To enroll in the Health Insurance Marketplace, you need essential documents such as proof of identity, income verification, and current health insurance information. Supporting documents may include a Social Security number, recent pay stubs or tax returns, and immigration status verification if applicable. Having these documents ready ensures a smooth and accurate enrollment process.

What Documents are Necessary for Health Insurance Marketplace Enrollment?

| Number | Name | Description |

|---|---|---|

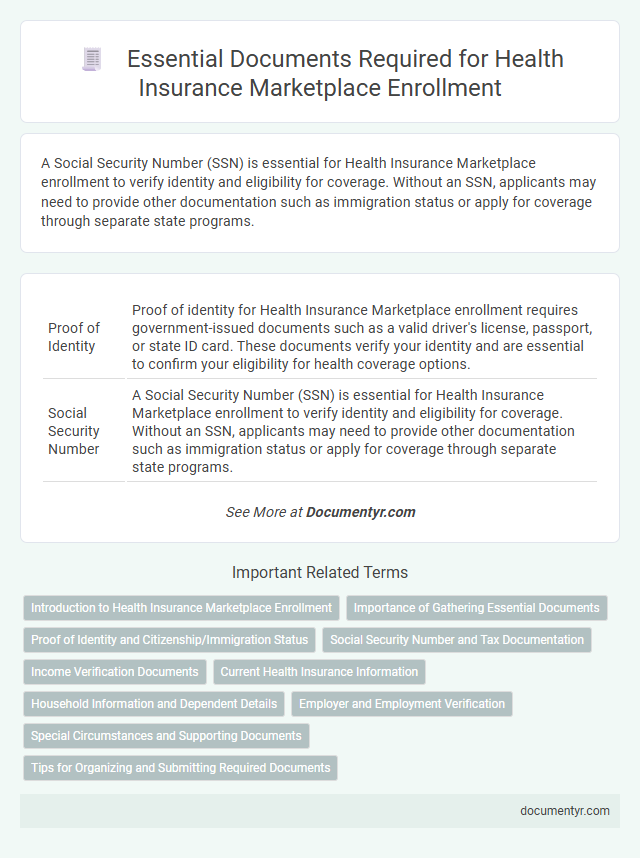

| 1 | Proof of Identity | Proof of identity for Health Insurance Marketplace enrollment requires government-issued documents such as a valid driver's license, passport, or state ID card. These documents verify your identity and are essential to confirm your eligibility for health coverage options. |

| 2 | Social Security Number | A Social Security Number (SSN) is essential for Health Insurance Marketplace enrollment to verify identity and eligibility for coverage. Without an SSN, applicants may need to provide other documentation such as immigration status or apply for coverage through separate state programs. |

| 3 | Proof of Citizenship or Lawful Presence | Proof of citizenship or lawful presence for Health Insurance Marketplace enrollment requires documents such as a U.S. passport, birth certificate, naturalization certificate, or permanent resident card. These documents verify identity and eligibility, ensuring compliance with federal regulations for health coverage access. |

| 4 | Income Verification (pay stubs, W-2 forms, tax returns) | Income verification for Health Insurance Marketplace enrollment requires documents such as recent pay stubs, W-2 forms from employers, and federal tax returns including Form 1040 to accurately determine eligibility and premium subsidies. Providing these income documents ensures proper assessment of household income, which impacts coverage options and potential financial assistance. |

| 5 | Employer Information | For Health Insurance Marketplace enrollment, essential employer information includes the employer's name, address, and Employer Identification Number (EIN). Accurate details about your employer, such as income verification documents like recent pay stubs or a Letter from Employer, help determine eligibility for subsidies and coverage options. |

| 6 | Current Health Insurance Policy Numbers | Current health insurance policy numbers are essential for Health Insurance Marketplace enrollment as they verify existing coverage and prevent gaps or duplicate plans. Providing accurate policy numbers ensures seamless integration of benefits and supports eligibility assessments for subsidies or plan comparisons. |

| 7 | Immigration Documents (if applicable) | Immigration documents required for Health Insurance Marketplace enrollment include valid visas, permanent resident cards (Green Card), employment authorization documents, or refugee/asylee status proof to verify lawful presence in the United States. These documents ensure eligibility for coverage and may impact subsidy qualifications under the Affordable Care Act. |

| 8 | Proof of Household Size (tax documents, birth certificates) | Proof of household size for Health Insurance Marketplace enrollment typically requires tax documents such as the most recent federal tax return (Form 1040) and birth certificates for all household members, confirming dependent relationships. These documents validate the number of individuals in the household, which directly affects eligibility and premium calculations. |

| 9 | Proof of Address (utility bill, lease, government correspondence) | Proof of address is essential for Health Insurance Marketplace enrollment and can be validated through documents such as a utility bill, lease agreement, or government correspondence. These documents confirm residency and ensure accurate plan assignment and eligibility verification within your state or county. |

| 10 | Documentation of Other Health Coverage (COBRA, Medicaid, CHIP, VA, TRICARE) | Documentation for other health coverage during Health Insurance Marketplace enrollment typically includes proof of COBRA continuation coverage, Medicaid or CHIP eligibility letters, VA benefits statements, and TRICARE enrollment verification. Providing these documents ensures accurate assessment of existing coverage and eligibility for subsidies or alternative plans. |

| 11 | Employment Verification Letter (if recently employed) | An Employment Verification Letter is crucial for Health Insurance Marketplace enrollment to confirm recent employment status, income, and eligibility for coverage options. This document must include the employer's contact information, employee's job title, start date, and current salary to accurately assess premium subsidies and plan eligibility. |

| 12 | Notice of Job Termination (if recently lost coverage) | A Notice of Job Termination is essential for Health Insurance Marketplace enrollment to verify recent loss of employer-sponsored coverage and qualify for special enrollment periods. This document substantiates eligibility for subsidies and alternative plan options under the Affordable Care Act. |

| 13 | Adoption or Foster Care Documents (if applicable) | Adoption or foster care documents required for Health Insurance Marketplace enrollment include legal adoption decrees, foster care placement papers, and court orders verifying guardianship or custody. These documents must clearly establish the parental or custodial relationship to ensure accurate coverage and eligibility verification. |

| 14 | Tribal Enrollment/Membership Documents (if applicable) | Tribal Enrollment or Membership Documents such as a Tribal ID card, Certificate of Indian Blood, or membership letter from a federally recognized tribe are essential for Health Insurance Marketplace enrollment to verify eligibility for specific tribal benefits and cost-sharing reductions. These documents support access to programs like the Indian Health Service (IHS) and ensure accurate application processing under the Affordable Care Act provisions for Native Americans. |

| 15 | Documentation of Qualifying Life Event (if applying outside Open Enrollment) | Documentation for a Qualifying Life Event (QLE) is required to enroll in the Health Insurance Marketplace outside the Open Enrollment Period, including proof of events such as marriage, birth of a child, job loss, or loss of other health coverage. Essential documents may include marriage certificates, birth certificates, termination notices, or letters from previous insurers confirming coverage end dates, enabling verification of eligibility for Special Enrollment Periods. |

Introduction to Health Insurance Marketplace Enrollment

The Health Insurance Marketplace offers a streamlined way to compare and purchase health insurance plans. Enrollment requires specific documents to verify eligibility and coverage options.

Proof of identity and citizenship or immigration status is essential for the enrollment process. Income documentation helps determine eligibility for premium tax credits and subsidies.

Importance of Gathering Essential Documents

Gathering essential documents is crucial for a smooth Health Insurance Marketplace enrollment process. These documents verify your identity, income, and household information, ensuring accurate eligibility and subsidy determination. Having them ready prevents delays and helps secure the best coverage options for your needs.

Proof of Identity and Citizenship/Immigration Status

What documents are necessary to prove identity and citizenship or immigration status for Health Insurance Marketplace enrollment? You need valid proof of identity such as a government-issued photo ID or passport. For citizenship or immigration status, documents like a U.S. birth certificate, U.S. passport, or permanent resident card are required.

Social Security Number and Tax Documentation

Enrolling in the Health Insurance Marketplace requires specific documentation to verify your identity and eligibility. The Social Security Number is a crucial document for this process.

You will also need tax documentation, such as your most recent tax return, to determine the correct amount of financial assistance. These documents help verify income and household size accurately. Providing accurate information ensures you receive appropriate coverage and subsidies.

Income Verification Documents

Income verification documents are essential for Health Insurance Marketplace enrollment to determine eligibility for subsidies and plans. These documents confirm your financial status accurately to ensure proper coverage and cost assistance.

- Pay Stubs - Recent pay stubs show your current earnings and help verify your monthly or annual income.

- Tax Returns - The latest federal tax return provides comprehensive income information for the previous year.

- Benefit Statements - Documents such as Social Security or unemployment benefits statements verify additional income sources.

Submitting accurate income verification documents helps secure the best available health insurance options through the Marketplace.

Current Health Insurance Information

Current health insurance information is essential when enrolling in the Health Insurance Marketplace. Accurate documentation ensures eligibility verification and smooth processing of your application.

- Proof of Existing Coverage - Documents such as insurance cards or policy statements confirm your current plan details.

- Coverage Start and End Dates - These dates help determine eligibility for new Marketplace plans and potential enrollment periods.

- Policyholder Information - Name and identification number on current insurance records verify your identity and coverage status.

Household Information and Dependent Details

Enrolling in the Health Insurance Marketplace requires accurate household information to determine eligibility and subsidies. Detailed dependent information ensures all qualifying family members receive appropriate coverage.

Providing comprehensive household data helps verify income and residency for correct plan pricing. Including dependent details establishes who qualifies under your policy. Missing or incorrect documents can delay or affect application approval.

- Proof of Household Size - Documents such as tax returns or pay stubs listing all household members verify family size for subsidy calculations.

- Dependent Birth Certificates - Birth certificates confirm dependent relationships and are necessary for adding children to the policy.

- Social Security Numbers - SSNs for all applicants and dependents support identity verification and eligibility determination.

Employer and Employment Verification

| Document Type | Description | Purpose |

|---|---|---|

| Recent Pay Stubs | Recent pay stubs or earnings statements from your employer that show your income. | Verify current employment status and monthly or yearly income to determine eligibility and premium costs for health insurance plans. |

| Employment Letter | An official letter from your employer confirming your job status, title, and employment duration. | Provide proof of active employment which supports income claims and validates eligibility for employer-sponsored insurance options or marketplace subsidies. |

| IRS Form W-2 | A federal tax form reporting your annual wages and the taxes withheld by your employer. | Confirm total yearly income and employment through an official tax document, critical for accurate health insurance marketplace enrollment income reporting. |

| Self-Employment Documentation | Business licenses, tax returns (Schedule C), or invoices if you are self-employed. | Verify income and business status when no formal employer documents are available, ensuring correct eligibility and premium calculations. |

| Employer's Contact Information | Names, addresses, and phone numbers of employers listed on employment documents. | Ensure the marketplace can verify employment details directly with the employer if needed during the application process. |

Special Circumstances and Supporting Documents

Special circumstances such as pregnancy, recent job loss, or changes in household size require specific supporting documents during Health Insurance Marketplace enrollment. Key documents include proof of income like pay stubs or tax returns, identification such as a driver's license or birth certificate, and evidence of qualifying life events such as divorce decrees or adoption papers. These documents ensure accurate eligibility verification and help determine subsidies or coverage options tailored to individual needs.

What Documents are Necessary for Health Insurance Marketplace Enrollment? Infographic