To file a homeowners insurance claim, you need to provide the completed claim form, a copy of your insurance policy, and proof of loss such as photographs or videos of the damage. Supporting documents like repair estimates, receipts for temporary repairs, and police reports (if applicable) are essential to validate your claim. Timely submission of these records ensures a smoother and faster claims process.

What Documents Are Required for Filing a Homeowners Insurance Claim?

| Number | Name | Description |

|---|---|---|

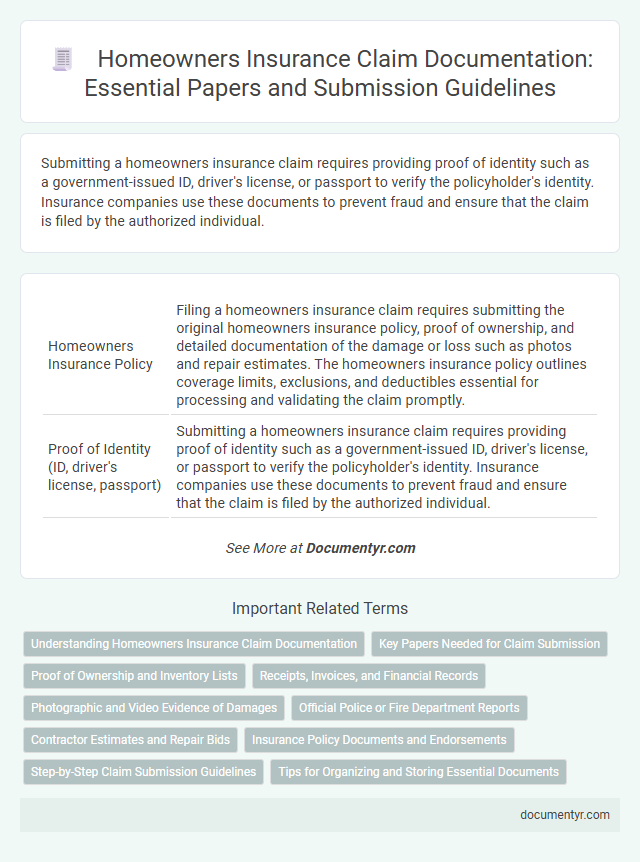

| 1 | Homeowners Insurance Policy | Filing a homeowners insurance claim requires submitting the original homeowners insurance policy, proof of ownership, and detailed documentation of the damage or loss such as photos and repair estimates. The homeowners insurance policy outlines coverage limits, exclusions, and deductibles essential for processing and validating the claim promptly. |

| 2 | Proof of Identity (ID, driver's license, passport) | Submitting a homeowners insurance claim requires providing proof of identity such as a government-issued ID, driver's license, or passport to verify the policyholder's identity. Insurance companies use these documents to prevent fraud and ensure that the claim is filed by the authorized individual. |

| 3 | Completed Claim Form | Submitting a completed claim form is essential for initiating a homeowners insurance claim, as it provides detailed information about the incident, policyholder, and specific damages incurred. Accurate completion of this form helps expedite the claims process and ensures the insurer has all necessary data to assess and validate the claim effectively. |

| 4 | Police Report (if applicable: theft, vandalism) | A police report is essential for filing a homeowners insurance claim involving theft or vandalism, providing official documentation of the incident. This report helps validate the claim and expedites the investigation and settlement process with the insurance company. |

| 5 | Fire Department Report (if applicable: fire damage) | The Fire Department Report is a crucial document when filing a homeowners insurance claim for fire damage, providing official verification of the incident and details about the fire's origin and extent. Including this report ensures accurate assessment and timely processing of the claim by the insurance company. |

| 6 | List of Damaged or Stolen Items (inventory) | A detailed list of damaged or stolen items, including descriptions, purchase dates, and approximate values, is essential for filing a homeowners insurance claim to ensure accurate reimbursement. Supporting documents such as photos, receipts, and appraisals strengthen the inventory and expedite the claims process. |

| 7 | Receipts or Proof of Purchase for Damaged Items | Receipts or proof of purchase for damaged items are essential documents when filing a homeowners insurance claim, as they provide verified evidence of the item's value and ownership. Insurance companies rely on these documents to accurately assess the claim amount and expedite the reimbursement process. |

| 8 | Photos or Videos of Damaged Property | Photos or videos of damaged property provide crucial visual evidence for homeowners insurance claims, clearly documenting the extent of destruction and supporting the assessment process. Including detailed multimedia files with timestamps helps insurers verify the claim's validity and accelerates the approval and settlement timeline. |

| 9 | Repair Estimates or Contractor Quotes | Repair estimates or contractor quotes are essential documents when filing a homeowners insurance claim, as they provide detailed cost assessments for damages and repairs needed. Insurance companies rely on these professionally prepared documents to verify the scope of damage, determine claim validity, and calculate accurate compensation amounts. |

| 10 | Temporary Repairs Receipts | Temporary repairs receipts are essential for filing a homeowners insurance claim as they provide proof of immediate actions taken to prevent further damage after an incident such as roof tarping, boarding up broken windows, or water damage mitigation. Insurers require these receipts to verify the legitimacy of expenses and to process reimbursement for emergency repairs that protect the property while the claim is under review. |

| 11 | Medical Reports (if personal injury involved) | Homeowners insurance claims involving personal injury require detailed medical reports to substantiate the extent and nature of the injuries sustained. These medical documents should include physician evaluations, hospital records, treatment plans, and any related medical bills to ensure accurate claim processing and fair compensation. |

| 12 | Bank Account Information (for claim payment) | Bank account information, including account number and routing number, is essential for filing a homeowners insurance claim to ensure direct deposit of claim payments. Providing accurate bank details expedites the reimbursement process and minimizes payment delays. |

| 13 | Correspondence with the Insurance Company | When filing a homeowners insurance claim, maintaining thorough and organized correspondence with the insurance company is crucial, including copies of claim forms, email exchanges, letters, and notes from phone conversations. These documents serve as official records to track claim progress, verify information accuracy, and support dispute resolution if coverage or payment issues arise. |

| 14 | Property Deed or Mortgage Statement | Submitting a property deed or mortgage statement is essential when filing a homeowners insurance claim to verify ownership and confirm the insured property's legal description. These documents help insurers assess the claim's legitimacy and expedite the processing by providing proof of the policyholder's investment in the home. |

| 15 | Witness Statements (if available) | Witness statements are crucial documents for filing a homeowners insurance claim as they provide third-party verification of the incident, helping to establish the circumstances surrounding the loss or damage. Collecting detailed accounts from witnesses, including contact information and signed declarations, strengthens the claim by supporting the insured's version of events and facilitating a smoother claims process. |

| 16 | Appraisal Reports (if applicable) | Appraisal reports are essential for filing a homeowners insurance claim when property value disputes arise, providing an expert assessment to support the claim amount. These documents should include detailed evaluations of the property's condition, market value, and any damages incurred to ensure accurate claim processing. |

Understanding Homeowners Insurance Claim Documentation

Filing a homeowners insurance claim requires specific documentation to ensure a smooth and efficient process. Understanding the necessary documents helps prevent delays and supports the accuracy of your claim.

Key documents include the insurance policy, a completed claim form, and proof of ownership for the damaged property. Photographs or videos of the damage provide essential visual evidence. Receipts, repair estimates, and any relevant police or fire reports further strengthen the claim documentation.

Key Papers Needed for Claim Submission

Filing a homeowners insurance claim requires several key documents to ensure a smooth and accurate process. Providing complete and organized paperwork helps expedite claim approval and compensation.

- Insurance Policy Document - This paper outlines the coverage terms and conditions and verifies your insurance contract.

- Proof of Loss Statement - A detailed report listing the items damaged or lost, describing the incident and estimated values.

- Photographic Evidence - Photos or videos of the damage serve as visual proof to support the claim.

- Receipts and Invoices - Original purchase receipts or repair invoices help validate the value of the damaged property.

- Police or Fire Reports - Official reports provide verification for claims involving theft, vandalism, or fire damage.

Submitting these documents promptly improves the likelihood of a timely and fair insurance claim resolution.

Proof of Ownership and Inventory Lists

Filing a homeowners insurance claim requires specific documents to ensure a smooth process. Proof of ownership, such as a deed or mortgage statement, validates your legal possession of the property. Detailed inventory lists, including descriptions and values of personal belongings, help substantiate the extent of the loss and support accurate claim assessment.

Receipts, Invoices, and Financial Records

Receipts, invoices, and financial records are essential for substantiating the value of damaged or lost property in a homeowners insurance claim. These documents help verify expenses and support the accuracy of the claim amount.

- Receipts for Purchased Items - Provide proof of original cost and purchase date for damaged or replaced belongings.

- Invoices for Repair Services - Show detailed charges and services performed to restore your home or property.

- Financial Records of Improvements - Document any upgrades or renovations that increase the insured value of your home.

Photographic and Video Evidence of Damages

What photographic and video evidence is required for filing a homeowners insurance claim? Clear images and videos showing the extent of the property damage are essential for supporting your claim. These visual documents help insurance adjusters assess the severity and verify the legitimacy of your losses efficiently.

Official Police or Fire Department Reports

| Document Type | Description | Importance in Homeowners Insurance Claim | Source |

|---|---|---|---|

| Official Police Report | Detailed record filed by law enforcement documenting incidents such as burglary, vandalism, theft, or any event causing property damage. | Serves as verified evidence of the incident, crucial for claim validation and preventing fraud. | Local Police Department |

| Fire Department Report | Comprehensive report created by fire department personnel outlining fire cause, extent of damage, and response actions. | Provides authoritative confirmation of fire-related damage and helps determine claim legitimacy and severity. | Local Fire Department |

Contractor Estimates and Repair Bids

Filing a homeowners insurance claim requires specific documentation to support the damage assessment and repair costs. Contractor estimates and repair bids play a crucial role in validating the extent of the damage and the projected expenses.

- Contractor Estimates - Detailed cost breakdowns from licensed contractors help insurance adjusters verify repair needs and costs.

- Repair Bids - Multiple bids provide a comparative analysis to ensure fair pricing and scope of work for the repairs.

- Itemized Documentation - Clear, itemized estimates improve claim accuracy and speed up the approval process.

Insurance Policy Documents and Endorsements

Filing a homeowners insurance claim requires specific documentation to ensure a smooth process. The primary documents include the original insurance policy and any endorsements that modify coverage details.

Insurance policy documents outline the scope of coverage, exclusions, and claim procedures essential for validating the claim. Endorsements provide critical updates or changes to the policy terms that can affect claim eligibility and payout amounts.

Step-by-Step Claim Submission Guidelines

Filing a homeowners insurance claim requires several essential documents to ensure smooth processing. Gather your insurance policy, a detailed inventory of damaged or lost items, and proof of ownership such as receipts or photographs. Additionally, include any repair estimates and official reports like police or fire department documents if applicable.

Start the claim submission by contacting your insurance provider promptly to report the incident. Complete the claim form provided by the insurer with accurate details about the damage or loss. Attach all required documents, including photos of the damage, along with the claim form before submission.

Keep copies of all submitted documents and correspondence with your insurance company for reference. Follow up regularly to monitor the status of your claim and provide any additional information requested by the adjuster. Understanding this step-by-step guideline helps ensure timely and efficient claim resolution.

What Documents Are Required for Filing a Homeowners Insurance Claim? Infographic