To apply for renters insurance, essential documents include a government-issued ID, proof of residency such as a lease agreement, and an inventory of personal belongings with estimated values. Applicants may also need to provide payment information and sometimes prior insurance records if applicable. Accurate documentation ensures a smooth application process and appropriate coverage.

What Documents Are Necessary for Renters Insurance Application?

| Number | Name | Description |

|---|---|---|

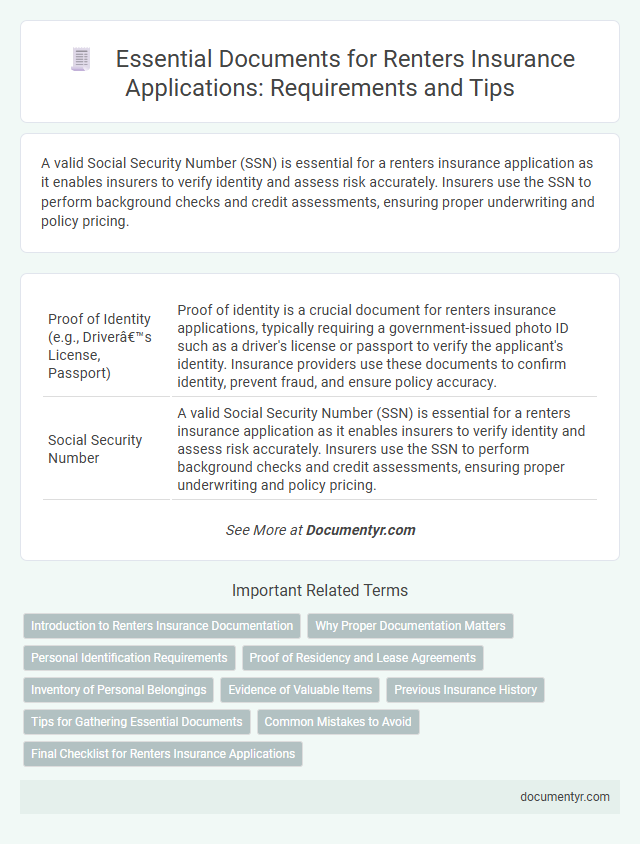

| 1 | Proof of Identity (e.g., Driver’s License, Passport) | Proof of identity is a crucial document for renters insurance applications, typically requiring a government-issued photo ID such as a driver's license or passport to verify the applicant's identity. Insurance providers use these documents to confirm identity, prevent fraud, and ensure policy accuracy. |

| 2 | Social Security Number | A valid Social Security Number (SSN) is essential for a renters insurance application as it enables insurers to verify identity and assess risk accurately. Insurers use the SSN to perform background checks and credit assessments, ensuring proper underwriting and policy pricing. |

| 3 | Proof of Residency (e.g., Lease Agreement, Utility Bill) | Proof of residency documents, such as a current lease agreement or recent utility bill, are essential for renters insurance applications to verify the insured property's address and occupancy status. Insurers rely on these documents to assess risk accurately and ensure coverage aligns with the insured location. |

| 4 | Completed Insurance Application Form | A completed insurance application form is essential for renters insurance, containing detailed personal information, property details, coverage preferences, and identification. Accurate and thorough completion ensures proper risk assessment and expedites the policy approval process. |

| 5 | List of Personal Belongings (Inventory) | A detailed list of personal belongings, or an inventory, is essential for renters insurance applications to accurately assess coverage and potential claims. This inventory should include descriptions, purchase dates, values, and receipts or photos to substantiate the items owned. |

| 6 | Estimated Value of Personal Property | Renters insurance applications require an accurate inventory of personal property along with estimated values to determine adequate coverage limits. Detailed receipts, appraisals, and photographs help substantiate the estimated value of belongings for claim processing and premium calculations. |

| 7 | Previous Insurance Information (if applicable) | Providing previous insurance information, including prior renters insurance policy numbers and coverage details, helps streamline the application process and may qualify applicants for loyalty discounts. Accurate documentation of past claims history and policy periods also allows insurers to assess risk more effectively and customize coverage options. |

| 8 | Contact Information for Landlord or Property Management | Providing accurate contact information for your landlord or property management is essential when applying for renters insurance, as insurers often require verification of the rental agreement and property details. This contact information typically includes full name, phone number, and email address to facilitate prompt communication and confirmation of tenancy. |

| 9 | Payment Information (Bank Details, Credit Card) | Essential documents for renters insurance application include valid payment information such as bank account details for direct debit or credit card information for automatic premium payments, ensuring smooth transaction processing. Accurate and up-to-date financial data helps insurance providers verify payment methods and facilitate timely policy activation. |

| 10 | Pet Information (if applicable) | Pet information required for a renters insurance application typically includes the breed, size, and vaccination records of any pets to assess liability risks. Providing detailed pet documentation ensures accurate policy coverage and helps determine potential exclusions or additional premiums related to pet-related claims. |

| 11 | Fire Safety Features Documentation (if requested) | Fire safety features documentation, such as certificates of smoke detector installation, fire extinguisher presence, and compliance with local fire codes, may be required for renters insurance applications. Submitting these documents demonstrates reduced fire risk, potentially lowering premiums and expediting approval. |

| 12 | Security System Information (if present) | Renters insurance applications require documentation such as a lease agreement, proof of identity, and details of the insured property, while providing information about any installed security systems like alarms or surveillance cameras can significantly lower premiums. Insurers may request verification of security features through system installation receipts or monitoring service contracts to assess risk and enhance coverage terms. |

Introduction to Renters Insurance Documentation

Renters insurance provides essential protection for your personal belongings and liability while renting a home or apartment. Understanding what documentation is required will streamline your application process.

- Proof of Identity - A government-issued ID such as a driver's license or passport verifies your identity for the insurance provider.

- Rental Agreement - This document confirms your tenancy and the insured property's address.

- Inventory of Personal Belongings - A detailed list or photos of your possessions helps establish coverage limits and claim accuracy.

Why Proper Documentation Matters

Submitting the correct documents is essential when applying for renters insurance to ensure a smooth approval process. Proper documentation verifies your identity, residency, and the value of your belongings.

Required documents typically include a government-issued ID, a copy of your lease agreement, and an inventory of personal property. These papers help insurers assess risk accurately and determine appropriate coverage and premiums. Providing accurate documentation prevents delays and potential claim disputes in the future.

Personal Identification Requirements

When applying for renters insurance, providing valid personal identification is essential to verify your identity. Commonly accepted documents include a government-issued photo ID such as a driver's license, passport, or state ID card. These forms of identification help insure companies accurately match the policyholder to the application and prevent fraud.

Proof of Residency and Lease Agreements

Proof of residency and lease agreements are essential documents for a renters insurance application. These documents verify your living situation and the rental property's legitimacy.

- Proof of Residency - Documents like utility bills or official mail confirm your current address and residency status.

- Lease Agreement - The signed lease contract details the rental terms, property address, and landlord information.

- Importance for Insurance - Insurers use these documents to validate the insured location and assess risk accurately.

Submitting accurate proof of residency and a valid lease agreement ensures a smooth renters insurance application process.

Inventory of Personal Belongings

When applying for renters insurance, an inventory of personal belongings is crucial to ensure accurate coverage. This document lists all valuable items within the rental property along with their estimated value.

The inventory helps insurance providers assess the replacement cost in case of theft, damage, or loss. Photographs, receipts, or appraisals often accompany the inventory to validate the items listed.

Evidence of Valuable Items

Providing evidence of valuable items is a crucial part of your renters insurance application. This documentation helps insurers accurately assess the worth of high-value possessions for proper coverage.

- Receipts or Purchase Invoices - Proof of original purchase price and date confirms the value of your valuable items.

- Photographs or Videos - Visual documentation creates a detailed record of the item's condition and existence.

- Appraisals or Certificates of Authenticity - Expert evaluations validate the item's worth, especially for jewelry, art, or collectibles.

Previous Insurance History

What documents are necessary to prove your previous insurance history when applying for renters insurance? Insurance providers typically require a copy of your previous insurance policy or a declaration page as proof. These documents help establish your coverage history and may influence your new policy's terms and rates.

Tips for Gathering Essential Documents

Gathering essential documents for a renters insurance application ensures a smooth and efficient process. Key documents verify your identity, rental agreement, and the value of personal belongings.

Include a valid government-issued ID, a copy of your lease or rental agreement, and an inventory list of your possessions with estimated values. Receipts or appraisals for high-value items strengthen your application and help determine accurate coverage.

Common Mistakes to Avoid

When applying for renters insurance, key documents include a valid ID, proof of residency, and an inventory of personal belongings. Common mistakes to avoid involve submitting incomplete documentation, underestimating the value of possessions, and neglecting to disclose previous claims. Ensuring accurate and thorough paperwork accelerates approval and prevents coverage issues.

What Documents Are Necessary for Renters Insurance Application? Infographic