To update life insurance beneficiary information, policyholders typically need to provide a completed beneficiary change form, a copy of the current insurance policy, and valid identification such as a driver's license or passport. Some insurers may also require additional documentation like a marriage certificate, divorce decree, or court order if the change involves legal status alterations. Submitting these documents ensures the insurer processes the beneficiary update accurately and promptly.

What Documents are Required for Life Insurance Beneficiary Changes?

| Number | Name | Description |

|---|---|---|

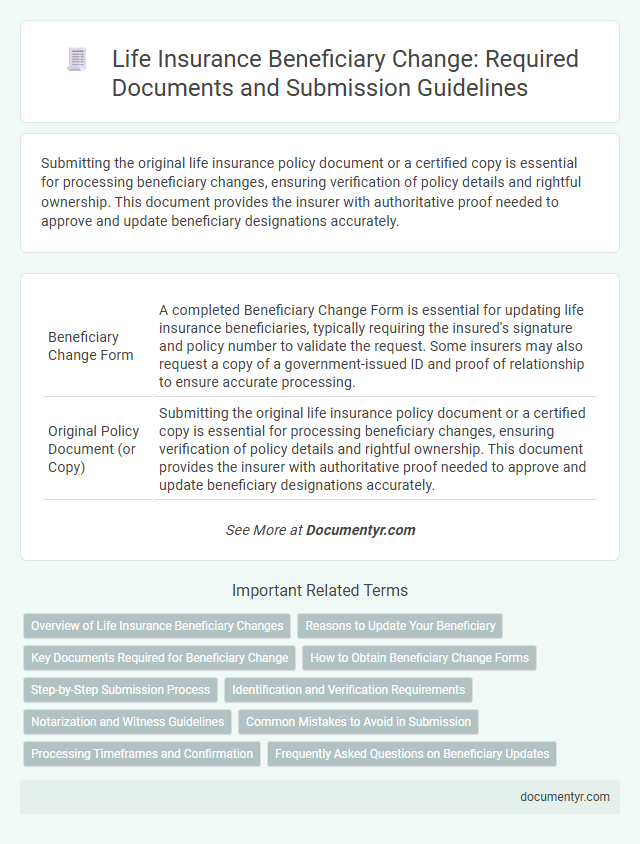

| 1 | Beneficiary Change Form | A completed Beneficiary Change Form is essential for updating life insurance beneficiaries, typically requiring the insured's signature and policy number to validate the request. Some insurers may also request a copy of a government-issued ID and proof of relationship to ensure accurate processing. |

| 2 | Original Policy Document (or Copy) | Submitting the original life insurance policy document or a certified copy is essential for processing beneficiary changes, ensuring verification of policy details and rightful ownership. This document provides the insurer with authoritative proof needed to approve and update beneficiary designations accurately. |

| 3 | Valid Government-issued Photo ID | Life insurance beneficiary changes require a valid government-issued photo ID such as a passport, driver's license, or state ID to verify the identity of the policyholder or new beneficiary. Insurers use these documents to prevent fraud and ensure the accuracy and security of beneficiary updates. |

| 4 | Proof of Relationship (if applicable) | To change a life insurance beneficiary, providing proof of relationship is essential when the new beneficiary is a family member, such as a spouse, child, or dependent, to verify their eligibility. Acceptable documents typically include birth certificates, marriage certificates, or court-issued guardianship papers, which must be submitted alongside the beneficiary change form to the insurance provider. |

| 5 | Social Security Number (of New Beneficiary) | Updating a life insurance beneficiary requires submitting the new beneficiary's Social Security Number to verify identity and ensure accurate record-keeping. Providing the correct Social Security Number is essential to prevent processing delays and confirm the rightful recipient of policy benefits. |

| 6 | Notarized Signature (if required) | Life insurance beneficiary changes typically require a completed beneficiary designation form along with the policyholder's valid identification, while a notarized signature may be necessary if specified by the insurer to ensure authenticity and prevent fraud. Submitting a notarized signature guarantees the legal verification of the policyholder's intent, reducing processing delays and safeguarding the accuracy of beneficiary records. |

| 7 | Court-Ordered Documentation (if applicable, e.g., divorce decree) | Court-ordered documentation, such as a divorce decree or legal guardianship papers, is required to process life insurance beneficiary changes when mandated by a judicial authority. These documents validate the change and ensure compliance with legal obligations and family court rulings. |

| 8 | Trust Documentation (if naming a trust) | When changing a life insurance beneficiary to a trust, submitting the official trust document or trust agreement is essential to verify the trust's legal standing and specify trustee details. Insurance companies often require a certificate of trust or a summary that outlines the trust's name, date, and trustee authority to process the beneficiary change accurately. |

| 9 | Guardian/Power of Attorney Papers (if applicable) | Life insurance beneficiary changes require submitting the original or notarized Guardian or Power of Attorney (POA) papers to verify legal authority for making such changes. These documents ensure the designated individual has the proper authorization to update beneficiary information according to state laws and policy terms. |

| 10 | Contact Information of New Beneficiary | To update the contact information of a new life insurance beneficiary, you typically need to provide a completed beneficiary designation form along with valid identification documents of the new beneficiary. Insurance companies may also require proof of relationship or legal documents, such as a marriage certificate or court order, to process the change accurately. |

Overview of Life Insurance Beneficiary Changes

Changing the beneficiary on a life insurance policy ensures that the death benefit is paid to the correct person or entity. It requires submitting specific documents to the insurance company to update the policy records accurately.

- Beneficiary Change Form - A completed and signed beneficiary change request form provided by the insurance company must be submitted.

- Identification Proof - Valid government-issued identification such as a driver's license or passport is required for verification.

- Policy Documents - The original life insurance policy or policy number must be presented to facilitate the beneficiary update process.

Reasons to Update Your Beneficiary

Updating your life insurance beneficiary ensures that your policy benefits are distributed according to your current wishes. Life events such as marriage, divorce, or the birth of a child often necessitate changes to your beneficiary designation.

Required documents for beneficiary changes typically include a completed beneficiary change form provided by the insurance company. You may also need to submit identification documents and proof of the life event prompting the update, such as a marriage certificate or court order. Keeping your beneficiary information current guarantees that your loved ones receive the intended financial protection without delays or legal complications.

Key Documents Required for Beneficiary Change

To update the beneficiary on a life insurance policy, policyholders must provide a completed beneficiary change form issued by the insurance company. A valid government-issued photo ID, such as a driver's license or passport, is typically required to verify the policyholder's identity. In some cases, a copy of the original life insurance policy document may be necessary to confirm account details and ensure the correct beneficiary update.

How to Obtain Beneficiary Change Forms

What documents are required for life insurance beneficiary changes? Most insurance companies require a completed beneficiary change form along with a valid photo ID. Some insurers may also request a copy of the original policy for reference.

How to obtain beneficiary change forms for life insurance? Policyholders can typically download the forms directly from the insurance company's official website. Alternatively, contacting the insurer's customer service department allows you to request forms via mail or email for easy completion.

Step-by-Step Submission Process

Changing the beneficiary on a life insurance policy requires specific documents to ensure accuracy and legal compliance. Understanding the step-by-step submission process helps streamline your request.

- Completed Change of Beneficiary Form - This form, provided by the insurance company, must be accurately filled out to initiate the beneficiary change.

- Proof of Identity - A government-issued ID such as a driver's license or passport is necessary to verify your identity during the submission.

- Policy Documentation - Provide a copy of the original life insurance policy or policy number to facilitate reference and update.

Submit all documents to the insurer via mail, online portal, or in person, following the insurer's specific instructions.

Identification and Verification Requirements

| Document Type | Description |

|---|---|

| Proof of Identity | Government-issued photo identification such as a passport, driver's license, or national ID card to verify the identity of the beneficiary or policyholder making the change. |

| Policyholder Identification | Valid identification documents for the policyholder, often matching the information on the life insurance policy, confirming authorization to request changes. |

| Beneficiary Proof of Identity | Beneficiary's official ID to confirm the individual receiving benefits, ensuring correct beneficiary designation and preventing fraud. |

| Change of Beneficiary Form | Completed and signed form provided by the insurance company that details the requested changes to the beneficiary designation. |

| Verification Documents | Supporting documents such as marriage certificates, divorce decrees, or legal name change documents if the beneficiary's status or name has changed. |

| Notarization or Witness Signatures | Some insurance companies require notarized documents or witness signatures to verify the authenticity of the beneficiary change request. |

Your life insurance provider relies on these identification and verification documents to process beneficiary changes accurately and securely.

Notarization and Witness Guidelines

To change the beneficiary on a life insurance policy, submission of specific documents is required to ensure legal validity. These typically include the beneficiary change form completed by the policyholder and proof of identity.

Notarization of the beneficiary change form is often mandated to verify the authenticity of the policyholder's signature. Some insurers require witnesses to be present during the signing, with specific guidelines on who qualifies as an acceptable witness.

Common Mistakes to Avoid in Submission

When submitting documents for life insurance beneficiary changes, ensure the beneficiary change form is fully completed and signed by the policyholder. Avoid submitting outdated identification or incomplete forms, as these can delay processing. Missing signatures and illegible handwriting are common mistakes that lead to rejection of the beneficiary change request.

Processing Timeframes and Confirmation

Changing the beneficiary on a life insurance policy requires submitting specific documents to ensure the update is processed accurately. Understanding processing timeframes and receiving confirmation are essential for policyholder peace of mind.

- Required Documents - Commonly requested documents include a completed beneficiary change form, a valid government-issued ID, and sometimes a copy of the current policy.

- Processing Timeframes - Life insurance companies typically take between 7 to 14 business days to process beneficiary change requests after receiving all necessary documentation.

- Confirmation of Change - Insurers provide written confirmation via mail or email to the policyholder once the beneficiary update is officially recorded in their system.

What Documents are Required for Life Insurance Beneficiary Changes? Infographic