To apply for flood insurance, you typically need to provide proof of property ownership, a completed application form, and a detailed flood zone determination map. Supporting documents may include recent elevation certificates, property blueprints, and previous flood damage records. Lenders often require these documents to accurately assess risk and determine policy terms.

What Documents Are Required for Flood Insurance Application?

| Number | Name | Description |

|---|---|---|

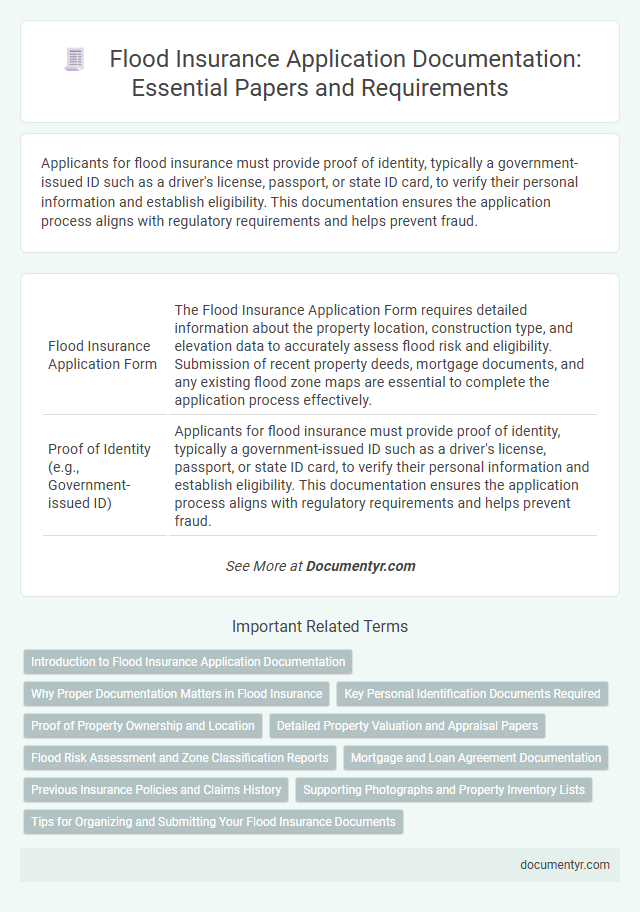

| 1 | Flood Insurance Application Form | The Flood Insurance Application Form requires detailed information about the property location, construction type, and elevation data to accurately assess flood risk and eligibility. Submission of recent property deeds, mortgage documents, and any existing flood zone maps are essential to complete the application process effectively. |

| 2 | Proof of Identity (e.g., Government-issued ID) | Applicants for flood insurance must provide proof of identity, typically a government-issued ID such as a driver's license, passport, or state ID card, to verify their personal information and establish eligibility. This documentation ensures the application process aligns with regulatory requirements and helps prevent fraud. |

| 3 | Proof of Property Ownership (e.g., Deed, Title) | Proof of property ownership is a crucial document for flood insurance applications, typically evidenced by a deed or title confirming the applicant's legal ownership of the insured property. Insurers rely on these documents to verify eligibility and assess risk accurately before issuing flood insurance coverage. |

| 4 | Mortgage or Loan Documents | Flood insurance applications typically require mortgage or loan documents to verify property ownership and financial responsibility. These documents include the mortgage agreement, loan statements, and proof of escrow accounts to ensure compliance with lender requirements for flood coverage. |

| 5 | Property Tax Records | Property tax records are essential documents for flood insurance applications, providing verifiable proof of property ownership and details such as address and assessed value. Insurers use this information to accurately assess risk levels and determine appropriate coverage and premium rates. |

| 6 | Elevation Certificate | An Elevation Certificate is a critical document required for flood insurance applications, providing detailed information about a property's elevation relative to the Base Flood Elevation (BFE). This certificate, typically prepared by a licensed surveyor or engineer, helps insurers accurately assess flood risk and determine premium rates for National Flood Insurance Program (NFIP) policies. |

| 7 | Previous Flood Insurance Policy (if renewing/switching) | Submitting a previous flood insurance policy is crucial when renewing or switching your flood insurance application, as it provides proof of continuous coverage and helps streamline the underwriting process. This document ensures accurate assessment of your flood risk history and may impact premium calculations or eligibility for preferred rates. |

| 8 | Property Appraisal or Valuation Report | A Property Appraisal or Valuation Report is essential for a flood insurance application, providing an accurate assessment of the property's market value and replacement cost. This report helps insurers determine the appropriate coverage limits and premiums based on the flood risk and property characteristics. |

| 9 | Recent Photographs of the Property | Recent photographs of the property are essential for flood insurance applications as they provide visual proof of current conditions and help assess risk accurately. These images must clearly show the structure's exterior, grading, and any existing protective features to ensure proper evaluation by the insurance provider. |

| 10 | Building Plans or Floor Plans | Building plans or floor plans are essential documents for a flood insurance application, providing detailed information about the property's layout, construction materials, and elevation. These plans help insurers accurately assess flood risk and determine appropriate coverage and premium rates. |

| 11 | Proof of Residency (e.g., Utility Bills, Lease Agreement) | Proof of residency is essential for flood insurance applications and can be demonstrated through documents such as recent utility bills or a valid lease agreement. These documents confirm the applicant's occupancy at the insured property, ensuring accurate risk assessment and policy issuance. |

| 12 | Property Location Map or Survey | A detailed property location map or survey is essential for flood insurance applications, as it precisely identifies the property's boundaries and its position relative to flood zones designated by FEMA. This documentation supports accurate flood risk assessment and premium calculation by insurers. |

| 13 | Flood Zone Determination Document | Flood insurance applications require a Flood Zone Determination document, which identifies the property's location in relation to FEMA-designated flood zones, ensuring accurate risk assessment and premium calculation. This document, often prepared by licensed surveyors or engineers, is essential for confirming flood risk and meeting underwriting requirements. |

| 14 | Loss History Report (if applicable) | A Flood Insurance application typically requires a Loss History Report to verify any previous flood-related claims, helping insurers assess risk and determine premiums accurately. This report is essential if the property has experienced past flood damage or claims, ensuring transparency and precise underwriting decisions. |

| 15 | Proof of Repairs or Flood Mitigation Improvements | Proof of repairs or flood mitigation improvements for flood insurance applications typically includes contractor invoices, detailed repair receipts, photographs before and after repairs, and permits issued by local authorities. These documents demonstrate the measures taken to reduce flood risk, directly impacting eligibility and potential premium discounts under flood insurance policies. |

| 16 | Authorization or Letter of Consent (if applying on behalf of someone else) | A Flood Insurance application requires an Authorization or Letter of Consent when applying on behalf of another individual, ensuring legal permission to handle their insurance matters. This document must clearly state the applicant's authority to act for the insured party and is essential for processing the application accurately. |

Introduction to Flood Insurance Application Documentation

Applying for flood insurance requires specific documents to ensure accurate coverage and risk assessment. Proper documentation helps streamline the approval process and protects your property from flood-related damages.

- Proof of Property Ownership - Documents such as a deed or mortgage statement verify ownership of the property to be insured.

- Property Location Details - Providing a detailed address and flood zone information assists in determining the appropriate insurance rate.

- Previous Flood Claims - Records of any past flood insurance claims influence underwriting decisions and coverage terms.

Why Proper Documentation Matters in Flood Insurance

Proper documentation is essential for a successful flood insurance application because it verifies the insured property's eligibility and risk level. Required documents typically include property deeds, elevation certificates, and previous flood history reports. Accurate documentation ensures correct premium calculation and prevents claim denials during flood-related damages.

Key Personal Identification Documents Required

When applying for flood insurance, key personal identification documents are crucial to verify your identity and property ownership. These documents ensure a smooth application process and accurate risk assessment.

Applicants must provide a government-issued photo ID, such as a driver's license or passport. Proof of property ownership can include a deed or mortgage statement. Additional documents like a Social Security number or taxpayer identification number may also be required to complete the application.

Proof of Property Ownership and Location

Applying for flood insurance requires submitting specific documents to verify your eligibility. Proof of property ownership, such as a deed or property tax statement, is essential to confirm your legal interest in the property.

Documentation verifying the property's location, including a detailed address and flood zone designation from official flood maps, is necessary for accurate risk assessment. These documents help insurers determine premium rates and coverage options based on geographic flood risk.

Detailed Property Valuation and Appraisal Papers

| Document Type | Description | Importance for Flood Insurance |

|---|---|---|

| Property Valuation Report | A comprehensive assessment of the property's market value conducted by a certified appraiser or valuation expert. Includes details on location, size, structural condition, and comparable market sales. | Establishes accurate coverage limits based on the current market value of the property, ensuring adequate flood insurance protection and preventing underinsurance. |

| Appraisal Certificate | Official documentation certifying the completion and findings of the property appraisal. Often includes date, appraiser credentials, and method of valuation used. | Validates the legitimacy and accuracy of the property valuation report required by flood insurance underwriters to assess risk and premium costs. |

| Detailed Structural Description | Documentation providing a detailed breakdown of the building's materials, foundation type, elevation, and flood mitigation features. | Helps insurers evaluate flood risk exposure and calculate premiums by understanding the property's resilience and vulnerability to flooding. |

| Previous Appraisal Reports | Any earlier valuation or appraisal records that demonstrate property value trends or changes over time. | Offers historical data supporting the current valuation, assisting in risk assessment and premium determination for flood insurance policies. |

| Supporting Documentation | Additional papers such as recent sales agreements, tax assessments, and repair or renovation records that influence property valuation. | Complements the appraisal by providing context on improvements or changes affecting the property's flood risk and value. |

Flood Risk Assessment and Zone Classification Reports

Flood insurance applications require specific documents to accurately assess the property's risk. Among the most critical are the Flood Risk Assessment and Zone Classification reports, which help insurers determine premium rates and coverage eligibility.

The Flood Risk Assessment report evaluates the likelihood and potential impact of flooding on the property. Zone Classification reports categorize the property location based on FEMA flood maps, identifying high-risk and moderate-risk flood zones crucial for underwriting decisions.

Mortgage and Loan Agreement Documentation

For a flood insurance application, mortgage and loan agreement documents are essential to verify your property's financial obligations. These documents confirm lender requirements and ensure compliance with flood zone regulations. Providing accurate mortgage or loan agreements helps facilitate a smooth approval process for flood insurance coverage.

Previous Insurance Policies and Claims History

What documents related to previous insurance policies are needed for a flood insurance application?

Applicants must provide copies of prior insurance policies, specifically those covering flood or related damages. These documents help verify past coverage and assess the risk for underwriting purposes.

Why is claims history important when applying for flood insurance?

Claims history documents reveal any previous flood damage claims made by the applicant. Insurers use this information to evaluate risk factors and determine appropriate premium rates.

Supporting Photographs and Property Inventory Lists

Flood insurance applications require comprehensive documentation to ensure accurate coverage assessment. Supporting photographs and detailed property inventory lists play a crucial role in validating the property's condition and contents.

- Supporting Photographs - Clear images of the property's exterior and interior provide visual evidence of its current condition and any existing vulnerabilities.

- Property Inventory List - A detailed list of personal belongings and structural features helps in estimating the value and potential loss in case of flood damage.

- Documentation Accuracy - Accurate and up-to-date photographs and inventory lists increase the likelihood of thorough evaluation and appropriate insurance coverage.

What Documents Are Required for Flood Insurance Application? Infographic