To provide proof of renter's insurance, essential documents include the insurance policy declaration page, proof of payment or receipt, and a verification letter from the insurance company. The declaration page outlines coverage details such as policy number, coverage limits, and effective dates, confirming active coverage. Landlords or property managers typically request these documents to ensure tenants have the necessary insurance protection.

What Documents are Required for Renter's Insurance Proof?

| Number | Name | Description |

|---|---|---|

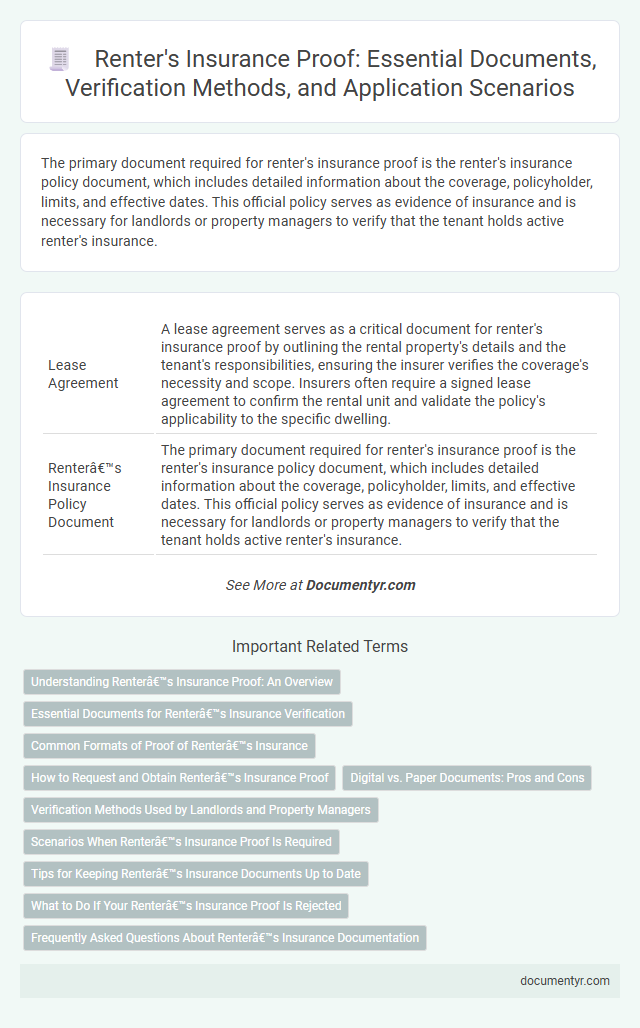

| 1 | Lease Agreement | A lease agreement serves as a critical document for renter's insurance proof by outlining the rental property's details and the tenant's responsibilities, ensuring the insurer verifies the coverage's necessity and scope. Insurers often require a signed lease agreement to confirm the rental unit and validate the policy's applicability to the specific dwelling. |

| 2 | Renter’s Insurance Policy Document | The primary document required for renter's insurance proof is the renter's insurance policy document, which includes detailed information about the coverage, policyholder, limits, and effective dates. This official policy serves as evidence of insurance and is necessary for landlords or property managers to verify that the tenant holds active renter's insurance. |

| 3 | Proof of Premium Payment (Receipt/Bank Statement) | Proof of premium payment for renter's insurance typically requires a receipt issued by the insurance provider or a bank statement showing the transaction. These documents validate active coverage and are essential when submitting claims or verifying insurance status with landlords. |

| 4 | Certificate of Insurance | A Certificate of Insurance serves as the primary document required for renter's insurance proof, detailing the policyholder's coverage limits, effective dates, and insured property. This certificate is often requested by landlords to verify that tenants maintain adequate liability and personal property protection. |

| 5 | Declarations Page | The declarations page is a crucial document for renter's insurance proof, outlining policy details such as coverage limits, insured property, and effective dates. Insurers and landlords often require this page to verify active coverage and specific protections provided under the renter's insurance policy. |

| 6 | Inventory List of Personal Property | An inventory list of personal property is essential for renter's insurance proof as it details all items covered under the policy, including descriptions, purchase dates, and values. This document supports claims by providing evidence of ownership and item specifics in case of loss, theft, or damage. |

| 7 | Identification Document (Driver’s License/ID Card) | A valid identification document, such as a driver's license or state-issued ID card, is essential for renter's insurance proof to verify the policyholder's identity and residence. Insurance providers require these documents to ensure accurate application processing and to prevent potential fraud in renter's insurance claims. |

| 8 | Proof of Residence (Utility Bill/Rental Receipt) | Proof of residence is a critical document for renter's insurance verification, commonly fulfilled by providing a recent utility bill or a rental receipt that includes the insured's name and address. These documents confirm the insured's occupancy at the specified location, enabling insurers to assess risk and validate coverage accurately. |

| 9 | Endorsement or Addendum Forms | Endorsement or addendum forms serve as crucial documents for renter's insurance proof, detailing any modifications or additional coverage beyond the standard policy. These forms must be provided alongside the original insurance policy to verify specific terms and ensure the tenant meets landlord or property management requirements. |

| 10 | Landlord’s Request Letter (if applicable) | A Landlord's Request Letter for renter's insurance proof typically specifies the required coverage limits, policy effective dates, and named insured details to ensure compliance with lease terms. This letter serves as formal documentation mandating tenants to provide insurance certificates confirming liability and property protection before occupancy. |

Understanding Renter’s Insurance Proof: An Overview

Renter's insurance proof typically includes a declaration page that outlines the coverage details, policy number, and effective dates. This document serves as official verification that your rental property is insured.

Understanding renter's insurance proof begins with recognizing the importance of the declaration page from your insurance provider. Some landlords may also request a copy of the full policy or an insurance binder, which is a temporary proof of coverage. Keep these documents accessible to quickly verify your insurance when needed.

Essential Documents for Renter’s Insurance Verification

Essential documents for renter's insurance verification include the insurance policy declaration page and proof of premium payment. These documents confirm coverage details and policy validity for the insured rental property.

A copy of the insurance card or certificate of insurance may also be requested by landlords or property managers. Your insurance provider can supply these documents to ensure compliance with rental agreements.

Common Formats of Proof of Renter’s Insurance

What documents are required for renter's insurance proof? Common formats include the insurance declaration page and the certificate of insurance. These documents confirm coverage details like policy number, effective dates, and insured property.

How is the proof of renter's insurance typically presented? Proof often appears as a digital or printed insurance ID card or a detailed policy summary. Landlords and property managers use these formats to verify renters have active coverage.

How to Request and Obtain Renter’s Insurance Proof

To request and obtain renter's insurance proof, contact your insurance provider directly via their website, customer service, or mobile app. Typically, you need to provide your policy number and personal identification to verify coverage. Once verified, your insurance company will send a certificate of insurance or proof of coverage document electronically or by mail.

Digital vs. Paper Documents: Pros and Cons

| Document Type | Digital Proof | Paper Proof |

|---|---|---|

| Insurance Policy | Accessible via provider's app or email; allows quick sharing and storage; easier to update with changes. | Physical copy provided at purchase; requires safe storage; can be lost or damaged but accepted universally. |

| Proof of Payment | Electronic receipts or bank statements; instantly retrievable; supports automatic record-keeping. | Printed receipts or canceled checks; tangible evidence; can be misplaced or faded over time. |

| Certificate of Insurance | PDF or digital certificate emailed; easy to forward to landlords or agencies; reduces paperwork clutter. | Paper certificate issued by insurer; some landlords require original document; risks physical damage. |

| Communication Records | Email correspondence or chat logs; searchable history; provides instant proof of coverage discussions. | Printed copies of letters or notices; may be necessary for legal purposes; prone to misplacement. |

| Pros |

|

|

| Cons |

|

|

Verification Methods Used by Landlords and Property Managers

Renter's insurance proof is essential for landlords and property managers to ensure tenant coverage against potential damages. Verification methods confirm that renters have valid and adequate insurance policies in place.

- Insurance Declaration Page - This document provides detailed information about the coverage, policy limits, and insured parties, serving as the primary proof of renter's insurance.

- Certificate of Insurance (COI) - Issued by the insurance company, this certificate verifies the policy's active status and includes the landlord or property manager as an additional insured if required.

- Direct Verification with Insurer - Property managers may contact the insurance provider directly to confirm policy validity, coverage specifics, and expiration dates for added assurance.

These verification methods help landlords enforce insurance requirements and protect property investments effectively.

Scenarios When Renter’s Insurance Proof Is Required

Proof of renter's insurance is commonly required when signing a lease agreement or renewing one. Landlords request this documentation to ensure tenants have coverage for personal property and liability.

Another scenario is during a claim process, where tenants must show their insurance proof to validate coverage. Some apartment complexes also require this proof upon move-in or when applying for residency.

Tips for Keeping Renter’s Insurance Documents Up to Date

To provide proof of renter's insurance, essential documents include your insurance policy declaration page, the insurance ID card, and the payment receipt. Keep copies of these documents in both physical and digital formats to ensure easy access during emergencies or when requested by landlords. Regularly update your policy information, and review your coverage annually to maintain accurate and current proof of insurance for your protection.

What to Do If Your Renter’s Insurance Proof Is Rejected

Renter's insurance proof typically includes a policy declaration page or a certificate of insurance. If your renter's insurance proof is rejected, it's important to know how to respond effectively to ensure coverage verification.

- Review the rejection reason - Understand the specific cause for denial to address the issue directly with your insurance provider.

- Contact your insurance company - Request updated or corrected documents such as an endorsement or confirmation letter that meets landlord requirements.

- Provide supplementary documents - Submit payment receipts or policy agreement copies to reinforce proof of active renter's insurance coverage.

What Documents are Required for Renter's Insurance Proof? Infographic