To qualify for a Health Insurance Special Enrollment Period, you must provide documents verifying your qualifying life event, such as proof of loss of coverage, marriage certificate, or birth certificate. Income documentation like pay stubs or tax returns may also be required to determine eligibility for subsidies. Submitting accurate and complete paperwork ensures a smooth enrollment process and timely coverage activation.

What Documents Are Necessary for Health Insurance Special Enrollment Period?

| Number | Name | Description |

|---|---|---|

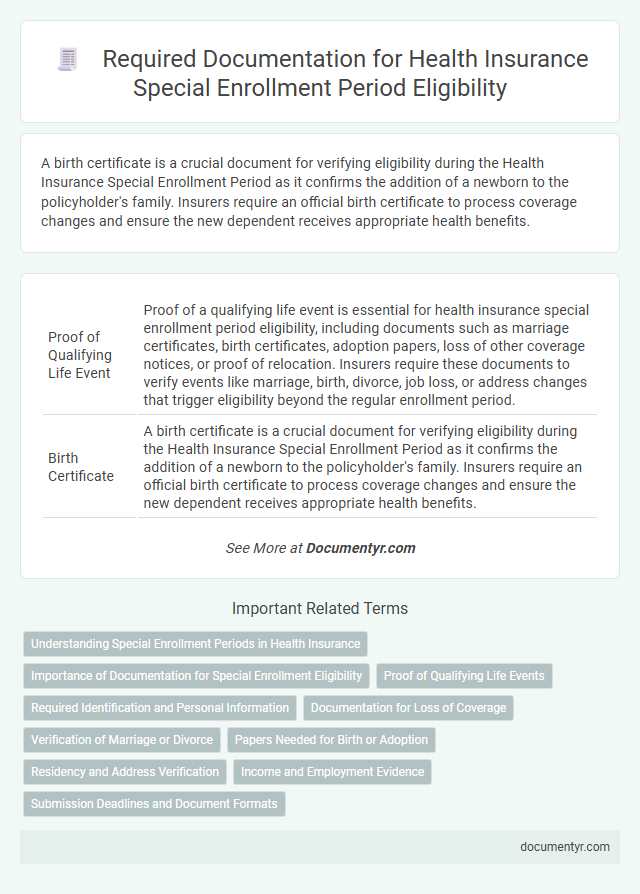

| 1 | Proof of Qualifying Life Event | Proof of a qualifying life event is essential for health insurance special enrollment period eligibility, including documents such as marriage certificates, birth certificates, adoption papers, loss of other coverage notices, or proof of relocation. Insurers require these documents to verify events like marriage, birth, divorce, job loss, or address changes that trigger eligibility beyond the regular enrollment period. |

| 2 | Birth Certificate | A birth certificate is a crucial document for verifying eligibility during the Health Insurance Special Enrollment Period as it confirms the addition of a newborn to the policyholder's family. Insurers require an official birth certificate to process coverage changes and ensure the new dependent receives appropriate health benefits. |

| 3 | Marriage Certificate | A marriage certificate is essential for health insurance Special Enrollment Period as it verifies a qualifying life event allowing policy changes or new coverage outside the standard enrollment timeframe. Insurers require this legal document to confirm marital status changes and adjust beneficiaries, coverage tiers, or premium rates accordingly. |

| 4 | Divorce Decree | A divorce decree is a crucial document for verifying eligibility during a Health Insurance Special Enrollment Period, as it confirms changes in marital status impacting coverage options. This legal proof allows individuals to update or alter their health insurance plans outside the regular enrollment timeframe. |

| 5 | Death Certificate | A death certificate is a crucial document required during a Health Insurance Special Enrollment Period to prove eligibility due to the loss of a spouse or dependent. This official record verifies the date and cause of death, enabling qualifying individuals to add or change coverage outside the regular enrollment timeframe. |

| 6 | Adoption Papers | Adoption papers are crucial documents required during the Health Insurance Special Enrollment Period to verify a legal change in family status and qualify for new coverage. These papers must include official court orders or final decrees confirming the adoption date to ensure eligibility for enrollment outside the regular open enrollment. |

| 7 | Court Order | A court order is essential documentation for a Health Insurance Special Enrollment Period when it mandates coverage changes such as adding a dependent due to custody arrangements or adoption. This legal document validates eligibility for enrollment outside the standard period, ensuring compliance with insurance plan requirements. |

| 8 | Proof of Loss of Coverage | Proof of loss of coverage documents for a Health Insurance Special Enrollment Period include termination letters from previous insurance providers, proof of COBRA coverage ending, or employer statements confirming loss of eligibility. These documents validate the qualifying event, ensuring eligibility for enrollment outside the open enrollment period. |

| 9 | Termination Letter | A termination letter from a previous health insurance provider is crucial for qualifying for a Special Enrollment Period (SEP), as it serves as official proof of loss of coverage. This document must clearly state the date coverage ended or will end, enabling applicants to enroll in a new plan without waiting for the open enrollment period. |

| 10 | COBRA Election Notice | A COBRA Election Notice is essential for health insurance Special Enrollment Period eligibility, serving as proof of qualifying events such as job loss or reduction in hours. This document must be submitted within the specified timeframe to ensure timely enrollment and coverage continuity. |

| 11 | Employer Coverage Termination Letter | A Health Insurance Special Enrollment Period requires an Employer Coverage Termination Letter as proof that previous health insurance through an employer has ended. This document verifies eligibility and must include the termination date and policy details to ensure a seamless transition to new coverage. |

| 12 | Proof of Change in Employment Status | Proof of change in employment status for health insurance Special Enrollment Period typically includes employer termination or layoff notices, offer letters for new jobs, or documented changes in work hours such as reduced schedules affecting coverage eligibility. These documents verify qualifying life events, enabling individuals to enroll outside the standard open enrollment period. |

| 13 | Proof of Change in Household Size | Documents necessary for a Health Insurance Special Enrollment Period to prove a change in household size include birth certificates, adoption papers, marriage certificates, divorce decrees, and legal guardianship documents. These proofs validate qualifying life events such as births, adoptions, marriages, divorces, or custody changes that impact eligibility for special enrollment. |

| 14 | Proof of Change in Residence | Proof of change in residence for a health insurance Special Enrollment Period typically requires documents such as a lease agreement, utility bills, or a change of address confirmation from the post office, validating the new address. These documents establish eligibility for enrollment outside the standard period by confirming a qualifying move. |

| 15 | Lease Agreement | A lease agreement serves as crucial documentation during a Health Insurance Special Enrollment Period to verify your change of residence, which qualifies you for enrollment outside the standard period. Insurers often require a signed lease agreement including your name, new address, and move-in date to validate your eligibility for coverage adjustments. |

| 16 | Mortgage Statement | A mortgage statement can serve as proof of a qualifying life event, such as moving to a new residence, which allows eligibility for the Health Insurance Special Enrollment Period (SEP). This document must clearly show the new address and date of the move to meet the enrollment criteria. |

| 17 | Utility Bill | A utility bill is essential for verifying your residency during the Health Insurance Special Enrollment Period, ensuring eligibility based on your current address. This document must be recent and include your name and address to confirm residency status for accurate enrollment processing. |

| 18 | Government Benefit Award Letter | A Government Benefit Award Letter is a critical document required for health insurance Special Enrollment Period verification as it confirms eligibility based on recent changes in public assistance such as Medicaid or CHIP awards. This letter must clearly outline the recipient's name, benefit type, and effective dates to expedite enrollment and ensure coverage activation. |

| 19 | Proof of Citizenship or Lawful Presence | Proof of citizenship or lawful presence for a Health Insurance Special Enrollment Period typically includes documents such as a U.S. passport, birth certificate, naturalization certificate, or permanent resident card (green card). These documents verify identity and legal status, enabling eligibility to enroll outside the standard enrollment period. |

| 20 | Social Security Card | A Social Security Card is a critical document needed during the Health Insurance Special Enrollment Period as it verifies identity and citizenship or legal residency status. Insurers require this card to ensure accurate processing of applications and eligibility for coverage under the special enrollment criteria. |

| 21 | Passport | A valid passport serves as a critical proof of identity and citizenship when applying for a health insurance Special Enrollment Period (SEP), ensuring eligibility verification. Submitting a clear, up-to-date passport copy alongside other required documents such as proof of qualifying life events strengthens the application process. |

| 22 | Permanent Resident Card (Green Card) | A Permanent Resident Card (Green Card) is essential documentation required to qualify for a Health Insurance Special Enrollment Period, as it verifies lawful permanent resident status in the United States. Insurers and the Health Insurance Marketplace mandate this proof to confirm eligibility for coverage outside the annual Open Enrollment Period. |

| 23 | Visa Documentation | During the Health Insurance Special Enrollment Period, proof of legal immigration status is critical, with a valid visa and supporting immigration documents required to verify eligibility. These documents typically include the visa approval notice, passport with visa stamp, and any official immigration status forms issued by the Department of Homeland Security. |

| 24 | Proof of Income | Proof of income documents necessary for a health insurance Special Enrollment Period (SEP) include recent pay stubs, tax returns, or an employer's income verification letter to demonstrate eligibility and financial need. These documents help verify changes in income that qualify applicants for SEP coverage outside the open enrollment window. |

| 25 | Pay Stubs | Pay stubs serve as crucial documentation during the Health Insurance Special Enrollment Period by verifying recent income changes that qualify individuals for enrollment outside the standard period. These pay stubs provide proof of employment status and income fluctuations, ensuring accurate eligibility assessment for health coverage adjustments. |

| 26 | Tax Return | A recent tax return is essential for the Health Insurance Special Enrollment Period as it verifies income eligibility and household size, ensuring accurate subsidy calculations. IRS Form 1040 or transcripts serve as primary proof, supporting the application process during the special enrollment timeframe. |

| 27 | Unemployment Benefit Letter | An Unemployment Benefit Letter is a critical document required during the Health Insurance Special Enrollment Period to verify loss of coverage due to job loss. This letter provides proof of income and eligibility, enabling enrollment in a new health insurance plan outside the standard open enrollment timeframe. |

Understanding Special Enrollment Periods in Health Insurance

Understanding Special Enrollment Periods (SEPs) in health insurance is crucial for obtaining coverage outside the regular enrollment times. SEPs allow individuals to apply for or change their health plans when qualifying life events occur.

Essential documents verify eligibility and support your SEP application to ensure timely health insurance coverage.

- Proof of Qualifying Life Event - Documents such as marriage certificates, birth certificates, or adoption papers confirm the life event triggering the SEP.

- Previous Health Coverage Information - Proof of prior insurance, like insurance cards or coverage termination letters, helps demonstrate gaps or changes in coverage.

- Identification Documents - Valid photo IDs, Social Security numbers, or immigration status documents establish personal identity and eligibility for enrollment.

Importance of Documentation for Special Enrollment Eligibility

| Document Type | Purpose | Examples |

|---|---|---|

| Proof of Qualifying Life Event | Establish eligibility for Special Enrollment Period (SEP) | Marriage certificate, birth certificate, adoption papers, divorce decree |

| Proof of Loss of Coverage | Verify loss of prior health insurance coverage | Termination letter from employer, COBRA notice, notice of Medicaid termination |

| Identification Documents | Confirm the identity of the applicant | State-issued ID, driver's license, passport |

| Proof of Residency | Demonstrate state residency required for certain plans | Utility bills, lease agreement, government mail |

| Income Documentation | Assess eligibility for subsidies or Medicaid during SEP | Pay stubs, tax returns, Social Security award letters |

| Legal Documents | Support specific qualifying events such as loss of dependent status | Court orders, guardianship papers |

The importance of documentation for Special Enrollment Period eligibility lies in its role to authenticate qualifying events and ensure timely access to health insurance coverage. Accurate and complete documents prevent application delays and support appropriate plan selection and premium subsidies.

Proof of Qualifying Life Events

Proof of qualifying life events is essential to enroll in a health insurance Special Enrollment Period (SEP). These documents verify significant changes in your life that make you eligible to apply outside the regular open enrollment period.

Common qualifying events include marriage, birth or adoption of a child, loss of other health coverage, and relocation. Valid proof may include marriage certificates, birth certificates, termination of previous insurance coverage, or utility bills confirming a new address.

Required Identification and Personal Information

During the Health Insurance Special Enrollment Period, required identification documents include a government-issued photo ID such as a driver's license or passport. Personal information necessary for enrollment consists of your Social Security number, birth date, and current address. These documents verify your identity and eligibility to secure health coverage outside the standard enrollment timeframe.

Documentation for Loss of Coverage

Proof of loss of coverage is essential for qualifying under the Health Insurance Special Enrollment Period. Acceptable documents include a letter from your previous insurer confirming termination, a final premium bill showing non-payment or cancellation, or a notice from an employer detailing the end of group health benefits. These documents verify that your previous insurance ended through no fault of your own, allowing you to secure new coverage promptly.

Verification of Marriage or Divorce

Verification of marriage or divorce is essential during the health insurance Special Enrollment Period to confirm eligibility. Documents such as a marriage certificate or divorce decree serve as official proof for these life changes.

You must provide certified copies to ensure your application is processed accurately and without delay. These documents validate your status and justify your need to enroll outside the open enrollment period.

Papers Needed for Birth or Adoption

During the Health Insurance Special Enrollment Period for birth or adoption, specific documents are required to confirm the qualifying life event. These documents help validate eligibility for enrolling outside the standard enrollment timeframe.

For birth, a certified birth certificate or hospital birth record is necessary to prove the new addition to the family. In the case of adoption, adoption papers or legal custody documents must be submitted as proof. Providing these documents ensures a smooth and timely enrollment process for health insurance coverage.

Residency and Address Verification

Proving residency and verifying your address are crucial steps during the Health Insurance Special Enrollment Period. Insurers require specific documents to confirm your location and eligibility.

- Utility Bills - Recent bills such as electricity, water, or gas clearly displaying your name and address serve as valid proof of residency.

- Lease Agreements - A current, signed lease or rental contract establishes your residence and provides official address verification.

- Government-issued IDs - Driver's licenses or state ID cards with your current address on file offer additional confirmation of residency.

Submitting these documents promptly ensures a smooth enrollment process during your special enrollment period.

Income and Employment Evidence

What income and employment documents are required for the Health Insurance Special Enrollment Period? You need to provide proof of income such as recent pay stubs, tax returns, or W-2 forms. Employment verification may include a letter from your employer or recent pay statements to confirm your job status.

What Documents Are Necessary for Health Insurance Special Enrollment Period? Infographic