To secure professional indemnity insurance, essential documents typically include proof of professional qualifications, a detailed description of the services offered, and a claims history if applicable. Insurers may also require completed proposal forms, evidence of previous insurance coverage, and client contracts to assess risk accurately. Providing these documents helps streamline the underwriting process and ensures appropriate coverage tailored to professional needs.

What Documents are Necessary for Professional Indemnity Insurance?

| Number | Name | Description |

|---|---|---|

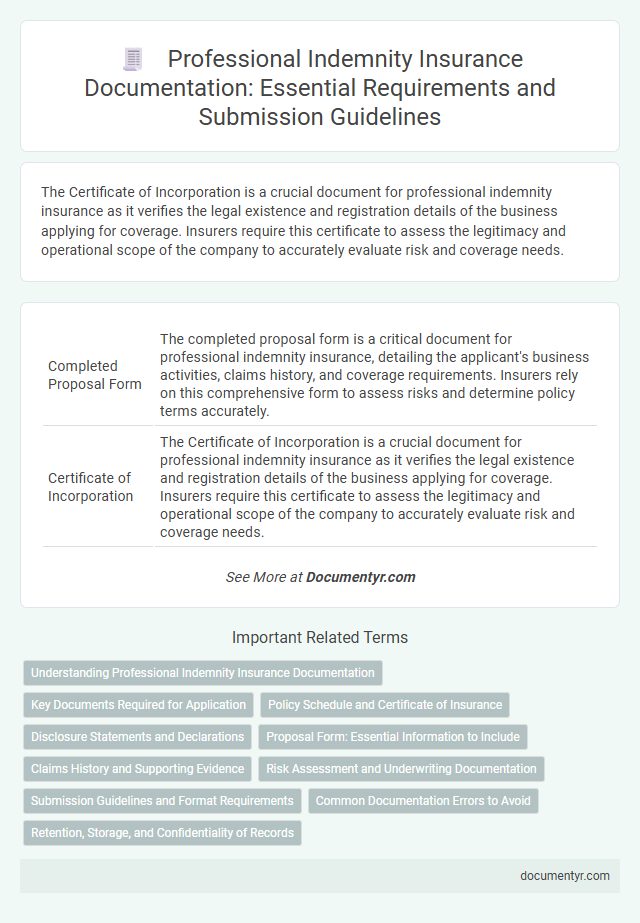

| 1 | Completed Proposal Form | The completed proposal form is a critical document for professional indemnity insurance, detailing the applicant's business activities, claims history, and coverage requirements. Insurers rely on this comprehensive form to assess risks and determine policy terms accurately. |

| 2 | Certificate of Incorporation | The Certificate of Incorporation is a crucial document for professional indemnity insurance as it verifies the legal existence and registration details of the business applying for coverage. Insurers require this certificate to assess the legitimacy and operational scope of the company to accurately evaluate risk and coverage needs. |

| 3 | Business Registration Certificate | A valid Business Registration Certificate is essential for obtaining professional indemnity insurance as it verifies the legal status and legitimacy of the insured business. Insurers require this document to assess risk accurately and ensure the business operates within the legal framework. |

| 4 | Previous Professional Indemnity Policy (if any) | Previous Professional Indemnity Insurance policies, including declarations, claims history, and coverage limits, are essential documents required to assess risk and determine renewals or new policy terms. Detailed records of past indemnity claims, policy expiration dates, and any exclusions help insurers evaluate the applicant's risk profile accurately. |

| 5 | Claims History/Declaration | A detailed claims history or declaration that outlines all previous claims related to professional indemnity insurance is essential for accurate risk assessment. This document must include the date, nature, and outcome of each claim to ensure comprehensive evaluation and appropriate coverage. |

| 6 | Financial Statements (Recent) | Recent financial statements, including balance sheets, income statements, and cash flow statements, are essential for professional indemnity insurance to assess the financial stability and risk exposure of the insured party. Accurate and up-to-date financial documentation ensures proper underwriting and helps determine appropriate coverage limits and premium rates. |

| 7 | Professional Qualifications Certificates | Professional indemnity insurance requires submission of certified copies of professional qualifications certificates to verify the insured's expertise and legitimacy in their field. These documents support risk assessment by insurers, ensuring coverage aligns with the professional's credentials and scope of practice. |

| 8 | Proof of Experience/Resumes of Key Personnel | Proof of experience and detailed resumes of key personnel are essential documents for professional indemnity insurance applications, demonstrating the expertise and qualifications relevant to the insured profession. Insurers require these documents to assess risk accurately and ensure that the individuals involved possess the necessary skills and industry experience to mitigate potential claims. |

| 9 | Details of Services/Scope of Work | Detailed descriptions of services provided and the specific scope of work are essential documents for professional indemnity insurance, as they define the risk exposure and coverage limits. Accurate records of service contracts, project plans, and client agreements help insurers assess potential liabilities and tailor policy terms effectively. |

| 10 | Client Contracts/Engagement Letters | Client contracts and engagement letters are essential documents for professional indemnity insurance as they define the scope of services, responsibilities, and terms of the professional relationship, which help insurers assess risk exposure accurately. These documents provide evidence of agreed professional duties and limitations, crucial for validating claims and determining coverage boundaries. |

| 11 | Risk Management Procedures | Risk management procedures for professional indemnity insurance require submission of detailed documentation including signed risk assessment reports, documented client engagement processes, and evidence of ongoing staff training in compliance standards. Supporting records such as incident logs, previous claims history, and quality control manuals are essential to demonstrate adherence to risk mitigation and liability prevention practices. |

| 12 | Copy of Practice/Business License | A valid copy of the practice or business license is essential for professional indemnity insurance to verify that the insured entity complies with industry regulations and is legally authorized to offer services. Insurers rely on this document to assess risk accurately and ensure coverage aligns with the licensed scope of professional activities. |

| 13 | Regulatory or Professional Body Membership/License | Professional indemnity insurance requires submission of a valid membership certificate or license issued by the relevant regulatory or professional body to confirm the insured's authorization to practice. Proof of compliance with industry standards and any additional documentation stipulated by these bodies ensures policy validity and claims acceptance. |

| 14 | List of Partners or Directors | A comprehensive list of partners or directors, including full names, addresses, and professional qualifications, is essential for professional indemnity insurance application. This documentation verifies the key stakeholders' identities and their roles within the firm, facilitating accurate risk assessment and policy customization. |

| 15 | Brochures/Company Profile | Brochures and company profiles are essential documents for professional indemnity insurance as they provide detailed information about the insured's business operations, services offered, and industry experience. These documents help insurers assess risk accurately and tailor coverage to the specific professional activities of the policyholder. |

| 16 | Organizational Chart | An organizational chart is essential for professional indemnity insurance as it clearly outlines the company's structure, key decision-makers, and the distribution of responsibilities, which help insurers assess risk and coverage needs accurately. Including detailed roles and reporting lines ensures transparency and aids in the evaluation of potential professional liabilities within the organization. |

| 17 | Details of Major Projects | Detailed project reports, including contract agreements, scope of work, timeline, and budget allocations, are necessary for professional indemnity insurance to assess risk exposure accurately. Documentation of previous project outcomes, client feedback, and any claims history related to major projects further supports the underwriting process. |

| 18 | Employee List/Roles | A comprehensive employee list detailing roles, job titles, and responsibilities is essential for professional indemnity insurance to accurately assess risk exposure and liability coverage. Insurers require this documentation to evaluate the expertise levels within the organization and ensure appropriate policy terms are applied. |

| 19 | Written Risk Control Policies | Written risk control policies are essential documents for professional indemnity insurance as they demonstrate a proactive approach to managing and mitigating potential professional risks. Insurers require these policies to assess the adequacy of risk management measures in place, ensuring that the insured party follows standardized procedures to prevent errors and claims. |

| 20 | Current Litigation or Legal Proceedings Documents | Current litigation or legal proceedings documents required for professional indemnity insurance typically include detailed statements of claim, court summons, defense affidavits, and correspondence related to ongoing disputes. Insurers may also request copies of settlement agreements, expert reports, and any regulatory investigation notices to assess potential liabilities accurately. |

| 21 | Schedule of Insurance Requirements | The Schedule of Insurance Requirements for professional indemnity insurance typically includes a detailed list of necessary documents such as proof of prior claims experience, evidence of professional qualifications, and a comprehensive risk assessment report. These documents ensure thorough evaluation of coverage needs, policy limits, and terms tailored to the insured professional's specific industry and risk exposure. |

| 22 | Indemnity Agreement (if applicable) | The Indemnity Agreement, if applicable, is a crucial document for Professional Indemnity Insurance as it outlines the responsibilities and liabilities between the insured party and the insurer. This agreement typically includes detailed terms on coverage limits, claim procedures, and indemnification clauses that protect professionals against legal costs and damages from claims of negligence or malpractice. |

| 23 | Power of Attorney (if applicable) | Professional indemnity insurance applications require a valid Power of Attorney document when an authorized representative submits the policy on behalf of the insured, ensuring legal authorization and accountability. This document must clearly specify the scope of authority granted to the representative to validate claims and contract obligations under the insurance agreement. |

Understanding Professional Indemnity Insurance Documentation

What documents are necessary for professional indemnity insurance? Professional indemnity insurance requires detailed documentation to assess the risk and coverage needs effectively. These documents typically include proof of identity, proof of professional qualifications, and any previous claims history.

Why is understanding professional indemnity insurance documentation important? Knowing the required documents ensures a smooth application process and helps avoid delays or denials. It also helps professionals accurately represent their coverage needs to the insurer.

Which proof of identity documents are accepted for professional indemnity insurance? Commonly accepted documents include government-issued photo IDs such as passports or driver's licenses. These confirm the applicant's identity to the insurance provider.

What professional qualification documents are needed? Applicants must provide certificates, licenses, or degrees that verify their qualifications and expertise in their specific field. These documents demonstrate the legitimacy of the professional services being insured.

How does claims history impact professional indemnity insurance? A detailed claims history reveals any past liability issues which influence policy terms and premiums. Providing accurate claims records helps insurers tailor coverage to the professional's risk profile.

Are financial statements required for professional indemnity insurance? Depending on the insurer, financial statements such as balance sheets or profit and loss statements may be requested. These documents help assess the financial stability and operational scale of the insured business.

What role does a proposal form play in professional indemnity insurance documentation? The proposal form collects essential information on professional activities, risks, and coverage preferences. Accurate completion of this form is crucial for policy approval and appropriate coverage limits.

Is a contract copy necessary for professional indemnity insurance applications? Insurers may require contracts or engagement letters with clients to understand the scope of professional work and potential liabilities. This helps in evaluating risk exposures tied to specific projects or clients.

Can references or testimonials support a professional indemnity insurance application? While not always mandatory, references or client testimonials can enhance credibility and reduce underwriting concerns. These documents highlight professional competence and reliability.

How should professionals organize their documentation for a professional indemnity insurance application? Keeping all documents up-to-date, clearly labeled, and accessible streamlines the review process. Organized documentation improves communication with the insurer and expedites policy issuance.

Key Documents Required for Application

Professional indemnity insurance requires specific documents to complete your application effectively. Key documents help verify your professional background and the risks involved in your practice.

Proof of identity, business registration, and previous insurance certificates are essential. Financial statements and a detailed description of your professional activities further support the underwriting process.

Policy Schedule and Certificate of Insurance

For Professional Indemnity Insurance, the Policy Schedule is a crucial document that outlines the specific terms, coverage limits, and the period of insurance. It serves as a detailed summary of what is insured under your policy.

The Certificate of Insurance provides formal proof of your insurance coverage and is often required when working with clients or regulatory bodies. This document verifies your policy is active and specifies key details, ensuring your professional protection is recognized.

Disclosure Statements and Declarations

Professional indemnity insurance requires accurate disclosure statements to assess risk and determine coverage. These statements must include details about past claims, business activities, and any potential liabilities.

Declarations form a critical part of the application process, confirming that all information provided is truthful and complete. Failure to disclose relevant information may result in denial of claims or cancellation of the policy. You must carefully review and sign these documents to ensure full compliance with insurer requirements.

Proposal Form: Essential Information to Include

Professional indemnity insurance requires specific documentation to ensure appropriate coverage and risk assessment. The proposal form plays a critical role by capturing essential information accurately.

- Personal and Business Details - Include your full name, business name, contact information, and registration number for verification and identification purposes.

- Nature of Professional Services - Clearly describe the services offered, detailing the scope and any specialties to tailor the policy to your professional risks.

- Claims History - Provide previous claims or legal actions related to professional liability to help insurers evaluate risk and set premiums accordingly.

Claims History and Supporting Evidence

For professional indemnity insurance, claims history documentation is essential to assess past liabilities and risk exposure accurately. Insurers require detailed records of previous claims, including dates, nature of claims, and outcomes. Supporting evidence such as correspondence, settlement agreements, and expert reports strengthens the application and facilitates smoother claim processing.

Risk Assessment and Underwriting Documentation

| Document Type | Purpose | Details |

|---|---|---|

| Risk Assessment Report | Evaluate potential liabilities | Comprehensive analysis of business activities, client contracts, and past claim history to identify exposure to professional risks. |

| Professional Qualifications | Confirm expertise and credentials | Copies of certifications, licenses, and relevant educational background supporting the insured's professional competence. |

| Business Financial Statements | Assess financial stability | Recent balance sheets, income statements, and cash flow statements to determine the financial health affecting underwriting decisions. |

| Client Contract Samples | Review scope of services and liabilities | Typical agreements outlining the terms, responsibilities, and indemnity clauses impacting risk exposure. |

| Claims History Documentation | Analyze previous claims | Records of prior insurance claims related to professional indemnity, including outcomes and settlements. |

| Insurance Application Form | Provide detailed information to insurer | Completed application detailing professional activities, coverage requirements, and declaration of any known risks. |

| Risk Management Procedures | Demonstrate mitigation strategies | Policies and protocols implemented to reduce the likelihood and impact of professional errors or omissions. |

Submission Guidelines and Format Requirements

Submitting the correct documents is crucial for a smooth professional indemnity insurance application process. Understanding the submission guidelines and format requirements will help you avoid delays and ensure accurate evaluation.

- Completed Application Form - Must be filled out accurately, signed, and dated to verify your professional details and insurance needs.

- Proof of Professional Qualification - Submit certificates or licenses in PDF or scanned format to confirm your eligibility and expertise.

- Claims History - Provide a detailed statement of previous claims or incidents, formatted clearly as per insurer specifications to assess risk.

Following these documentation standards increases the likelihood of timely processing for your professional indemnity insurance application.

Common Documentation Errors to Avoid

Professional indemnity insurance requires accurate documentation such as proof of qualifications, client contracts, and detailed records of previous claims. Common errors include submitting outdated certificates, incomplete claim forms, and missing signatures. Ensuring your documents are complete and up-to-date helps prevent delays in processing your insurance application.

What Documents are Necessary for Professional Indemnity Insurance? Infographic