To provide proof of auto insurance in California, you need to present a valid insurance card that includes your policy number, vehicle information, and coverage dates. The document must come from your insurance company and clearly show that you meet the state's minimum liability coverage requirements. Carrying this proof in your vehicle is mandatory and may be requested by law enforcement during traffic stops.

What Documents are Needed for Auto Insurance Proof in California?

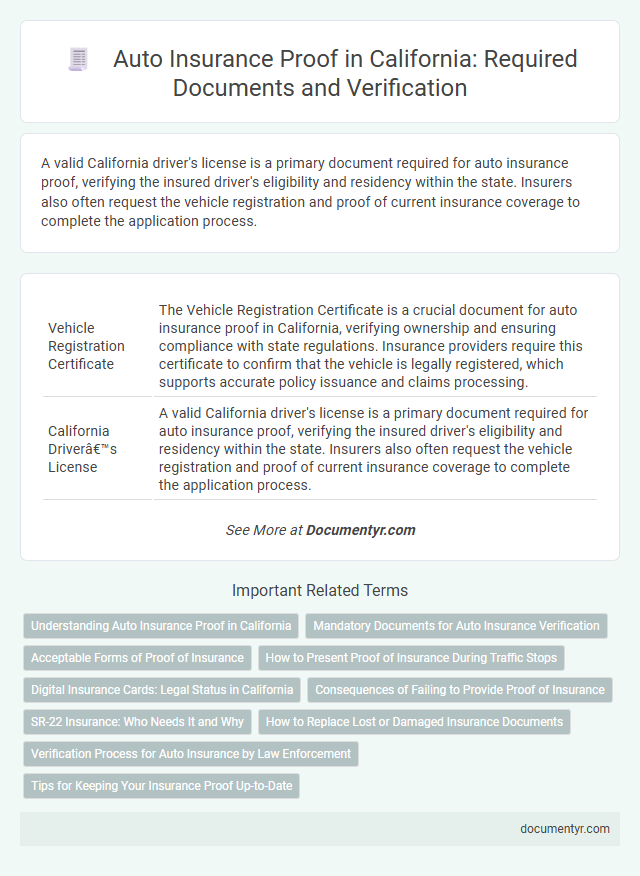

| Number | Name | Description |

|---|---|---|

| 1 | Vehicle Registration Certificate | The Vehicle Registration Certificate is a crucial document for auto insurance proof in California, verifying ownership and ensuring compliance with state regulations. Insurance providers require this certificate to confirm that the vehicle is legally registered, which supports accurate policy issuance and claims processing. |

| 2 | California Driver’s License | A valid California driver's license is a primary document required for auto insurance proof, verifying the insured driver's eligibility and residency within the state. Insurers also often request the vehicle registration and proof of current insurance coverage to complete the application process. |

| 3 | Proof of Auto Insurance Card | In California, the primary document required for auto insurance proof is a valid insurance card that includes the policy number, effective and expiration dates, insured vehicle details, and insurance company contact information. Law enforcement officers and DMV officials use this card to verify compliance with state mandatory liability insurance laws during traffic stops or vehicle registration processes. |

| 4 | DMV Insurance Certificate (SR-22, if required) | California requires an SR-22 form as a DMV insurance certificate to provide proof of auto insurance for high-risk drivers, filed by the insurer directly with the DMV. This document verifies continuous compliance with state liability insurance requirements, critical for license reinstatement or after serious traffic violations. |

| 5 | Proof of Financial Responsibility (Alternative Options) | In California, acceptable proof of financial responsibility for auto insurance includes a valid insurance card, a surety bond of at least $35,000 filed with the DMV, or a DMV-issued self-insurance certificate. Alternative options such as cash deposits or a certificate of deposit at $35,000 also satisfy the state's proof requirements. |

| 6 | Named Operator Policy Documentation (if applicable) | Named operator policy documentation in California auto insurance requires a clearly completed named operator form listing all authorized drivers, along with the primary insured's valid driver's license and vehicle registration. Proof of continuous coverage and the actual insurance policy declarations page further validate the named operator arrangement for legal and claims purposes. |

| 7 | Out-of-State Insurance Card (for new residents) | New residents to California must provide an out-of-state insurance card as proof of auto insurance when registering their vehicle, which demonstrates continuous coverage during the transition period. This document, alongside a completed application and California driver's license, ensures compliance with the state's mandatory liability insurance requirements. |

| 8 | Title of Vehicle | The title of the vehicle serves as a critical document for auto insurance proof in California, establishing legal ownership and aiding in accurate policy issuance. Insurers require the vehicle title along with proof of registration and driver's license to verify coverage eligibility and confirm the insured vehicle's identity. |

| 9 | Lease or Loan Agreement (if financed) | For auto insurance proof in California, a lease or loan agreement is required if the vehicle is financed, serving as evidence of legal interest in the vehicle. This document must clearly outline the terms and show the lessee or borrower's responsibility, which insurers use to validate coverage eligibility and ownership. |

| 10 | Rental Agreement (for rental cars) | For auto insurance proof in California specifically regarding rental cars, a valid rental agreement is essential as it confirms the rental period, vehicle details, and renter's identity. This document must include the renter's name, rental company information, vehicle information such as make and model, and the rental duration to ensure proper insurance coverage validation. |

Understanding Auto Insurance Proof in California

In California, proof of auto insurance is mandatory for all drivers to legally operate a vehicle. Required documents typically include the insurance card, a policy declaration page, or a digital insurance proof accepted by the California Department of Motor Vehicles. Understanding these requirements helps ensure compliance with state laws and avoids penalties during traffic stops or vehicle registration.

Mandatory Documents for Auto Insurance Verification

In California, mandatory documents for auto insurance verification include your current insurance policy declaration page and a valid driver's license. These documents serve as proof that your vehicle is insured according to state requirements.

Proof of vehicle registration and the auto insurance identification card must also be presented during verification. These items confirm that your insurance coverage matches the insured vehicle and comply with California law.

Acceptable Forms of Proof of Insurance

In California, acceptable forms of proof for auto insurance include a physical insurance card, an electronic insurance card displayed on a smartphone, or a digital copy sent via email. These documents must clearly show the policyholder's name, vehicle information, and policy number to be considered valid by authorities.

You can present a paper or electronic insurance card during a traffic stop or after an accident. California law requires the insurance proof to be current and issued by an authorized insurer licensed in the state. Keep these documents readily accessible to avoid fines and legal complications.

How to Present Proof of Insurance During Traffic Stops

In California, drivers must carry proof of auto insurance to comply with state law and avoid penalties. Accepted documents include the insurance card issued by the insurer, electronic proof via a mobile app, or a digital copy saved on a smartphone. During traffic stops, present these documents clearly to law enforcement officers to verify coverage efficiently and prevent fines or vehicle impoundment.

Digital Insurance Cards: Legal Status in California

Auto insurance proof in California requires specific documents to verify coverage during traffic stops or accidents. Digital insurance cards have become widely accepted as legal proof, enhancing convenience for drivers.

- Legal Recognition of Digital Insurance Cards - California law permits use of digital insurance cards on smartphones as valid proof of auto insurance.

- Requirements for Digital Insurance Proof - The digital card must clearly display policyholder name, vehicle details, insurer information, and policy effective dates.

- Exceptions and Recommendations - Despite legal acceptance, carrying a physical insurance card is recommended in case of technology failures or connectivity issues.

Consequences of Failing to Provide Proof of Insurance

In California, drivers must carry specific documents as proof of auto insurance to comply with state law. Failure to provide these documents during a traffic stop can result in severe legal consequences.

- Proof of Insurance Card - A physical or digital insurance card from your provider showing your coverage details is mandatory.

- Registration Documents - Vehicle registration must be current and often checked in conjunction with insurance proof.

- Driver's License - A valid driver's license must be presented alongside insurance proof during enforcement stops.

Not presenting valid proof of auto insurance can lead to fines, license suspension, and potential vehicle impoundment in California.

SR-22 Insurance: Who Needs It and Why

| Document | Description | Relevance for SR-22 Insurance |

|---|---|---|

| SR-22 Certificate | Official form filed by an insurance company to the California DMV proving proof of auto insurance coverage. | Mandatory for individuals who have been required by the court or DMV to maintain high-risk insurance status. |

| Proof of Valid Auto Insurance | Insurance card or policy declaration page showing the active coverage. | Required to verify compliance with minimum liability coverage before SR-22 filing. |

| California Driver's License | State-issued driver identification for verification purposes. | Confirms identity and eligibility for insurance in California. |

| Vehicle Registration | Official documentation confirming ownership and registration of the vehicle. | Needed to link the insured vehicle to the SR-22 filing. |

| Court or DMV Order | Legal documents specifying the requirement for SR-22 insurance. | Determines who must file an SR-22 and outlines the duration and conditions. |

| Proof of Payment for Insurance Premiums | Receipts or billing statements confirming policy payments. | Ensures continuous coverage to avoid suspension or penalties. |

How to Replace Lost or Damaged Insurance Documents

What documents are needed for auto insurance proof in California? You generally need your insurance card or policy documents showing active coverage and vehicle information. These documents confirm that your vehicle is legally insured as required by California law.

How can you replace lost or damaged auto insurance documents in California? Contact your insurance provider to request new copies, either through their website, customer service phone line, or mobile app. Most insurers offer digital copies that you can print or display on your smartphone for proof of insurance.

Verification Process for Auto Insurance by Law Enforcement

In California, law enforcement officers require specific documents to verify your auto insurance during traffic stops or accidents. These documents confirm that your vehicle is insured in compliance with state regulations.

- Insurance Card - A valid insurance card issued by your provider that shows coverage details and policy dates.

- Electronic Proof - Verification through an official mobile app or digital insurance card accepted by California authorities.

- Registration Document - Vehicle registration that often includes insurance status to cross-check with the DMV records.

What Documents are Needed for Auto Insurance Proof in California? Infographic