To process a life insurance payout, the insurer typically requires the original death certificate, a completed claim form, and the policy document. Beneficiaries may also need to provide identification proof and any medical records if the death involved specific circumstances. Timely submission of these documents ensures a smooth and efficient claims process.

What Documents are Needed for Life Insurance Payouts?

| Number | Name | Description |

|---|---|---|

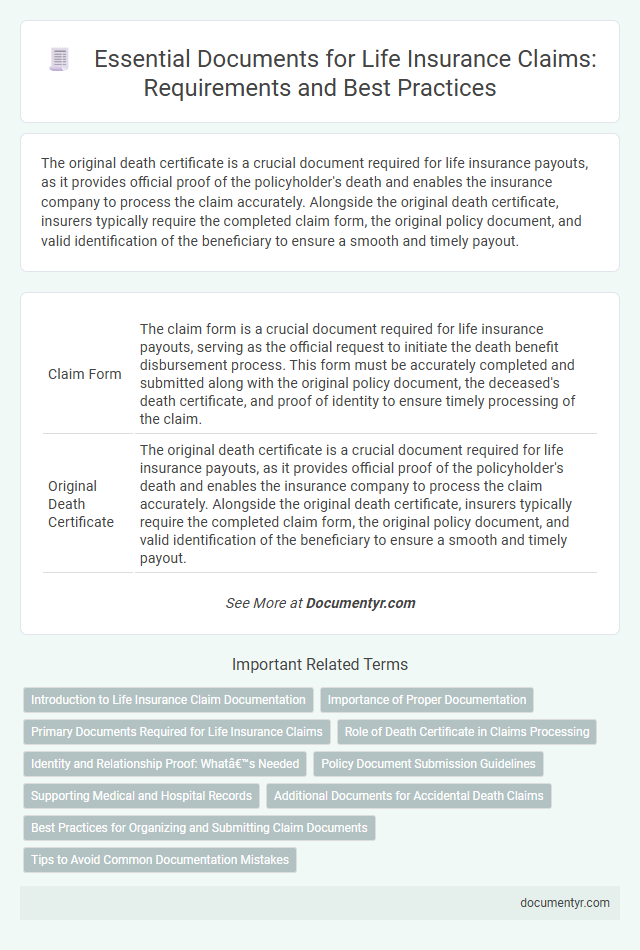

| 1 | Claim Form | The claim form is a crucial document required for life insurance payouts, serving as the official request to initiate the death benefit disbursement process. This form must be accurately completed and submitted along with the original policy document, the deceased's death certificate, and proof of identity to ensure timely processing of the claim. |

| 2 | Original Death Certificate | The original death certificate is a crucial document required for life insurance payouts, as it provides official proof of the policyholder's death and enables the insurance company to process the claim accurately. Alongside the original death certificate, insurers typically require the completed claim form, the original policy document, and valid identification of the beneficiary to ensure a smooth and timely payout. |

| 3 | Policy Document | For life insurance payouts, submitting the original policy document is crucial as it verifies the details of the coverage and beneficiary designations. Insurers use the policy document to process claims accurately and ensure the payout aligns with the terms specified in the contract. |

| 4 | Proof of Identity (Claimant) | Proof of identity for the claimant in life insurance payouts typically requires a government-issued photo ID such as a passport, driver's license, or national identity card to verify the claimant's legitimacy and prevent fraud. Insurers may also request additional documents like a birth certificate or Social Security number to further establish identity and ensure secure processing of the claim. |

| 5 | Proof of Relationship (Claimant) | To ensure a smooth life insurance payout, claimants must provide proof of relationship documents such as a marriage certificate for spouses, birth certificates for children, or legal adoption papers for adopted dependents. These documents verify the claimant's eligibility and are critical for validating the beneficiary status under the insurance policy. |

| 6 | Medical Records (if applicable) | For life insurance payouts, submitting medical records is crucial when the policy requires proof of cause of death or pre-existing conditions. These documents, including hospital records, doctor's notes, and diagnostic reports, help verify claims and expedite the compensation process. |

| 7 | FIR/Police Report (in case of unnatural death) | For life insurance payouts in cases of unnatural death, submitting a First Information Report (FIR) or police report is crucial as it officially documents the incident and supports claim verification. Alongside the FIR, the insurer typically requires the death certificate, identity proofs of the policyholder and nominee, and the original insurance policy document for a smooth claims process. |

| 8 | Postmortem Report (if applicable) | A postmortem report, when applicable, is a critical document required to process life insurance payouts as it confirms the cause and circumstances of death, ensuring claim authenticity. Insurers use this report alongside the death certificate and policy documents to validate the claim and expedite the payout process. |

| 9 | Hospital Discharge Summary (if applicable) | For life insurance payouts, submitting a Hospital Discharge Summary is crucial when the insured's death followed recent hospitalization, as it provides detailed medical information and confirms the cause of death. This document, alongside the death certificate and claim form, helps insurers validate the claim promptly and accurately. |

| 10 | Nominee’s Bank Account Details | For life insurance payouts, the nominee must provide essential documents including the policyholder's death certificate, the original policy document, and valid identification proof of the nominee. Accurate bank account details of the nominee, such as the account number, bank name, branch, and IFSC code, are critical for seamless fund transfer. |

| 11 | Assignment/Ownership Documents (if policy assigned) | Life insurance payouts require submission of assignment or ownership documents, such as the original policy contract with the assignment endorsement or a formal assignment agreement, to verify the beneficiary's legal right to receive the proceeds. These documents ensure the insurer acknowledges the transfer of policy ownership and prevents disputes during the claims process. |

| 12 | Legal Heir Certificate (if no nominee) | In life insurance payouts, the Legal Heir Certificate becomes essential when no nominee is designated, serving as the primary document to establish the rightful claimants. This certificate, issued by competent local authorities, verifies the legal successors, enabling insurance companies to process claims and release funds to the heirs. |

| 13 | Succession Certificate (if required) | A Succession Certificate is required for life insurance payouts when the policyholder passes away without a nomination or if there are disputes among legal heirs, serving as legal proof for the rightful claimant. Along with the death certificate and insurance policy document, the succession certificate ensures smooth and legitimate transfer of the insurance benefits. |

| 14 | Guardian Certificate (if nominee is minor) | For life insurance payouts involving a minor nominee, a Guardian Certificate is essential to legally appoint a guardian to manage the funds on behalf of the minor. This certificate safeguards the minor's interests by authorizing the appointed guardian to receive and administer the insurance proceeds until the nominee reaches adulthood. |

| 15 | KYC Documents (Claimant) | For life insurance payouts, essential KYC documents for the claimant include a valid government-issued ID such as a passport or driver's license, proof of relationship to the deceased like a birth or marriage certificate, and the claimant's address proof. Insurers may also require the claimant's PAN card and death certificate of the policyholder to verify identity and process the claim efficiently. |

| 16 | Cancelled Cheque (Nominee/Claimant) | A cancelled cheque of the nominee or claimant is essential for verifying bank account details to ensure the accuracy and security of life insurance payouts. This document helps the insurance company prevent fraud and process the payment directly into the rightful account without delays. |

| 17 | Physician’s Statement (if requested) | A Physician's Statement may be required for life insurance payouts to verify cause of death and medical history, providing critical evidence for claim approval. This document typically includes detailed medical records, diagnosis, and treatment information relevant to the insured's condition before death. |

| 18 | Employer Certificate (in case of group insurance) | For life insurance payouts under group insurance policies, submitting an Employer Certificate is crucial as it verifies the deceased's employment status and coverage details. This document, alongside the original policy, death certificate, and claim form, ensures a smooth and timely settlement of the insurance claim. |

| 19 | Insurance Company’s Acknowledgement/Intimation Receipt | The insurance company's acknowledgement or intimation receipt serves as a crucial document confirming the claim notification for a life insurance payout. Policyholders must submit this receipt along with the death certificate and the original policy document to initiate the claims process efficiently. |

Introduction to Life Insurance Claim Documentation

Life insurance payout claims require specific documentation to process the beneficiary's request efficiently. Understanding these required documents helps streamline your claim and ensures timely settlement.

- Death Certificate - Official proof of the policyholder's death issued by a government authority.

- Life Insurance Policy Document - The original or a copy of the life insurance policy containing terms and beneficiary details.

- Claim Form - A completed and signed claim form submitted by the beneficiary to initiate the payout process.

Submitting accurate and complete documents is essential for a smooth life insurance claim process.

Importance of Proper Documentation

Proper documentation is crucial for a smooth life insurance payout process. It ensures that the claim is processed quickly and without unnecessary disputes.

Key documents include the original insurance policy, the death certificate, and a completed claim form. Additional documents such as identity proof and medical records may also be required to verify the claim.

Primary Documents Required for Life Insurance Claims

Life insurance payouts require specific primary documents to initiate the claims process. These documents verify the policyholder's identity and the validity of the claim.

The key documents needed include the original life insurance policy, a completed claim form, and the death certificate of the insured. Proof of identity for the claimant is also essential, such as a government-issued ID. Sometimes, medical records or a police report may be required to support the claim.

Role of Death Certificate in Claims Processing

The death certificate is a critical document required for processing life insurance payouts. Insurers rely on it to officially confirm the policyholder's death.

Along with the death certificate, beneficiaries must submit the original insurance policy and a completed claim form. These documents collectively enable the insurance company to verify the claim and release the payout efficiently.

Identity and Relationship Proof: What’s Needed

Life insurance payouts require key documents to verify the identity of the claimant and their relationship to the deceased. Identity proof typically includes government-issued photo IDs such as a passport, driver's license, or national ID card. Relationship proof may involve a marriage certificate, birth certificate, or legal documents like a will or court order confirming beneficiary status.

Policy Document Submission Guidelines

Submitting the correct documents is essential to process life insurance payouts efficiently. Understanding the policy document submission guidelines ensures timely claim settlements without complications.

- Original Policy Document - The insured must submit the original life insurance policy to verify coverage details and beneficiary information.

- Claim Form - A duly filled and signed claim form must accompany the policy document to initiate the payout process.

- Death Certificate - An official death certificate issued by a competent authority is required to confirm the insured's demise for claim approval.

Supporting Medical and Hospital Records

Supporting medical and hospital records are crucial for processing life insurance payouts as they verify the cause and circumstances of death. These documents typically include discharge summaries, medical bills, test reports, and physician's notes. Insurers rely on accurate and detailed medical records to validate claims and ensure timely and fair settlement of the policy benefits.

Additional Documents for Accidental Death Claims

What additional documents are needed for accidental death claims in life insurance payouts? Insurers require specific papers beyond the standard claim form to verify the nature of the accidental death. These documents help ensure the claim is valid and processed accurately.

Which extra documents are commonly requested for accidental death claims? Typically, a police report, post-mortem or autopsy report, and an accident cause report are essential. These documents provide detailed evidence of the accident circumstances to support the payout.

Why is a police report important for accidental death insurance claims? The police report verifies the incident and official investigation results. This substantiates the cause of death and helps avoid fraudulent claims.

How does the post-mortem report contribute to the claim process? It confirms the exact cause and nature of death medically. Life insurers rely on this for accurate evaluation of accidental versus natural death.

Are there any other documents that may be required for an accidental death claim? Yes, some insurers ask for death certificates mentioning accidental causes, witness statements, or hospital records. These additional proofs enhance claim validity and speed up processing.

Best Practices for Organizing and Submitting Claim Documents

| Document Type | Description | Best Practices for Submission |

|---|---|---|

| Death Certificate | Official document confirming the policyholder's death, issued by a certified authority. | Obtain an original certified copy. Verify details match the policyholder's information exactly. |

| Life Insurance Policy | Original policy document detailing coverage terms, beneficiary information, and policy number. | Submit the original or a certified copy. Review policy for any special claim procedures or conditions. |

| Claim Form | Form provided by the insurer to initiate the life insurance payout process. | Complete all fields accurately. Sign and date as required. Keep a copy for records before submission. |

| Proof of Identity | Government issued ID to verify the claimant's identity and relationship to the deceased. | Provide clear, legible copies of IDs. Use a valid passport, driver's license, or national identity card. |

| Medical Records or Cause of Death Certificate | Documents detailing the medical cause of death, if requested by the insurer. | Secure official documents from healthcare providers or coroners. Ensure information aligns with the death certificate. |

| Financial Records | Documents that may be required to show outstanding loans or debts linked to the deceased. | Gather bank statements, loan agreements, or tax documents relevant to the claim. |

| Best Practices for Organizing and Submitting Claim Documents | Organize documents chronologically or by type in a dedicated folder. Use clear labels on files. Scan all paper documents to create digital copies. Ensure all submitted documents are complete, accurate, and legible. Confirm receipt with the insurance provider and follow up regularly. Retain copies of every document submitted for personal records. | |

What Documents are Needed for Life Insurance Payouts? Infographic