To provide proof of renters insurance, essential documents typically include the insurance policy declaration page, which outlines coverage details and policyholder information, and the insurance ID card or proof of insurance certificate that verifies active coverage. A copy of the signed lease agreement may also be requested to confirm the rental property address. Maintaining updated and easily accessible documentation ensures smooth claims processing and compliance with rental agreements.

What Documents are Necessary for Renters Insurance Proof?

| Number | Name | Description |

|---|---|---|

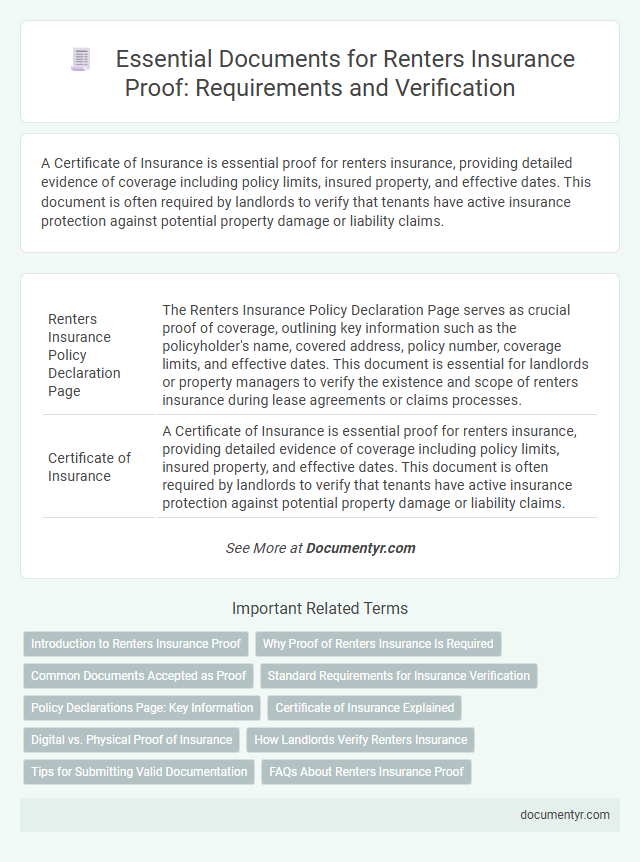

| 1 | Renters Insurance Policy Declaration Page | The Renters Insurance Policy Declaration Page serves as crucial proof of coverage, outlining key information such as the policyholder's name, covered address, policy number, coverage limits, and effective dates. This document is essential for landlords or property managers to verify the existence and scope of renters insurance during lease agreements or claims processes. |

| 2 | Certificate of Insurance | A Certificate of Insurance is essential proof for renters insurance, providing detailed evidence of coverage including policy limits, insured property, and effective dates. This document is often required by landlords to verify that tenants have active insurance protection against potential property damage or liability claims. |

| 3 | Insurance Binder | An insurance binder serves as a temporary proof of renters insurance, documenting essential policy details such as coverage limits, insured property, and effective dates before the formal policy is issued. This legally binding document is crucial for landlords or property managers requiring immediate confirmation of insurance coverage. |

| 4 | Proof of Premium Payment Receipt | A proof of premium payment receipt is essential for renters insurance as it verifies that the policyholder has fulfilled their financial obligation, ensuring continuous coverage. This document typically includes payment date, amount, policy number, and insurer details, serving as official evidence during claims or disputes. |

| 5 | Insurance Identification Card | An Insurance Identification Card serves as the primary document for renters insurance proof, displaying essential policy details such as coverage limits, policy number, and effective dates. Providing this card to landlords or property managers confirms active renters insurance coverage and simplifies the verification process. |

| 6 | Policy Schedule | The Policy Schedule is a crucial document for renters insurance proof, detailing the insured property, coverage limits, premium amounts, and policy duration. This schedule serves as evidence of active insurance and is often required when submitting claims or verifying coverage to landlords. |

| 7 | Insurance Invoice or Billing Statement | An insurance invoice or billing statement serves as a crucial proof of renters insurance, detailing the policy number, coverage period, and payment status to verify active protection. These documents are often required by landlords or property managers to confirm that tenants maintain adequate renters insurance coverage. |

| 8 | Coverage Confirmation Letter | A Coverage Confirmation Letter serves as essential proof for renters insurance, detailing the policyholder's coverage limits, effective dates, and insured property specifics. This document verifies active insurance status and is often required by landlords or property managers to confirm liability and personal property protection. |

| 9 | Landlord Notification Letter | A Landlord Notification Letter is a critical document for renters insurance proof, confirming that the tenant has informed their landlord of the insurance coverage. This letter typically includes the insurance policy number, effective dates, and landlord contact information, serving as official evidence that the landlord has been notified and that the property is adequately insured. |

| 10 | Electronic Insurance Verification Letter | An electronic insurance verification letter serves as critical proof for renters insurance by providing a digitally accessible document that confirms coverage details, policy number, and effective dates. This secure, verifiable letter streamlines the process for landlords and property managers to validate renters insurance without requiring physical paperwork. |

Introduction to Renters Insurance Proof

Renters insurance proof serves as verification that a tenant has active coverage protecting personal belongings and liability within a rental property. Common documents used as renters insurance proof include the declarations page, insurance policy summary, and insurance ID card. Providing these documents helps landlords confirm tenants meet lease requirements and ensures preparedness for potential damages or losses.

Why Proof of Renters Insurance Is Required

Proof of renters insurance is essential to confirm that your personal property and liability risks are covered. Landlords and property managers often require documentation to protect their investment and ensure responsible tenancy.

- Certificate of Insurance - A formal document issued by your insurer verifying your policy details and coverage limits.

- Policy Declarations Page - A summary page that outlines the key coverages, insured locations, and policy period.

- Payment Receipt - Evidence of premium payment demonstrating an active and valid renters insurance policy.

Providing proof of renters insurance safeguards your rights and helps meet lease agreement obligations.

Common Documents Accepted as Proof

Proof of renters insurance is essential to confirm coverage and protect personal belongings. Providing the right documents helps landlords and insurance companies verify active insurance policies accurately.

- Insurance Policy Declaration Page - Shows policyholder details, coverage limits, and effective dates for renters insurance.

- Certificate of Insurance - A formal document issued by the insurer confirming the insurance coverage status and terms.

- Payment Receipt or Proof of Premium - Demonstrates that the insurance premium has been paid and the policy is currently active.

Standard Requirements for Insurance Verification

What documents are necessary for renters insurance proof? Standard requirements for insurance verification include a copy of the insurance policy and a certificate of insurance. Your insurance provider may also require a declaration page to confirm coverage details.

Policy Declarations Page: Key Information

The Policy Declarations Page is a critical document for renters insurance proof. It outlines the key details of your insurance coverage in a concise format.

This page includes essential information such as the policyholder's name, coverage limits, and effective dates. Insurers and landlords often require this document to verify active renters insurance.

Certificate of Insurance Explained

Proof of renters insurance is essential for verifying coverage to landlords or property managers. A Certificate of Insurance is the primary document used to confirm this protection.

- Certificate of Insurance Definition - A Certificate of Insurance is an official document issued by the insurance provider that outlines the key details of the renters insurance policy.

- Proof of Coverage Details - It includes information such as the policyholder's name, coverage limits, effective dates, and the insured property address.

- Importance for Renters - Presenting a Certificate of Insurance ensures landlords that the tenant has valid renters insurance, protecting against potential liabilities and property damage.

Digital vs. Physical Proof of Insurance

Renters insurance proof can be provided through either digital or physical documents. Digital proof often includes emailed PDFs or mobile app displays, while physical proof consists of printed insurance cards or policy documents.

Digital proof offers immediate access and easy sharing via smartphones or email, benefiting tenants and landlords in fast verification. Physical proof is typically required for formal submissions or where electronic devices are not permitted.

How Landlords Verify Renters Insurance

| Document Type | Description | Role in Verification |

|---|---|---|

| Certificate of Insurance (COI) | A formal document issued by the insurance company proving that your renters insurance policy is active. It includes policy number, coverage limits, and effective dates. | This is the primary proof landlords request to confirm that renters insurance is in place and meets required coverage specifications. |

| Declarations Page | An excerpt from your insurance policy detailing who is insured, the property covered, and coverage amounts. | Landlords review this document to verify the scope and validity of renters insurance coverage relevant to the rental property. |

| Insurance Binder | A temporary proof of insurance provided prior to the policy being fully issued, confirming coverage start date and limits. | Used as interim verification when immediate proof is needed, pending official documentation. |

| Direct Insurance Verification | Landlords may contact the insurance company directly to confirm active coverage and policy details. | Ensures authenticity and up-to-date status of renters insurance without relying solely on tenant-provided documents. |

| Policy Renewal Statements | Documents confirming continued coverage and updated terms after policy renewal. | Landlords use these to verify ongoing insurance compliance throughout the tenancy. |

Tips for Submitting Valid Documentation

Providing valid documentation is essential when submitting proof for renters insurance. Key documents include the insurance policy declarations page and a proof of payment receipt.

Ensure the insurance policy clearly lists the renter's name, property address, and coverage dates. Submit documents in their original format or certified copies to avoid rejection. Double-check that all information matches your rental agreement to expedite verification.

What Documents are Necessary for Renters Insurance Proof? Infographic