To renew homeowners insurance, you need to provide your current policy documents, recent proof of home ownership, and updated information about any home improvements or renovations. Supporting documents such as a home inspection report or updated property valuation may be required to assess risk accurately. Proof of identity and payment details are essential to finalize the renewal process efficiently.

What Documents are Necessary for Homeowners Insurance Renewal?

| Number | Name | Description |

|---|---|---|

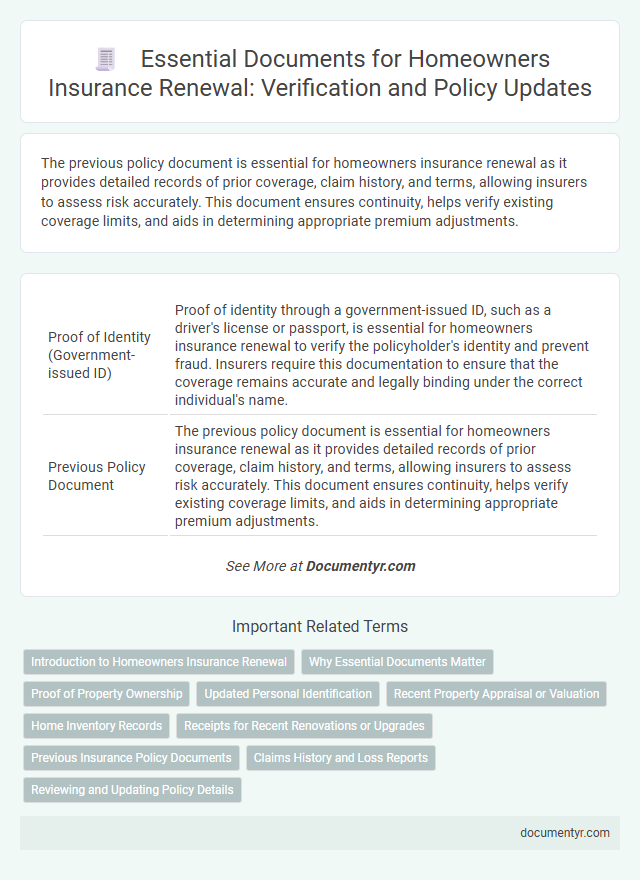

| 1 | Proof of Identity (Government-issued ID) | Proof of identity through a government-issued ID, such as a driver's license or passport, is essential for homeowners insurance renewal to verify the policyholder's identity and prevent fraud. Insurers require this documentation to ensure that the coverage remains accurate and legally binding under the correct individual's name. |

| 2 | Previous Policy Document | The previous policy document is essential for homeowners insurance renewal as it provides detailed records of prior coverage, claim history, and terms, allowing insurers to assess risk accurately. This document ensures continuity, helps verify existing coverage limits, and aids in determining appropriate premium adjustments. |

| 3 | Proof of Property Ownership (Deed, Title, Mortgage Statement) | Proof of property ownership is essential for homeowners insurance renewal, typically requiring documents such as the deed, title, or mortgage statement to verify legal ownership and lien status. Insurers use these documents to confirm property details and validate the policyholder's eligibility for coverage continuation. |

| 4 | Updated Home Appraisal or Valuation Report | An updated home appraisal or valuation report is essential for homeowners insurance renewal to accurately reflect the current market value and condition of the property. This document ensures appropriate coverage limits and premium adjustments based on recent property improvements or market fluctuations. |

| 5 | Recent Home Inspection Report | A recent home inspection report is essential for homeowners insurance renewal as it provides detailed information on the property's current condition, identifying potential risks that could affect coverage or premiums. Insurance companies rely on this document to assess damages, maintenance issues, and any improvements, ensuring accurate risk evaluation for policy continuation. |

| 6 | Receipts or Documentation for Recent Renovations/Improvements | Receipts or documentation for recent renovations and improvements are essential for homeowners insurance renewal to verify the increased value and enhanced safety features of the property. Providing detailed invoices, contractor agreements, or permits ensures accurate coverage adjustments and prevents potential claim disputes. |

| 7 | Inventory of Personal Belongings | An accurate inventory of personal belongings, including receipts, photographs, and detailed descriptions of high-value items, is essential for homeowners insurance renewal to ensure proper coverage and claim accuracy. Maintaining an up-to-date list supports verification of possessions and helps adjust policy limits to reflect current asset values. |

| 8 | Claims History Report | A Claims History Report is essential for homeowners insurance renewal, providing detailed records of past claims that influence premium rates and coverage eligibility. Insurers rely on this report to assess risk and determine any necessary adjustments in policy terms for the upcoming period. |

| 9 | Updated Mortgage Information | Updated mortgage information is essential for homeowners insurance renewal, including the current mortgage statement detailing the lender's name, loan number, and outstanding balance. Providing this documentation ensures accurate coverage alignment with loan requirements and prevents potential lapses or claim disputes. |

| 10 | Proof of Address (Utility Bill, Bank Statement) | For homeowners insurance renewal, proof of address is essential and can be verified through documents such as a recent utility bill or a bank statement, which confirm your residence and support the policy's accuracy. These documents must be current, typically dated within the last 30 to 60 days, ensuring the insurer has up-to-date information for risk assessment and policy validation. |

| 11 | Security System Certificate (if applicable) | Homeowners insurance renewal requires submitting a valid Security System Certificate to verify the functionality and monitoring status of your home alarm system, which may qualify you for premium discounts. Ensure the certificate is up-to-date and issued by a licensed security provider to maintain coverage eligibility and avoid renewal delays. |

| 12 | Loss History Report (CLUE Report) | A Loss History Report, commonly known as a CLUE Report, is essential for homeowners insurance renewal as it details past claims made on the property, providing insurers with critical information about potential risk factors. This report helps underwriters accurately assess the likelihood of future claims, ensuring appropriate premium adjustments and coverage terms for the policyholder. |

| 13 | Proof of Upgrades (Roof, Plumbing, Electrical) | Proof of upgrades such as receipts, contractor invoices, or inspection reports for roof, plumbing, and electrical improvements are essential documents for homeowners insurance renewal to verify property condition and risk reduction. Providing detailed documentation of these upgrades helps insurers assess the enhanced safety features and may result in premium discounts or improved coverage terms. |

| 14 | Occupancy Certificate | An Occupancy Certificate is essential for homeowners insurance renewal as it verifies the property's compliance with local building codes and confirms it is safe for habitation. Insurance companies require this document to assess risk accurately and ensure continuous coverage without interruptions. |

| 15 | Photographs of Property and Contents | Photographs of the property and contents are essential for homeowners insurance renewal as they provide visual proof of the current condition and value of the insured assets, supporting accurate premium calculations and claims processing. Clear, dated images of the interior, exterior, and high-value items help insurers verify coverage and assess risk effectively. |

Introduction to Homeowners Insurance Renewal

What documents are necessary for homeowners insurance renewal? Homeowners insurance renewal requires specific documents to verify the property's current condition and insurance history. Essential paperwork typically includes the previous insurance policy, proof of home ownership, and recent home maintenance records.

Why Essential Documents Matter

Homeowners insurance renewal requires specific documents to verify property details and risk factors. These documents ensure accurate coverage and prevent gaps in protection.

Essential documents often include proof of ownership, updated property appraisal, and recent repair or improvement receipts. Insurance providers use these to assess current property value and condition. Proper documentation helps avoid claim disputes and supports seamless policy renewal.

Proof of Property Ownership

Proof of property ownership is a critical document required for homeowners insurance renewal. This proof typically includes a deed or mortgage statement that confirms your legal ownership of the property.

Insurers use this documentation to verify the insured asset's legitimacy and update policy details accurately. Ensuring you provide clear and current proof can facilitate a smooth renewal process.

Updated Personal Identification

Updated personal identification is a crucial document for homeowners insurance renewal to verify your identity accurately. Insurance providers require up-to-date identification to process renewals smoothly and maintain security.

- Valid government-issued ID - A current driver's license or passport confirms your identity for the renewal process.

- Proof of address - Utility bills or bank statements matching your policy's address help validate residency.

- Social Security number or Tax ID - Required to verify personal identification and support the insurer's records during renewal.

Recent Property Appraisal or Valuation

Recent property appraisal or valuation plays a crucial role in homeowners insurance renewal, ensuring your coverage reflects the current market value of your home. Insurance providers require updated documentation to assess any changes in property worth that might affect premium rates and coverage limits. Submitting an accurate and recent appraisal supports accurate risk evaluation and helps prevent coverage gaps during the renewal process.

Home Inventory Records

Home inventory records play a crucial role in the homeowners insurance renewal process. These detailed lists of personal belongings help verify the current value of insured items.

Accurate home inventory documents ensure adequate coverage during policy renewal. Insurers may request updates to reflect new purchases or disposals since the last policy period.

Receipts for Recent Renovations or Upgrades

| Document | Description | Importance for Renewal |

|---|---|---|

| Receipts for Recent Renovations or Upgrades | Official proof of completed home improvements, including invoices and payment receipts from contractors or suppliers. | Validates the current value and condition of the property, allowing the insurer to accurately adjust coverage limits and premiums based on property enhancements. |

| Proof of Purchase for Major Appliances | Receipts documenting recent installation or replacement of essential home appliances like HVAC systems or water heaters. | Supports updated coverage needs related to appliances, ensuring protection against potential damage or breakdowns. |

| Photographic Evidence of Renovations | Photos taken before, during, and after upgrades demonstrating the scope and quality of work completed. | Assists in verifying renovations and assessing property value changes for precise insurance adjustments. |

| Detailed Work Orders or Contracts | Documents specifying the renovations' scope, materials used, and costs agreed upon with contractors. | Helps underwriters understand the extent of modifications and calculate coverage requirements appropriately. |

Previous Insurance Policy Documents

Renewing your homeowners insurance requires specific documents to ensure accurate policy updates. Previous insurance policy documents play a critical role in this process.

- Proof of Prior Coverage - Previous policy documents provide evidence of continuous insurance protection, helping the insurer assess risk.

- Claims History Verification - These documents detail past claims, enabling the insurer to evaluate your claim frequency and adjust premiums accordingly.

- Coverage Details Reference - The existing policy outlines current coverage limits and exclusions, guiding the renewal terms and any necessary adjustments.

Claims History and Loss Reports

Insurance providers require detailed claims history and loss reports to process homeowners insurance renewal efficiently. Claims history offers insight into past incidents, while loss reports detail the extent and nature of damages. You must submit these documents to ensure accurate risk assessment and policy continuation.

What Documents are Necessary for Homeowners Insurance Renewal? Infographic