To process life insurance claims, essential documents include the original policy document, a certified copy of the death certificate, and the claimant's identification proof. Supporting documents such as medical records, proof of relationship, and the claim form filled out by the beneficiary may also be required. Ensuring accurate and complete documentation expedites the claim settlement process.

What Documents are Needed for Life Insurance Claims?

| Number | Name | Description |

|---|---|---|

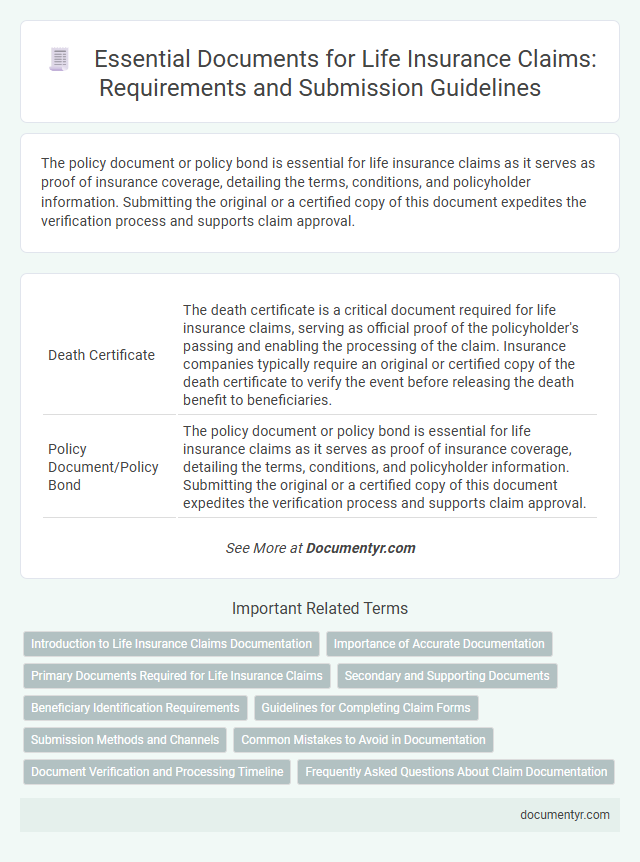

| 1 | Death Certificate | The death certificate is a critical document required for life insurance claims, serving as official proof of the policyholder's passing and enabling the processing of the claim. Insurance companies typically require an original or certified copy of the death certificate to verify the event before releasing the death benefit to beneficiaries. |

| 2 | Policy Document/Policy Bond | The policy document or policy bond is essential for life insurance claims as it serves as proof of insurance coverage, detailing the terms, conditions, and policyholder information. Submitting the original or a certified copy of this document expedites the verification process and supports claim approval. |

| 3 | Claimant’s Identity Proof (ID proof) | Claimant's identity proof for life insurance claims typically includes a valid government-issued ID such as a passport, driver's license, or Aadhaar card to verify the claimant's identity and relationship to the policyholder. Insurance providers require these documents to prevent fraud and ensure claims are processed accurately and promptly. |

| 4 | Claimant’s Address Proof | Claimant's address proof for life insurance claims typically includes government-issued identification documents such as a passport, driver's license, or utility bills that clearly display the claimant's current residential address. These documents help verify the claimant's identity and residence, ensuring the claim process complies with regulatory requirements and prevents fraud. |

| 5 | Claimant’s Relationship Proof (with the insured) | Claimants must provide official documents proving their relationship with the insured, such as a marriage certificate for spouses or birth certificates for children. These proofs are essential to establish eligibility and ensure the claimant's rightful entitlement to the life insurance benefits. |

| 6 | Filled Claim Form | A filled claim form is essential for processing life insurance claims, serving as the primary document that initiates the beneficiary's request for benefits. This form must be accurately completed and submitted alongside the insured's death certificate and policy documents to ensure timely claim settlement. |

| 7 | Medical Records (if applicable) | Life insurance claims require submission of the insured's medical records, including detailed hospitalization reports, doctor's certificates, and medical test results, to verify the cause of death and policy validity. These medical documents are crucial for assessing claim eligibility and accelerating the settlement process. |

| 8 | Hospital Discharge Summary (if applicable) | For life insurance claims, the hospital discharge summary is a critical document as it provides detailed information about the insured's medical condition, treatment, and date of discharge, which validates the claim. Alongside the discharge summary, insurers typically require the death certificate, policy document, claim form, and proof of identity to process the claim efficiently. |

| 9 | Postmortem Report (if required) | A postmortem report is required in life insurance claims to verify the cause and circumstances of death, ensuring that the claim aligns with the policy terms. This document, often mandated for accidental or unclear deaths, serves as a critical piece of evidence for claim approval by insurance companies. |

| 10 | FIR/Police/Investigation Report (for accidental or unnatural death) | For life insurance claims involving accidental or unnatural death, submitting the FIR (First Information Report) or police investigation report is essential to verify the circumstances surrounding the claim. These documents provide critical evidence that supports the claim's legitimacy and expedite the approval process. |

| 11 | Employer Certificate (if group insurance) | For life insurance claims under group insurance, the Employer Certificate serves as a critical document verifying the insured employee's coverage and employment status at the time of death. This certificate, often issued by the employer, confirms policy details and eligibility, expediting the claims process and ensuring accurate benefit disbursement. |

| 12 | Bank Passbook/Cancelled Cheque (for claim payment) | A bank passbook or cancelled cheque is essential for life insurance claims to verify the beneficiary's bank account details for claim disbursement. Providing these documents ensures accurate and timely transfer of the claim amount directly into the nominated account. |

| 13 | Succession Certificate (if nominee is not declared) | A Succession Certificate is essential for life insurance claims when no nominee is declared, as it legally authorizes the claimant to collect the policy proceeds. This document serves as proof of entitlement and helps prevent disputes among legal heirs during the claim settlement process. |

| 14 | Assignment/Transfer Deed (if policy is assigned) | For life insurance claims involving an assigned policy, submitting the original Assignment/Transfer Deed is essential to verify the legal transfer of ownership and ensure the claim is processed correctly. This document, along with the original policy papers, claim form, and the insured's death certificate, enables the insurer to validate the claimant's entitlement under the terms of the assignment. |

| 15 | Legal Heir Certificate (if required) | A Legal Heir Certificate is required for life insurance claims when the policyholder passes away without nominating a beneficiary or when the nominee is no longer alive, ensuring rightful claim settlement to the legal heirs. This document establishes the claimant's legal entitlement to receive the insurance proceeds and must be submitted along with the death certificate, policy documents, and claim form to process the claim smoothly. |

Introduction to Life Insurance Claims Documentation

Filing a life insurance claim requires submitting specific documents to ensure a smooth and timely process. Proper documentation verifies the policyholder's identity and the validity of the claim.

The key documents typically include the original life insurance policy, a completed claim form, and the insured person's death certificate. Additional documents such as medical records, proof of identity, and beneficiary identification may be requested. Accurate and complete paperwork helps avoid delays and facilitates prompt claim settlement by the insurance company.

Importance of Accurate Documentation

Life insurance claims require precise documentation to ensure a smooth and timely process. Key documents include the original policy, the death certificate, and claim forms provided by the insurer. Accurate documentation helps prevent delays and facilitates prompt settlement of Your claim.

Primary Documents Required for Life Insurance Claims

Filing a life insurance claim requires submitting essential documents to verify the policyholder's identity and the claim's validity. These primary documents facilitate a smooth and timely processing of the claim by the insurance provider.

- Death Certificate - An official death certificate issued by a government authority confirms the policyholder's demise, making it mandatory for claim approval.

- Life Insurance Policy Document - The original or a certified copy of the life insurance policy document proves the coverage details and the beneficiary designation.

- Claim Form - A duly filled and signed claim form is required to initiate the claims process and provide necessary claim-related information.

Secondary and Supporting Documents

Secondary and supporting documents play a crucial role in processing life insurance claims efficiently. These include medical reports, hospital records, and cause of death certificates that help verify the claim details.

Other essential documents may consist of identity proofs and bank statements, which ensure proper verification and payment disbursement. Your insurance provider might also request past policy documents or legal affidavits to avoid discrepancies during approval.

Beneficiary Identification Requirements

What documents are needed to verify beneficiary identification for a life insurance claim? An official government-issued ID such as a passport or driver's license is essential. Proof of relationship to the insured, like a birth certificate or marriage certificate, may also be required to confirm beneficiary status.

Guidelines for Completing Claim Forms

Submitting a life insurance claim requires specific documentation to ensure a smooth process. You will be asked to provide the completed claim form, original policy documents, and a certified copy of the death certificate.

Guidelines for completing claim forms emphasize accuracy and clarity in all entries. Ensure that all personal details match the policy records and sign the form where required to avoid delays in claim processing.

Submission Methods and Channels

| Document | Description | Submission Methods | Channels |

|---|---|---|---|

| Death Certificate | Official certificate issued by the relevant authority confirming the policyholder's death. | Physical copy or scanned digital version | Mail, Email, Insurance company portal |

| Claim Form | Completed life insurance claim form provided by the insurer, detailing the policy information and claimant details. | Printed and signed copy or online submission | Insurance company website, Physical branch office, Email |

| Policy Document | The original or a copy of the life insurance policy document. | Scan or photocopy | Email, Postal mail, Online upload |

| Identity Proof | Official identification such as passport, driver's license, or government-issued ID of the claimant. | Scanned or physical copy | Email, In-person submission, Online portal |

| Medical Records | Relevant medical documents if the claim requires cause of death verification. | Digital copies or hard copies depending on insurer requirements | Email, Secure upload portal, Physical delivery |

| Bank Details | Proof of bank account for claim payout transfer. | Scanned bank passbook or canceled cheque | Online portal, Email, Postal submission |

Common Mistakes to Avoid in Documentation

Submitting accurate documents is crucial when filing life insurance claims to ensure timely processing. Missing or incorrect paperwork often causes delays or claim denials.

- Incomplete Claim Form - Failing to provide a fully completed and signed claim form can result in rejection of your life insurance claim.

- Missing Death Certificate - The original or certified copy of the death certificate is mandatory to validate the claim and verify the insured's demise.

- Incorrect Policy Details - Errors in policy numbers or beneficiary information can create complications and slow down the approval process.

Document Verification and Processing Timeline

Life insurance claims require essential documents such as the original policy, death certificate, and proof of identity for verification purposes. Document verification ensures the authenticity of the claim and helps prevent fraud, speeding up the approval process. The claim processing timeline typically ranges from 7 to 30 days after submitting all required documents to the insurer.

What Documents are Needed for Life Insurance Claims? Infographic