To obtain auto insurance reimbursement, you need to submit a copy of the police report, repair estimates or invoices, and proof of payment for the repairs. It is also essential to provide your insurance policy details and a completed claim form to support the reimbursement process. Clear documentation of any damages or injuries related to the accident can expedite claim approval.

What Documents Are Needed for Auto Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

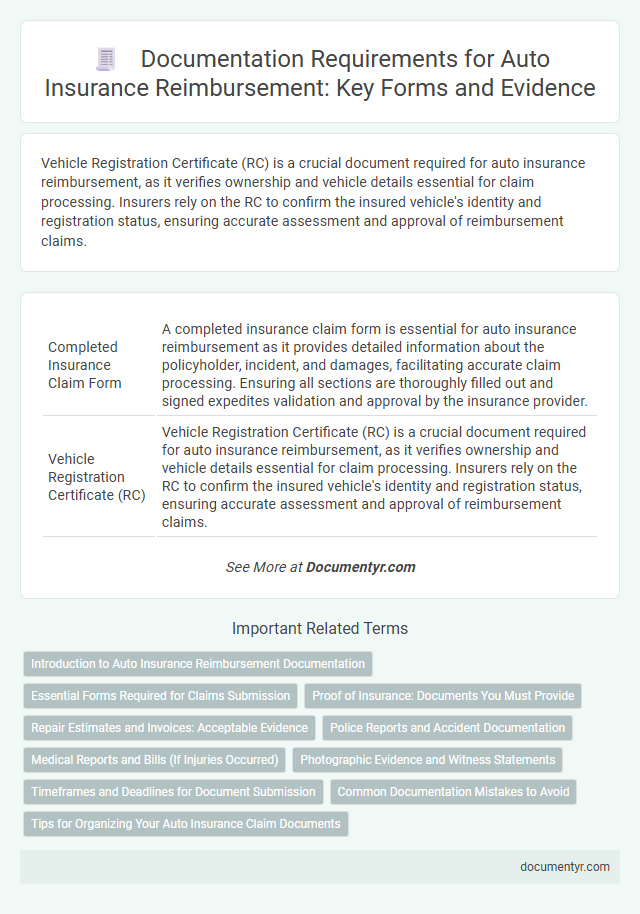

| 1 | Completed Insurance Claim Form | A completed insurance claim form is essential for auto insurance reimbursement as it provides detailed information about the policyholder, incident, and damages, facilitating accurate claim processing. Ensuring all sections are thoroughly filled out and signed expedites validation and approval by the insurance provider. |

| 2 | Vehicle Registration Certificate (RC) | Vehicle Registration Certificate (RC) is a crucial document required for auto insurance reimbursement, as it verifies ownership and vehicle details essential for claim processing. Insurers rely on the RC to confirm the insured vehicle's identity and registration status, ensuring accurate assessment and approval of reimbursement claims. |

| 3 | Valid Driving License | A valid driving license is essential for auto insurance reimbursement as it verifies the policyholder's legal eligibility to operate a vehicle, a fundamental requirement for claim approval. Insurance companies require this document to validate the legitimacy of the claim and ensure compliance with state regulations. |

| 4 | Policy Document (Insurance Certificate) | The Policy Document, often referred to as the Insurance Certificate, is essential for auto insurance reimbursement as it verifies the coverage details and validity of the policy. Presenting this document expedites claim processing by confirming the insured vehicle, coverage limits, and policy period to the insurer. |

| 5 | First Information Report (FIR) (if applicable) | For auto insurance reimbursement, submitting a First Information Report (FIR) is crucial if the incident involves theft, vandalism, or an accident requiring legal verification; the FIR serves as official documentation for claim processing. Alongside the FIR, policyholders should provide a duly filled claim form, vehicle registration documents, and proof of insurance to ensure a smooth reimbursement procedure. |

| 6 | Repair Estimate/Bill | To process auto insurance reimbursement, the repair estimate or bill must include detailed information such as the vehicle identification number (VIN), itemized repair costs, and authorized repair shop details. This document serves as proof of the damages and the expenses incurred, enabling the insurer to verify the claim and determine the reimbursement amount accurately. |

| 7 | Payment Receipts/Invoiced Bills | Payment receipts and invoiced bills are essential documents for auto insurance reimbursement as they provide verifiable proof of the expenses incurred for repairs or services. Ensuring these documents clearly detail the date, amount paid, service description, and service provider helps expedite the claims process and validates the reimbursement request. |

| 8 | Photographs of Damaged Vehicle | Photographs of the damaged vehicle serve as crucial evidence for auto insurance reimbursement, clearly documenting the extent and specifics of the damage for claims assessors. High-resolution images taken from multiple angles help validate the claim, expedite the approval process, and prevent disputes by providing visual proof alongside other required documents like police reports and repair estimates. |

| 9 | Discharge Voucher/Claim Discharge Form | The Discharge Voucher or Claim Discharge Form is a critical document required for auto insurance reimbursement, serving as official proof that the insurer has settled the claim. This form must include detailed information such as the policyholder's name, claim number, amount paid, and date of settlement to ensure accurate processing and verification by the insurance company. |

| 10 | No Trace Report (in case of theft) | For auto insurance reimbursement in theft cases, a No Trace Report from the police is essential as it officially confirms the vehicle's disappearance and supports the claim's legitimacy. This document must be submitted alongside the insurance policy, proof of ownership, and a completed claim form to facilitate prompt processing and settlement. |

| 11 | Inspection Report (if required) | An inspection report, often required for auto insurance reimbursement, provides detailed documentation of vehicle damage and condition, supporting claim validation. Submitting this report alongside the claim form and repair invoices ensures accurate assessment and faster reimbursement processing. |

| 12 | Surveyor’s Report | A Surveyor's Report is a critical document for auto insurance reimbursement, detailing the assessed damages, repair estimates, and liability determinations after an accident. Insurers rely on this report to validate claims, ensuring accurate processing and timely payout based on the professional evaluation provided by the certified surveyor. |

| 13 | Proof of Identity | Proof of identity for auto insurance reimbursement typically requires a valid government-issued ID, such as a driver's license or passport, to verify the claimant's identity. Insurance companies may also request additional documents like a Social Security card or utility bills to confirm residency and ensure accurate processing of the reimbursement claim. |

| 14 | Proof of Address | Proof of address is a crucial document for auto insurance reimbursement claims, typically requiring utility bills, bank statements, or government-issued IDs that clearly display the policyholder's current residence. Insurers use this verification to confirm the insured party's identity and ensure the accuracy of the provided information for processing claims efficiently. |

| 15 | Bank Account Details/Canceled Cheque | To process auto insurance reimbursement efficiently, submitting accurate bank account details or a canceled cheque is essential to verify the policyholder's account for direct deposit. This documentation ensures seamless transfer of claim funds, minimizing processing delays and errors. |

Introduction to Auto Insurance Reimbursement Documentation

Auto insurance reimbursement requires submitting specific documents to validate your claim efficiently. Key paperwork typically includes the insurance policy, proof of incident, and repair or medical bills. Proper documentation ensures timely processing and maximizes your reimbursement benefits.

Essential Forms Required for Claims Submission

Filing an auto insurance reimbursement claim requires specific documents to ensure a smooth process. The essential forms typically include the completed claim form provided by your insurance company.

Additional necessary documents consist of the vehicle repair estimate, proof of payment, and a copy of the police report if applicable. These documents verify the damages and support your reimbursement request effectively.

Proof of Insurance: Documents You Must Provide

Proof of insurance is essential for auto insurance reimbursement claims. The primary documents required include your insurance policy and an insurance ID card that verifies active coverage.

Other necessary documents may include a copy of the accident report and repair estimates. Providing accurate proof of insurance ensures a smooth and timely reimbursement process.

Repair Estimates and Invoices: Acceptable Evidence

Repair estimates and invoices serve as primary evidence for auto insurance reimbursement claims. Insurers require detailed repair estimates outlining the costs of parts and labor from certified repair shops. Official invoices that confirm completed repairs and payments provide proof to validate reimbursement requests.

Police Reports and Accident Documentation

What documents are required for auto insurance reimbursement? Police reports and detailed accident documentation play a crucial role in the reimbursement process. These documents provide verified evidence of the incident and support your insurance claim effectively.

Medical Reports and Bills (If Injuries Occurred)

Submitting accurate medical documentation is crucial for auto insurance reimbursement when injuries are involved. Properly organized medical reports and bills ensure a smoother claims process and expedite compensation.

- Medical Reports - Detailed accounts from healthcare providers outlining the diagnosis, treatment plan, and injury severity.

- Hospital Bills - Itemized statements showing all medical expenses incurred during treatment related to the auto accident.

- Doctor's Prescriptions - Official prescriptions supporting ongoing medical care and medication expenses associated with the injury.

Photographic Evidence and Witness Statements

Submitting the correct documents is essential for a smooth auto insurance reimbursement process. Photographic evidence and witness statements play a critical role in validating your claim.

- Photographic Evidence - Clear images of the vehicle damage and accident scene provide visual proof of the incident.

- Witness Statements - Signed accounts from witnesses help corroborate the details of the accident.

- Accident Report - A formal report filed with authorities supports the legitimacy of the claim.

Gathering these documents promptly increases the chances of a successful insurance reimbursement.

Timeframes and Deadlines for Document Submission

Submitting the correct documents on time is crucial for auto insurance reimbursement claims. Missing deadlines can result in delayed payments or claim denials.

Typically, insurers require accident reports, repair invoices, and proof of payment to process reimbursements. Most insurance companies set a submission deadline ranging from 30 to 60 days after the incident or repair completion. Check your policy details to ensure documents are submitted within the specified timeframe for a smooth reimbursement process.

Common Documentation Mistakes to Avoid

Submitting accurate documents is essential for a smooth auto insurance reimbursement process. Errors or missing paperwork can delay claims and reduce the likelihood of approval.

- Incomplete Accident Reports - Ensure the police or incident report is fully detailed and signed to avoid processing delays.

- Missing Repair Estimates - Provide official repair shop invoices or detailed estimates to validate the costs claimed.

- Unclear Proof of Ownership - Submit clear vehicle registration documents or title records to confirm ownership during the claim.

What Documents Are Needed for Auto Insurance Reimbursement? Infographic