Small businesses need several key documents for a commercial insurance application, including a detailed business plan, financial statements, and proof of ownership or operational licenses. Insurance providers also require employee information, such as payroll records and workers' compensation details, as well as prior insurance policies and claims history. Accurate documentation helps insurers assess risk and determine appropriate coverage options tailored to the business's specific needs.

What Documents Does a Small Business Need for Commercial Insurance Application?

| Number | Name | Description |

|---|---|---|

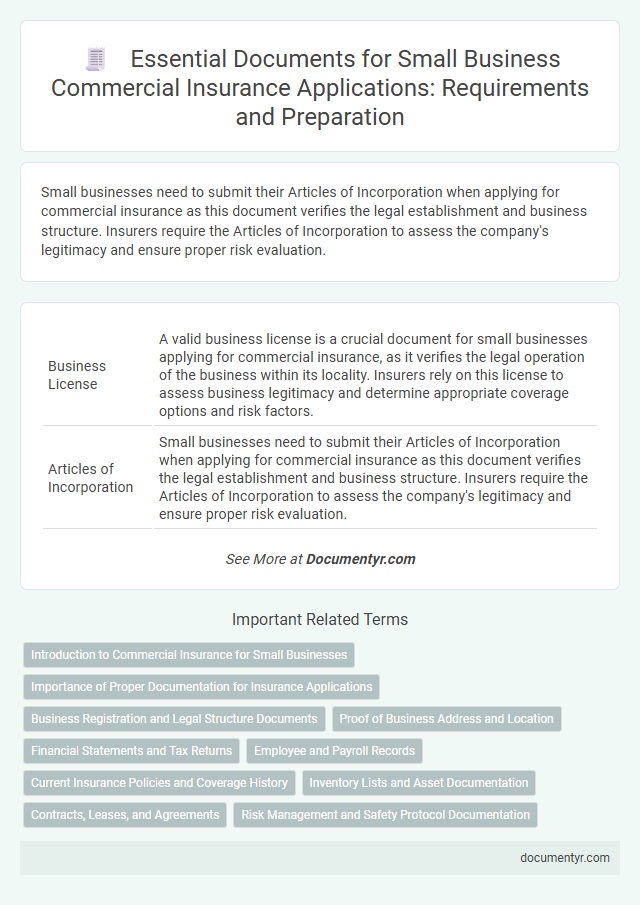

| 1 | Business License | A valid business license is a crucial document for small businesses applying for commercial insurance, as it verifies the legal operation of the business within its locality. Insurers rely on this license to assess business legitimacy and determine appropriate coverage options and risk factors. |

| 2 | Articles of Incorporation | Small businesses need to submit their Articles of Incorporation when applying for commercial insurance as this document verifies the legal establishment and business structure. Insurers require the Articles of Incorporation to assess the company's legitimacy and ensure proper risk evaluation. |

| 3 | Employer Identification Number (EIN) | A small business must provide its Employer Identification Number (EIN) when applying for commercial insurance to verify its legal identity and facilitate tax reporting. The EIN is crucial for underwriters to assess risk accurately and ensure compliance with federal regulations. |

| 4 | Prior Insurance Policies | Small businesses must provide prior insurance policies, including certificates of insurance and claims history, to demonstrate risk management and coverage continuity during a commercial insurance application. Insurers assess these documents to evaluate previous coverage limits, policy types, and any past claims that may affect underwriting decisions. |

| 5 | Loss Run Reports | Loss run reports provide a detailed history of a small business's insurance claims, which insurers use to assess risk and determine premium rates for commercial insurance applications. These reports typically include claim dates, amounts paid, claim status, and descriptions, making them an essential document for accurate underwriting and policy evaluation. |

| 6 | Financial Statements | Small businesses applying for commercial insurance must provide comprehensive financial statements, including balance sheets, income statements, and cash flow statements, to demonstrate financial stability and risk level. Accurate financial documents help insurers evaluate the business's ability to cover liabilities and determine appropriate coverage and premium rates. |

| 7 | Tax Returns | Small businesses typically need to provide recent tax returns to validate financial stability and revenue streams when applying for commercial insurance. These documents help insurers assess risk by verifying income, expenses, and overall business health for accurate policy underwriting. |

| 8 | Lease Agreements | Lease agreements play a critical role in a small business's commercial insurance application by providing proof of premises and outlining property responsibilities, which insurers use to assess risk and coverage needs. Detailed lease documents help validate the business location, clarify ownership liabilities, and influence premium calculations based on property conditions and usage terms. |

| 9 | Asset Inventory List | A detailed asset inventory list is crucial for a small business applying for commercial insurance, as it provides a comprehensive record of all physical and digital assets, including equipment, inventory, and property. This document enables insurers to accurately assess risk and determine appropriate coverage and premiums. |

| 10 | Vehicle Registration (if applicable) | Small businesses applying for commercial insurance must provide vehicle registration documents to verify ownership and ensure accurate coverage for company vehicles. These documents include the official vehicle registration certificate and proof of any modifications or additional equipment that may affect insurance risk assessment. |

| 11 | Employee Roster | A small business applying for commercial insurance must provide a detailed employee roster listing full names, job titles, hire dates, and Social Security numbers to accurately assess risk and premium costs. This document helps insurers verify payroll amounts and eligibility for workers' compensation coverage, ensuring compliance with underwriting requirements. |

| 12 | Workers’ Compensation Records | Small businesses must provide accurate Workers' Compensation Records, including payroll reports, injury logs, and claims history, to ensure proper coverage and risk assessment during the commercial insurance application. These documents substantiate employee exposure to workplace risks and help insurers determine appropriate premiums and policy terms. |

| 13 | Proof of Ownership Documents | Small businesses must provide proof of ownership documents such as property deeds, lease agreements, or business licenses when applying for commercial insurance. These documents verify legal ownership and help insurers assess risk and coverage eligibility accurately. |

| 14 | Contracts with Clients or Vendors | Small businesses must provide contracts with clients or vendors to demonstrate established business relationships and financial reliability, which insurers use to assess risk and coverage needs. These contracts often include terms of service, payment agreements, and scopes of work that verify operational legitimacy and potential liabilities. |

| 15 | Risk Management Policies | Small businesses applying for commercial insurance must provide comprehensive risk management policies, including documented safety procedures, employee training records, and incident response plans. These documents demonstrate proactive risk mitigation efforts essential for accurately evaluating policy coverage and premiums. |

| 16 | Payroll Records | Payroll records are essential for small businesses applying for commercial insurance as they provide accurate data on employee wages, hours worked, and job classifications, which insurers use to assess risk and calculate premiums. Maintaining organized, up-to-date payroll documentation ensures compliance with insurance requirements and facilitates a smoother underwriting process. |

| 17 | Equipment Purchase Receipts | Equipment purchase receipts serve as critical proof of asset ownership and value in a commercial insurance application for small businesses. These documents help insurers accurately assess risk and determine appropriate coverage limits for business equipment. |

| 18 | Professional Licenses or Certifications | Small businesses must provide professional licenses or certifications relevant to their industry when applying for commercial insurance, as these documents validate expertise and compliance with regulatory standards. Insurers use these credentials to assess risk levels and ensure the business operates legally and meets industry-specific requirements. |

| 19 | Certificate of Occupancy | A Certificate of Occupancy is a crucial document required for a small business commercial insurance application, as it verifies that the business premises comply with local building codes and zoning laws. Insurers rely on this certificate to assess risk accurately and confirm the location is legally authorized for commercial use. |

| 20 | Site Plan or Floor Plan | A detailed site plan or floor plan is essential for commercial insurance applications as it provides the insurer with precise information regarding the layout, square footage, and structural features of the business premises. Accurate documentation of property dimensions and location of fire exits, security systems, and hazardous areas helps in assessing risk levels and determining appropriate coverage and premium rates. |

Introduction to Commercial Insurance for Small Businesses

Commercial insurance protects small businesses from financial losses due to unexpected events. It covers risks such as property damage, liability claims, and employee injuries.

When applying for commercial insurance, your business must provide specific documents to verify operations and risk factors. Proper documentation helps insurers assess your coverage needs accurately.

Importance of Proper Documentation for Insurance Applications

| Document Type | Description | Importance for Commercial Insurance Application |

|---|---|---|

| Business License | Official permit to operate your business legally within a specific jurisdiction. | Verifies legitimacy and compliance, essential for underwriting and risk assessment. |

| Financial Statements | Income statements, balance sheets, and cash flow reports that reflect business financial health. | Demonstrates financial stability, impacting premium calculations and coverage limits. |

| Previous Insurance Policies | Records of past commercial insurance coverage and claims history. | Provides insurer with risk evaluation and helps avoid gaps in coverage. |

| Employee Details | Information on the number of employees and their roles in the business. | Assists in determining workers' compensation and liability coverage requirements. |

| Business Property Details | Descriptions and valuations of physical assets owned or leased by the business. | Crucial for accurate property insurance coverage and risk management. |

| Safety and Compliance Records | Documentation of safety protocols, inspections, and regulatory compliance. | Indicates risk mitigation efforts, potentially lowering premiums. |

| Contracts with Clients or Vendors | Agreements outlining business operations and liabilities. | Helps determine liability exposures and required coverage types. |

Proper documentation streamlines the commercial insurance application process. Accurate and complete records improve risk evaluation and ensure that Your business receives appropriate coverage. Missing or incorrect documents can delay approvals and risk inadequate protection.

Business Registration and Legal Structure Documents

Applying for commercial insurance requires submitting specific business registration and legal structure documents. These documents verify your business's legitimacy and operational framework.

- Business Registration Certificate - Confirms your business is officially registered with state or local authorities.

- Articles of Incorporation or Organization - Details your company's legal structure, such as corporation or LLC, defining ownership and governance.

- Operating Agreement or Partnership Agreement - Outlines how your business is managed and ownership responsibilities among partners or members.

Proof of Business Address and Location

Proof of business address is a fundamental requirement for a commercial insurance application, as it establishes the physical location of the business. Acceptable documents include utility bills, lease agreements, or property tax receipts that clearly display the business name and address. Insurers rely on this verification to assess risk factors related to the business location and to determine accurate coverage options and premiums.

Financial Statements and Tax Returns

Applying for commercial insurance requires submitting several key documents to accurately assess your business's risk and coverage needs. Financial statements and tax returns are critical for providing proof of your business's financial health.

- Financial Statements - These include balance sheets, income statements, and cash flow statements essential for demonstrating your business's profitability and stability.

- Tax Returns - Business tax returns from previous years verify reported income and expenses, supporting underwriting decisions and premium calculations.

- Consistency Between Documents - Alignment between financial statements and tax returns ensures accuracy and transparency in your insurance application.

Submitting accurate financial documentation streamlines the commercial insurance application process and helps secure appropriate coverage.

Employee and Payroll Records

Employee and payroll records are essential documents for a small business applying for commercial insurance. These records provide detailed information about the workforce and salary expenses, which insurers use to assess risk accurately.

Payroll records include wage details, hours worked, and benefits provided to employees. Accurate employee information such as job titles, start dates, and employment status is also necessary. These documents help insurers determine appropriate coverage levels and premium rates tailored to the business's specific needs.

Current Insurance Policies and Coverage History

Small businesses must provide copies of current insurance policies when applying for commercial insurance. This documentation helps insurers assess existing coverage and identify any gaps or overlaps. A detailed coverage history ensures accurate risk evaluation and tailored insurance solutions.

Inventory Lists and Asset Documentation

Small businesses must prepare accurate inventory lists and comprehensive asset documentation when applying for commercial insurance. These documents help insurers assess risk and determine appropriate coverage levels.

- Inventory Lists - Detailed records of all products, raw materials, and supplies ensure accurate valuation of business assets for insurance purposes.

- Asset Documentation - Proof of ownership, purchase receipts, and appraisals validate the value of physical assets like equipment and machinery.

- Regular Updates - Maintaining current inventory and asset records helps prevent underinsurance and facilitates smooth claims processing.

Contracts, Leases, and Agreements

Contracts, leases, and agreements are essential documents required for a commercial insurance application. These documents provide proof of your business obligations and operational scope.

Insurance providers use contracts and leases to assess risk exposure related to property and liability coverage. Well-documented agreements help in accurately determining premium rates and policy terms.

What Documents Does a Small Business Need for Commercial Insurance Application? Infographic