A teenager applying for car insurance typically needs a valid driver's license, vehicle registration, and proof of residency. Insurance providers may also require a social security number for identity verification and a copy of the parent or guardian's insurance policy if the teen is added to an existing plan. Maintaining a clean driving record and completing a driver's education course can further support the application process.

What Documents Does a Teenager Need for Car Insurance?

| Number | Name | Description |

|---|---|---|

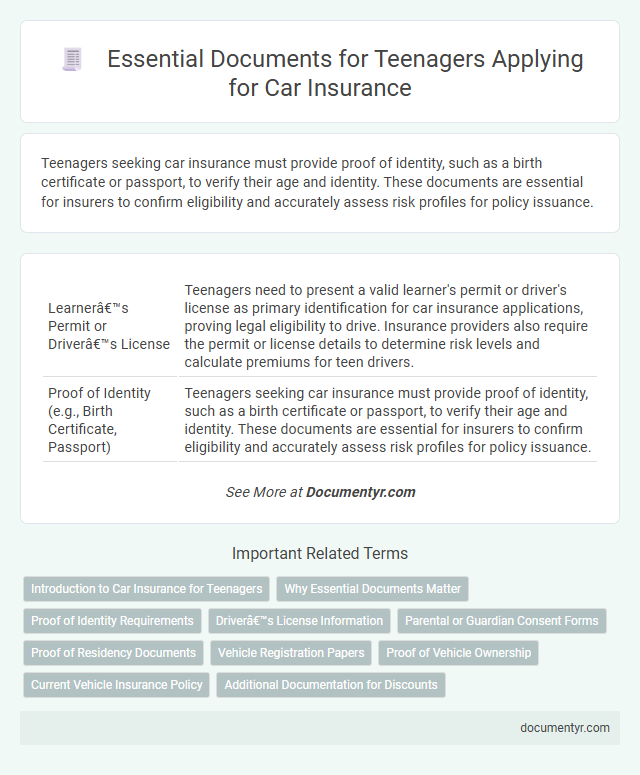

| 1 | Learner’s Permit or Driver’s License | Teenagers need to present a valid learner's permit or driver's license as primary identification for car insurance applications, proving legal eligibility to drive. Insurance providers also require the permit or license details to determine risk levels and calculate premiums for teen drivers. |

| 2 | Proof of Identity (e.g., Birth Certificate, Passport) | Teenagers seeking car insurance must provide proof of identity, such as a birth certificate or passport, to verify their age and identity. These documents are essential for insurers to confirm eligibility and accurately assess risk profiles for policy issuance. |

| 3 | Proof of Address (e.g., Utility Bill, Lease Agreement) | A teenager applying for car insurance must provide proof of address, which can include documents such as a recent utility bill or a lease agreement bearing their name or that of a parent or guardian. Insurers require these documents to verify residency and assess risk factors associated with the insured vehicle's location. |

| 4 | Social Security Number | A teenager needs to provide their Social Security Number (SSN) when applying for car insurance, as it is essential for verifying identity and checking driving records. Insurance companies use the SSN to accurately assess risk and determine premium rates. |

| 5 | Vehicle Registration | A teenager applying for car insurance must provide proof of vehicle registration to verify legal ownership and ensure the car meets state regulations. The vehicle registration document includes vital details such as the car's make, model, year, and VIN, which insurers use to assess risk and calculate premiums accurately. |

| 6 | Vehicle Title | A teenager needs the vehicle title to prove ownership or permission to use the car for insurance purposes, as insurers require this document to verify the insured vehicle's legal status. This title ensures the insurer accurately assesses risk and processes claims related to the policy. |

| 7 | Proof of Vehicle Ownership | A teenager must provide proof of vehicle ownership, such as a valid title or registration, to secure car insurance. This document verifies legal possession of the car, which is crucial for policy eligibility and coverage activation. |

| 8 | Proof of Insurance History (if applicable) | Teens applying for car insurance may need to provide proof of insurance history, such as previous policy documents or declarations pages, to demonstrate their driving record and potentially qualify for lower rates. If no prior insurance exists, a clean driving record or completion certificate of a driver's education course can also support the application. |

| 9 | Parent or Guardian’s Consent (if under 18) | A teenager applying for car insurance must provide a parent or guardian's consent form if under 18, serving as legal approval for coverage. This consent is essential for regulatory compliance and confirms the adult's responsibility for the policyholder's liabilities. |

| 10 | Parent or Guardian’s Insurance Policy Information | A teenager needs the parent or guardian's insurance policy number, proof of coverage, and contact information when applying for car insurance. These documents verify eligibility and enable the insurer to add the teen as a driver under the existing policy. |

| 11 | Completed Insurance Application Form | A completed insurance application form for a teenager typically requires detailed personal information, including full name, date of birth, driver's license number, vehicle details, and coverage preferences to ensure accurate policy issuance. This form must be signed by the teen and often a parent or guardian to verify information and consent for the insurance contract. |

| 12 | School Enrollment or Report Card (for good student discounts) | A teenager may need to provide a current school enrollment verification or a recent report card to qualify for good student discounts on car insurance. Insurance companies use these documents to confirm academic performance, which can lower premiums by demonstrating responsible behavior. |

| 13 | Financial Responsibility Form (if required by state) | Teenagers applying for car insurance may need to submit a Financial Responsibility Form if mandated by their state, which verifies their ability to cover potential damages in an accident. This form often acts as proof of insurance or a bond, ensuring the insurer or state that the teen driver meets minimum liability coverage requirements. |

Introduction to Car Insurance for Teenagers

Car insurance is essential for teenagers who are new drivers, providing financial protection in case of accidents or damages. Understanding the required documents helps streamline the application process and ensures legal compliance. Parents and teenagers should prepare these documents ahead of time to secure appropriate coverage efficiently.

Why Essential Documents Matter

Car insurance for teenagers requires several essential documents to verify identity, driving eligibility, and vehicle details. These documents include a valid driver's license or learner's permit, proof of residency, and the vehicle registration. Ensuring you have these documents helps streamline the application process and secures the right coverage quickly.

Proof of Identity Requirements

| Document Type | Description |

|---|---|

| Government-Issued ID | A valid driver's license or state ID card proves your teenager's identity and eligibility to drive. |

| Birth Certificate | Acts as a primary proof of identity and age when applying for car insurance for a teen driver. |

| Social Security Card | Often required to verify identity and for background checks during the insurance application process. |

| Proof of Residency | Documents such as utility bills or school records confirm the teenager's residential address for policy purposes. |

| Consent Forms | Parental or guardian consent forms may be required if the teenager is under 18. |

Driver’s License Information

Obtaining car insurance for a teenager requires specific documentation, with a primary focus on the driver's license details. Insurance providers use this information to verify eligibility and assess risk associated with teen drivers.

- Valid Driver's License - The teenager must present a current and active driver's license issued by the relevant state department of motor vehicles.

- License Number and Expiry Date - Insurance companies require the license number and the expiration date to confirm the license's validity throughout the insurance policy period.

- Driving Restrictions Noted on License - Any restrictions such as provisional or learner's permits must be disclosed, as they impact the insurance coverage and premium rates.

Parental or Guardian Consent Forms

Teenagers applying for car insurance typically need to provide parental or guardian consent forms as proof of authorization. These documents confirm that a responsible adult agrees to the insurance policy terms on behalf of the minor.

Insurance companies require signed consent forms to ensure legal approval and financial responsibility for the teenager's coverage. Without this consent, insurers may deny the application or consider it incomplete.

Proof of Residency Documents

Proof of residency is a crucial requirement for teenagers applying for car insurance. Insurance companies need to verify the address where the teen resides to establish eligibility and risk assessment.

- Utility Bills - Recent utility bills such as electricity, water, or gas showing the teenager's name and address serve as acceptable proof of residency.

- Bank Statements - Official bank or credit card statements that include the teenager's name and residential address confirm their place of living.

- School Enrollment Records - Documentation from the school indicating the student's address can sometimes be used as proof of residency for insurance purposes.

Providing valid proof of residency helps streamline the car insurance application process for teenagers.

Vehicle Registration Papers

Vehicle registration papers are essential documents required for a teenager to obtain car insurance. These papers prove that the vehicle is legally registered and eligible for coverage.

Insurance companies use the registration details to confirm the vehicle's identity, ownership, and ensure compliance with legal standards. Without valid registration papers, your insurance application may be delayed or denied.

Proof of Vehicle Ownership

Proof of vehicle ownership is a critical document for teenagers applying for car insurance. This document verifies the legal ownership of the vehicle, which is essential to complete the insurance process.

- Title or Registration - Official vehicle title or registration proves that you legally own or have permission to insure the vehicle.

- Bill of Sale - A bill of sale may be required if the vehicle was recently purchased, confirming the transfer of ownership.

- Loan or Lease Agreement - If the car is financed or leased, the agreement serves as proof of your right to insure and use the vehicle.

Current Vehicle Insurance Policy

What documents does a teenager need to provide from their current vehicle insurance policy when applying for car insurance? A copy of the current policy declarations page is essential to verify coverage and premium details. Proof of continuous insurance helps insurers assess risk and may reduce the new policy's cost.

What Documents Does a Teenager Need for Car Insurance? Infographic