To file a renter's insurance proof of loss, essential documents include a detailed inventory list of damaged or stolen items, copies of receipts or photographs verifying ownership and value, and a completed proof of loss form provided by the insurer. It is also crucial to submit a police report if the claim involves theft or vandalism. Maintaining organized records and timely submission of these documents ensures a smooth and efficient claims process.

What Documents are Necessary for Renter’s Insurance Proof of Loss?

| Number | Name | Description |

|---|---|---|

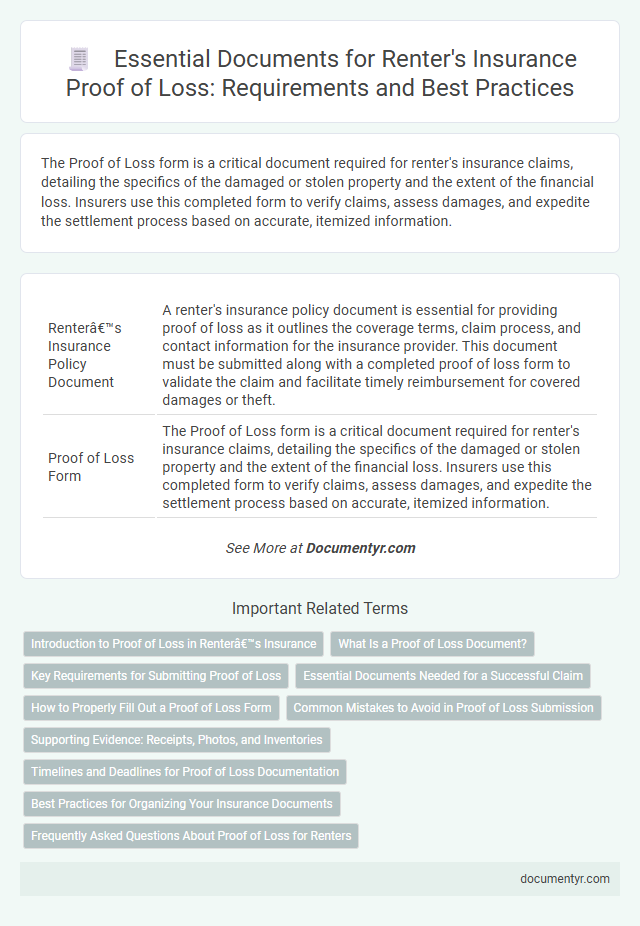

| 1 | Renter’s Insurance Policy Document | A renter's insurance policy document is essential for providing proof of loss as it outlines the coverage terms, claim process, and contact information for the insurance provider. This document must be submitted along with a completed proof of loss form to validate the claim and facilitate timely reimbursement for covered damages or theft. |

| 2 | Proof of Loss Form | The Proof of Loss form is a critical document required for renter's insurance claims, detailing the specifics of the damaged or stolen property and the extent of the financial loss. Insurers use this completed form to verify claims, assess damages, and expedite the settlement process based on accurate, itemized information. |

| 3 | Inventory List of Damaged/Lost Items | The inventory list of damaged or lost items is a crucial document for renter's insurance proof of loss, detailing each item's description, purchase date, original cost, and estimated value. This list supports claim verification by providing clear evidence of the extent of property damage or loss for accurate reimbursement. |

| 4 | Receipts or Proof of Ownership (for claimed items) | Receipts or proof of ownership are essential for renter's insurance proof of loss, providing detailed evidence of the item's purchase date, price, and description to validate the claim. These documents help insurers accurately assess the value of the claimed items and expedite the claim settlement process. |

| 5 | Photographs or Video Evidence of Damage | Photographs or video evidence of damage serve as critical documentation for renter's insurance proof of loss, providing visual confirmation of the extent and nature of the damages sustained. Insurers rely on these digital records to validate claims quickly, ensuring accurate assessment and facilitating timely compensation. |

| 6 | Police Report (if applicable) | For renter's insurance proof of loss, a police report is necessary when the claim involves theft, vandalism, or other criminal activity, providing official documentation of the incident. This report helps validate the claim and supports the insurer's assessment of the loss. |

| 7 | Repair Estimates or Invoices | Repair estimates or invoices are essential documents for renter's insurance proof of loss as they provide detailed costs incurred to restore or replace damaged property. Accurate, itemized repair estimates or official invoices validate the claim amount and expedite the reimbursement process. |

| 8 | Landlord or Property Manager Statement | A Landlord or Property Manager Statement is essential for renter's insurance proof of loss as it verifies the tenancy and documents the condition of the property at the time of the claim. This statement helps insurers confirm the legitimacy of the loss and supports accurate assessment and settlement of property damage or theft claims. |

| 9 | Lease Agreement | A lease agreement is a crucial document for renter's insurance proof of loss as it verifies the tenant's occupancy and responsibility for the rented property. Insurers often require a copy of the lease to validate claims related to property damage, liability, or loss under the renter's insurance policy. |

| 10 | Incident Report | An Incident Report is a critical document for Renter's Insurance Proof of Loss, detailing the circumstances and specifics of the loss event, such as theft, fire, or water damage. This report provides the insurer with essential evidence to validate the claim and typically includes the date, location, description of damage, and involved parties. |

| 11 | Appraisal Reports (for high-value items) | Appraisal reports are essential for renter's insurance proof of loss when claiming high-value items such as jewelry, artwork, or collectibles, providing a professional valuation to substantiate the item's worth. Insurers require these detailed documents to verify the item's value accurately and process claims efficiently. |

| 12 | Communication Records with Insurance Company | Communication records with the insurance company, including emails, letters, and phone call logs, are essential documents for renter's insurance proof of loss as they establish timely reporting and claim submission. Maintaining detailed correspondence ensures verification of claim status, policy coverage discussions, and any agreed-upon adjustments to the settlement. |

Introduction to Proof of Loss in Renter’s Insurance

What documents are necessary for renter's insurance proof of loss? Proof of Loss is a formal statement provided by the policyholder that details the extent of the damage or loss. It serves as a critical document for processing claims under renter's insurance policies.

What Is a Proof of Loss Document?

A proof of loss document is a formal statement submitted to an insurance company detailing the amount and cause of loss or damage. It is a critical requirement for processing renter's insurance claims and verifying the legitimacy of the claim.

- Definition - A proof of loss is a written affidavit that explains the circumstances and extent of the loss to support the insurance claim.

- Purpose - It serves as evidence for the insurer to evaluate and process the claim for renter's insurance reimbursement.

- Contents - The document includes detailed descriptions of damaged or stolen property, estimated values, dates of loss, and sometimes police reports or receipts.

Key Requirements for Submitting Proof of Loss

Submitting a Proof of Loss is a crucial step in the renter's insurance claims process. It provides official documentation to support your claim and helps the insurer assess the damages accurately.

- Completed Proof of Loss Form - This form must be filled out accurately, detailing the date, cause, and extent of the loss to validate your claim.

- Itemized List of Damaged or Lost Property - A detailed inventory with descriptions, purchase dates, and values is required to quantify the claim amount.

- Supporting Documentation - Receipts, photographs, police reports, and repair estimates strengthen the claim by providing evidence of ownership and loss.

Ensuring all these documents are submitted promptly will expedite the claims review and settlement process.

Essential Documents Needed for a Successful Claim

| Document | Description | Purpose |

|---|---|---|

| Proof of Loss Form | A detailed, signed statement outlining the nature and extent of the loss. | Serves as the primary claim document to initiate the insurance process. |

| Rental Agreement | Official lease or rental contract between the tenant and landlord. | Confirms tenancy and eligibility for renter's insurance coverage. |

| Photographic or Video Evidence | Images or videos of damaged or stolen personal property. | Provides tangible proof supporting the claim's validity and extent. |

| Receipts and Invoices | Original purchase receipts, credit card statements, or repair bills for lost or damaged items. | Documents ownership and value of personal belongings. |

| Police or Incident Report | Official report filed with law enforcement or relevant authorities in case of theft or vandalism. | Validates the claim by confirming the occurrence of an insured event. |

| Identification Documents | Government-issued ID such as a driver's license or passport. | Verifies the identity of the claimant. |

| Repair or Replacement Estimates | Quotes from contractors or service providers for fixing or replacing damaged items. | Assists in determining the amount reimbursable under the policy. |

How to Properly Fill Out a Proof of Loss Form

To properly fill out a Proof of Loss form for renter's insurance, gather essential documents like the original lease agreement, a detailed list of damaged or stolen items, and corresponding receipts or photos. Accurately provide personal information, policy number, date of loss, and a thorough description of the incident and damages. Ensure all statements are truthful and sign the form before submitting it to your insurance company promptly to avoid claim delays.

Common Mistakes to Avoid in Proof of Loss Submission

Submitting a complete and accurate proof of loss is crucial for a smooth renter's insurance claim process. Understanding common mistakes can help avoid delays or claim denials.

- Incomplete Documentation - Failing to provide all required documents such as the original lease, police reports, or inventory lists can result in claim rejection.

- Incorrect or Missing Dates - Omitting essential dates like the date of loss or date of claim submission often leads to processing delays or denial.

- Lack of Detailed Description - Providing vague descriptions of damaged or stolen items can hinder claim approval due to insufficient evidence.

Supporting Evidence: Receipts, Photos, and Inventories

Supporting evidence is crucial when filing a Proof of Loss for renter's insurance. Receipts, photos, and detailed inventories help validate the value and ownership of lost or damaged items.

Receipts provide concrete proof of purchase dates and costs, while photos capture the condition and existence of belongings before the loss. Inventories list all covered possessions systematically, making the claims process more efficient and accurate.

Timelines and Deadlines for Proof of Loss Documentation

Proof of Loss is a critical document required to validate a renter's insurance claim. Insurers mandate submission within a specific timeframe to ensure timely processing and claim approval.

Most insurance companies require the Proof of Loss form to be submitted within 60 days from the date of the loss. Missing this deadline can result in claim denial or delayed payments. Claimants should review their policy for precise deadlines and gather all necessary documentation promptly to meet these requirements.

Best Practices for Organizing Your Insurance Documents

Proof of Loss for renter's insurance requires key documents such as the original insurance policy, a detailed inventory of damaged or stolen items, and any receipts or photographs supporting your claim. Organize these documents in a dedicated folder or digital file to ensure quick access during the claims process. Keep copies of all correspondence with your insurance provider to maintain a clear record of your claim's progress.

What Documents are Necessary for Renter’s Insurance Proof of Loss? Infographic