Proof of insurance at the DMV requires providing a valid insurance card or policy declaration page that clearly shows the vehicle owner's name, insurance company, and policy number. Some states may also accept electronic proof through mobile apps or digital insurance cards. Always verify specific DMV requirements beforehand to ensure all necessary documents are prepared for registration or renewal.

What Documents Are Needed for Proof of Insurance at DMV?

| Number | Name | Description |

|---|---|---|

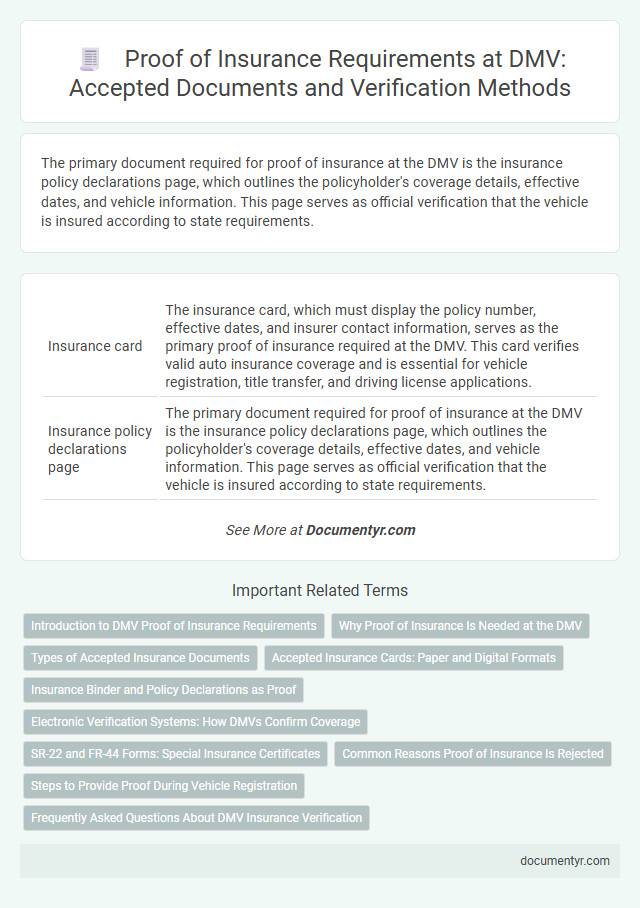

| 1 | Insurance card | The insurance card, which must display the policy number, effective dates, and insurer contact information, serves as the primary proof of insurance required at the DMV. This card verifies valid auto insurance coverage and is essential for vehicle registration, title transfer, and driving license applications. |

| 2 | Insurance policy declarations page | The primary document required for proof of insurance at the DMV is the insurance policy declarations page, which outlines the policyholder's coverage details, effective dates, and vehicle information. This page serves as official verification that the vehicle is insured according to state requirements. |

| 3 | SR-22 form (if applicable) | For proof of insurance at the DMV, motorists must present a valid insurance policy card or certificate, and if required, an SR-22 form filed by their insurance company confirms financial responsibility following driving violations. The SR-22 form is often mandated for high-risk drivers and serves as a crucial document verifying that the individual maintains the minimum state-required liability coverage. |

| 4 | Proof of financial responsibility certificate | A Proof of Financial Responsibility certificate is required by the DMV to verify that drivers maintain the minimum auto insurance coverage mandated by state law. This document typically includes policy number, vehicle details, effective dates, and insurer contact information, serving as official evidence of valid insurance coverage. |

| 5 | Binder or temporary insurance card | A binder or temporary insurance card serves as immediate proof of insurance at the DMV, verifying vehicle coverage until the permanent policy documents arrive. This document must include the insurer's name, the insured vehicle's details, effective dates, and policy number to be accepted for registration or title processing. |

| 6 | Letter of coverage from insurance company | A letter of coverage from your insurance company is required at the DMV as official proof of active auto insurance, confirming policy details such as coverage dates and policy number. This document verifies compliance with state insurance mandates and must be presented during vehicle registration or title transfer processes. |

| 7 | Electronic proof of insurance (digital) | Electronic proof of insurance at the DMV requires a digital insurance card or a mobile app confirmation showing the policy number, insured vehicle details, coverage dates, and insurer information. Most states accept screenshots or QR codes from the insurer's app, streamlining verification while reducing paperwork during vehicle registration or driving record updates. |

| 8 | Bill of sale with insurance information (sometimes accepted) | The Department of Motor Vehicles (DMV) often requires a bill of sale that includes insurance information as proof of insurance, especially when registering a newly purchased vehicle. While not always accepted alone, the bill of sale with detailed insurance coverage can sometimes serve as temporary proof until official insurance documents are provided. |

| 9 | DMV insurance affidavit form (state-specific) | The DMV insurance affidavit form is a state-specific document required to verify proof of insurance, often including policy number, insurer details, and effective dates. Submitting a completed affidavit ensures compliance with state insurance mandates and facilitates vehicle registration and licensing processes. |

| 10 | Insurance renewal notice (occasionally accepted) | The DMV may accept an insurance renewal notice as proof of insurance if it clearly displays the policy number, effective dates, and insured vehicle information. However, some states require an official insurance card or declaration page for verification, so it is essential to confirm specific DMV requirements beforehand. |

Introduction to DMV Proof of Insurance Requirements

When visiting the Department of Motor Vehicles (DMV), providing proof of insurance is a mandatory requirement to register or renew a vehicle. This documentation verifies that the vehicle is covered by a valid insurance policy in compliance with state laws.

Proof of insurance typically includes a current insurance card or certificate issued by the insurance provider. The document must clearly show the policyholder's name, policy number, vehicle details, and coverage dates. Meeting these requirements helps ensure legal driving and avoids penalties or fines at the DMV.

Why Proof of Insurance Is Needed at the DMV

| Document | Description | Purpose at DMV |

|---|---|---|

| Insurance Card | Official proof issued by your insurance company including policy number, coverage dates, and vehicle details. | Confirms active auto insurance coverage required for vehicle registration, renewal, or title transfer. |

| Digital Insurance Proof | Electronic version of the insurance card accessible via mobile apps or email, accepted by most DMV locations. | Verifies up-to-date insurance without physical documents, streamlining DMV processes. |

| Binder/Temporary Insurance | Temporary document proving short-term insurance coverage before a formal policy is issued. | Provides immediate proof of insurance, allowing vehicle registration while formal documents are pending. |

| SR-22 Form | Certification of financial responsibility filed by the insurance company, typically required after violations. | Ensures compliance with legal insurance requirements mandated by the DMV for high-risk drivers. |

| Vehicle Registration Documents | Documents showing vehicle registration status that may require updated insurance proof. | Links insurance status to vehicle ownership and validates registration transactions at the DMV. |

Why Proof of Insurance Is Needed at the DMV

Proof of insurance is crucial at the DMV to ensure that all registered vehicles have valid financial liability coverage. This requirement protects all drivers by guaranteeing compensation for damages or injuries resulting from accidents. The DMV validates insurance to comply with state laws, prevent uninsured driving, and maintain public safety on roads. Without this verification, vehicle registration or renewal cannot be completed. This process helps reduce the risk of financial loss and legal consequences for both individual drivers and the community.

Types of Accepted Insurance Documents

When visiting the DMV, providing acceptable proof of insurance is essential to complete vehicle registration or renewals. The DMV requires specific types of insurance documents that clearly verify coverage details.

- Insurance Card - A valid insurance card issued by the provider showing policy number, vehicle details, and effective dates.

- Electronic Proof - Digital insurance documents or electronic insurance cards accessible on a smartphone or tablet are accepted.

- Insurance Policy Declaration Page - A declaration page from the insurance policy confirming active coverage and policyholder information.

Accepted Insurance Cards: Paper and Digital Formats

When visiting the DMV, proof of insurance is mandatory to register or renew your vehicle. Accepted insurance cards come in both paper and digital formats, ensuring convenience for all drivers.

Your insurance card must display key details such as policy number, effective dates, and the insured vehicle's information. Digital insurance cards on smartphones are widely accepted, but the digital copy should be clear and accessible for DMV personnel.

Insurance Binder and Policy Declarations as Proof

When proving insurance at the DMV, an insurance binder serves as a temporary proof of coverage until the official policy is issued. The insurance binder includes essential details such as the insured vehicle, coverage limits, and effective dates. Policy declarations provide a formal summary of the insurance policy, confirming active coverage required by the DMV for vehicle registration or renewal.

Electronic Verification Systems: How DMVs Confirm Coverage

Proof of insurance at the DMV is essential to register a vehicle and comply with state laws. Electronic verification systems have streamlined this process by allowing instant confirmation of insurance coverage.

- Insurance Identification Card - Your electronic or printed insurance card provides basic details required for manual verification.

- Electronic Verification Systems - DMVs use databases connected to insurance providers to confirm active coverage in real-time.

- Policy Number and Insurer Information - Providing accurate policy details ensures seamless matching within electronic verification platforms.

SR-22 and FR-44 Forms: Special Insurance Certificates

Proof of insurance at the DMV requires specific documents to verify coverage. Special insurance certificates like the SR-22 and FR-44 forms are often necessary for high-risk drivers.

- SR-22 Form - A certificate filed by an insurance company to prove you have the minimum required liability insurance after certain violations.

- FR-44 Form - A mandatory form in some states providing higher liability coverage limits than the SR-22 for serious offenses.

- Insurance Policy or Card - Standard proof of current auto insurance coverage accepted by the DMV.

You must submit the correct form mandated by your state to maintain driving privileges and ensure compliance with legal requirements.

Common Reasons Proof of Insurance Is Rejected

Proof of insurance at the DMV typically requires a valid insurance card displaying your name, policy number, and effective dates. Common reasons proof of insurance is rejected include expired policies, mismatched personal information, or incomplete documentation. Ensuring your insurance documents match DMV records helps prevent delays during registration or licensing processes.

Steps to Provide Proof During Vehicle Registration

When registering a vehicle at the DMV, providing proof of insurance is a mandatory step. The required documents typically include a valid insurance card or policy declarations page issued by your insurer.

You must present these documents in original or electronic format as accepted by the DMV. Confirm that the insurance policy meets your state's minimum coverage requirements to avoid registration delays.

What Documents Are Needed for Proof of Insurance at DMV? Infographic