To secure disability insurance approval, essential documents include a detailed medical report from your healthcare provider outlining the nature and extent of your disability, along with employment records verifying your job role and income. A completed disability insurance application form and proof of identity are also required. Providing accurate and comprehensive documentation accelerates the claims process and ensures proper evaluation.

What Documents are Necessary for Disability Insurance Approval?

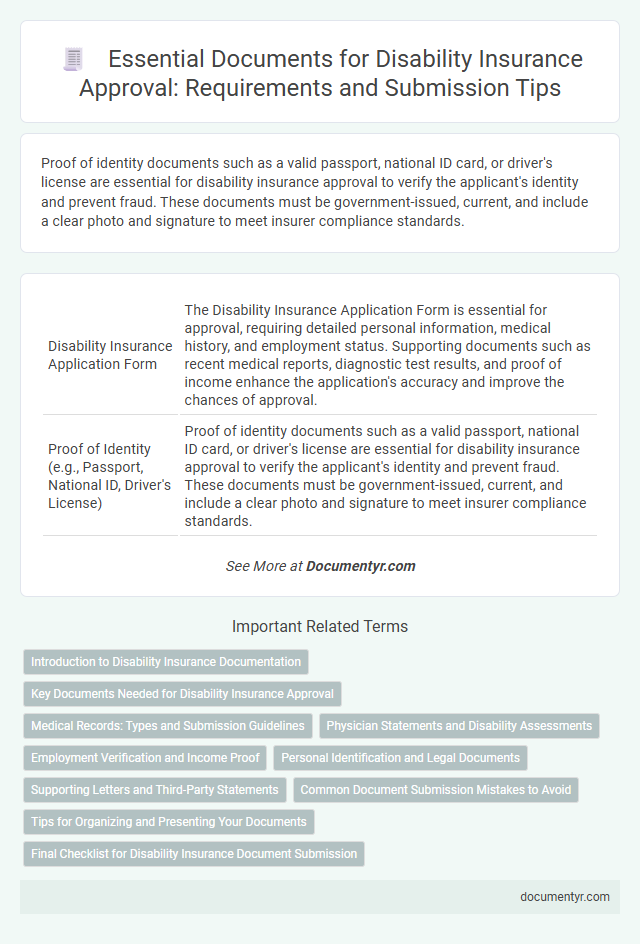

| Number | Name | Description |

|---|---|---|

| 1 | Disability Insurance Application Form | The Disability Insurance Application Form is essential for approval, requiring detailed personal information, medical history, and employment status. Supporting documents such as recent medical reports, diagnostic test results, and proof of income enhance the application's accuracy and improve the chances of approval. |

| 2 | Proof of Identity (e.g., Passport, National ID, Driver's License) | Proof of identity documents such as a valid passport, national ID card, or driver's license are essential for disability insurance approval to verify the applicant's identity and prevent fraud. These documents must be government-issued, current, and include a clear photo and signature to meet insurer compliance standards. |

| 3 | Medical Records/Reports | Comprehensive medical records and detailed reports from healthcare providers are essential for disability insurance approval, as they verify the diagnosis, treatment history, and severity of the disability. These documents must include physician notes, lab results, imaging studies, and any specialist evaluations to substantiate the claim accurately. |

| 4 | Attending Physician Statement (APS) | The Attending Physician Statement (APS) is a critical document for disability insurance approval, providing detailed medical information from the insured's treating physician about the nature, severity, and prognosis of the disabling condition. Insurers rely on the APS to verify medical claims, assess the extent of disability, and determine eligibility and benefit levels. |

| 5 | Employer Statement/Letter | An Employer Statement or Letter is essential for disability insurance approval as it verifies the claimant's job duties, salary, and employment status, providing insurers with critical details to assess eligibility. This document must be detailed and signed by the employer to confirm the nature of the disability's impact on the insured's ability to perform work-related tasks. |

| 6 | Recent Pay Slips or Income Proof | Recent pay slips or comprehensive income proof are essential documents for disability insurance approval, as they verify the applicant's current earnings and employment status. Insurers rely on these financial records to accurately assess eligibility and determine appropriate benefit amounts. |

| 7 | Tax Returns | Tax returns are critical for disability insurance approval as they verify income stability and financial history, supporting claims of lost earnings due to disability. Insurers often require at least two years of filed tax returns to assess eligibility and determine accurate benefit amounts. |

| 8 | Social Security Statement (if applicable) | The Social Security Statement is a crucial document for disability insurance approval, providing a detailed record of earnings and estimated benefits that help verify eligibility and calculate claim value. Insurers rely on this statement to confirm the applicant's work history and Social Security disability status, ensuring accurate benefit determination. |

| 9 | Work History Documentation | Accurate work history documentation is essential for disability insurance approval, including detailed employment records, job descriptions, and income statements to verify the applicant's ability to perform job-related tasks. Medical evaluations must align with occupational demands documented to substantiate the disability claim effectively. |

| 10 | Job Description | A detailed job description outlining specific duties, physical demands, and work environment is crucial for disability insurance approval, as it helps assess the extent to which an individual can perform their occupational tasks. Medical records, employer statements, and functional capacity evaluations complement the job description to provide insurers with a comprehensive understanding of the applicant's ability to work. |

| 11 | Disability Benefit Claim Form | The Disability Benefit Claim Form is a crucial document required for disability insurance approval, serving as the primary record of the claimant's medical condition, employment history, and disability status. Accurate completion of this form, along with supporting medical records and proof of income, significantly influences the timely and successful processing of disability benefits. |

| 12 | Authorization to Disclose Medical Information | The Authorization to Disclose Medical Information form is essential for disability insurance approval as it allows insurers to obtain accurate and detailed medical records from healthcare providers. This document ensures the insurer can verify medical history, treatment plans, and current health status necessary to assess the validity and extent of the disability claim. |

| 13 | Proof of Age (Birth Certificate) | A birth certificate serves as essential proof of age required for disability insurance approval, verifying the applicant's identity and eligibility. Insurers rely on this document to confirm policyholder details and prevent fraudulent claims. |

| 14 | Banking Information (for direct deposit) | Disability insurance approval requires submitting accurate banking information, including the bank name, account number, and routing number, to facilitate direct deposit payments. Ensuring these details are correct accelerates claim processing and guarantees timely benefit disbursement. |

| 15 | Functional Capacity Evaluation Report | A Functional Capacity Evaluation (FCE) Report is essential for disability insurance approval as it provides an objective assessment of an individual's physical and functional abilities related to their job. This report documents specific limitations and capacity levels, enabling insurers to accurately determine eligibility and benefit amounts. |

| 16 | Rehabilitation or Therapy Reports | Rehabilitation or therapy reports are crucial documents for disability insurance approval as they provide detailed evidence of ongoing treatment and functional limitations. These reports must include therapist assessments, progress notes, and documented treatment plans to validate the claimant's medical condition and need for benefits. |

| 17 | Pharmacy Records | Pharmacy records play a critical role in disability insurance approval by providing verified evidence of prescribed medications and treatment adherence over time. These documents help insurers assess the severity and consistency of a disability, supporting claims with detailed prescription histories and dosage information. |

| 18 | Hospital Discharge Summaries | Hospital discharge summaries are essential documents for disability insurance approval, providing detailed medical information about the patient's diagnosis, treatment, and prognosis. These summaries validate the severity and duration of the disability, ensuring accurate claim assessment and timely processing by insurance providers. |

| 19 | Letter of Disability from Treating Doctor | The Letter of Disability from the treating doctor is a critical document for disability insurance approval, providing detailed medical evidence of the claimant's condition, diagnosis, and limitations. Insurers rely on this letter to verify the severity of the disability and to assess eligibility based on consistent clinical evaluations and stated functional impairments. |

| 20 | Workers’ Compensation Records (if applicable) | Workers' Compensation Records are crucial documents for disability insurance approval as they provide detailed evidence of work-related injuries or illnesses that qualify for benefits. Properly submitted records, including medical reports and claim forms, help verify the legitimacy and extent of the disability, expediting claim processing and approval. |

Introduction to Disability Insurance Documentation

Disability insurance provides crucial financial protection if you become unable to work due to illness or injury. Proper documentation is essential to verify the extent of your disability and ensure timely approval of your claim. Understanding the required documents helps streamline the approval process for disability insurance benefits.

Key Documents Needed for Disability Insurance Approval

Disability insurance approval requires specific documents to verify medical conditions and employment status. Providing accurate and complete paperwork ensures a smoother approval process.

Key documents needed for disability insurance approval include medical records detailing diagnosis and treatment from healthcare providers. Employment verification forms and recent pay stubs confirm eligibility and income level. Additionally, a comprehensive disability claim form must be completed to initiate the application.

Medical Records: Types and Submission Guidelines

What medical records are necessary for disability insurance approval? Medical records must comprehensively document your diagnosis, treatment history, and the impact of your disability on daily functioning. Submit these records in clear, organized formats, ensuring they include physician notes, test results, and any specialist evaluations.

Physician Statements and Disability Assessments

Physician statements play a critical role in obtaining disability insurance approval. These documents provide detailed medical information verifying the applicant's condition and limitations.

Disability assessments offer an objective evaluation of the applicant's functional abilities. Insurers rely heavily on these assessments to determine eligibility and benefit amounts.

Employment Verification and Income Proof

Obtaining disability insurance approval requires submitting specific documents to verify your employment and income. These documents confirm your eligibility and help assess the benefit amount you qualify for.

- Employment Verification Letter - A letter from your employer confirming your job title, duties, and length of employment.

- Recent Pay Stubs - Copies of your latest pay stubs provide proof of your current income and earnings history.

- Tax Returns - Official tax documents show consistent income and help validate your reported earnings over time.

Personal Identification and Legal Documents

Personal identification is a crucial requirement for disability insurance approval, including government-issued ID such as a driver's license or passport. Legal documents like birth certificates and Social Security numbers help verify the applicant's identity and eligibility. Insurance providers also require signed consent forms to access medical records and validate disability claims.

Supporting Letters and Third-Party Statements

Supporting letters and third-party statements play a crucial role in securing disability insurance approval by providing credible evidence of the claimant's condition. These documents validate medical claims and offer an objective perspective on the applicant's everyday limitations.

- Supporting Letters - Written by healthcare providers to detail the medical diagnosis, treatment plans, and functional impairments affecting the claimant.

- Third-Party Statements - Provided by family members, coworkers, or friends to describe observed difficulties in performing daily activities or job duties.

- Importance - These documents strengthen the insurance claim by corroborating medical records with external observations of disability impact.

Submitting comprehensive and well-documented supporting letters and third-party statements increases the likelihood of disability insurance approval.

Common Document Submission Mistakes to Avoid

Submitting the correct documents is crucial for disability insurance approval. Understanding common mistakes can help avoid delays or denials in your claim.

- Incomplete Medical Records - Failure to provide comprehensive and up-to-date medical documentation often leads to claim rejection.

- Missing Employment Verification - Not submitting proof of employment or income can result in insufficient evidence of disability impact.

- Unsigned or Uncertified Forms - Applications lacking required signatures or official certifications may be deemed invalid by insurers.

Tips for Organizing and Presenting Your Documents

Collecting all necessary documents ensures a smoother disability insurance approval process. Essential paperwork includes medical records, proof of income, and completed application forms.

Organize your documents in chronological order and use clear labels for each section. Presenting well-structured files helps insurance evaluators quickly verify your claims and speeds up approval.

What Documents are Necessary for Disability Insurance Approval? Infographic