting underwriting requirements. |

| 8 | Utility Bills (for address verification) | College students applying for renter's insurance typically need to provide utility bills such as electricity, water, or gas statements to verify their current address. These documents serve as proof of residence, helping insurers confirm the insured property's location for accurate policy coverage. |

| 9 | School Enrollment Verification | College students applying for renter's insurance typically need school enrollment verification, such as an official enrollment letter or a current class schedule, to confirm their student status. This documentation helps insurers assess eligibility and may qualify students for specialized renter's insurance discounts or coverage options. |

| 10 | Previous Insurance Documents (if transferring coverage) | College students transferring renter's insurance coverage should provide previous insurance policy documents, including the declaration page and proof of continuous coverage, to streamline the application process and potentially secure lower premiums. These documents verify prior protection, policy limits, and claims history, ensuring seamless transition and accurate risk assessment by the new insurer. |

| 11 | Emergency Contact Information List | A college student needs to provide an Emergency Contact Information List, including names, phone numbers, and addresses of reliable contacts, to ensure quick communication during emergencies for renter's insurance claims. This list supports the insurer's ability to reach authorized individuals in case of incidents affecting the student's rental property. |

Introduction to Renter's Insurance for College Students

Renter's insurance provides essential protection for college students living off-campus. It covers personal belongings, liability, and additional living expenses in case of unexpected events.

Your college life can be unpredictable, making renter's insurance a valuable safety net. Understanding the required documents helps streamline the application process and ensures you get the coverage you need.

Why Essential Documents Matter for Insurance Approval

What documents does a college student need for renter's insurance? Proof of enrollment and a valid ID are crucial to verify the student's status and identity. Insurance providers require these documents to assess eligibility and ensure accurate policy issuance.

Why do essential documents matter for insurance approval? These documents confirm the applicant's risk profile and living situation, which help insurers determine coverage terms and premiums. Without proper documentation, the approval process can be delayed or denied, impacting the student's protection.

Identification Requirements for Renter’s Insurance

College students applying for renter's insurance must provide valid identification to verify their identity. Commonly accepted documents include a government-issued ID such as a driver's license, state ID card, or passport. Insurers may also require proof of enrollment from the college to confirm student status and eligibility for potential discounts.

Proving Residency: What Documentation is Needed

| Document Type | Description | Purpose for Renter's Insurance |

|---|---|---|

| Lease Agreement | Official rental contract between the student and landlord or property management | Verifies the student's residency at the rental property for insurance eligibility |

| Utility Bill | Monthly statements for services like electricity, water, or internet | Confirms physical address and residency duration to support insurance application |

| School Enrollment or Housing Letter | Official document from the college verifying enrollment and, if applicable, campus housing assignment | Supports residency claim especially for on-campus or affiliated housing |

| Identification with Address | Driver's license or state-issued ID showing current rental address | Serves as proof of identity linked to the rental residence |

| Bank Statement | Recent statements displaying the name and rental address | Additional documentation to verify residency and financial responsibility |

Personal Property Records: Creating an Accurate Inventory

Creating an accurate inventory of personal property is essential for college students applying for renter's insurance. Detailed records help ensure proper coverage and streamline the claims process in case of loss or damage.

- Comprehensive Item List - Document all personal belongings, including electronics, clothing, and valuables, to provide a full overview of insured items.

- Photographic Evidence - Capture clear photos or videos of each item to validate ownership and condition at the time of coverage.

- Receipts and Proofs of Purchase - Keep original receipts or bank statements as proof of value and purchase dates for accurate claim assessments.

An organized and detailed personal property inventory is a critical document for college students securing renter's insurance protection.

Gathering Academic and Lease Agreements

Gathering your academic documents is essential when applying for renter's insurance as a college student. Proof of enrollment or student ID helps verify your student status, which may qualify you for discounted rates.

Lease agreements are critical documents needed to establish residency and protect your rented property under the insurance policy. Ensure your lease includes your name, address, and the landlord's contact information. Submitting both academic and lease documents streamlines the application process and secures appropriate coverage.

Documenting High-Value Items for Coverage

Documenting high-value items is crucial for ensuring adequate renter's insurance coverage. Proper records protect against loss or theft by verifying the item's existence and value.

- Keep detailed receipts - Store original or digital receipts that prove the purchase price of valuable belongings.

- Photograph your items - Capture clear images showing the item's condition and identifying features as visual proof.

- Create an inventory list - Compile a list including item descriptions, purchase dates, and estimated values to streamline claims processing.

Digital vs. Physical Document Storage Solutions

College students applying for renter's insurance need to provide identification, proof of residence, and an inventory of personal belongings. Digital document storage solutions, such as cloud-based apps, offer easy access and secure backup for these documents. Physical copies remain important for in-person verification, but digital methods streamline the process and help you stay organized.

Keeping Your Renter’s Insurance Documents Updated

College students applying for renter's insurance must keep their documents current to ensure full coverage. Staying updated prevents claim delays and coverage gaps during the rental period.

- Proof of Residency - A current lease agreement verifies your living location and is essential for policy accuracy.

- Identification - Valid government-issued ID confirms your identity and supports the application process.

- Inventory of Belongings - An updated list with receipts or photos documents personal property, aiding in accurate claim evaluations.

What Documents Does a College Student Need for Renter’s Insurance? Infographic