When applying for homeowners insurance, it is essential to provide key documents such as proof of property ownership, including the deed or mortgage statement. A recent home inspection report and a detailed inventory of personal belongings can help insurers accurately assess risk and coverage needs. Additionally, applicants should submit proof of identity and any prior insurance records to streamline the evaluation process.

What Documents are Needed for Homeowners Insurance Application?

| Number | Name | Description |

|---|---|---|

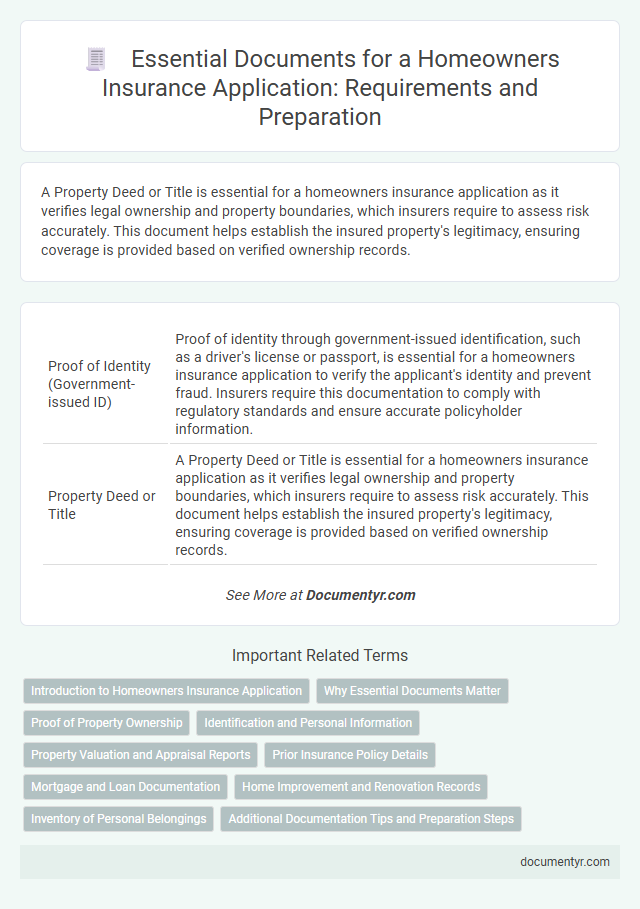

| 1 | Proof of Identity (Government-issued ID) | Proof of identity through government-issued identification, such as a driver's license or passport, is essential for a homeowners insurance application to verify the applicant's identity and prevent fraud. Insurers require this documentation to comply with regulatory standards and ensure accurate policyholder information. |

| 2 | Property Deed or Title | A Property Deed or Title is essential for a homeowners insurance application as it verifies legal ownership and property boundaries, which insurers require to assess risk accurately. This document helps establish the insured property's legitimacy, ensuring coverage is provided based on verified ownership records. |

| 3 | Mortgage Statement | A mortgage statement is a critical document for a homeowners insurance application as it verifies ownership and the outstanding loan balance on the property. Insurers use this information to assess risk and determine appropriate coverage limits. |

| 4 | Recent Property Appraisal | A recent property appraisal is essential for a homeowners insurance application, providing an accurate valuation of the home's current market worth. This document helps insurers assess risk and determine appropriate coverage levels, ensuring protection aligns with the property's true value. |

| 5 | Previous Insurance Policy Declarations Page | The previous insurance policy declarations page provides essential information about your coverage history, claims record, and policy limits, which insurers use to assess risk and determine premiums for your homeowners insurance application. Submitting this document helps ensure accurate underwriting and may expedite the approval process. |

| 6 | Home Inspection Report | A detailed home inspection report provides critical information about the property's condition, including structural integrity, electrical systems, plumbing, and potential hazards, which insurers require to assess risk accurately. This document helps underwriters determine coverage options, premiums, and exclusions for a homeowners insurance application. |

| 7 | Construction Details (Year Built, Renovation Records) | Homeowners insurance applications require detailed construction data including the year the property was built and comprehensive renovation records to assess risk accurately. These documents help insurers evaluate structural integrity and update replacement cost estimates for precise coverage. |

| 8 | Purchase Agreement | The Purchase Agreement is a crucial document required for a homeowners insurance application as it verifies property ownership and details the sale price and terms. Insurers rely on this agreement to assess risk and determine coverage limits accurately before issuing a policy. |

| 9 | Home Inventory List | A detailed home inventory list is essential for a homeowners insurance application, providing a comprehensive record of personal property including descriptions, purchase dates, and values to ensure accurate coverage and claims processing. This document supports proof of ownership and helps insurers assess risk while expediting claim settlements in case of loss or damage. |

| 10 | Receipts for Major Upgrades or Appliances | Receipts for major upgrades or appliances are essential in a homeowners insurance application to verify the value and condition of significant improvements, which can affect coverage limits and premiums. Providing detailed documentation of expenditures on renovations, electrical systems, HVAC units, or kitchen appliances helps insurers accurately assess risk and ensure appropriate protection. |

| 11 | Security System Documentation | Security system documentation is essential for a homeowners insurance application, typically including proof of installation, system specifications, and ongoing monitoring service agreements. Insurance providers use these documents to assess risk reduction measures and potentially offer discounts on premiums. |

| 12 | Flood Zone Determination | Homeowners insurance applications require flood zone determination documents including elevation certificates, flood maps from FEMA, and local floodplain management data to assess risk accurately. Providing these specific documents ensures proper coverage and compliance with lender or policy requirements for flood-prone properties. |

| 13 | HOA (Homeowners Association) Statements | Homeowners insurance applications require HOA statements to verify property rules, fees, and any pending assessments that could affect coverage risk. These documents ensure accurate policy underwriting by detailing the community's maintenance standards and financial obligations. |

| 14 | Recent Utility Bills | Recent utility bills serve as crucial proof of residence and help verify the insurance applicant's address for homeowners insurance applications. These documents typically include electricity, water, or gas bills issued within the last three months to ensure current occupancy and billing accuracy. |

| 15 | Building Plans or Blueprints | Building plans or blueprints are essential documents for a homeowners insurance application as they provide detailed information about the structure, layout, and materials used in the construction of the property. Insurers use these documents to accurately assess risk and determine appropriate coverage and premiums based on the home's design and construction quality. |

| 16 | Photographs of Property and Contents | Photographs of the property and its contents are essential for a homeowners insurance application as they provide visual proof of the home's condition and valuable possessions, aiding accurate risk assessment. High-resolution images of the exterior, interior rooms, and major assets like appliances and jewelry help insurers verify coverage needs and expedite claim processes. |

| 17 | Occupancy Certificate | An Occupancy Certificate is a critical document required for a homeowners insurance application, verifying that the property complies with local building codes and is safe for habitation. Insurers use the Occupancy Certificate to assess the risk and validate that the home is legally approved for residential use. |

| 18 | Property Tax Statements | Property tax statements are essential documents for a homeowners insurance application, providing verified details about the property's assessed value and tax amount, which insurers use to determine coverage limits and risk. Accurate property tax records help ensure appropriate premium calculations and confirm property ownership and location. |

Introduction to Homeowners Insurance Application

| Introduction to Homeowners Insurance Application | |

|---|---|

| Purpose of Application | To provide the insurance company with necessary information to assess risk and determine coverage for your home. |

| Key Documents Required | Proof of Homeownership, Property Deed, Recent Home Appraisal, Previous Insurance Policy (if any), Identification Proof (Driver's License or Passport), Mortgage Information, and Details of Home Security Systems. |

| Importance of Accurate Information | Ensures proper coverage, accurate premium calculation, and smooth claims processing. |

| Verification Process | Insurers typically review submitted documents to validate property details and risk factors before policy issuance. |

Why Essential Documents Matter

Homeowners insurance applications require essential documents to verify property ownership and assess risk accurately. These documents include property deeds, mortgage statements, and recent home inspection reports.

Submitting accurate documentation ensures your insurance coverage reflects the true value and condition of your home. Essential documents help insurers customize policies, leading to better protection and potentially lower premiums.

Proof of Property Ownership

Proof of property ownership is essential when applying for homeowners insurance. It confirms your legal right to insure the property and helps the insurer assess risk accurately.

- Title Deed - A legal document that establishes ownership of the home and land.

- Property Tax Receipt - A record showing payment of property taxes, linking you to the property.

- Mortgage Statement - Evidence of a mortgage holder's interest, verifying your ownership stake in the home.

Identification and Personal Information

Homeowners insurance applications require specific documents to verify identification and personal information. Essential documents include a government-issued photo ID, such as a driver's license or passport, and proof of residence like a utility bill or lease agreement. Providing these ensures accurate processing and helps protect your property effectively.

Property Valuation and Appraisal Reports

Property valuation and appraisal reports are essential documents when applying for homeowners insurance. These reports provide an accurate estimate of your property's market value to determine appropriate coverage levels.

- Property Valuation Report - A detailed analysis of your home's worth based on market trends, location, and condition.

- Professional Appraisal Report - An expert evaluation conducted by a certified appraiser to verify the replacement cost and value.

- Recent Sales Comparisons - Data comparing similar properties recently sold nearby to support the appraisal accuracy.

Submitting these documents helps insurers assess risk and calculate premiums accurately.

Prior Insurance Policy Details

When applying for homeowners insurance, providing prior insurance policy details is crucial. These documents typically include your previous policy number, coverage limits, and claims history. Accurate prior insurance information helps insurers assess risk and determine the best coverage options for your home.

Mortgage and Loan Documentation

Mortgage and loan documentation are essential for a homeowners insurance application. These documents verify financial obligations linked to your property.

Lenders require proof of insurance to protect their interest in the home. Providing your mortgage agreement and loan statements speeds up the approval process.

Home Improvement and Renovation Records

What documents are needed for a homeowners insurance application related to home improvement and renovation records? Home improvement receipts, invoices, and contractor agreements provide proof of upgrades and repairs. Including detailed renovation records helps accurately assess the home's current value and risk profile.

Inventory of Personal Belongings

When applying for homeowners insurance, an accurate inventory of personal belongings is essential. This document helps insurers assess the value of your possessions for proper coverage.

Your inventory should include detailed descriptions, purchase dates, and estimated values of items such as electronics, jewelry, furniture, and appliances. Photographs or receipts provide additional proof of ownership and condition. Keeping this documentation updated ensures comprehensive protection and smooth claims processing.

What Documents are Needed for Homeowners Insurance Application? Infographic